Global Micro-perforated Food Packaging Market

Global Micro-perforated Food Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (PE, PP, PET, Others), By Application (Fruits & Vegetables, Bakery & Confectionery, Ready-to-Eat, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Micro-perforated Food Packaging Market Summary

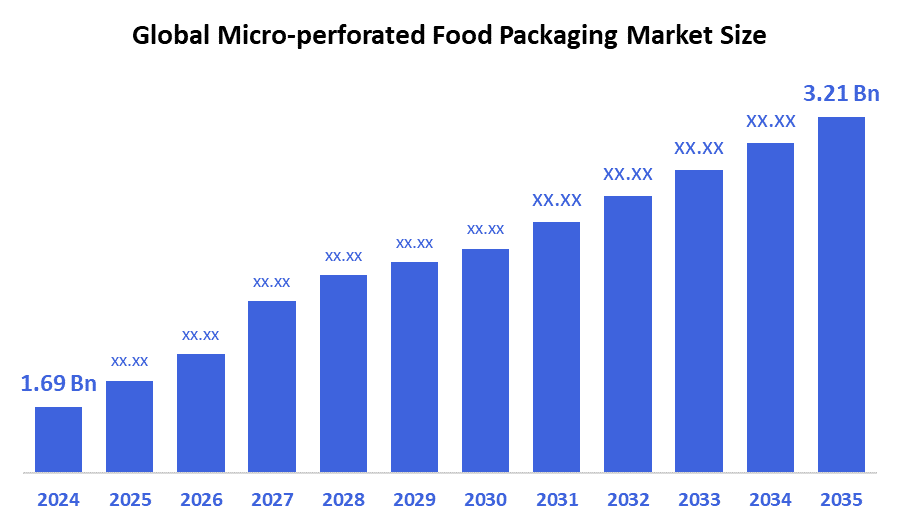

The Global Micro-Perforated Food Packaging Market Size Was Estimated at USD 1.69 Billion in 2024 and is Projected to Reach USD 3.21 Billion by 2035, Growing at a CAGR of 6.01% from 2025 to 2035. The market for micro-perforated food packaging is expanding due to factors such as the need to decrease food waste and rising consumer demand for convenient, fresh, and long-lasting products.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 30.4% and dominated the market globally.

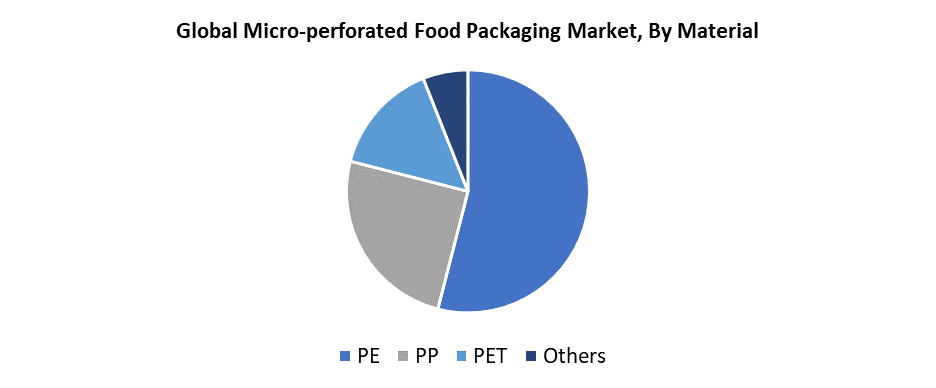

- In 2024, the PE segment had the highest market share by material, accounting for 54.3%.

- In 2024, the fruits and vegetables segment had the biggest market share by application, accounting for 48.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.69 Billion

- 2035 Projected Market Size: USD 3.21 Billion

- CAGR (2025-2035): 6.01%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The micro-perforated food packaging market extends the shelf life of perishable food items such as fruits, vegetables, baked goods, and prepared meals through the production and use of packaging materials that contain tiny holes, which allow regulated gas exchange. The packaging method controls oxygen and carbon dioxide levels to maintain taste and texture while preventing spoiling and maintaining freshness. The industry experiences growth because consumers want fresh, minimally processed foods, convenience foods are becoming more popular, and people are becoming more aware of food waste reduction. The demand for micro-perforated packaging continues to grow because of expanding global retail markets, along with consumers seeking sustainable packaging choices.

Micro-perforated food packaging has become more effective and efficient due to recent technological developments. Modern laser and mechanical micro-perforation techniques allow manufacturers to precisely control hole dimensions, which optimizes product respiration rates and extends shelf life. New developments have emerged in smart packaging through the integration of sensors and atmospheric modification technologies. Various governments throughout the world are pushing for permeable packaging made from recyclable and biodegradable materials through their food safety regulations and sustainable packaging support programs. The combination of funding for sustainable packaging research with these legal frameworks drives both innovation and rapid market growth.

Material Insights

The polyethylene (PE) segment dominated the micro-perforated food packaging market with the largest revenue share of 54.3% in 2024. PE serves as the primary packaging material for fresh produce and baked goods, along with ready-to-eat foods, because it provides outstanding flexibility and durability, along with cost-effectiveness and strong moisture barrier capabilities. The precise control of gas exchange through PE materials enables extended shelf life and product freshness because they work well with micro-perforation technologies. The food packaging industry commonly uses PE materials since they possess both lightweight properties and straightforward processing methods. The growing need for sustainable packaging solutions has led to the development of recyclable and bio-based PE materials, which have elevated the segment's position in the global market.

The micro-perforated food packaging market's polypropylene (PP) segment is anticipated to grow at the fastest CAGR through the forecast period. The packaging applications requiring durability and visibility benefit from PP's exceptional mechanical strength, high heat resistance, and clarity, which make it perfect for fresh fruit and bakery goods and snack packaging. Through modern micro-perforation methods, PP enables precise control of gas and moisture management, which extends the shelf life of perishable items. The growing demand for economical, recyclable, and lightweight packaging materials supports the adoption of PP. The PP market shows strong growth potential across both developed and developing countries because food packaging requirements for sustainability and performance are gaining more significance.

Application Insights

The fruits and vegetables segment led the micro-perforated food packaging market during 2024 with the largest revenue share of 48.4%. Worldwide demand for fresh fruit with extended shelf life, along with minimal spoiling rates, remains the primary factor that drives this dominance. Through micro-perforated packing, the packaging maintains optimal oxygen and carbon dioxide levels while slowing down fruit and vegetable respiration and preserving freshness, texture, and nutritional content. The demand for packaged fresh produce continues to expand because of growing urbanization and modern retail channels, as well as increasing numbers of health-conscious buyers. The market segment continues to grow because customers focus more on reducing food waste and improving supply chain efficiency.

The ready-to-eat segment of the micro-perforated food packaging industry is anticipated to experience the fastest CAGR growth during the forecast timeline. Urbanization, shifting consumer lifestyles, and the growing need for quick, portable meal options are the main drivers of this industry's explosive expansion. The regulated gas exchange function of micro-perforated packaging protects food texture while maintaining freshness by preventing condensation and spoilage. The increasing popularity of healthy, minimally processed meals and the expanding food delivery market are driving higher demand for micro-perforated packaging. The demand for sustainable breathable packaging solutions, along with improved product shelf life and customer satisfaction in ready-to-eat products, drives producers to adopt micro-perforated materials for their products.

Regional Insights

The market for micro-perforated food packaging is dominated by the North America region, with the largest revenue share of 30.4% in 2024. The leading market position of this industry stems from customers wanting fresh foods along with established retail and foodservice sectors. The sophisticated packaging technology infrastructure in the region, together with the growing understanding of sustainability and food waste reduction, has driven the faster adoption of micro-perforated packaging solutions. Producers allocate funds toward packaging solutions that extend product freshness and extend shelf life because of increasing consumer interest in organic and premium food products. The market growth of North America, along with its global leadership position, remains supported by government initiatives that promote both food safety and environmentally friendly packaging methods.

Europe Micro-perforated Food Packaging Market Trends

The European market for micro-perforated food packaging shows consistent growth because consumers want sustainable packaging and fresh organic food products. The stringent EU regulations about food safety and packaging waste management promote the use of innovative permeable packaging systems that help extend product shelf life while minimizing food spoilage. The increasing popularity of fresh-cut fruits and vegetables, along with ready-to-eat foods, has driven up the market for micro-perforated films. The market growth benefits from advancements in laser micro-perforation technology, together with access to recyclable and biodegradable materials. The European region maintains its position as a leading force in the global micro-perforated food packaging market since it possesses strong retail networks and increasing food sustainability requirements.

Asia Pacific Micro-perforated Food Packaging Market Trends

The Asia Pacific micro-perforated food packaging market will experience the fastest CAGR during the forecast period because of fast urbanization, along with increasing disposable income and rising demand for convenient fresh food products. The combination of food safety concerns with shelf life extension requirements and food waste reduction has forced manufacturers and merchants to adopt modern packaging technologies such as micro-perforated films. The expanding retail and e-commerce sectors, specifically in China, India, and Southeast Asian nations, are driving demand growth. The sector growth benefits from government initiatives supporting sustainable packaging, together with investments in food processing facility infrastructure. The region will drive global micro-perforated food packaging growth because consumers prefer fresh, ready-to-eat, and minimally processed food items.

Key Micro-perforated Food Packaging Companies:

The following are the leading companies in the micro-perforated food packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sev-Rend

- Constatia Flexibles

- Huhtamaki

- Crystal Vision Packaging

- Specialty Polyfilms

- Uflex Limited

- Greendot Biopak Pvt. Ltd.

- Perfo Tec

- Sealed Air

- KM Packaging Services Ltd.

- Others

Recent Developments

- In May 2025, Hotpack made a $100 million investment in a 70,000 square foot facility in New Jersey to produce individualized food packaging for customers in the United States.

- In April 2025, Amcor concluded an all-stock combination with Berry Global, establishing a larger packaging group seeking USD 3 billion annual cash flow.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the micro-perforated food packaging market based on the below-mentioned segments:

Global Micro-perforated Food Packaging Market, By Material

- PE

- PP

- PET

- Others

Global Micro-perforated Food Packaging Market, By Application

- Fruits & Vegetables

- Bakery & Confectionery

- Ready-to-Eat

- Others

Global Micro-perforated Food Packaging Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 198 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |