Global Lithium Chromate Market

Global Lithium Chromate Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Anhydrous Lithium Chromate and Hydrated Lithium Chromate), By Application (Battery Materials, Corrosion Inhibitors, Pigments, and Other Industrial Uses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Lithium Chromate Market Summary, Size & Emerging Trends

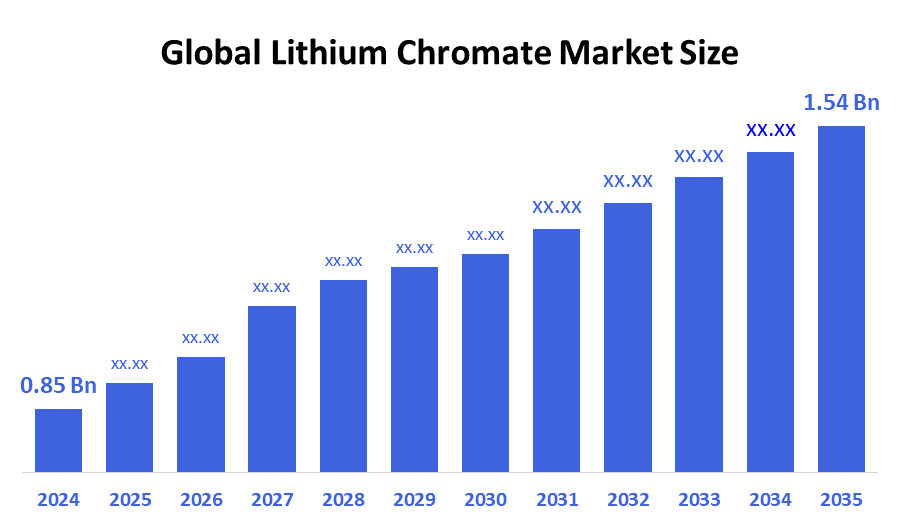

- The Global Lithium Chromate Market Size is expected to grow from USD 0.85 Billion in 2024 to USD 1.54 Billion by 2035, at a CAGR of 5.8% during the forecast period 2025-2035.

- Increasing demand for lithium-based compounds in battery manufacturing and corrosion protection applications is a key driving factor for the lithium chromate market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the lithium chromate market during the forecast period.

- In terms of product type, the anhydrous lithium chromate segment dominated in terms of revenue during the forecast period.

- In terms of application, the battery materials segment accounted for the largest revenue share in the global lithium chromate market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 0.85 Billion

- 2035 Projected Market Size: USD 1.54 Billion

- CAGR (2025-2035): 5.8%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Lithium Chromate Market

The Lithium Chromate Market Size Centers on the production and application of lithium chromate compounds primarily used in battery materials, corrosion inhibitors, pigments, and other industrial uses. Lithium chromate acts as an important additive in lithium-ion battery cathodes, enhancing energy density and stability. Additionally, it serves as an effective corrosion inhibitor in industrial coatings and pigments due to its chemical stability and protective properties. Growing adoption of electric vehicles, renewable energy storage solutions, and stringent environmental regulations promoting safer corrosion protection compounds drive the lithium chromate market growth. Government incentives and investments in advanced battery technologies further bolster market expansion. With increasing focus on sustainable energy storage and industrial safety, lithium chromate remains a critical chemical in modern industrial applications.

Lithium Chromate Market Trends

- Rising adoption of lithium-ion batteries in automotive and consumer electronics fuels lithium chromate demand

- Development of eco-friendly and low-toxicity lithium chromate formulations gains traction.

- Increasing use of lithium chromate in corrosion protection coatings to comply with environmental regulations.

Lithium Chromate Market Dynamics

Driving Factors: Growing Electric Vehicle Market and Renewable Energy Storage Demand

The Global Lithium Chromate Market Size is witnessing significant growth, primarily fueled by the rapid expansion of the electric vehicle (EV) sector and the increasing deployment of renewable energy storage systems. Lithium chromate plays a critical role in lithium-ion battery chemistry, where it enhances thermal stability and battery efficiency, making it highly sought after in EV battery manufacturing. In addition, global efforts to reduce carbon emissions have accelerated investment in clean energy technologies, thereby increasing the demand for high-performance and durable battery materials like lithium chromate. Furthermore, stricter environmental regulations are driving industries to adopt less hazardous corrosion inhibitors, positioning lithium chromate as a safer and more efficient alternative to conventional hexavalent chromates.

Restrain Factors: Toxicity Concerns and Stringent Regulatory Compliance

Despite its benefits, the growth of the lithium chromate market is restrained by health and environmental concerns related to chromate toxicity. While lithium chromate is considered less hazardous than some hexavalent chromium compounds, it is still subject to strict regulatory oversight, particularly in regions like North America and the European Union. Compliance with safety, labeling, and disposal standards increases operational and production costs for manufacturers. In addition, volatile raw material prices, particularly for lithium and chromium derivatives, impact cost stability and profit margins. The presence of alternative corrosion inhibitors and battery additives that are safer and more cost-effective further intensifies competition.

Opportunity: Growing Demand for Sustainable and Advanced Battery Materials

The Lithium Chromate Market Size is positioned to benefit from the global shift toward sustainability and innovation in next-generation battery technologies. As electric mobility becomes mainstream and energy storage solutions gain prominence, there's increasing demand for eco-friendly, high-performance materials that offer both safety and efficiency. Lithium chromate’s potential for customization and improved compatibility with solid-state and high-voltage batteries opens up new avenues for application. Moreover, emerging markets across Asia Pacific, Latin America, and Africa, which are investing heavily in electric infrastructure and industrial growth, present untapped opportunities for market expansion. Strategic collaborations between battery manufacturers and chemical companies focused on developing low-toxicity lithium chromate formulations may unlock new use cases and enable broader regulatory acceptance, driving further innovation and adoption.

Challenges: Environmental Regulations and Raw Material Supply Chain Issues

The Lithium Chromate Market Size faces multiple challenges that could hinder long-term scalability. One of the primary issues is the tightening of environmental regulations, particularly those limiting the use of chromium-based compounds due to their potential carcinogenic properties. Regulatory pressure demands that manufacturers invest heavily in R&D for safer formulations, which increases lead time and development costs. Additionally, the supply chain for high-purity lithium and chromium is vulnerable to disruptions caused by geopolitical instability, trade restrictions, or mining limitations.

Global Lithium Chromate Market Ecosystem Analysis

The Global Lithium Chromate Market Size ecosystem comprises raw material suppliers, chemical manufacturers, battery producers, coating manufacturers, and end-users in automotive, electronics, and industrial sectors. Major suppliers, especially in Asia Pacific, play a key role in raw material availability and pricing. Manufacturers focus on developing safer and more efficient lithium chromate variants to meet evolving regulations. End-users demand high-quality lithium chromate compounds for battery performance and corrosion protection, influencing market trends and innovation.

Global Lithium Chromate Market, By Product Type

The anhydrous lithium chromate segment dominated the global lithium chromate market in terms of revenue during the forecast period, accounting for approximately 62% of the total market share. This dominance is primarily attributed to its superior chemical stability, higher purity, and enhanced performance in battery-related applications. Anhydrous lithium chromate is widely used in lithium-ion battery cathodes, where it improves thermal stability and electrochemical efficiency, making it highly suitable for electric vehicles and renewable energy storage systems. Additionally, its effectiveness as a corrosion inhibitor in industrial coatings adds to its widespread demand across automotive, aerospace, and heavy machinery sectors.

The hydrated lithium chromate segment is gaining traction in the global lithium chromate market, accounting for approximately 38% of the total market share during the forecast period. This growth is driven by its increasing use in industrial coatings and corrosion inhibitor applications, particularly in sectors such as marine, aerospace, and heavy equipment manufacturing, where long-term protection against oxidation and corrosion is essential. Hydrated lithium chromate offers favorable solubility and stability in aqueous solutions, making it ideal for formulating advanced anti-corrosion coatings.

Global Lithium Chromate Market, By Application

The battery materials segment accounted for the largest revenue share of approximately 50% in the global lithium chromate market during the forecast period, making it the dominant application area. This significant share is primarily driven by the rapid growth in electric vehicle (EV) production, renewable energy storage systems, and portable electronics, all of which rely heavily on high-performance lithium-ion batteries. Lithium chromate is used as an additive in battery cathode materials due to its ability to enhance thermal stability, electrochemical performance, and overall battery lifespan.

The corrosion inhibitors segment contributed a significant revenue share of approximately 28% in the global lithium chromate market during the forecast period. This notable share is driven by the compound’s excellent anti-corrosive properties, which make it highly effective in protecting metal surfaces across industries such as aerospace, marine, automotive, and heavy machinery. Lithium chromate is particularly valued for its chemical stability and long-lasting protection in harsh environments, making it a preferred choice for industrial coatings and surface treatment formulations.

Asia Pacific is expected to account for the largest share of the lithium chromate market during the forecast period, holding approximately 45% of the global market revenue. This dominance is driven by increasing lithium battery manufacturing in China, Japan, and South Korea, combined with government support for clean energy technologies and expanding electronics and automotive sectors. Investment in research and development of advanced lithium chromate compounds further supports regional growth.

India is witnessing robust growth in the lithium chromate market, with a projected CAGR of approximately 13% during the forecast period, propelled by expanding electric vehicle adoption, government incentives under the “Make in India” initiative, and growing battery manufacturing capabilities in industrial clusters such as Maharashtra and Gujarat.

North America is anticipated to register a significant CAGR in the lithium chromate market during the forecast period, holding approximately 22% of the global market share. The region’s growth is primarily driven by rising electric vehicle production, renewable energy storage projects, and technological innovation in battery materials. The United States leads the market with several major battery manufacturers investing in lithium chromate-based cathode technologies.

WORLDWIDE TOP KEY PLAYERS IN THE LITHIUM CHROMATE MARKET INCLUDE

- Shanghai Oujin Industrial Co., Ltd.

- Axiom Chemicals Private Limited

- Sontara Organo Industries

- Mody Chemi Pharma Ltd

- Shanghai Acmec Biochemical Co., Ltd.

- Shanghai Canspec Scientific & Technology Co., Ltd.

- Shanghai Aladdin Biochemical Technology Co., Ltd.

- Nanjing Taiye Chemical Industry Co., Ltd.

- Ganfeng Lithium Industry Co., Ltd.

- Triveni Chemicals

- Others

Product Launches in Lithium Chromate Market

• In March 2024, SQM announced a new low-toxicity lithium chromate formulation designed to meet stringent environmental regulations while enhancing battery cathode stability. This innovation aims to strengthen its market position in the Asia Pacific and North America regions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the lithium chromate market based on the below-mentioned segments:

Global Lithium Chromate Market, By Product Type

- Anhydrous Lithium Chromate

- Hydrated Lithium Chromate

Global Lithium Chromate Market, By Application

- Battery Materials

- Corrosion Inhibitors

- Pigments

- Other Industrial Uses

Global Lithium Chromate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |