Global Major Appliances Market

Global Major Appliances Market Size, Share, and COVID-19 Impact Analysis, By Type (Conventional Appliances, Smart Appliances), By Distribution Channel (Hypermarkets & Supermarkets, Electronic Stores, Exclusive Brand Outlets, Online, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Major Appliances Market Summary

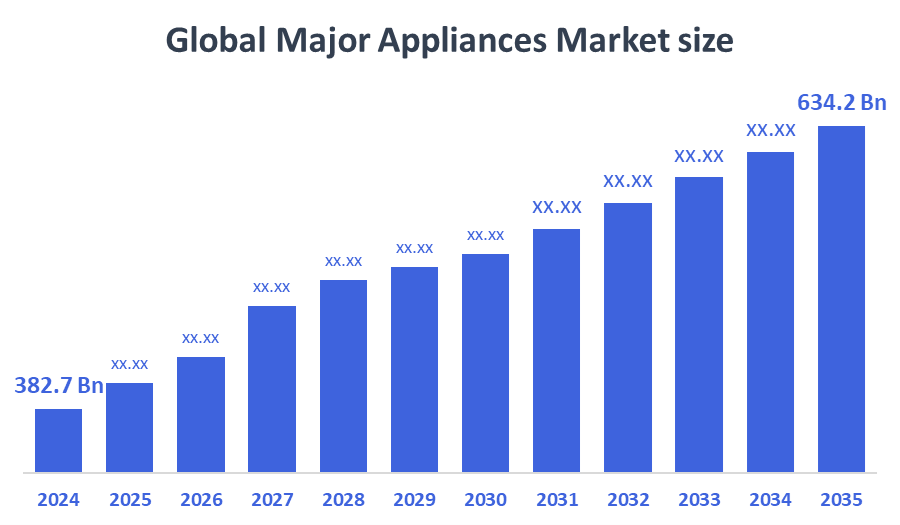

The Global Major Appliances Market Size Was Estimated at USD 382.7 Billion in 2024 and is Projected to Reach USD 634.2 Billion by 2035, Growing at a CAGR of 4.7% from 2025 to 2035. The market for major appliances is booming because of factors such as increased urbanization, rising disposable incomes, the need for smart and energy-efficient appliances, lifestyle improvements, and growing real estate development. The availability of e-commerce and technological developments further fuels customer interest and market growth internationally.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 21.5% and dominated the market globally.

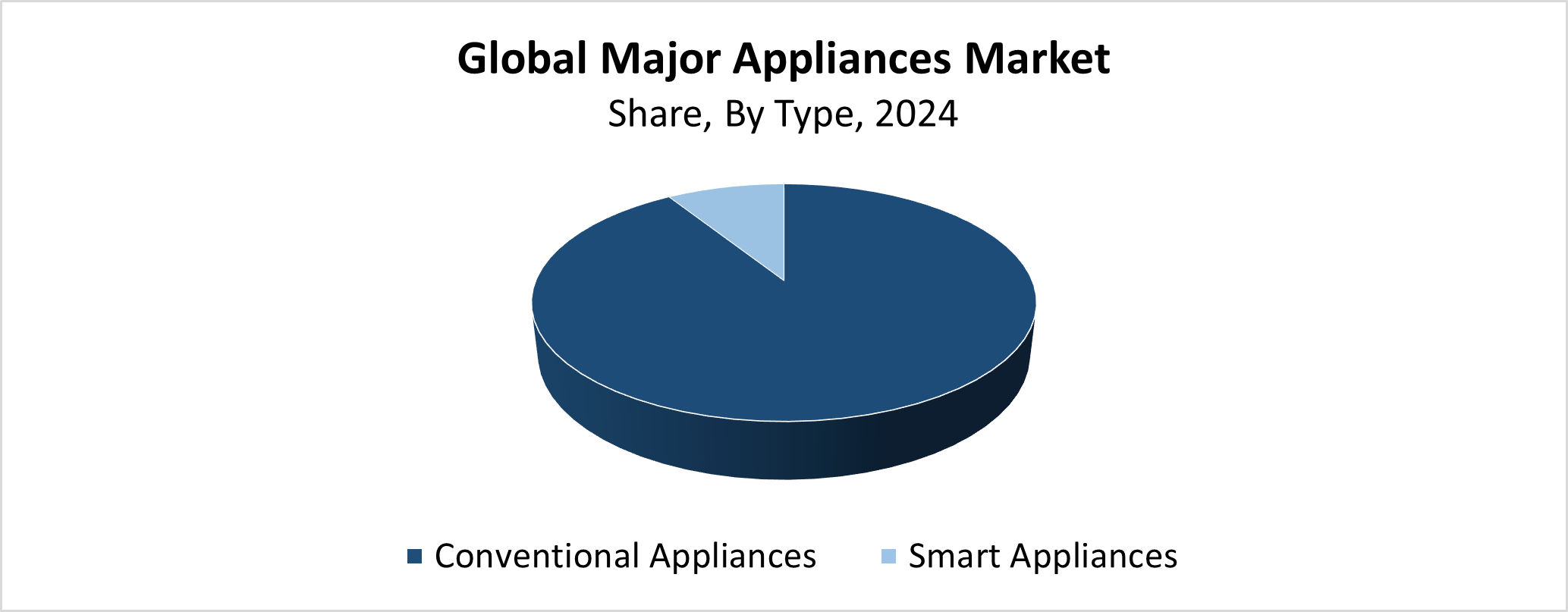

- In 2024, the conventional appliances segment had the highest market share by type, accounting for 91.32%.

- In 2024, the electronic stores segment had the biggest market share by distribution channel, accounting for 43.62%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 382.7 Billion

- 2035 Projected Market Size: USD 634.2 Billion

- CAGR (2025-2035): 4.7%

- Asia Pacific: Largest market in 2024

The major appliances market includes significant domestic equipment that handles daily responsibilities, including laundry, food storage, and cooking. Modern households need this essential equipment, which consists of air conditioners along with ovens, washing machines, and refrigerators. The industry expands due to three main factors, which include growing urbanization together with rising disposable income, and an expanding middle-class population, and changing consumer lifestyle patterns. The demand for time-saving and convenient appliances is increasing because urbanization and busy lifestyles are becoming more common. The appliance market experiences growth because home renovation activities and real estate construction, alongside smaller family units, have become more prevalent. The worldwide sales growth happened because consumers gained access to affordable financing options and improved their understanding of energy-efficient devices.

Major appliance markets experience massive transformations because of advancements in technology. Users are adopting smart appliances with IoT and AI capabilities and voice control because these devices offer convenience and energy savings while integrating with smart home systems. Modern manufacturers release touch-screen appliances with remote access and expanded features as their primary focus remains innovation. The government runs programs that help people replace their old appliances with energy-efficient ones through energy-efficient labeling and financial support for new devices. Businesses design their products with recyclable components and environmentally friendly refrigerants because of regulations that promote sustainable practices. The market expansion will continue on a global level because of the combination of policy advancements and technological progress.

Type Insights

What Factors Contributed to the Conventional Appliances Segment Capturing a 91.32% Revenue Share in the Major Appliances Market in 2024?

The conventional appliances segment dominates the major appliances market with the largest revenue share of 91.32% in 2024. The substantial market dominance results from the widespread application and established reputation of standard appliances such as air conditioners, ovens, washing machines, and refrigerators, which serve residential and commercial areas. People select these appliances because they deliver reliable performance at reasonable prices while being easy to operate, and smart appliance adoption remains limited in developing countries. The growing popularity of linked and energy-efficient appliances has led to rising smart device adoption but their market penetration remains limited by expensive upfront costs and insufficient infrastructure networks. Traditional appliances maintain their worldwide market leadership because customers continue to select them as their main choice.

The smart appliances segment in the major appliances market will experience substantial growth throughout the forecast period because customers want energy-efficient and convenient devices that connect to other systems. Customers now prefer appliances that enable remote control and smart device integration because of growing interest in smart homes and the Internet of Things (IoT). The technological advancements of voice control, along with AI capabilities, serve as leading examples that enhance both operational features and user satisfaction. The combination of government initiatives supporting intelligent energy solutions, together with growing consumer understanding of energy conservation, drives increased market demand. Modern appliances dominate the current market, but smart appliances will experience substantial annual growth, which will gradually reshape the worldwide major appliances industry.

Distribution Channel Insights

How Did Electronic Stores Dominate Distribution Channels in the Major Appliances Market in 2024?

The electronic stores segment held the highest revenue share of 43.62% and dominated the major appliances market in 2024. Consumers buy from stores because they want to see products personally and get immediate help and instant buying options. Electronic stores offer a vast selection of brands and models, which enables customers to check features and prices before purchasing. Most buyers maintain faith in physical retail stores when buying costly items such as air conditioners and refrigerators, and washing machines. Electronic stores maintain their position as customers' preferred choice even though internet retail grows in popularity because they provide personalized service, along with post-sale care and product demonstrations.

The online segment of the major appliances market will experience a significant CAGR during the forecast period because of rising internet penetration, increasing smartphone numbers, and convenient e-commerce platforms. The growing popularity of online shopping among consumers stems from its wide range of products, combined with affordable prices, simple product comparison functions, and home delivery services. The growth of online sales receives additional momentum from digital payment solutions, together with simple user interfaces and improved logistics networks. Consumers feel more confident about making high-value online transactions because online reviews, virtual product demonstrations, and seasonal discounts continue to grow in importance. The online distribution channel will serve as a key growth factor for the major appliances market because of ongoing changes in consumer habits and technology adoption.

Regional Insights

The North American major appliances market is expected to grow at a significant CAGR during the forecast period because customers seek energy-efficient and advanced technological appliances. The rising adoption of IoT-enabled devices together with smart home technology, changes how people operate domestic appliances, thus driving the market expansion. The replacement of old appliances with modern, environmentally friendly models continues to gain support from factors such as rising disposable income and rapid urbanization and sustainability initiatives. Energy Star-rated products receive support through government initiatives that promote energy efficiency and provide incentives. North America stands as an ideal market for major appliances growth because of its innovative manufacturers and well-established physical and digital retail networks.

Asia Pacific Major Appliances Market Trends

The Asia Pacific major appliances market led the global market with a revenue share of 43.25% in 2024. The main driving forces behind this market leadership include quick urban population growth, along with better economic conditions and expanding awareness about modern home appliances in China, India, Japan and South Korea. The expanding middle class, together with rising demand for both classic and smart appliances, drives this market growth. The market growth results from increased product availability combined with product affordability, which stems from expanded industrial facility spending and technical innovations. The implementation of government initiatives that promote energy-efficient appliances stands as a crucial factor. Asia Pacific maintains its position as the leader of the worldwide major appliances market because its stable economic development and rising living standards position it as an essential hub for appliance manufacturing and consumer needs.

Europe Major Appliances Market Trends

The market for major appliances in Europe experiences significant growth as customers show rising interest in smart devices and energy-saving products. Government regulations about energy consumption and environmental sustainability requirements force manufacturers to create and offer green products. Modern energy-saving technology adoption in appliances continues to grow because consumers increasingly understand the importance of lowering their carbon emissions. The region's well-established retail networks and growing e-commerce platforms make a wide selection of products available to customers. The market growth receives a boost from technological innovations, which include smart home features and IoT system integration. The market remains stable because all European countries maintain both high consumer spending power and good life quality standards. The major appliance market in Europe will experience strong growth throughout the upcoming years.

Key Major Appliances Companies:

The following are the leading companies in the major appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation

- Midea Group

- Miele & Cie. KG

- Electrolux AB

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- iRobot Corporation

- Panasonic Corporation

- Daikin Industries Ltd.

- LG Electronics Inc.

- Bosch (BSH Hausgeräte)

- Gree Electric Appliances Inc.

- Others

Recent Developments

- In August 2024, in India, Samsung introduced a new range of refrigerators as part of their Bespoke AI Double Door series. Features like Twin Cooling Plus, Convertible 5-in-1, and SmartThings AI Energy Mode are all included in this state-of-the-art appliance to meet the evolving needs of Indian consumers.

- In July 2024, at $699, Bosch Home Appliances unveiled their new 300 Series dishwasher, which includes a full stainless-steel tub. This model has two racks and uses PureDry drying technology and Bosch's PrecisionWash cleaning system to clean and dry dishes effectively. With its contemporary edge-to-edge recessed handle and built-in controls, its design combines functionality and flair.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the major appliances market based on the below-mentioned segments:

Global Major Appliances Market, By Type

- Conventional Appliances

- Smart Appliances

Global Major Appliances Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Electronic Stores

- Exclusive Brand Outlets

- Online

- Others

Global Major Appliances Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 218 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |