Global Margarine Market

Global Margarine Market Size, Share, and COVID-19 Impact Analysis, By Product (Hard, Soft, Liquid), By Application (Commercial, Household), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Margarine Market Summary

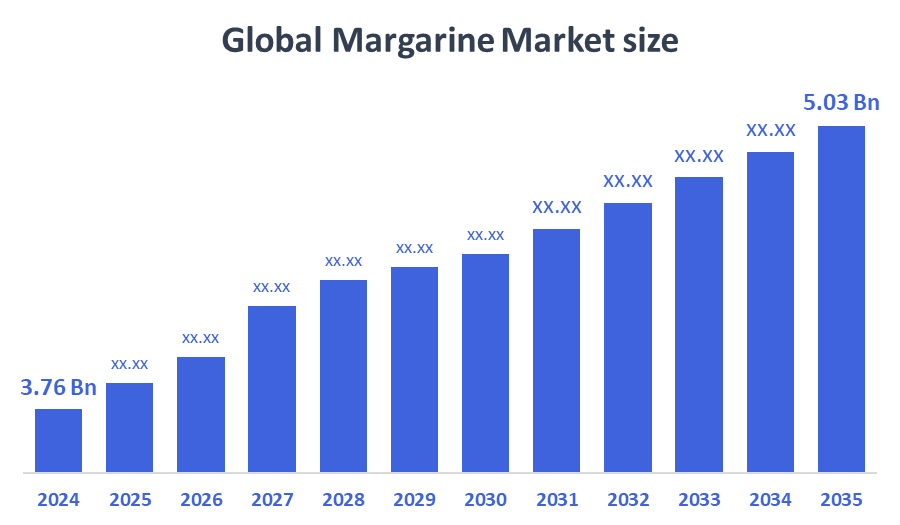

The Global Margarine Market Size Was Estimated at USD 3.76 Billion in 2024 and is Projected to Reach USD 5.03 Billion by 2035, Growing at a CAGR of 2.68% from 2025 to 2035. Growing health consciousness, a desire for lower-fat and cholesterol-free options, the expansion of vegan and dairy-free diets, the affordability of margarine in comparison to butter, and its expanding use in the bakery, confectionery, and processed food industries are all factors propelling the market for margarine.

Key Regional and Segment-Wise Insights

- In 2024, the North American margarine market held the largest revenue share of 33.4% and dominated the global market.

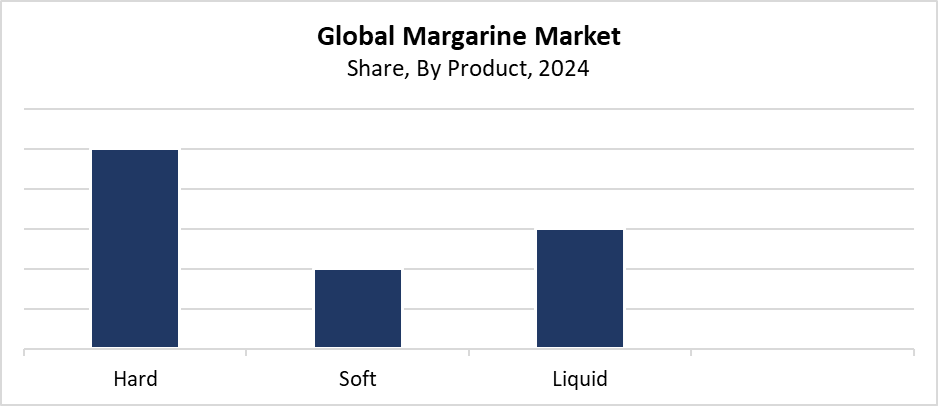

- In 2024, the hard segment held the highest revenue share of 50.3% and dominated the global market by product.

- With the biggest revenue share of 81.3% in 2024, the commercial segment led the worldwide market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.76 Billion

- 2035 Projected Market Size: USD 5.03 Billion

- CAGR (2025-2035): 2.68%

- North America: Largest market in 2024

The worldwide business sector that creates and distributes margarine, which serves as a non-dairy butter substitute made from vegetable oils and water, is referred to as the margarine market. The food industry depends on margarine because it provides a cost-effective solution with long shelf stability and versatility for baking and cooking needs, and food processing operations. The market shows continuous growth because more people request food products which contain low-fat content. This is because of plant-based ingredients. People choose margarine over butter because they want to reduce their cholesterol levels and saturated fat intake while following health-conscious eating practices. The increasing number of vegans in North America and Europe drives up the market for dairy-free alternatives such as margarine. The product's low price point and broad application in baked goods and processed foods drive market expansion.

The food processing sector has made progress, which has resulted in margarine products that deliver enhanced taste and texture, along with improved fat composition. The market now shows increasing demand for alternative products, which include trans-fat-free and non-hydrogenated margarine options. The packaging industry has developed advanced methods which extend product shelf life. They also make products easier to handle. The market has shown positive effects from government initiatives which promote plant-based eating, while reducing saturated fat intake, and encouraging heart health. The food industry receives regulatory support, which motivates producers to develop clean-label products and fortified foods that meet public health standards.

Product Insights

What Factors Enabled the Hard Segment to Capture a 50.3% Revenue Share in the Global Margarine Market in 2024?

The hard segment led the global margarine market in 2024 by capturing the largest revenue share of 50.3%. The product maintains its industry leadership because the industrial baking and food processing sectors rely on its stability and consistent performance at high melting temperatures. Hard margarine serves as the preferred choice for baking cookies, pastries, and other baked goods because it provides both structural support and improved texture. The product provides a cost-effective alternative to butter, which makes it suitable for large-scale manufacturing operations. The product has become more attractive to various applications because of its formulation changes. These reduce trans-fat content while enhancing nutritional value. The firm margarine sector maintains its position as market leader because modern consumers choose processed foods for their convenience.

The liquid segment is expected to grow at a significant CAGR throughout the forecasted period because customers want fast and straightforward cooking solutions. Liquid margarine serves as an ideal cooking ingredient for commercial and restaurant kitchens, as well as home kitchens, because it offers benefits like improved spreadability, precise portion control, and fast mixing capabilities. People who focus on their health choose it as an alternative to regular oils and solid fats because it contains reduced saturated fats along with extra nutrients. The material provides excellent versatility in modern kitchen settings because it functions well for baking, sautéing, and frying applications. The market growth continues to rise because more people choose clean-label products and plant-based diets. The global liquid margarine market will experience rapid growth because culinary tastes now focus on both convenience and health benefits.

Application Insights

How Did the Commercial Segment Secure the Leading Position in the Margarine Market with 81.3% Revenue Share in 2024?

The commercial segment dominated the margarine market with the largest revenue share of 81.3% in 2024. The foodservice sector maintains its dominant position because it uses margarine extensively throughout its operations, which include bakeries, restaurants, food processing facilities, and lodging facilities. Large-scale food manufacturing operations select margarine as their primary fat source because it provides cost savings, extended storage capabilities, and enhances product quality through its ability to improve texture and flavour. It also maintains moisture. The product finds its main applications in spreads, baked goods, sauces, and sweets. The segment grows because more people want processed and ready-to-eat foods. The market demand for margarine rises due to the worldwide growth of quick-service restaurants and commercial catering services, which maintain the commercial segment's dominant market position.

The household segment of the margarine market is expected to grow at the fastest CAGR during the forecast period because customers want affordable butter alternatives that also promote better health. People who want to live healthier now choose margarine products that contain no trans fats and have reduced levels of saturated fats. People now use margarine for their regular cooking and baking needs because they want to follow plant-based eating and dairy-free living. The accessibility of margarine products has improved through supermarkets, convenience stores, and internet platforms. These offer various margarine products in convenient packaging options. The household segment will show fast expansion because people have more money to spend and because their food preferences change, especially in developing countries.

Regional Insights

The North American margarine market dominated globally with the largest revenue share of 33.4% in 2024. The market leadership exists because margarine serves as an affordable, healthful butter replacement while consumers maintain a solid understanding of nutrition and health matters. The United States and Canada support market growth through their major food processing companies and their developed bakery industries. The demand for plant-based products that are low in fat and free of trans fats rises as health-conscious and vegan customer groups continue to grow. The retail infrastructure of supermarkets and e-commerce platforms functions as a strong system which guarantees products will be available to customers at all times. North America achieved its leading position in the worldwide margarine market through its development of new product flavours and formula compositions.

Europe Margarine Market Trends

The European margarine market is growing significantly in 2024 because commercial baking and food processing operations showed strong demand for this product. The region has used margarine as a butter substitute for many years, especially in Germany, the UK, and France. People now seek plant-based margarine products that contain no trans fats and have reduced fat content because they want to maintain their health. People now prefer plant-based foods because vegan and flexitarian diets have gained popularity. This drives up demand for these products in both homes and commercial establishments. Market expansion is also supported by government rules that encourage sustainable practices and better food choices. The European margarine market will experience ongoing growth because new flavour options, packaging formats, and nutritional content developments continue to shape its development.

Asia Pacific Margarine Market Trends

The Asia Pacific margarine market is expected to grow at a significant CAGR during the forecast period because of shifting eating habits, increasing disposable income, and fast urban development. The demand for margarine as an economical fat replacement continues to grow because people consume more baked goods and processed foods in developing countries, including China, India, and Indonesia. The market for low-fat and trans-fat-free margarine products continues to expand because people have become more aware of their health and nutritional needs. The expanding retail industry, together with e-commerce platforms, enables better product access throughout urban centres and rural areas. The market expansion receives support from the increasing number of people who choose plant-based and dairy-free eating habits in the region. Strong regional demand is anticipated to be supported by ongoing product innovation and flavour localisation.

Key Margarine Companies Companies:

The following are the leading companies in the margarine market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever

- Uni-President

- Cargill, Incorporated.

- Flora Food Group

- Bunge

- Wilmar International Ltd

- Conagra Brands, Inc.

- BRF Global.

- Yildiz Holding

- NMGK Group

- Namchow (THAILAND) LTD.

- Others

Recent Developments

- In February 2025, The Flora Food Group trademark BlueBand launched an affordable margarine pack to support the expansion of food MSMEs. The BlueBand Master Cake Margarine 500g and the "BlueBand Professional UMKM Star #AhlinyaRasaSukses" program were also introduced, providing high-quality and cost-effective solutions.

- In March 2024, in its most recent culinary creation, Wilmar Africa unveiled "Fortune Spread & Fortune All Purpose Margarine." In order to produce this new product in an efficient and high-quality manner, it opened a state-of-the-art factory.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the margarine market based on the below-mentioned segments:

Global Margarine Market, By Product

- Hard

- Soft

- Liquid

Global Margarine Market, By Application

- Commercial

- Household

Global Margarine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |