Global Medical Grade Polypropylene Market

Global Medical Grade Polypropylene Market Size, Share, and COVID-19 Impact Analysis, By Type (Homopolymer Polypropylene, Random Copolymer Polypropylene, Impact Copolymer Polypropylene, Other types), By Application (Medical Devices, Medical Packaging, Laboratory Equipment, Nonwoven Medical Textiles, Drug Delivery Systems, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Medical Grade Polypropylene Market Summary

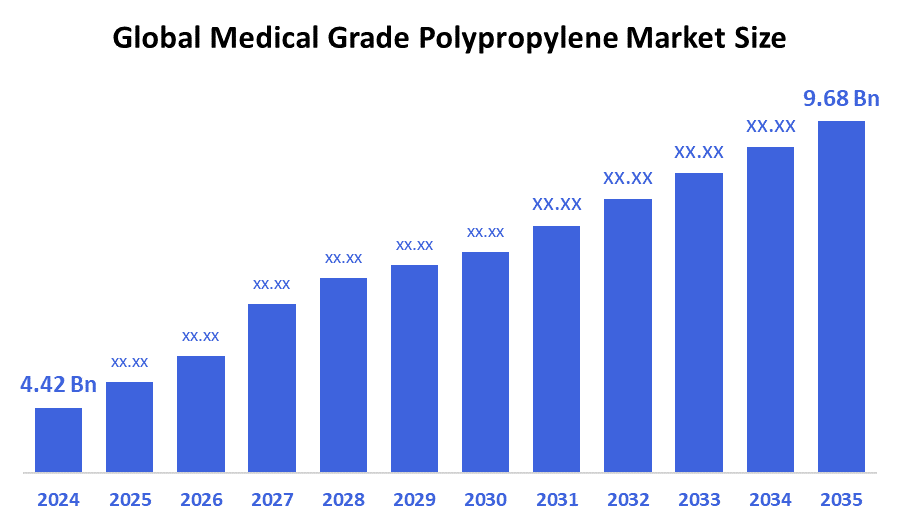

The Global Medical Grade Polypropylene Market Size Was Estimated at USD 4.42 Billion in 2024 and is Projected to Reach USD 9.68 Billion by 2035, Growing at a CAGR of 7.39% from 2025 to 2035. The market for medical-grade polypropylene is expanding due to the growing need for safe, affordable, and lightweight materials in the healthcare industry, especially for medical devices and packaging, as well as rising healthcare costs and the development of infrastructure in emerging nations.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 38.29% and dominated the market globally.

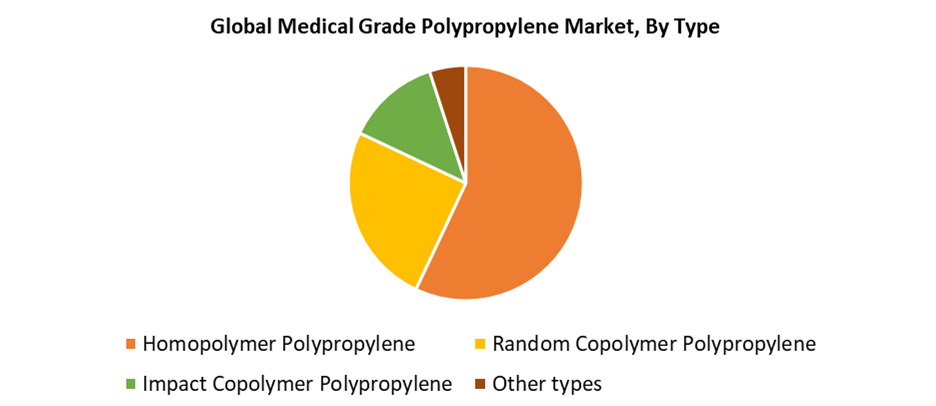

- In 2024, the homopolymer polypropylene segment had the highest market share by type, accounting for 57.92%.

- In 2024, the medical devices segment had the biggest market share by application, accounting for 30.83%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.42 Billion

- 2035 Projected Market Size: USD 9.68 Billion

- CAGR (2025-2035): 7.39%

- Asia Pacific: Largest market in 2024

The medical grade polypropylene market consists of manufacturing processes and usage of polypropylene materials that meet specific pharmaceutical and medical specifications. Medical-grade polypropylene serves as a fundamental material for manufacturing medical equipment and surgical tools, as well as packaging and diagnostic elements, because it offers outstanding chemical resistance and biocompatibility, together with lightweight properties and sterilization capabilities. The market experiences growth because of increasing chronic disease rates, along with rising healthcare costs and expanding needs for disposable medical equipment. The demand for high-quality medical-grade materials increases because of advancements in minimally invasive surgery, along with the expanding pharmaceutical industry. The COVID-19 pandemic triggered a market surge because of heightened demand for medical supplies, including vials, syringes, and protective equipment.

The medical-grade polypropylene market experiences substantial changes because of ongoing technological breakthroughs. Polypropylene applications have expanded because polymer blending and processing methods have enhanced material attributes, including durability, transparency, and sterilization compatibility. The development of recyclable and bio-based polypropylene aligns with both legal requirements and sustainability targets. All over the world, governments drive healthcare system modernization while implementing demanding safety and quality rules for medical equipment. The market growth rate increases due to initiatives that support sophisticated polymer research, along with additional funding for healthcare system advancements. The worldwide healthcare industry drives medical-grade polypropylene advancement through these factors, which foster innovation and adoption.

Type Insights

The homopolymer polypropylene segment held the largest market share at 57.92% in 2024 and dominated the medical grade polypropylene market. The outstanding mechanical strength, together with stiffness and chemical resistance of homopolymer polypropylene, makes it ideal for numerous medical applications, including syringes, surgical tools, and medical packaging. Medical facilities extensively utilize this material because it withstands degradation during sterilization methods, including autoclaving. The material offers superior processability and clarity that medical manufacturers require to create exact medical components. The pharmaceutical and medical industries continue to adopt homopolymer polypropylene because it meets their requirements for durable, lightweight, and biocompatible materials.

During the forecast period, the random copolymer polypropylene segment is projected to experience a significant CAGR. The material's enhanced flexibility, together with its clarity and impact resistance properties, leads to its increasing application in medical components that require both softness and durability. The production of medical devices such as needles and diagnostic tools, together with random copolymer polypropylene containers and packaging, requires both transparency and durability. The healthcare sector adopts this material more frequently because it stands strong against chemical exposure and sterilizing procedures. The random copolymer polypropylene market shows strong growth potential because the medical industry demands advanced materials for its disposable and single-use devices. Medical-grade polypropylene as a whole will benefit from this development.

Application Insights

The medical devices segment dominated the medical-grade polypropylene market with a 30.83% market share during 2024. The extensive application of polypropylene in medical device manufacturing stems from its excellent chemical resistance and biocompatibility, as well as its ability to withstand sterilization methods, including autoclaving and gamma irradiation. Medical-grade polypropylene serves as the preferred material for manufacturing syringes, along with IV components and diagnostic equipment, and surgical instruments, because it offers both durability and cost-effectiveness, and safety features. The rising demand for disposable medical equipment drives this segment's expansion because both infection control standards and worldwide surgical operation numbers are increasing. Medical devices require high-performance materials like polypropylene, which will see continuous growth because healthcare systems keep expanding and modernizing.

The medical packaging segment of the medical-grade polypropylene market will experience a substantial CAGR during the forecast period. The healthcare industry requires sterile packaging solutions with long-lasting capabilities and safety features, which drives market growth. Medical-grade polypropylene serves as an ideal packaging material for blister packs, bottles and caps, and containers due to its superior moisture barrier capabilities and chemical resistance, and ability to withstand sterilization processes like autoclaving and gamma radiation. The rising trend of home healthcare services, together with pharmaceutical manufacturing growth and enhanced infection control measures, drives higher market demand. The shift towards recyclable and sustainable packaging materials makes polypropylene an appealing choice, which fuels the application segment's substantial growth.

Regional Insights

The Asia Pacific medical-grade polypropylene market dominated globally with the largest revenue share of 38.29% in 2024. The region maintains its market dominance because of its rapidly expanding healthcare facilities, combined with population growth and increased demand for quality medical products at affordable prices. The pharmaceutical and medical device industries are rapidly expanding in China, India, and Japan, which drives up the need for medical-grade polypropylene in syringe production and intravenous components, as well as medical packaging applications. Market growth receives support from local healthcare access programs as well as domestic manufacturing capabilities. The market leadership of the Asia Pacific becomes stronger through its abundant raw material suppliers and production cost advantages.

North America Medical Grade Polypropylene Market Trends

During the forecast period, the North American medical-grade polypropylene market will experience considerable growth. The main factors driving this expansion include rising healthcare costs, and growing pharmaceutical industry, and increasing demand for advanced medical technology. The strong regulatory framework in this region promotes the use of medical-grade polypropylene because it establishes high-quality safety standards. The market grows because of rising needs for single-use medical equipment, including syringes and surgical tools, and growing infection control awareness. The market growth in North America benefits from technological progress in polymer manufacturing and established major industry participants. The global medical-grade polypropylene market will maintain its strong position in North America as long as healthcare innovation continues.

Europe Medical Grade Polypropylene Market Trends

The medical-grade polypropylene market in Europe experiences growth because of modern healthcare facilities combined with increasing medical device quality requirements and strict safety and regulatory standards. The demand for medical supplies and packaging composed of reliable biocompatible materials, including polypropylene, has increased due to Europe's aging population, along with rising chronic disease occurrences. Medical-grade polypropylene stands as the top choice for Europe because its strict environmental and medical regulations support materials that can be recycled and sterilized. The market growth receives additional support through improved medical device manufacturing techniques, together with growing financial support for healthcare technology development. Europe maintains its position as a major contributor to the worldwide medical grade polypropylene market growth through its focus on sustainable healthcare solutions.

Key Medical Grade Polypropylene Companies:

The following are the leading companies in the medical grade polypropylene market. These companies collectively hold the largest market share and dictate industry trends.

- Borealis AG

- Avient Corporation

- TotalEnergies Corbion

- LyondellBasell Industries

- SABIC

- INEOS Olefins & Polymers

- Braskem

- Trinseo

- ExxonMobil Chemical

- LG Chem

- Others

Recent Developments

- In May 2025, Bornewables, a new medical-grade polypropylene produced by Borealis, will be made from renewable feedstocks and is intended to make closed-loop recycling in the healthcare industry easier. An important step toward attaining circularity in regulated medical settings was taken when this innovation was tested in partnership with Sanitas Healthcare, where medical equipment was collected, sanitized, reconditioned, and converted into new functional items

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the medical-grade polypropylene market based on the below-mentioned segments:

Global Medical Grade Polypropylene Market, By Type

- Homopolymer Polypropylene

- Random Copolymer Polypropylene

- Impact Copolymer Polypropylene

- Other types

Global Medical Grade Polypropylene Market, By Application

- Medical Devices

- Medical Packaging

- Laboratory Equipment

- Nonwoven Medical Textiles

- Drug Delivery Systems

- Other applications

Global Medical Grade Polypropylene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 189 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |