Global Lithium Compounds Market

Global Lithium Compounds Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Lithium Carbonate, Lithium Hydroxide, and Lithium Chloride), By Application (Batteries, Ceramics & Glass, Lubricants, and Pharmaceuticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Lithium Compounds Market Summary, Size & Emerging Trends

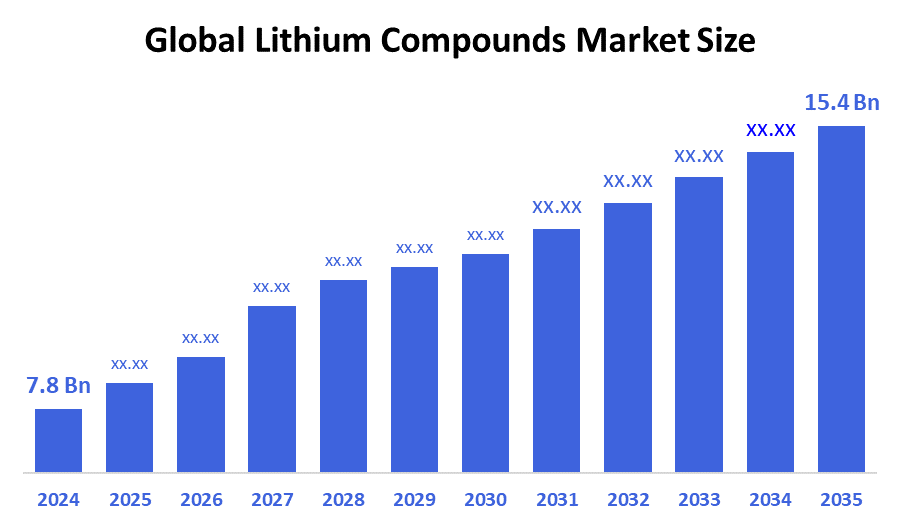

According to Spherical Insights, the Global Lithium Compounds Market Size is Expected to Grow from USD 7.8 Billion in 2024 to USD 15.4 Billion by 2035, at a CAGR of 6.5% during the forecast period 2025-2035. The market is driven by increasing demand for lithium compounds in battery manufacturing, especially for electric vehicles (EVs), along with expanding applications in ceramics, glass, and pharmaceuticals.

Key Market Insights

- Asia Pacific is projected to hold the largest share in the lithium compounds market during the forecast period.

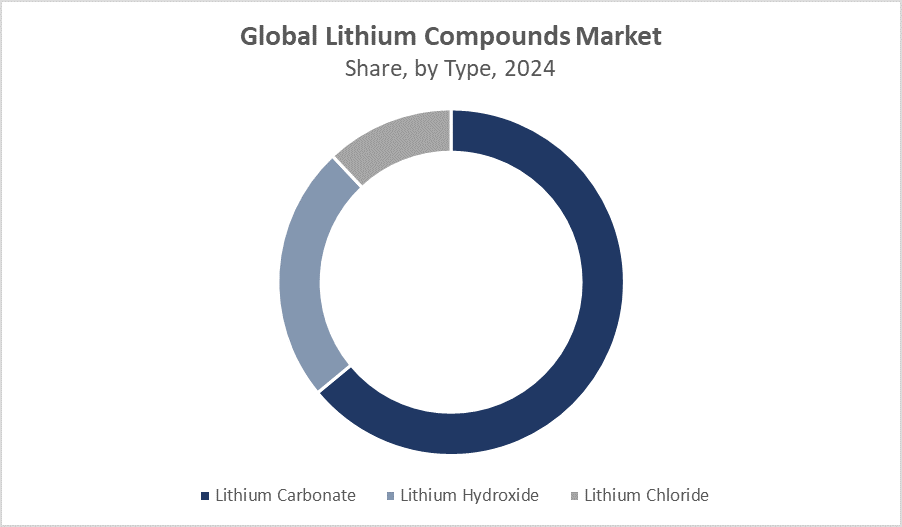

- Lithium carbonate segment accounted for the highest revenue share globally.

- Batteries application dominates the lithium compounds market owing to EV and energy storage growth.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 7.8 Billion

- 2035 Projected Market Size: USD 15.4 Billion

- CAGR (2025-2035): 6.5%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Lithium Compounds Market

The lithium compounds market includes various lithium-based chemicals used across key industries such as batteries, ceramics, lubricants, and pharmaceuticals. The rapid growth in electric vehicle adoption and renewable energy storage has significantly increased demand for lithium carbonate and lithium hydroxide, essential components in lithium-ion batteries. Technological advancements in battery chemistry and the expansion of global battery manufacturing capacity further drive market growth. Government regulations and policies promoting clean energy, along with substantial investments in EV infrastructure, are crucial factors supporting this expansion. Additionally, lithium compounds find increasing applications in ceramics and glass, offering alternative growth avenues. Innovations in these sectors, combined with the push for sustainability, position the lithium compounds market for sustained long-term growth across diverse end-use industries.

Lithium Compounds Market Trends

- Growing electric vehicle production and energy storage demand increase lithium compounds consumption.

- Rising investments in battery recycling and sustainable lithium extraction technologies.

- Expansion of lithium compounds applications in ceramics and pharmaceutical sectors.

- Increasing focus on high-purity lithium compounds for advanced battery technologies.

Lithium Compounds Market Dynamics

Driving Factors: Rising EV adoption and energy storage demand

The lithium compounds market is propelled largely by the swift increase in electric vehicle (EV) production worldwide. Governments are offering incentives and setting ambitious carbon neutrality goals, encouraging manufacturers to boost lithium-ion battery output. As renewable energy sources like solar and wind expand, the need for efficient, large-scale energy storage grows, which in turn raises demand for lithium compounds. Beyond batteries, lithium compounds find uses in ceramics, glass, and pharmaceuticals, further broadening the market and supporting consistent growth.

Restrain Factors: Supply chain volatility and environmental concerns

The lithium compounds market faces significant hurdles due to unstable supply chains and fluctuating raw material prices. Lithium mining and extraction can have considerable environmental impacts, including water depletion and habitat disruption, which leads to increased regulatory scrutiny and stricter sustainability standards. Additionally, the limited geographical distribution of lithium reserves, coupled with geopolitical tensions, creates uncertainty in supply reliability, posing risks to the market’s steady expansion.

Opportunity: Growth in emerging markets and battery recycling technologies

Emerging economies are showing rapid EV adoption and infrastructure growth, presenting major opportunities for lithium compounds market expansion. Furthermore, innovations in battery recycling technologies promise to reduce reliance on freshly mined lithium by recovering it from used batteries, promoting sustainability. Partnerships between battery producers and material suppliers are fostering new business models and circular economy approaches that can drive both economic and environmental benefits.

Challenges: Raw material price volatility and regulatory hurdles

Price instability of lithium raw materials remains a concern, affecting manufacturing costs and profit margins. Diverse and evolving regulations across different countries add layers of compliance complexity for companies operating globally. There is also increasing pressure from environmental advocacy groups and communities demanding responsible mining and production practices. Companies must therefore navigate these regulatory and social challenges to maintain their market presence and ensure long-term viability.

Global Lithium Compounds Market Ecosystem Analysis

The global lithium compounds market ecosystem includes lithium producers, battery manufacturers, chemical suppliers, automotive OEMs, and regulatory authorities. Key stakeholders prioritize sustainable mining practices and technological innovations to improve efficiency and reduce environmental impact. Strategic partnerships and collaborations across the supply chain help secure consistent raw material supplies. Government policies and industry efforts support advancements in lithium extraction and battery recycling technologies, enhancing resource sustainability. This interconnected network plays a vital role in addressing the growing demand for lithium compounds across diverse sectors such as electric vehicles, energy storage, and industrial applications, ensuring long-term market growth and stability.

Global Lithium Compounds Market, By Type

The lithium carbonate segment dominates the lithium compounds market, capturing approximately 45% of total revenue. This leadership is driven by its widespread application in lithium-ion batteries, which are essential for electric vehicles, consumer electronics, and energy storage systems. Lithium carbonate’s favorable electrochemical properties and cost-effectiveness make it the preferred choice for battery manufacturers. Its critical role in powering the rapidly expanding EV and renewable energy sectors further fuels demand. As a result, lithium carbonate remains the largest and most influential segment, significantly contributing to the overall growth and revenue generation within the lithium compounds market.

The lithium hydroxide segment is experiencing significant growth, accounting for approximately 30% of the lithium compounds market revenue. This growth is driven by its increasing preference in the production of high-nickel cathode batteries used in electric vehicles, which offer higher energy density and longer battery life. As demand for advanced battery technologies rises, lithium hydroxide is becoming a critical material for manufacturers aiming to improve battery performance. Its expanding application in next-generation lithium-ion batteries positions lithium hydroxide as one of the fastest-growing segments in the market, contributing substantially to overall industry expansion.

Global Lithium Compounds Market, By Application

The batteries application segment dominates the lithium compounds market with an approximate 55% share. This leadership is driven by the soaring demand for lithium-ion batteries used in electric vehicles, consumer electronics, and energy storage systems. The growing focus on clean energy and the global shift toward electrification significantly boost lithium compound consumption in this sector. As lithium-ion batteries remain the preferred choice for their high energy density and efficiency, the batteries segment continues to capture the largest market revenue, reflecting its critical role in powering the expanding electric mobility and renewable energy markets worldwide.

The ceramics & glass segment follows as a significant part of the lithium compounds market, accounting for approximately 20% of the total market share. Lithium compounds enhance the strength, thermal stability, and durability of ceramics and glass products, making them essential in manufacturing high-performance materials. Growing demand in construction, electronics, and household appliances fuels this segment’s steady growth. As industries seek advanced materials with improved properties, the ceramics and glass segment continues to contribute notably to the overall lithium compounds market revenue, reinforcing its importance alongside the dominant battery applications.

Asia Pacific is expected to maintain its position as the largest market, accounting for roughly 42% of global lithium compounds consumption during the forecast period.

The region’s growth is driven by rapid industrialization and urbanization, coupled with significant investments in electric vehicle (EV) manufacturing and renewable energy projects. Countries such as China, Japan, and South Korea lead the region due to their robust battery manufacturing infrastructure and growing demand for lithium-ion batteries in consumer electronics and energy storage systems.

China stands out as the fastest-growing country within the Asia Pacific region, projected to reach a 40% market share by 2025.

This is largely due to the Chinese government’s aggressive policies promoting clean energy and electric vehicles, substantial lithium reserves, and a well-established supply chain for battery production. China’s dominance in lithium processing and refinement also fuels the country’s rapid market expansion.

North America is anticipated to witness the fastest compound annual growth rate (CAGR), expected to command around 28% of the market by 2025.

This surge is attributed to rising government incentives for EV adoption, expanding lithium mining and refining operations, and an increasing number of battery manufacturing plants, especially in the United States and Canada. Technological advancements and strategic partnerships with automotive OEMs further strengthen market growth in this region.

Europe is projected to hold a significant share of about 18%, driven by the expansion of electric vehicle production and battery manufacturing capacities.

The European Union’s stringent environmental regulations and ambitious climate goals incentivize automakers and battery producers to accelerate lithium compound consumption. Key countries such as Germany, France, and the Netherlands are investing heavily in EV infrastructure and recycling technologies, which further propels market demand.

WORLDWIDE TOP KEY PLAYERS IN THE LITHIUM COMPOUNDS MARKET INCLUDE

- Albemarle Corporation

- Livent Corporation

- SQM (Sociedad Química y Minera de Chile)

- Ganfeng Lithium

- Tianqi Lithium

- FMC Corporation

- BASF SE

- Johnson Matthey

- Nemaska Lithium

- Lithium Americas Corporation

- Others

Product Launches in Lithium Compounds Market

- In January 2025, Albemarle Corporation launched a new high-purity lithium carbonate grade specifically optimized for next-generation electric vehicle batteries. This innovation aims to enhance energy density and extend battery lifecycle, addressing key demands in the rapidly growing EV market.

- In November 2024, Livent Corporation introduced a lithium hydroxide product tailored for high-performance batteries, with a focus on sustainability and improved processing efficiency. This development supports the increasing need for advanced battery materials while promoting environmentally responsible manufacturing practices.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the lithium compounds market based on the below-mentioned segments:

Global Lithium Compounds Market, By Type

- Lithium Carbonate

- Lithium Hydroxide

- Lithium Chloride

Global Lithium Compounds Market, By Application

- Batteries

- Ceramics & Glass

- Lubricants

- Pharmaceuticals

Global Lithium Compounds Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Which lithium compound type accounts for the highest revenue share globally?

A: Lithium carbonate accounts for the highest revenue share globally, capturing approximately 45% of total market revenue.

Q: What application segment dominates the Lithium Compounds Market?

A: The batteries application segment dominates, representing around 55% of the market share due to demand in electric vehicles and energy storage.

Q: Who are the top key players operating in the Global Lithium Compounds Market?

A: Key players include Albemarle Corporation, Livent Corporation, SQM, Ganfeng Lithium, Tianqi Lithium, FMC Corporation, BASF SE, Johnson Matthey, Nemaska Lithium, and Lithium Americas Corporation.

Q: What are the main drivers of growth in the Lithium Compounds Market?

A: Rising demand for lithium compounds in electric vehicle battery manufacturing, expanding applications in ceramics, glass, and pharmaceuticals, along with government incentives and investments in clean energy, are key growth drivers.

Q: What challenges are limiting the adoption of Lithium Compounds?

A: Supply chain volatility, raw material price fluctuations, environmental concerns related to mining, and evolving regulatory requirements pose significant challenges.

Q: What recent product launches have occurred in the Lithium Compounds Market?

A: In January 2025, Albemarle Corporation launched a high-purity lithium carbonate grade optimized for next-generation EV batteries. In November 2024, Livent Corporation introduced a lithium hydroxide product focused on sustainability and processing efficiency.

Q: How do China and other Asia Pacific countries impact the Lithium Compounds Market?

A: China is the fastest-growing country within Asia Pacific, expected to reach a 40% market share by 2025 due to aggressive clean energy policies, lithium reserves, and a strong battery manufacturing supply chain.

Q: What emerging trends are shaping the Lithium Compounds Market?

A: Trends include growing EV production, investments in battery recycling, sustainable lithium extraction, and expansion of applications in ceramics and pharmaceuticals.

Q: What opportunities exist for the Lithium Compounds Market in emerging regions?

A: Rapid EV adoption and infrastructure growth in emerging markets, coupled with advancements in battery recycling technologies, offer significant expansion opportunities.

Q: What is the role of regulatory policies in the Lithium Compounds Market?

A: Government policies promoting clean energy, carbon neutrality goals, and regulations supporting sustainable mining and battery recycling drive market expansion and innovation.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jun 2025 |

| Access | Download from this page |