Global Lithium Carbonate Market

Global Lithium Carbonate Market Size, Share, and COVID-19 Impact Analysis, By Battery (Lithium-ion Batteries, Lithium-metal Batteries, Others), By Grade (Battery Grade, Technical Grade, Industrial Grade), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Lithium Carbonate Market Size Summary

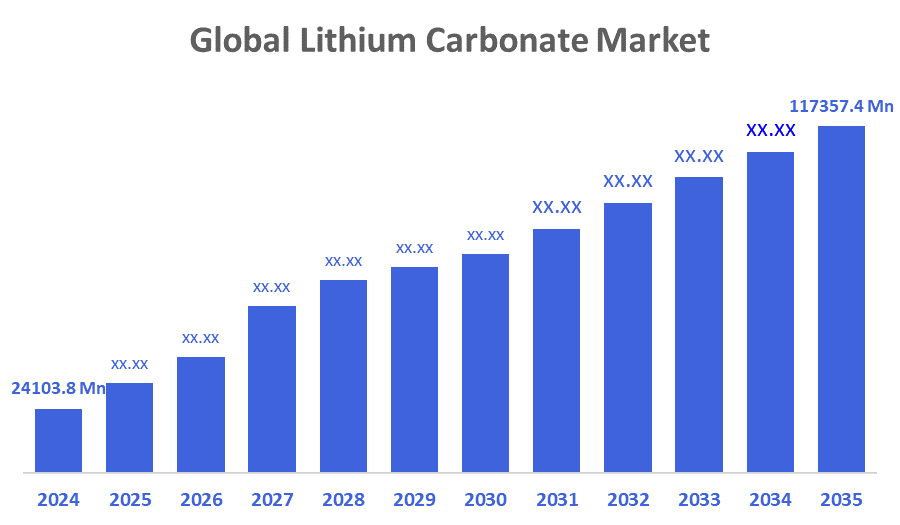

The Global Lithium Carbonate Market Size Was Estimated at USD 24103.8 Million in 2024 and is Projected to Reach USD 117357.4 Million by 2035, Growing at a CAGR of 15.48% from 2025 to 2035. The growing consumer electronics industry, growing demand for lithium-ion batteries in electric vehicles, rising energy storage requirements, government support for clean energy, and battery technology advancements propelling effective and sustainable energy solutions globally, which are all contributing factors to the growth of the lithium carbonate market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 59.3% and dominated the market globally.

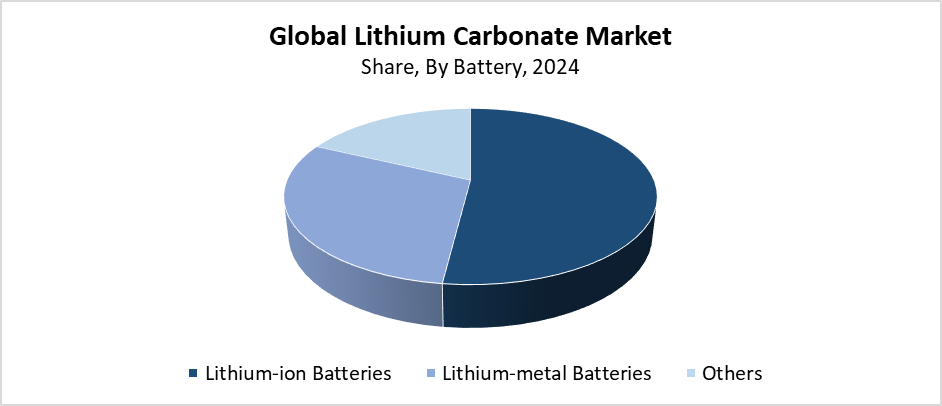

- In 2024, the lithium-ion batteries segment had the highest market share and led the market by battery, accounting for 52.4%.

- In 2024, the battery grade segment had the biggest market share and led the market by grade, accounting for 46.3%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 24103.8 Million

- 2035 Projected Market Size: USD 117357.4 Million

- CAGR (2025-2035): 15.48%

- Asia Pacific: Largest market in 2024

The market for lithium carbonate functions as an economic segment that manufactures and distributes this vital compound primarily for ceramic and glass production, alongside medical applications and lithium-ion battery manufacturing. Lithium carbonate plays an essential role in worldwide clean energy shifts because it serves as an essential component for consumer electronics, energy storage systems, and electric vehicles (EVs). The market experiences growth because of increasing interest in portable electronics, along with the massive expansion of electric vehicle manufacturing and rising investment in renewable energy infrastructure. The market for lithium carbonate continues to grow because numerous industries use this product to meet their demand for lithium-ion batteries, which have become essential due to worldwide emissions restrictions and rising environmental awareness.

Technological advancements in lithium extraction and refining have driven market expansion through enhanced production efficiency alongside cost reduction. The implementation of better recycling methods, together with direct lithium extraction methods, advances sustainability practices. Government initiatives that include tax incentives, together with subsidies and strict environmental regulations, drive the development of clean energy applications and electric vehicle adoption. Battery manufacturing investments, together with next-generation battery research initiatives, drive the expansion of the lithium carbonate market.

Battery Insights

What Factors Enabled the Lithium-Ion Batteries Segment to Lead the Lithium Carbonate Market with a 52.4% Revenue Share in 2024?

The lithium-ion batteries segment led the lithium carbonate market by holding the largest revenue share of 52.4% in 2024. The production of cathodes for lithium-ion batteries, which find widespread application in consumer electronics and energy storage devices, and electric vehicles, depends on lithium carbonate as a primary manufacturing material. The rapid increase in electric vehicle adoption led to explosive demand for lithium-ion batteries because governments introduced subsidies and environmental regulations. The market expands because renewable energy infrastructure requires durable and efficient energy storage solutions. The lithium carbonate market experienced continued dominance from lithium-ion batteries through both technological advancements in battery systems and global investment growth in battery production.

The lithium-metal batteries segment of the lithium carbonate market is anticipated to grow at a significant CAGR during the projected period. Modern electronic devices, electric vehicles, and future energy storage solutions prefer lithium-metal batteries because they offer better performance and higher energy density than traditional lithium-ion batteries. Lithium-metal technology attracts rising interest from manufacturers and investors because the battery market requires more durable, efficient solutions. The segment's expansion is driven by continuous research efforts, which aim to boost scalability while reducing costs and enhancing safety measures. The segment shows strong future growth potential because high-performance batteries are in increasing demand for grid storage applications, along with aerospace and defense applications.

Grade Insights

How Did the Battery Grade Segment Maintain Its Dominance in the Lithium Carbonate Market in 2024?

In 2024, the battery grade segment held the highest market share of 46.3% and dominated the lithium carbonate market. Battery-grade lithium carbonate represents high-purity lithium carbonate, which serves as the primary ingredient for producing cathode materials used in lithium-ion and lithium-metal batteries. The rapid expansion of electric vehicles (EVs) and rising energy storage requirements and widespread portable electronics usage serve as key drivers behind this segment's advancement. The escalating demand for dependable high-grade battery materials stems from both governmental and business sector efforts to speed up sustainable energy and electrification transitions. The global market dominance of battery-grade lithium carbonate continues to grow because of current battery technology advancements and the worldwide expansion of gigafactories.

During the forecast period, the technical grade segment of the lithium carbonate market is expected to grow at the fastest rate. Technical grade lithium carbonate serves as a key industrial element in the production of glass together with ceramics and lubricants, and medicines. The market expansion stems from the increasing requirements for advanced glass and ceramic products within electronic manufacturing, together with automotive production and construction industries. Increased utilization stems from the expanding use of specialized lubricants along with pharmaceutical applications. The current industrial applications of technical-grade lithium carbonate have become more attractive because production technology advancements have reduced costs and enhanced product quality. The technical grade segment will experience significant growth because industrial expansion and material performance requirements continue to increase.

Regional Insights

The North American lithium carbonate market experiences substantial growth because of expanding electric vehicle (EV) demand and increasing adoption of renewable energy storage solutions. The United States and Canada lead in providing funds for clean energy infrastructure development and battery production facilities. The market experiences growth because lithium-ion batteries need high-purity lithium carbonate for their production, which serves electric vehicles, consumer electronics, and grid storage applications. The adoption of lithium carbonate is accelerating due to government support programs and incentives that promote green technology development alongside carbon emission reduction. Technology advancements in lithium extraction and processing, together with growing lithium recycling efforts, lead to better sustainability of supply. The global lithium carbonate market in North America remains strong because major lithium producers and strategic partnerships ensure continuous expansion during the upcoming years.

Asia Pacific Lithium Carbonate Market Trends

The Asia Pacific lithium carbonate market held the highest revenue share of 59.3% and led the market during 2024. The electric vehicle market in China, Japan, and South Korea drives the Asia Pacific lithium carbonate market because these countries lead in lithium-ion battery consumption. The consumer electronics and renewable energy industries continue to expand, which drives additional demand for lithium carbonate. The region's supply chain benefits from abundant lithium reserves in Australia, together with expanding mining and processing operations. The market growth is driven by major battery production facility investments, together with pollution control regulations and governmental initiatives promoting sustainable energy adoption. Lithium extraction and refinement technology advancements help optimize production efficiency. Asia Pacific stands as the largest and fastest-growing lithium carbonate market worldwide because of multiple contributing factors that operate together.

Europe Lithium Carbonate Market Trends

The European market for lithium carbonate is growing significantly because of both its focus on sustainability and the fast adoption of electric vehicles (EVs) in the region. The increasing investments in renewable energy systems and energy storage solutions are driving up the demand for high-purity lithium carbonate. Government policies alongside incentives for reducing carbon emissions have driven both clean transportation and green technologies to become more widespread. The European automotive sector expands because major companies dedicate substantial resources toward producing electric vehicles and battery components. The supply chain sustainability improves through both lithium recycling initiatives and technological advancements in lithium extraction methods. The growing use of consumer electronics together with industrial applications strengthens Europe's standing as a main player in the worldwide lithium carbonate market.

Key Lithium Carbonate Companies:

The following are the leading companies in the lithium carbonate market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corp.

- Orocobre Limited Pty. Ltd.

- Lithium Americas Corp.

- Ganfeng Lithium Co., Ltd.

- Livent Corp.

- Pilbara Minerals

- SQM S.A.

- Tianqi Lithium Corporation

- Mineral Resources Group Co., Ltd.

- Others

Recent Developments

- In July 2025, Codelco, Chile's state-owned miner, was authorized to extract up to 2.5 million metric tons of lithium metal equivalent by 2060. This might result in 330,000 tons of lithium carbonate per year through its joint venture with SQM.

- In March 2025, by sending four officials of Indian state enterprises to negotiate a 20% ownership in SQM's Mount Holland and Andover lithium projects in Western Australia, India launched yet another attempt to secure lithium resources for its expanding EV market. The amount of the offer was $600 million.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the lithium carbonate market based on the below-mentioned segments:

Global Lithium Carbonate Market, By Battery

- Lithium-ion Batteries

- Lithium-metal Batteries

- Others

Global Lithium Carbonate Market, By Grade

- Battery Grade

- Technical Grade

- Industrial Grade

Global Lithium Carbonate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 160 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |