Global Loaders Market

Global Loaders Market Size, Share, and COVID-19 Impact Analysis, By Type (Backhoe Loader, Skid Steer Loader, Crawler Loader, and Wheeled Loader), By Fuel (Electric and ICE), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

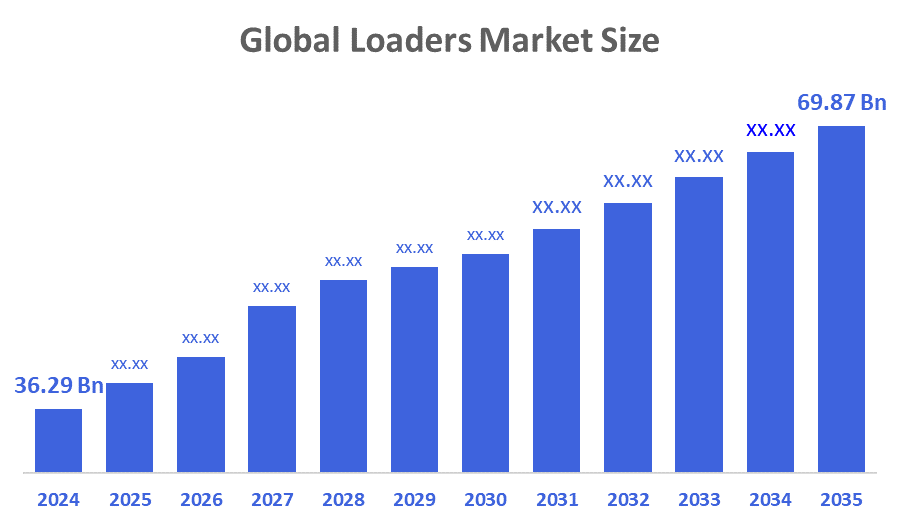

Global Loaders Market Size Insights Forecasts to 2035

- The Global Loaders Market Size Was valued at USD 36.29 Billion in 2024

- The Global Loaders Market Size is Expected to Grow at a CAGR of around 6.14% from 2025 to 2035

- The Worldwide Loaders Market Size is Expected to Reach USD 69.87 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Loaders Market Size was worth around USD 36.29 Billion in 2024 and is predicted to Grow to around USD 69.87 Billion by 2035 with a compound annual growth rate (CAGR) of 6.14% from 2025 to 2035. One of the main factors propelling the growth of the market is the fast-tracked implementation of various infrastructural projects coupled with the rise in number of construction activities around the globe, particularly in the countries with developing and emerging economies.

Market Overview

The loaders market all over the world includes the production, sales and application of loading equipment like wheel loaders, skid-steer loaders, and compact loaders. The loaders are mainly used for material handling, earthmoving and loading operations in construction, mining, agriculture and industrial sectors. Furthermore, custom loaders in the loader market not only meet specific requirements for different industries but also make the market more attractive. A custom loader configuration allows the user to pick the machine that is the best fit for their application which leads to better efficiency and productivity. This flexibility attracts a larger number of customers, thus increasing the demand for loaders with custom features and functionalities. Additionally, the rental market increases the demand for loaders since it provides a cheaper option than buying.

Report Coverage

This research report categorizes the loaders market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the loaders market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the loaders market.

Driving Factors

Technological advancements are one of the main factors driving the demand in the loader market. The combination of state-of-the-art technologies such as GPS for exact navigation, telematics for remote monitoring, IoT connectivity for data analysis, and automation for more efficient and safer working conditions has brought about a paradigm shift in loader operations. These innovations result in the increase of productivity, decrease of operating costs, and enhancement of operator comfort. The demand for new loaders with modern technology is thus directly correlated to the continuous growth of the market as the industries become more and more reliant on the advanced features.

Restraining Factors

Loader machines' exorbitant price tag at the outset adds a heavy burden on the demand that the market is not able to bear. The potential clients, particularly in the case of small enterprises and contractors with restricted spending, find it hard to pay for such capital-consuming machines. This fiscal blockade may cause the prospective customers to procrastinate their purchasing decisions, thus restricting the growth of the market.

Market Segmentation

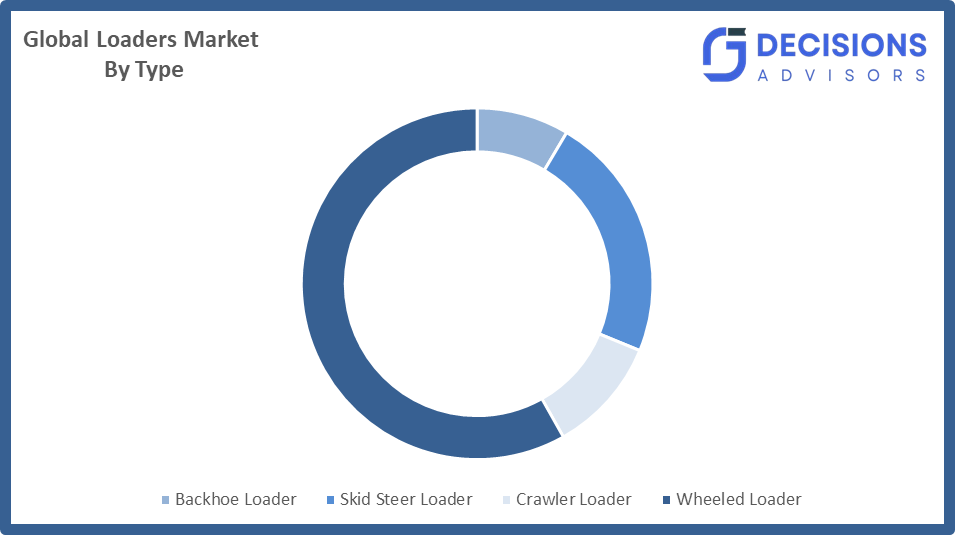

The loaders market share is classified into type and fuel.

- The wheeled loader segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the loaders market is divided into backhoe loader, skid steer loader, crawler loader, wheeled loader. Among these, the wheeled loader segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. A loader is a very flexible and highly mobile machine making it a perfect choice for infrastructure and construction projects. These loaders are extensively used in the mentioned projects because they can move swiftly and are versatile. In addition to that, the rapid expansion of logistics and agriculture industries in terms of material handling solutions has been one of the reasons contributing to the demand for the segment. Moreover, the growing concern for operator comfort through the introduction of technological innovations has opened new channels for the products by allowing them to be in line with the changing requirements in the industry.

- The ICE segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the Fuel, the loaders market is divided into electric and ICE. Among these, the ICE segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The significant demand for ICE-powered loaders has been supported by their fuel efficiency, global fuel infrastructure ensuring the easy availability of gasoline and diesel, and their low cost. Presently, the major construction projects are taking place in Southeast Asia, Africa, and Latin America, where the majority of the economies still favor the use of traditional construction machinery for such operations. Moreover, these loaders are not a hassle in regard to refueling, and their long-lasting quality attracts even more heavy machinery operators.

Regional Segment Analysis of the Loaders Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Loaders market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the loaders market over the predicted timeframe. The loader market in the Asia-Pacific region is seeing significant and strong growth mainly because of the large-scale infrastructure development projects in China and India. The combination of rapid urbanization and increased construction activities is leading to a higher demand for loaders. Moreover, the market is being further pushed by the mechanization of agriculture and the rise of the mining sector. The manufacturers are also paying more attention to the development of technologically advanced and eco-friendly loaders in order to meet the changing customer preferences and strict regulations in the region.

Europe is expected to grow at a rapid CAGR in the loaders market during the forecast period. There is still a strong demand for loaders around the world due to the construction and infrastructure activities that are still going on. At the same time, the trend towards sustainability is getting stronger, as manufacturers are more and more concentrating on the production of loaders that are less harmful to the environment. The rise of technological integration, such as automation and telematics, is also one of the factors that are contributing to getting loaders more efficient and ensuring operators' safety. Hence, the loader market in Europe is reflecting the three aspects of modernization, environmental responsibility, and better performance of machines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the loaders market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Caterpillar

- CNH Industrial N.V.

- Doosan Bobcat

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- AB Volvo

- Kobelco Construction Machinery Co., Ltd.

- Komatsu

- Liebherr

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Liebherr-Werk Bischofshofen GmbH announced plans to expand its production capacity significantly through an additional manufacturing facility in Styria, Austria, focusing on small wheel loaders. This development was expected to address the steadily rising global demand for compact wheel loaders, with the completion of this plant expected in 2029. The site’s present capacity produced 7,000 such loaders annually, with the imminent expansion expected to boost this production to 10,000 units. The new facility was involved in manufacturing the L 504 to L 518 loader models, along with models for the company’s OEM partners, Claas and John Deere.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the loaders market based on the below-mentioned segments:

Global Loaders Market, By Type

- Backhoe Loader

- Skid Steer Loader

- Crawler Loader

- Wheeled Loader

Global Loaders Market, By Fuel

- Electric

- ICE

Global Loaders Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the loaders market over the forecast period?

A: The global Loaders market is projected to expand at a CAGR of 6.14% during the forecast period.

- What is the market size of the loaders market?

A: the global loaders market size is estimated to grow from USD 36.29 billion in 2024 to USD 69.87 billion by 2035, at a CAGR of 6.14% during the forecast period 2025-2035.

- Which region holds the largest share of the loaders market?

A: Asia Pacific is anticipated to hold the largest share of the Loaders market over the predicted timeframe.

- Who are the top 10 companies operating in the global loaders market?

A: Caterpillar, CNH Industrial N.V., Doosan Bobcat, Hitachi Construction Machinery Co., Ltd., Hyundai Construction Equipment Co., Ltd., J C Bamford Excavators Ltd., AB Volvo, Kobelco Construction Machinery Co., Ltd., Komatsu, Liebherr, and Others.

- What are the market trends in the loaders market?

A: The loaders market is experiencing key market trends such as increased use of electric and hybrid loaders, incorporation of telematics and automation, growing popularity of compact equipment, and the continuous expansion of infrastructure, mining, and smart construction projects globally.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 194 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |