Global Mammography Workstation Market

Global Mammography Workstation Market Size, Share, and COVID-19 Impact Analysis, By Modality Types (Multimodal, Standalone), By Application (Diagnosis Screening, Advance Imaging, Clinical Review, Hair Samples), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Mammography Workstation Market Size Summary

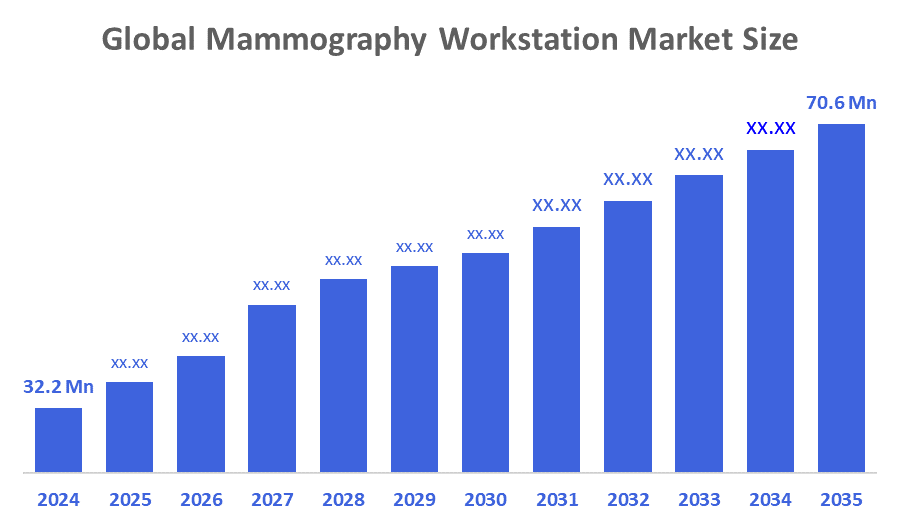

The Global Mammography Workstation Market Size Was Estimated at USD 32.2 Million in 2024 and is Projected to Reach USD 70.6 Million by 2035, Growing at a CAGR of 7.4% from 2025 to 2035. The market for mammography workstations is expanding due to the increased prevalence of breast cancer worldwide, growing awareness of early diagnosis, and important technological developments like digital tomosynthesis and software with artificial intelligence built in.

Key Regional and Segment-Wise Insights

- In 2024, the mammography workstation market in North America held the biggest revenue share of 59.4%, dominating the global market.

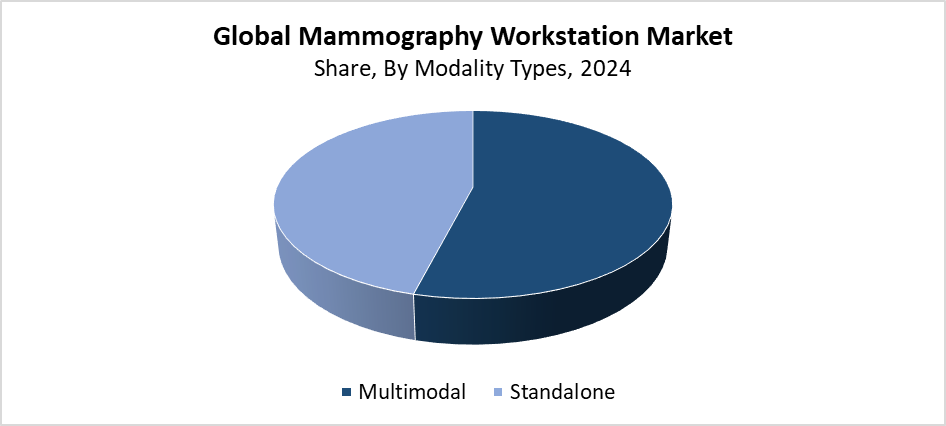

- With the most revenue share of 54.2% in 2024, the multimodal segment led the worldwide mammography workstation market by modality type.

- With the most revenue share of 38.7% in 2024, the diagnosis screening segment led the worldwide mammography workstation market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 32.2 Million

- 2035 Projected Market Size: USD 70.6 Million

- CAGR (2025-2035): 7.4%

- North America: Largest market in 2024

The market for mammography workstations specializes in computer systems dedicated to mammogram maintenance, viewing, and analysis for 2D and 3D breast imaging. Breast cancer screening and diagnosis rely on these workstations because they help radiologists assess medical images with greater accuracy and efficiency. The global market grows because of rising breast cancer rates and the increasing understanding of early detection and expanding requirements for advanced diagnostic systems. The market experiences growth because of both the shift from traditional mammography systems to digital technology and the increasing number of screening programs across established and developing nations. The growing elderly population, along with rising diagnostic imaging facilities, drives the increasing demand for mammography workstations.

Modern technological progress exerts a strong influence on the market for mammography workstations. The diagnostic precision and reading speed of medical imaging have improved through AI-based analysis tools and multimodal functionality with 3D tomosynthesis support. Modern workstations now connect directly to PACS (Picture Archiving and Communication Systems) systems, which leads to enhanced operational efficiency. The adoption rate of mammography workstations grows rapidly because of government programs that support breast cancer detection as well as funding for digital healthcare systems, primarily across North America and Europe. The worldwide market for mammography workstations expands through regulatory backing for AI imaging tools and the growing investment in tele-radiology services.

Modality Types Insights

The multimodal segment held the largest revenue share of 54.2% and led the mammography workstation market during 2024. The primary driver behind this leadership position is the rising demand for unified diagnostic platforms that let radiologists assess multiple imaging modalities like mammography alongside ultrasound, MRI, and tomosynthesis in one system. The assessment of breast abnormalities benefits from multimodal workstations because they enable the evaluation of various imaging sources, which enhances diagnostic accuracy while streamlining workflow processes. The use of these systems reduces image interpretation times while enabling medical professionals to make better clinical choices. The growing need for advanced diagnostic systems with rich data capabilities and the rising adoption of complex breast imaging methods, specifically in cancer screening programs, stand as primary factors behind the multimodal segment's market lead during 2024.

During the forecast period, the mammography workstation market's standalone segment is expected to grow at a significant CAGR. The increase in diagnostic centers, along with smaller clinics and facilities with limited resources, is driving the demand for compact, affordable imaging solutions. Healthcare providers operating in developing countries, together with rural healthcare facilities, find standalone workstations practical because these systems require less complex installation and operation processes. Standalone systems continue to evolve through technological advances that enable them to work with digital mammography equipment while providing high-quality picture viewing and basic analytic tools. The standalone market will experience consistent, substantial growth because breast cancer screening demand is rising across the globe, particularly in disadvantaged regions.

Application Insights

The diagnosis screening segment led the global mammography workstation market with 38.7% revenue share in 2024. This market leadership exists because of increasing focus on early breast cancer detection, along with expanding worldwide breast screening programs. Radiologists require diagnostic screening workstations because these devices enable accurate and efficient mammogram evaluations with special attention to early abnormality detection. Government health initiatives, along with public education efforts and rising breast cancer knowledge, have caused a massive increase in demand for diagnostic imaging solutions. The integration of AI image enhancement and digital breast tomosynthesis technologies enhances these workstations' screening capabilities, thus supporting their leading position in the market.

The advanced imaging segment of the mammography workstation market is anticipated to grow at the fastest CAGR. The increasing adoption of advanced imaging technologies such as contrast-enhanced mammography and 3D mammography (tomosynthesis) and their combination with MRI and ultrasound imaging modalities drives market expansion. Advanced imaging workstations deliver superior diagnostic results and superior lesion detail, along with improved image quality to patients who have dense breast tissue. The rising demand for specific diagnosis and tailored treatment protocols has led to an increase in high-performance workstation requirements. Modern software tools that include automatic detection functions and AI-powered picture analysis enhance the performance and reliability of advanced imaging systems, resulting in increased adoption by hospitals and breast imaging centers, and specialized diagnostic facilities.

Regional Insights

The North America mammography workstation market led globally with the largest revenue share of 59.4% in 2024. The high occurrence of breast cancer, together with the widespread use of digital breast imaging technology and advanced healthcare systems in the region, enables it to lead the market. Market development receives additional support from major industry players who lead the way in implementing advanced technologies such as 3D mammography alongside AI-based diagnostic equipment. The region maintains its market leadership because of strong government programs that emphasize early diagnosis, together with favorable reimbursement policies and established breast cancer screening networks. The use of mammography workstations throughout North America benefits from two main factors such as improved public awareness about routine screenings and sufficient numbers of experienced radiologists.

Asia Pacific Mammography Workstation Market Trends

The Asia Pacific mammography workstation market is expected to grow at the fastest CAGR during the forecast period because of heightened awareness about early diagnosis and better healthcare facilities, and growing breast cancer occurrence. Multiple countries, including China and India, together with Japan and others, invest heavily in enhancing their diagnostic capabilities through modern imaging technology. Government-backed initiatives alongside screening programs effectively boost breast cancer awareness and enhance diagnostic service accessibility throughout both city and countryside areas. The increasing adoption rate stems from digital imaging solutions becoming more affordable and the growth of both domestic and international market participants. Mammography workstations experience rapid growth in the Asia Pacific because the region invests more money into healthcare services.

Europe Mammography Workstation Market Trends

The European mammography workstation market will experience strong growth because of increasing breast cancer diagnosis numbers, while government screening initiatives across the region expand during the forecast period. Healthcare organizations in advanced systems adopt modern diagnostic technologies, including 3D mammography and AI-integrated workstations to enhance early detection and diagnostic precision. The rising adoption numbers stem from healthcare digitalization programs, together with government support for medical IT systems and cancer screening initiatives. Healthcare facilities must enhance their existing systems because of the mounting elderly population alongside rising requirements for reliable diagnostic processes. Multiple factors combine to drive the steady growth of the European mammography workstation market throughout the region.

Key Mammography Workstation Companies:

The following are the leading companies in the mammography workstation market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens HealthCare

- Analogic Corporation

- Fujifilm

- GE Healthcare

- Hologic

- Konica Minolta Business Solutions India Private Limited

- Phillips Healthcare

- Others

Recent Developments

- In May 2025, Hologic declared that MedTech Breakthrough had selected the Genius AI Detection PRO solution as the "Best New Imaging Technology Solution."

- In March 2024, iCAD, Inc. revealed new and improved ProFound Detection workstation features. The new features for 2D and 3D mammography will help radiologists interpret mammograms more easily and effectively at their workstation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the mammography workstation market based on the below-mentioned segments:

Global Mammography Workstation Market, By Modality Types

- Multimodal

- Standalone

Global Mammography Workstation Market, By Application

- Diagnosis Screening

- Advance Imaging

- Clinical Review

- Hair Samples

Global Mammography Workstation Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 237 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |