Global Kombucha Market

Global Kombucha Market Size, Share, and COVID-19 Impact Analysis, By Product (Hard, Conventional), By Distribution Channel (On-trade, Off-trade), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Kombucha Market Summary

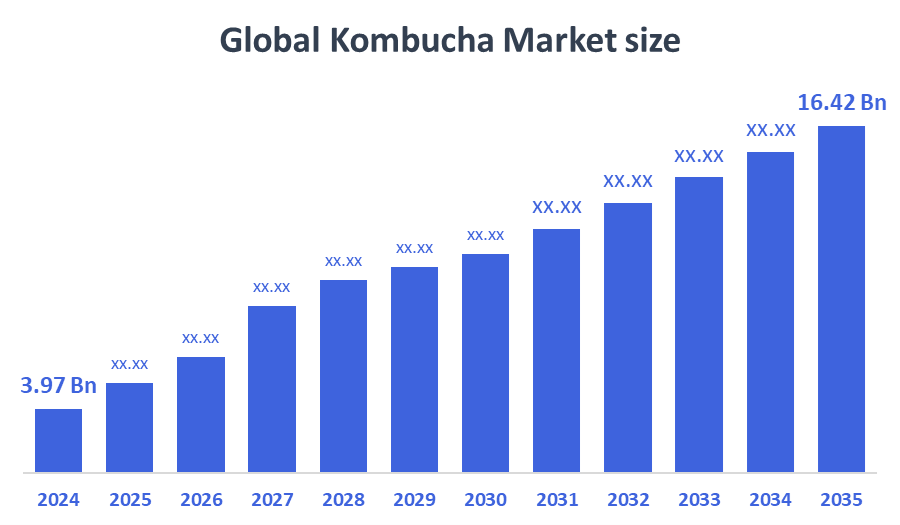

The Global Kombucha Market Size Was Estimated at USD 3.97 Billion in 2024 and is Projected to Reach USD 16.42 Billion by 2035, Growing at a CAGR of 13.78% from 2025 to 2035. The kombucha market is expanding due to factors such as increased customer interest in gut health, growing demand for functional beverages, and growing health consciousness.

Key Regional and Segment-Wise Insights

- In 2024, the North American kombucha market held the largest revenue share of 34.6% and dominated the global market.

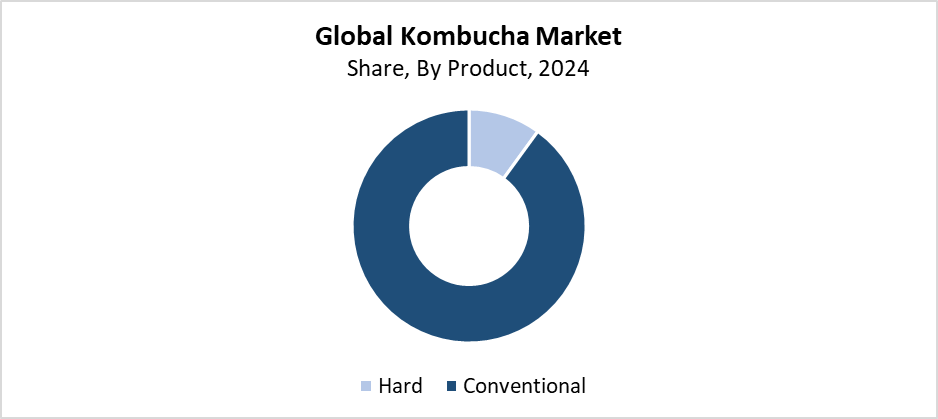

- In 2024, the conventional segment held the highest revenue share of 90.2% and dominated the global market by product.

- With the biggest revenue share of 58.4% in 2024, the on-trade segment led the worldwide market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.97 Billion

- 2035 Projected Market Size: USD 16.42 Billion

- CAGR (2025-2035): 13.78%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global market for kombucha functions as the industry which creates and distributes the fermented tea beverage that people know for its natural components and probiotic benefits. The market has grown substantially because consumers want carbonated drinks that contain no sugar and organic ingredients, while functional beverages experience rising popularity, and people become more aware of their health. The main factors behind the demand for clean-label products include rising plant-based eating habits and expanding urban areas. These bring increased disposable income. Young adults between 18 and 34 years old, and older wellness-conscious consumers make up the primary group who choose kombucha because they believe it supports their immune system, body detoxification, and digestive health.

The production of kombucha has undergone significant changes because technological advancements have enhanced fermentation methods and extended product shelf life, and made it possible to create new flavour combinations. The combination of cold-chain logistics with smart packaging solutions has boosted both product availability and quality standards. The functional beverage industry receives worldwide government support through financial backing of health-focused startups, relaxed food safety regulations, and organic farming funding. The market expansion of kombucha has grown as a result of programs that promote better living and reduced sugar consumption. This matches dietary guidelines and public health initiatives.

Product Insights

What Factors Enabled the Conventional Segment to Capture the Largest Revenue Share of 90.2% in the Kombucha Market in 2024?

The conventional segment held the largest revenue share of 90.2% and led the kombucha market in 2024. Its vast availability across several retail channels, affordability, and broad customer acceptance all contribute to its strong market position. The widespread availability of conventional kombucha stems from its recognised taste profiles and low production costs. These make it more accessible than organic options. Major manufacturers focus on this market because it helps them fulfil ongoing demand while achieving production cost savings through large-scale operations. Traditional kombucha products continue to increase their market presence because they receive backing from major marketing initiatives and established brand names. The organic market continues to grow, yet it remains a specialised segment because organic products cost more and have limited distribution, which allows conventional kombucha to maintain its market dominance.

The hard segment of the kombucha market is expected to grow at a significant CAGR during the projected period because consumers continue to show interest in alcoholic drinks that provide health benefits. People who want to avoid regular beer, wine, and cocktails choose hard kombucha because it contains more alcohol due to its extended fermentation process. The product appeals to Gen Z and millennial consumers who want to maintain their social drinking activities while promoting health because it contains natural ingredients and probiotics and has less sugar. The segment benefits from new branding strategies and flavour development because it focuses on premium and craft beverage markets. Hard kombucha will grow strongly in North America and Europe because it becomes more known and available through bars, restaurants, and speciality stores.

Distribution Channel Insights

How Did the On-Trade Segment Secure the Leading Position in the Global Kombucha Market with a 58.4% Revenue Share in 2024?

The on-trade segment led the global kombucha market in 2024 with the largest revenue share of 58.4%. The growing popularity of kombucha in cafés, restaurants, bars, and hotels drives this market leadership because customers want innovative, healthy drink choices. Through direct consumer experiences, sampling, and mixology breakthroughs, the on-trade market provides kombucha manufacturers with a unique opportunity to demonstrate their goods, increasing customer engagement and brand recognition. Younger, health-conscious consumers who want fresh, ready-to-drink beverages find their needs met by on-trade establishments. The on-trade channel drives market expansion through its social and experiential elements. These boost kombucha sales more than off-trade retail outlets such as supermarkets and convenience stores.

The off-trade segment of the kombucha market is anticipated to grow at a significant CAGR during the forecast period because consumers want convenient home consumption options. The category includes supermarkets, convenience stores, and internet retailers that offer kombucha products because of increasing customer demand for these beverages. The growing availability of kombucha in off-trade channels, together with e-commerce expansion and consumer health awareness, has made it easier for customers to find various flavours and brands. The market growth of off-trade is accelerated by bulk purchasing that comes with affordable pricing and marketing initiatives. The off-trade channel will serve as a key market driver. More people are starting to drink kombucha regularly.

Regional Insights

The North American kombucha market led globally with the largest revenue share of 43.4% in 2024. The leadership position exists because functional beverages with probiotics maintain strong market demand, while regional distribution systems stay robust, and consumers understand the health benefits of these products. The market growth results from major industry participants introducing new products and their emphasis on natural and organic ingredient usage. The North American market shows strong support for plant-based and clean-label products because millennials and Gen Z consumers actively follow lifestyle trends that promote these choices. North America maintains its leadership position in the global kombucha market because the region dedicates major funds to marketing. It expands product availability through supermarkets, health shops, and online platforms.

Europe Kombucha Market Trends

The European kombucha market is expected to grow at a substantial CAGR during the forecast period because consumers now prefer natural functional drinks and seek beverages that promote health. The demand for kombucha grows in major European countries, including the UK, Germany, and France, because people understand its probiotic and gut health advantages. People are turning to kombucha as a natural alternative to sugary sodas and alcoholic drinks because organic and vegan products have gained popularity in recent years. The market penetration receives a boost through enhanced distribution channels. These include e-commerce platforms, speciality health stores and supermarkets. Europe has become a fast-growing, profitable kombucha market because its government supports health initiatives through strict food safety regulations.

Asia Pacific Kombucha Market Trends

The Asia Pacific kombucha market is expected to grow at the fastest CAGR during the forecasted period because consumers now choose natural functional beverages, and their disposable income increases while health awareness expands. The expanding middle-class population, together with fast urban development, creates a rising need for probiotic beverages, including kombucha, and other wellness products. The internet sales channels and retail infrastructure development in China, Japan, India, and Australia have led to increased adoption rates in these nations. The region maintains an open environment for kombucha through its traditional fermented beverages. The market expansion receives additional backing from government initiatives, which promote wellness. Preventive medical services. The Asia Pacific region stands as a promising growth centre for the worldwide kombucha market because of its ongoing product development and its ability to adapt to local flavour preferences.

Key Kombucha Companies:

The following are the leading companies in the kombucha market. These companies collectively hold the largest market share and dictate industry trends.

- GT’s Living Foods

- Real Kombucha

- MOMO KOMBUCHA

- København Kombucha

- VIGO KOMBUCHA

- Remedy Drinks

- BB Kombucha

- Læsk

- Lo Bros

- Brothers and Sisters

- GO Kombucha

- Equinox Kombucha

- Others

Recent Developments

- In April 2023, Brew Dr Kombucha showcased a redesigned packaging and logo for their most recent product introduction. The new look includes a refreshed logo, revamped labels, and the intriguing addition of two mouthwatering flavours: Fields of Strawberry and Pineapple Paradise

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the kombucha market based on the below-mentioned segments:

Global Kombucha Market, By Product

- Hard

- Conventional

Global Kombucha Market, By Distribution Channel

- On-trade

- Off-trade

Global Kombucha Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 234 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |