Global Maritime Satellite Communication Market

Global Maritime Satellite Communication Market Size, Share, and COVID-19 Impact Analysis, By Type (Very Small Aperture Terminal (VSAT), Mobile Satellite Services (MSS)), By Revenue Source (Hardware, Software, Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Report Overview

Table of Contents

Maritime Satellite Communication Market Summary

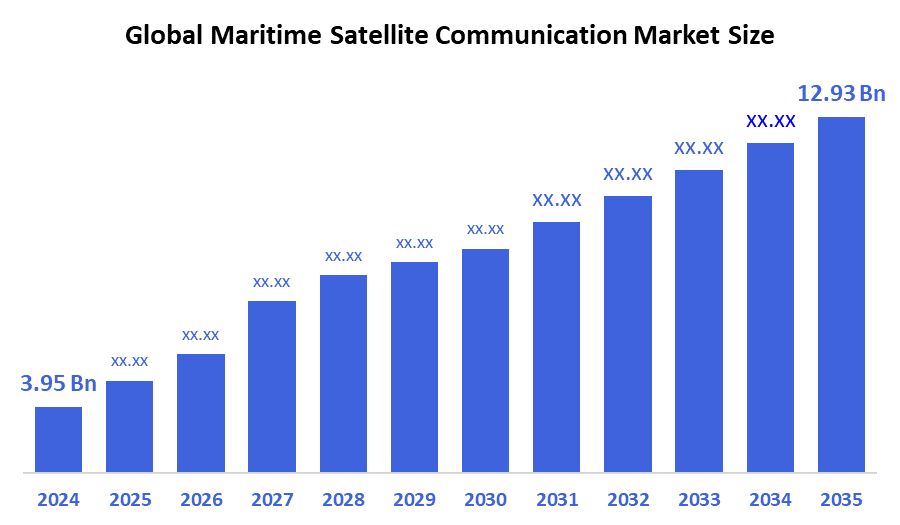

The Global Maritime Satellite Communication Market Size Was Estimated at USD 3.95 Billion in 2024, and is Projected to Reach USD 12.93 Billion by 2035, Growing at a CAGR of 11.38% from 2025 to 2035. Increased emphasis on crew welfare and high-speed connectivity, the need for better operational efficiency and safety through real-time data, and the wider digital transformation of the maritime sector are the main factors propelling the expansion of the maritime satellite communication market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific maritime satellite communication market held a 33.2% market share and dominated the market globally.

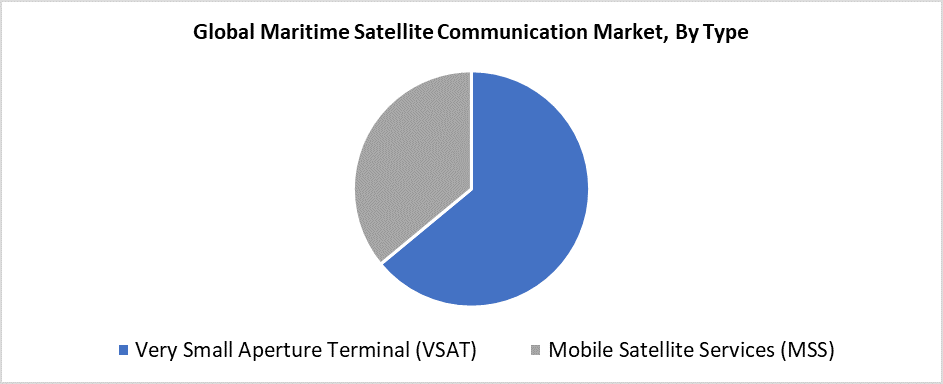

- In 2024, the Very small aperture terminal segment held the largest revenue share, accounting for 64.3% based on type.

- In 2024, the hardware segment had the biggest market share by revenue source, accounting for 60.7%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.95 Billion

- 2035 Projected Market Size: USD 12.93 Billion

- CAGR (2025-2035): 11.38%

- Asia Pacific: Largest market in 2024

The maritime satellite communication market consists of the equipment and services that deliver satellite networks for data, voice, and internet access to ships operating at sea. These solutions serve as essential components for navigation and crew welfare while supporting safety measures and fleet management operations, and enabling passenger communication. The rising demand for reliable fast communication among offshore oil and gas operations, commercial shipping and fishing activities, as well as naval operations, serves as the main market growth driver. Market expansion occurs because maritime operations require immediate data transmission and emergency support, while marine trade expands and cruise ship passengers demand internet access. Market expansion results from the maritime industry's push toward automation and digitization, which includes deploying smart ships and Internet of Things-based applications.

The maritime satellite communication environment undergoes modifications because of technological evolution. The combination of hybrid communication systems with LEO constellations and high-throughput satellites has significantly improved broadband capacity, latency performance, and coverage reach. The technologies deliver continuous access throughout remote oceanic regions. Governments, together with international marine organizations, back digital infrastructure upgrades by implementing programs that enhance both cybersecurity measures, maritime safety standards, and environmental compliance protocols. Through its e-navigation policy and smart port financing, the IMO promotes satellite communication usage, which leads to enhanced safety and operational efficiency of international maritime operations.

Type Insights

The VSAT segment of the maritime satellite communication market held the leading position with the largest market share of 64.3% in 2024. VSAT leads the market because it provides reliable high-speed broadband access, which supports various maritime needs, including crew welfare programs, fleet control systems, and navigational operations. The combination of wide coverage with reliable performance in isolated ocean regions and real-time data transmission support makes VSAT systems ideal for commercial ships, as well as cruise ships and offshore installations. The industry position of VSAT grows stronger through ongoing technological advancements that enhance its bandwidth capabilities and enable integration with high-throughput satellites (HTS). The rising popularity of VSAT solutions emerges from increasing maritime operational digitization and the need for uninterrupted sea-based communication.

The maritime satellite communication market's Mobile Satellite Services (MSS) segment is anticipated to grow at a significant CAGR during the forecast period. The market expansion stems mainly from the rising demand for portable, budget-friendly, reliable communication systems used by fishing vessels, along with coastal services and small ships. The ideal application of MSS exists for situations that require minimal bandwidth but essential voice communication and moderate data transmission. The market potential of MSS continues to grow because it finds increased applications in navigation systems, weather monitoring, and emergency communication operations. The future growth of MSS technology depends on its improved global coverage and signal reliability, together with marine safety regulations, which will drive wider adoption across different maritime sectors.

Revenue Source Insights

The hardware segment dominated the maritime satellite communication market with a 60.7% market share during 2024. The leadership position of hardware elements, including satellite phones, transceivers, antennas, and modems in marine communication networks, explains their market dominance. High-speed connectivity requirements for maritime operations have driven up the necessity for advanced and reliable hardware systems because crews need to communicate while ships need to share data instantly and navigate precisely. The rising number of international maritime vessels, together with growing cruise tourism and offshore energy activities, drives hardware demand in the market. The transition to LEO and HTS satellites requires upgraded onboard equipment, which drives continuous investments into cutting-edge maritime communication systems.

During the forecast period, the software segment of the maritime satellite communication market is predicted to grow at a significant CAGR. The rising need for efficient network management, along with cybersecurity and data optimization solutions in maritime operations, drives this market expansion. Software plays a crucial role in managing bandwidth distribution while monitoring system performance, protecting data, and enabling seamless integration between digital platforms onboard vessels that use advanced communication systems. The expanding usage of IoT-based maritime applications, along with smart vessel operations and real-time analytics, drives the accelerated need for advanced software solutions. This market is expected to experience strong growth because of the development of cloud-based marine communication platforms and AI applications for operational efficiency and predictive maintenance.

Regional Insights

The North American maritime satellite communication market held a significant revenue share in 2024 because of its active maritime operations and advanced technological infrastructure. The United States, along with Canada, maintained the primary demand for dependable, rapid satellite communication services to support offshore energy projects, along with naval operations and commercial vessels. The sector grew because businesses prioritized safety and navigation functions along with real-time data delivery and onboard internet connectivity. Service providers and satellite technology companies established strong partnerships, which enhanced their coverage and dependability of services. The worldwide maritime satellite communication market saw North America emerge as a leading force in 2024 because of government investments in maritime digitization and supportive programs. This upward trend is projected to persist throughout the upcoming years.

Europe Maritime Satellite Communication Market Trends

Europe presented a lucrative market for maritime satellite communication in 2024 because of its advanced maritime infrastructure, along with rigorous environmental and safety standards. The extensive commercial shipping networks, along with expanding offshore wind power installations and rising needs for real-time vessel monitoring, increased the demand for reliable satellite communication solutions in this region. The United Kingdom, together with Norway and Germany, led the way in maritime connection expansion through their investments in modern technological advancements. The European Union's support for digital maritime operations enabled greater adoption of satellite-based services throughout the region. Satellite communication providers identified Europe as an attractive market due to its emphasis on innovation, alongside sustainability and efficient fleet management.

Asia Pacific Maritime Satellite Communication Market Trends

The Asia Pacific maritime satellite communication market led globally with the largest revenue share of 33.2% in 2024 because of its long coastlines combined with active shipping networks and expanding offshore operations. The market expansion occurred because commercial fleets and smart marine technology investments from China, Japan, South Korea, and Singapore became the main drivers. The oil and gas sector, along with the fishing and cargo shipping sectors, experienced major growth in the need for real-time communication and navigation and crew welfare solutions. Government programs that support digital maritime infrastructure, along with rising fleet management requirements, helped accelerate the adoption of satellite communication systems. Asia Pacific held the market leadership position in 2024 because of its expanding marine trade combined with rapid technological advancements.

Key Maritime Satellite Communication Companies:

The following are the leading companies in the maritime satellite communication market. These companies collectively hold the largest market share and dictate industry trends.

- Inmarsat Global Limited

- Singapore Technologies Engineering Ltd

- ViaSat Inc.

- Leonardo S.p.A.

- EchoStar Corporation

- KVH Industries, Inc.

- Thuraya Telecommunications Company

- Orbcomm Inc.

- Iridium Communications Inc.

- Kongsberg Maritime AS

- Others

Recent Developments

- In June 2025, the launch of Alén Space's SATMAR nanosatellite into orbit was a major step forward for the digitization of marine communications. The 6U nanosatellite, SATMAR, was developed by Alén Space in partnership with Egatel and the technology center Gradiant and launched on June 23, 2025, from Vandenberg Space Force Base aboard a SpaceX Falcon 9 rocket. The project was funded by the Spanish Port Authorities and Puertos del Estado's Ports 4.0 initiative. The main goal of the mission is to validate the new VHF Data Exchange System (VDES) standard in orbit. This standard facilitates bidirectional satellite communications in the VHF band and is intended to replace the current Automatic Identification System (AIS).

- In February 2025, Thor 8, a brand-new geostationary satellite that Space Norway has commissioned and is scheduled to launch in 2027, will primarily serve the marine and offshore industries in the Middle East, Europe, and Africa by providing Ka-band connectivity. Thor 8, which will be built by Thales Alenia Space, is intended to last more than 15 years and will have three dedicated payloads that operate on the Ku and Ka bands. In order to enable Very Small Aperture Terminal (VSAT) services aboard ships, the satellite will provide dependable, fast data connections to national authorities and commercial maritime clients.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the maritime satellite communication market based on the below-mentioned segments:

Global Maritime Satellite Communication Market, By Type

- Very Small Aperture Terminal (VSAT)

- Mobile Satellite Services (MSS)

Global Maritime Satellite Communication Market, By Revenue Source

- Hardware

- Software

- Services

Global Maritime Satellite Communication Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |