Global Liquid Chiplets Market

Global Liquid Chiplets Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Processor Type (CPU, GPU, FPGA, AI/ASIC Coprocessors, and APUs), By Packaging Technology (2.5D/3D, SiP, WLCSP, FCCSP, FCBGA, and FO), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Liquid Chiplets Market Summary, Size & Emerging Trends

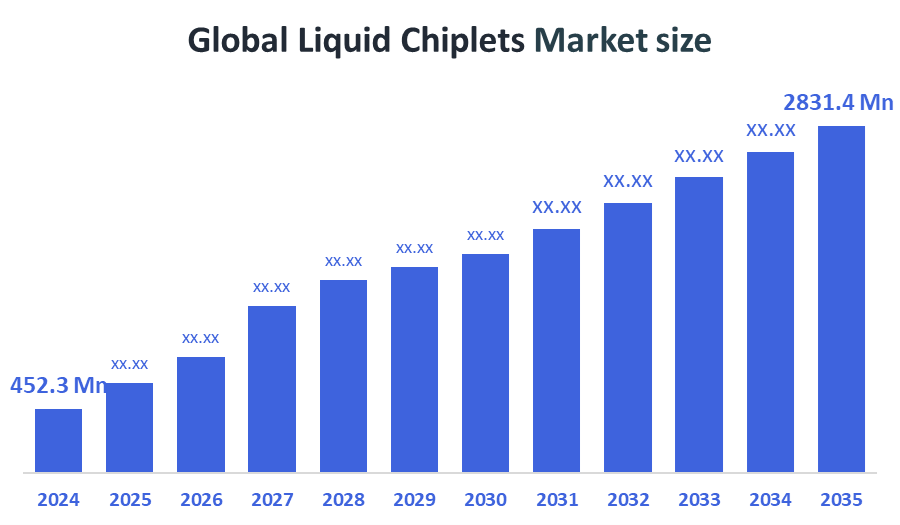

According to Decision Advisors, The Global Liquid Chiplets Market Size is Expected to Grow from USD 452.3 Million in 2024 to USD 2,831.4 Million by 2035, at a CAGR of 18.15% during the forecast period 2025-2035. This growth is fueled by increasing modularization in semiconductor design, adoption in AI and high?performance computing, and advancements in heterogeneous integration and packaging technologies.

Key Market Insights

- North America holds around 37.2% of the market, driven by strong R&D, large-scale data centers, and AI investments.

- Asia Pacific is the fastest-growing and largest region in 2024, accounting for over 40% market share, supported by aggressive semiconductor investments.

- CPU chiplets lead by processor type, followed by growing demand for GPU and AI-focused chiplets.

- 2.5D/3D packaging dominates due to its performance and interconnect efficiency.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 452.3 Million

- 2035 Projected Market Size: USD 2,831.4 Million

- CAGR (2025-2035): 18.15%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Liquid Chiplets Market

The liquid chiplets market represents an innovative approach in semiconductor packaging, where tiny liquid droplets containing functional microchips are integrated to form flexible, scalable, and reconfigurable systems. These liquid chiplets enable enhanced modularity and customization, allowing devices to adapt dynamically to performance demands or repair faulty units without replacing the entire chip. This technology addresses challenges in traditional rigid chip architectures by improving heat dissipation, reducing manufacturing complexity, and supporting heterogeneous integration of diverse functions. The market is driven by growing demand in high-performance computing, AI, flexible electronics, and IoT applications. As industries seek more efficient, compact, and adaptable computing solutions, liquid chiplets offer promising benefits such as improved yield, lower costs, and extended device lifespans. However, challenges remain around material stability, interconnection reliability, and large-scale manufacturing processes. Ongoing research and collaborations among semiconductor manufacturers and material scientists are expected to propel market growth in the coming years.

Liquid Chiplets Market Trends

- Liquid chiplets enable the combination of different semiconductor technologies (logic, memory, sensors) into a single flexible platform, enhancing device functionality and performance.

- The adaptability of liquid chiplets supports the growth of flexible and wearable devices, allowing electronics to conform to various shapes while maintaining high computing power.

- Liquid-based chiplets improve heat dissipation compared to traditional rigid chips, addressing one of the major bottlenecks in high-performance computing and extending device longevity.

- The modularity of liquid chiplets allows for easier upgrades and repairs at the component level, reducing electronic waste and lowering overall device maintenance costs.

Liquid Chiplets Market Dynamics

Driving Factor: Advancements in heterogeneous integration technologies

The liquid chiplets market is propelled by increasing demand for miniaturized, high-performance electronics that require efficient thermal management. Advancements in heterogeneous integration technologies allow combining multiple functionalities on a single chip. Growing applications in wearables, flexible devices, and IoT boost market adoption. The push towards modular, repairable electronics also drives innovation. Additionally, semiconductor industry trends favor chiplets to overcome traditional scaling limits, reducing manufacturing costs and improving yields, making liquid chiplets an attractive solution.

Restrain Factors: High manufacturing complexity

High manufacturing complexity and costs pose significant barriers to liquid chiplet adoption. Technical challenges in achieving reliable interconnects and managing fluidic environments limit scalability. Regulatory and standardization issues remain unresolved, slowing market penetration. Limited awareness and expertise in design and integration further restrain growth. Additionally, the nascent stage of liquid chiplet technology means slow commercialization cycles and potential reliability concerns, discouraging some manufacturers from early adoption.

Opportunities: Collaborations between semiconductor companies and research institutions

Emerging applications in flexible electronics, wearables, and medical devices offer substantial growth potential. Integration with AI and edge computing systems opens new markets. Advances in materials science and microfluidics can enhance performance and durability. Expansion into emerging economies with growing electronics demand also presents opportunities. Collaborations between semiconductor companies and research institutions can accelerate innovation. Sustainable electronics development through repairable, modular designs aligns with environmental goals, attracting investment and consumer interest.

Challenges: Educating designers and manufacturers on new processes is necessary to build market confidence

Ensuring long-term reliability and robustness of liquid chiplet systems is critical. Overcoming fluid leakage, thermal cycling, and mechanical stress issues requires advanced materials and engineering. Achieving industry-wide standards for design, testing, and integration is complex. Balancing cost with performance to make products commercially viable remains difficult. Educating designers and manufacturers on new processes is necessary to build market confidence. Supply chain constraints for specialized materials and components can disrupt production. Finally, competing with established semiconductor technologies poses a continuous challenge in market acceptance.

Global Liquid Chiplets Market Ecosystem Analysis

The global liquid chiplets market ecosystem comprises semiconductor manufacturers, material suppliers, design houses, and system integrators collaborating to develop advanced, modular chip architectures. Key players focus on innovative microfluidic cooling solutions and heterogeneous integration technologies. Research institutions and startups drive R&D for improved reliability and performance. End-users span consumer electronics, wearables, automotive, and medical sectors. Strong partnerships between technology providers and equipment manufacturers support scalable production. Growing demand for miniaturized, energy-efficient devices fuels ecosystem expansion, while regulatory bodies work toward standardization and safety compliance.

Global Liquid Chiplets Market, By Processor Type

CPU chiplets dominate the liquid chiplets market in 2024, accounting for the largest revenue share. These chiplets are widely used in server processors and general-purpose computing platforms due to their modularity, scalability, and cost-effectiveness. Liquid chiplet technology enhances thermal performance, allowing CPUs to maintain higher processing speeds under demanding workloads. Enterprises and data centers increasingly adopt chiplet-based CPU designs for improved energy efficiency, simplified manufacturing, and better yield management. Their established role in mainstream computing makes them a cornerstone of the current market landscape.

GPU chiplets represent the fastest-growing segment in the market, fueled by explosive demand in artificial intelligence (AI), machine learning (ML), and high-performance graphics processing. These chiplets enable modular GPU architectures, improving parallel computing capabilities and thermal efficiency critical for data-intensive workloads. The integration of liquid cooling directly into GPU chiplets allows sustained performance under heavy use, appealing to sectors like autonomous vehicles, gaming, scientific computing, and generative AI. As these industries grow rapidly, the demand for efficient and scalable GPU chiplets is expected to surge significantly.

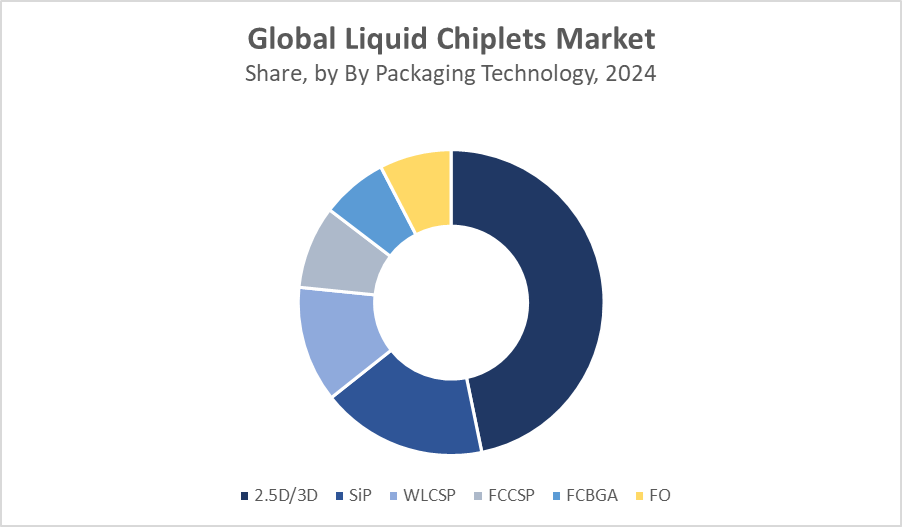

Global Liquid Chiplets Market, By Packaging Technology

2.5D/3D integration technologies hold the largest share of the liquid chiplets market, accounting for approximately 60% of total revenue in 2024. These methods enable the vertical or side-by-side stacking of multiple chiplets on a single substrate, allowing for high-density packaging with ultra-fast, low-latency interconnects. They are critical in high-performance computing (HPC), data centers, and advanced AI processors where bandwidth and space efficiency are vital. The compatibility of 2.5D/3D packaging with liquid thermal management solutions further boosts their dominance in heat-sensitive, high-power applications.

System-in-Package (SiP) technology holds an estimated 30% market share and is widely used in compact devices like smartphones, wearables, and consumer electronics. SiP integrates multiple chiplets such as processors, sensors, and memory into a single module to save space and improve energy efficiency. While not as performance-focused as 2.5D/3D, SiP benefits from its versatility, lower cost, and ease of integration in mobile platforms. With rising demand for miniaturized electronics and IoT devices, this segment is expected to grow steadily over the forecast period.

North America holds approximately 37.2% of the global liquid chiplets market in 2024. This dominance is driven by strong investments in R&D, presence of major semiconductor companies, and widespread adoption of high-performance computing infrastructure. The U.S. leads the region, fueled by increasing demand for AI and machine learning applications, large-scale data centers, and government support for advanced chip manufacturing. Strategic collaborations between tech giants and startups further bolster innovation in chiplet-based architectures and liquid cooling integration.

The United States is the dominant country in North America’s liquid chiplets market. It benefits from a robust semiconductor ecosystem, cutting-edge R&D in chiplet architecture, and early adoption of advanced packaging and liquid cooling technologies. Major tech companies like Intel, AMD, and NVIDIA are leading innovation in CPU and GPU chiplet designs, often collaborating with hyperscale cloud providers. Government initiatives like the CHIPS Act are further boosting domestic manufacturing and infrastructure, positioning the U.S. as a global leader in high-performance, chiplet-based computing platforms.

Asia Pacific is the largest and fastest-growing region, contributing over 40% of global market revenue in 2024. Countries like China, Taiwan, South Korea, and Japan are aggressively investing in semiconductor fabrication, packaging technologies, and next-gen chiplet manufacturing. The region benefits from strong government backing, expanding foundry capacity, and a rapidly growing consumer electronics base. Demand for AI chips, advanced packaging, and thermal-efficient systems in both industrial and consumer applications is accelerating growth, making Asia Pacific the central hub for future chiplet innovation.

China plays a critical role in Asia Pacific’s leadership. The country is rapidly scaling up its semiconductor industry through state-backed initiatives, increased capital investment, and aggressive expansion in fabless design and foundry capabilities. Chinese firms are exploring chiplet integration for AI processors, 5G infrastructure, and high-efficiency computing systems, while also developing domestic supply chains to reduce dependency on foreign IP. With a growing base of data centers and consumer electronics manufacturing, China is emerging as a major hub for both chiplet demand and innovation.

WORLDWIDE TOP KEY PLAYERS IN THE LIQUID CHIPLETS MARKET INCLUDE

- Intel

- AMD

- NVIDIA

- IBM

- Samsung Electronics

- TSMC

- Micron Technology

- Broadcom

- Qualcomm

- ON Semiconductor

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the liquid chiplets market based on the below-mentioned segments:

Global Liquid Chiplets Market, By Processor Type

- CPU

- GPU

- FPGA

- AI/ASIC Coprocessors

- APUs

Global Liquid Chiplets Market, By Packaging Technology

- 2.5D / 3D

- SiP

- Flip-Chip CSP

- WLCSP

- FCBGA

- Fan-Out (FO)

Global Liquid Chiplets Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

1. What is the expected CAGR of the Global Liquid Chiplets Market from 2025 to 2035?

The market is expected to grow at a CAGR of 18.15% during the forecast period 2025-2035.

2. Which region holds the largest market share in 2024?

Asia Pacific is the largest and fastest-growing region in 2024, accounting for over 40% of the market share.

3. What are liquid chiplets and why are they important?

Liquid chiplets are tiny liquid droplets containing functional microchips that enable flexible, scalable, and reconfigurable semiconductor systems, improving heat dissipation, modularity, and device longevity.

4. Which processor type dominates the liquid chiplets market?

CPU chiplets hold the largest revenue share in 2024, widely used in servers and general computing platforms.

5. What are the main challenges in the liquid chiplets market?

Key challenges include high manufacturing complexity, technical barriers in interconnection reliability, regulatory issues, and the need for educating designers and manufacturers.

6. What packaging technology holds the largest share in the liquid chiplets market?

2.5D/3D integration technologies dominate the market, accounting for about 60% of total revenue in 2024.

7. Who are some of the top key players in the global liquid chiplets market?

Top players include Intel, AMD, NVIDIA, IBM, Samsung Electronics, TSMC, Micron Technology, Broadcom, Qualcomm, and ON Semiconductor.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |