Mexico Hemostats Market

Mexico Hemostats Market Size, Share, and COVID-19 Impact Analysis, By Product (Active, Passive, Combination Hemostats, and Others), By Application (Trauma, Cardiovascular Surgery, General Surgery, Plastic Surgery, Orthopedic Surgery, Neurosurgery, and Others), By End User (Hospitals & ASCs, Tactical Combat Casualty Care Centers, and Others), and Mexico Hemostats Market Size Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

Mexico Hemostats Market Size Insights Forecasts to 2035

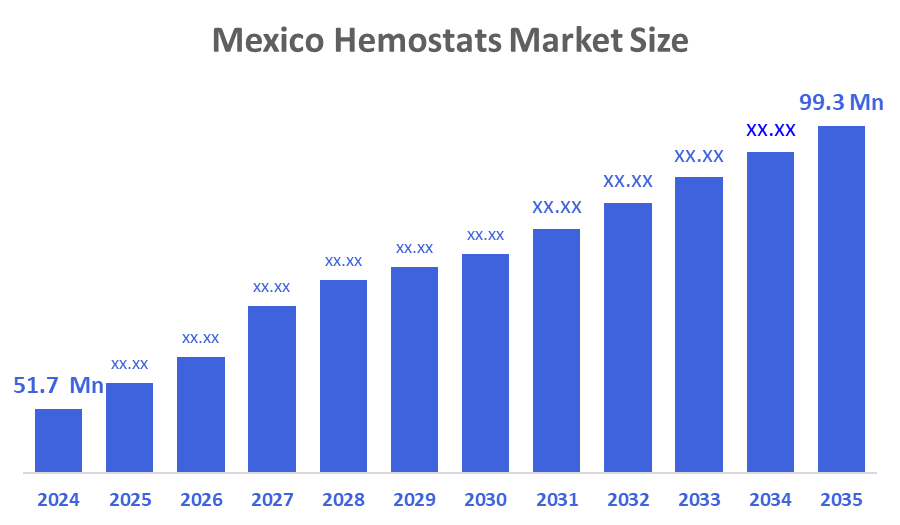

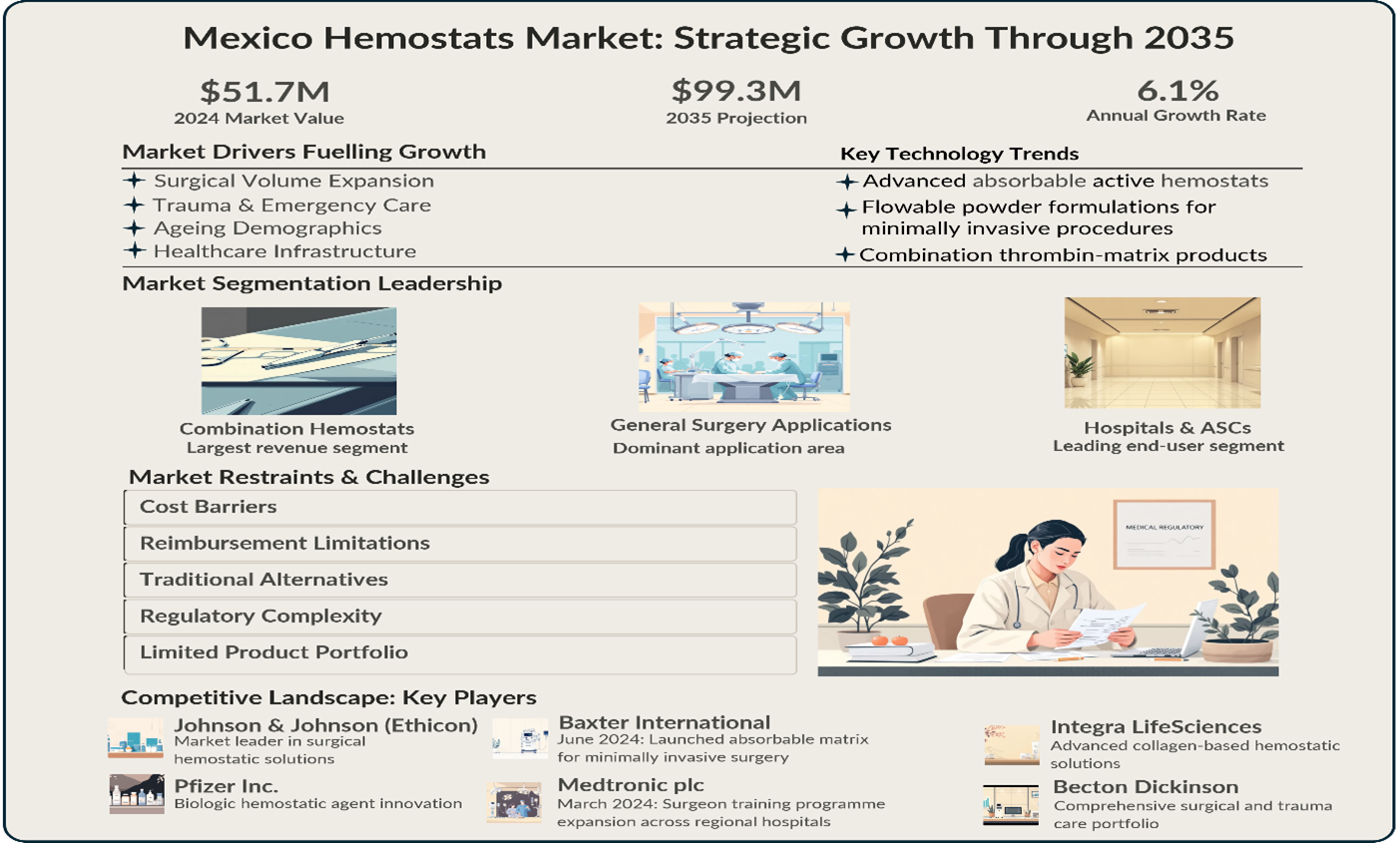

- The Mexico Hemostats Market Size Was Estimated at USD 51.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The Mexico Hemostats Market Size is Expected to Reach USD 99.3 Million by 2035

According to a Research Report Published by Decision Advisor & Consulting, The Mexico Hemostats Market Size is Anticipated to Reach USD 99.3 Million by 2035, Growing at a CAGR of 6.1% from 2025 to 2035. The Mexico Hemostats Market Size is driven by the increasing number of surgical procedures, rising trauma and accident cases, expansion of healthcare infrastructure, and growing adoption of advanced surgical bleeding control products in hospitals and ambulatory surgical centers.

Market Overview

The Mexico Hemostats Market Size refers to the industry involved in the production, distribution, and use of medical products designed to control bleeding during surgical procedures and traumatic injuries. Hemostats are used to achieve rapid hemostasis, reduce blood loss, shorten surgery time, and improve patient recovery outcomes. These products include thrombin-based agents, fibrin sealants, collagen-based sponges, oxidized regenerated cellulose, and combination hemostatic agents. The market is influenced by surgical volume, trauma incidence, healthcare expenditure, technological innovation, and regulatory approvals. Furthermore, increasing demand for minimally invasive surgeries, rising geriatric population, and growing prevalence of cardiovascular and orthopedic diseases are accelerating the adoption of advanced hemostatic solutions in Mexico.

Some of the key trends influencing the future of the Mexico Hemostats Market Size include a growing preference for innovative, absorbable, and active hemostats over traditional methods. This would help reduce surgical time, along with blood loss. With increasing robotic and endoscopic surgeries, the demand for advanced flowable and powder-based hemostats that allow for precise application is on the rise. There is a high demand for various products that combine matrices with thrombin for rapid and effective bleeding control. The orthopedic segment holds the maximum share in the market due to the growing incidence of injuries and surgeries.

The Mexican government has been strengthening healthcare services through hospital modernization programs and the enhancement of surgical care facilities. Public healthcare investments and better trauma care infrastructure are improving access to surgical treatments, thereby supporting the demand for surgical hemostatic products. On the other hand, regulatory approvals for advanced biologics and surgical materials are further encouraging the use of innovative hemostatic solutions.

Report Coverage

This research report categorizes the market for the Mexico Hemostats Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Mexico Hemostats Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Mexico Hemostats Market Size.

Driving Factors

The major driving factors for the hemostats market in Mexico include high volumes of surgical procedures, such as cardiovascular, orthopedic, and general surgeries. Growing road accidents and trauma injuries increase emergency surgical interventions, with the need to control bleeding rapidly. The aging population, chronic diseases of cancer, and cardiovascular disorders enhance the demand for surgeries. In addition, advancements in technology related to biologically active hemostatic agents and the expansion of ambulatory surgical centers also promote the market.

Restraining Factors

The high cost of advanced hemostatic products and limited reimbursement in some healthcare facilities restrain the growth of the market. Additionally, the availability of conventional sutures and electrocautery methods also decreases the rates of product adoption in smaller hospitals. More importantly, strict regulatory approval and risk of product-related complications may further hamper the market growth.

Market Segmentation

The Mexico Hemostats Market Size share is classified into product, application, and end user.

- The combination hemostats segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Mexico Hemostats Market Size is segmented by product into active, passive, combination hemostats, and others. Among these, the combination hemostats segment accounted for the largest revenue market in 2024 and is expected to grow at a significant CAGR during the forecast period. It provides active and passive modes of action, offering quicker and more efficient bleeding control than its single-type products. These hemostats have a wide preference in complicated and high-risk procedures, such as cardiovascular and orthopaedic surgeries, because of the rapid formation of clots. Reduced time consumption in surgery, blood loss minimization, and complication rates are some of the added advantages sought after by surgeons, which enhance adoption and revenue generation.

- The general surgery segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the Mexican hemostats market is segmented into trauma, cardiovascular surgery, general surgery, plastic surgery, orthopedic surgery, neurosurgery, and others. Among these, the general surgery segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The high volume of procedures carried out in Mexico includes abdominal surgeries, appendectomies, and tumour removals. Bleeding management is often routine in many of these types of surgery, which ensures consistent demand for hemostatic agents. The high frequency of general surgical procedures when compared with specialized surgeries significantly contributes to the segment’s leading market share.

- The hospitals & ASCs segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on end user, the Mexico Hemostats Market Size is segmented into hospitals & ascs, tactical combat casualty care centers, and others. Among these, the hospitals & ASCs segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. They handle the majority of surgical procedures and emergency trauma cases. They are equipped with advanced surgical infrastructure and trained professionals, allowing the adoption of modern hemostatic products. Additionally, the increasing shift toward outpatient surgeries in ASCs further boosts product utilization, leading to higher overall consumption and revenue.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Mexico Hemostats Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson (Ethicon)

- Baxter International Inc.

- Becton Dickinson and Company

- Pfizer Inc.

- Medtronic plc

- Integra LifeSciences

- CryoLife Inc.

- Teleflex Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In June 2024, Baxter International launched an advanced absorbable hemostatic matrix for minimally invasive and cardiovascular surgeries in Latin America.

In March 2024, Medtronic plc collaborated with regional hospital networks to expand the adoption of surgical hemostatic solutions through surgeon training programs.

Market Segment

This study forecasts revenue at the Mexico, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Mexico Hemostats Market Size based on the below-mentioned segments:

Mexico Hemostats Market Size, By Product

- Active

- Passive

- Combination Hemostats

- Others

Mexico Hemostats Market Size, By Application

- Trauma

- Cardiovascular Surgery

- General Surgery

- Plastic Surgery

- Orthopedic Surgery

- Neurosurgery

- Others

Mexico Hemostats Market Size, By End User

- Hospitals & ASCs

- Tactical Combat Casualty Care Centers

- Others

FAQ’s

1. What is the Mexico Hemostats Market Size?

The Mexico Hemostats Market Size refers to the industry involving products used to control bleeding during surgeries and trauma treatment.

2. What is the Mexico Hemostats Market Size ?

Mexico Hemostats Market Size is expected to grow from USD 51.7 million in 2024 to USD 99.3 million by 2035, growing at a CAGR of 6.1% during the forecast period 2025-2035.

3. What are the key drivers of the Mexico Hemostats Market Size?

The market is driven by rising surgeries, trauma cases, chronic diseases, and healthcare infrastructure expansion.

4. Which product segment dominates the Mexico Hemostats Market Size?

The combination hemostats segment dominates due to higher effectiveness and faster clotting.

5. What are the major trends in the Mexico Hemostats Market Size?

The Mexico Hemostats Market Size key trends include minimally invasive surgeries and bioabsorbable hemostatic agents.

6. Who are the key companies operating in the Mexico Hemostats Market Size?

Major players include Johnson & Johnson (Ethicon), Baxter International Inc., Becton Dickinson and Company, Pfizer Inc., Medtronic plc, Integra LifeSciences, CryoLife Inc., Teleflex Incorporated

7. What is the future outlook for the Mexico Hemostats Market Size?

Steady growth driven by increasing surgeries and advanced surgical technologies.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Country |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Feb 2026 |

| Access | Download from this page |