Global Micromachining Equipment Market

Global Micromachining Equipment Market Size, Share, and COVID-19 Impact Analysis, By Machine Type (Micro-milling & Micro-turning, Laser Micro-machining, Electrical Discharge Machining (EDM), Electrochemical Machining (ECM), Water Jet Cutting, Hybrid Micromachining, Others), By End-use (Semiconductors & Electronics, Automotive, Medical Devices, Aerospace & Defense, Optics & Photonics, Energy & Power, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Micromachining Equipment Market Summary

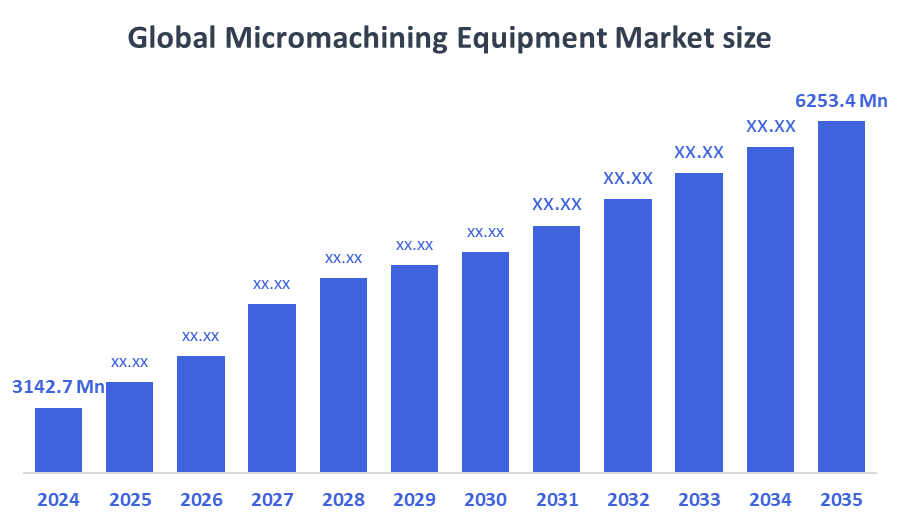

The Global Micromachining Equipment Market Size Was Valued at USD 3142.7 Million in 2024 and is Projected to Reach USD 6253.4 Million by 2035, Growing at a CAGR of 6.45% from 2025 to 2035. The market for micromachining equipment is expanding as a result of the need for high-accuracy, effective microfabrication processes across industries, the expansion of precision manufacturing technologies, the growing use of automation, and the growing demand for miniaturised components in electronics, medical devices, and aerospace.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific micromachining equipment market held the largest revenue share of 49.8% and dominated the global market.

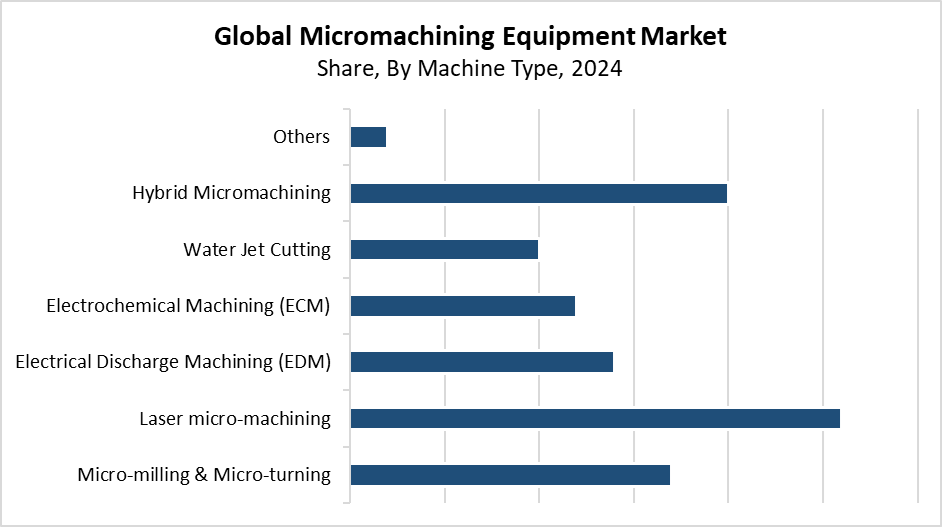

- In 2024, the laser micromachining segment held the highest revenue share of 26.3% and dominated the global market by machine type.

- With the biggest revenue share of 36.4% in 2024, the semiconductors and electronics segment led the worldwide market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3142.7 Million

- 2035 Projected Market Size: USD 6253.4 Million

- CAGR (2025-2035): 6.45%

- Asia Pacific: Largest market in 2024

The market for micromachining equipment includes advanced tools and machinery which produce small and exact components for use in electronics, medical devices, aerospace, automotive, and telecommunications. The equipment category includes Ultrasonic micromachining tools, micro-milling machines, laser micromachining systems, and micro-EDM. The market continues to grow because of rising demand for sophisticated compact components, which find their main application in consumer electronics and healthcare sectors. The rising need for wearable technology, implantable medical devices, and micro-electromechanical systems (MEMS) drives up the demand for micromachining technologies. Market expansion needs better manufacturing process efficiency and precision. This supports its growth.

Technological developments have created a strong influence on the micromachining equipment market. The combination of automation with computer numerical control (CNC) systems and laser, ultrasonic technology advancements enables micromachining operations to achieve improved precision, speed, and consistent repetition in their results. Industry 4.0 concepts, which include IoT and AI enable the development of intelligent manufacturing systems that adapt to changing circumstances. The high-precision machining industry receives support from governments worldwide through funding initiatives, tax incentives, and research grants, which promote innovation and market competitiveness. The programs work to build up and distribute micromachining equipment. This serves critical worldwide sectors.

Machine Type Insights

What Factors Enabled the Laser Micromachining Segment to Capture a 26.3% Revenue Share in the Micromachining Equipment Market in 2024?

The laser micromachining segment led the micromachining equipment market with the largest revenue share of 26.3% in 2024. Laser-based methods achieve this dominant position because they provide precise results through adaptable non-contact processes which create intricate micro-features across multiple material types. The electronics and medical device, and automotive industries use laser micromachining for microscale operations, which include drilling, cutting, and engraving. The system gains extra value through its ability to handle fragile, brittle, hard materials while maintaining thermal protection. The technology spread widely because ultrafast and femtosecond laser advancements improved precision and speed. The specific qualities of laser micromachining make it the preferred choice for all production operations that require exact precision.

The hybrid micromachining segment within the micromachining equipment market is anticipated to grow at a significant CAGR during the forecast period. Multi-functional machining systems, which combine two or more micromachining techniques, including laser, micro-EDM, and micro-milling, have gained popularity because they provide better precision and flexibility and improved efficiency. Hybrid systems enable faster production times and improved precision through their ability to process multiple materials and complex shapes within a single setup. These technologies find applications in electronics, medical devices, and aerospace sectors because they fulfil the growing demand for compact high-performance components. The development of automation and control technology has enhanced both the integration and performance of hybrid machines.

End-use Insights

How Did the Semiconductors and Electronics Segment Lead the Micromachining Equipment Market in 2024?

The semiconductors and electronics segment held the largest revenue share of 36.4% and led the micromachining equipment market in 2024. The main reason for this growth stems from the growing requirement for advanced compact electronic components. These power wearable devices and computers, cellphones, and advanced communication equipment. Modern electronics depend on the fabrication of micro-scale features on circuit boards, sensors, and microelectromechanical systems (MEMS), which is made possible by micromachining. The demand for precise micromachining solutions has grown because 5G technology and Internet of Things devices, and consumer electronics keep advancing. Manufacturers now must operate advanced micromachining equipment to produce electronic components with better precision, increased production speed, and superior quality because devices are shrinking in size and semiconductor components are becoming more complex.

The medical devices segment of the micromachining equipment market will experience a substantial CAGR during the forecasted period. The demand for high-precision small components in medical technology applications such as implantable, surgical tools, catheters, and diagnostic equipment drives this market growth. The production of complex shapes and detailed elements with high precision through micromachining enables patient safety and device performance. Medical component demand rises because of an ageing population, along with increasing chronic disease rates and developing minimally invasive medical procedures. Healthcare equipment manufacturers must acquire state-of-the-art micromachining technology to satisfy regulatory quality standards for medical device manufacturing. Healthcare equipment makers must acquire advanced micromachining technology according to regulatory requirements.

Regional Insights

The North American micromachining equipment market will experience significant growth during the forecast period because the region supports high-precision industries such as electronics, medical devices, and aerospace. Manufacturers must use micromachining solutions because the market demands smaller components for consumer electronics and medical technology. This requires exact manufacturing. The adoption of automated digital micromachining equipment continues to expand because Industry 4.0 and smart manufacturing initiatives actively promote its use across the United States and Canada. The market growth depends on strong research and development funding, major industry players, and supportive government policies that promote industrial innovation and production competitiveness. All of these elements work together to make North America an essential part of the world market for micromachining equipment.

Europe Micromachining Equipment Market Trends

The European micromachining equipment market is growing significantly because of advancements in precision engineering, healthcare technologies, and automobile manufacturing. Germany, France, and Switzerland lead the way in micromachining technology implementation for producing tiny, precise components used in electronics, medical devices, and aerospace equipment. The region's established industrial base and strong emphasis on research and development facilitate the incorporation of state-of-the-art micromachining technology. The market expansion receives support from the MEMS and semiconductor industry growth and the increasing need for minimally invasive medical equipment. The use of automated, high-performance micromachining equipment continues to expand throughout Europe's high-tech industries because governments support advanced manufacturing, sustainable technologies, and digital transformation through Industry 4.0 programs.

Asia Pacific Micromachining Equipment Market Trends

The Asia Pacific region dominated the micromachining equipment market by holding the largest revenue share of 49.8% in 2024. The region maintains its dominance through fast-growing electronics and semiconductor, and medical device manufacturing sectors in China, Japan, South Korea, and Taiwan. The demand for high-precision micromachining technologies grows because wearable technology, cellphones, and consumer electronics need smaller components. Advanced micromachining technologies are finding increasing adoption because smart manufacturing and industrial automation systems receive higher financial support. The region maintains its leadership position because of its strong supply chains and cost-effective manufacturing. Government programs that support high-tech business development. Precision manufacturing innovation alongside production processes continues to operate in the Asia Pacific.

Key Micromachining Equipment Companies:

The following are the leading companies in the micromachining equipment market. These companies collectively hold the largest market share and dictate industry trends.

- TRUMPF GmbH + Co. KG

- Georg Fischer Ltd.

- AMADA WELD TECH

- IPG Photonics Corporation

- Makino Milling Machine Co., Ltd.

- OpTek Ltd.

- Jenoptik AG

- MKS Inc

- Mitsubishi Heavy Industries, Ltd.

- Coherent, Inc.

- Synova SA

- Oxford Lasers

Recent Developments

- In June 2025, for high-performance DPSS systems, Coherent introduced the SES18-880A-190-10, an 18W, 880 nm single-emitter laser diode. It provides excellent brightness and efficiency for research, material processing, and precision micromachining applications. The small size reduces operating expenses and increases system reliability. Coherent's emphasis on developing industrial and research laser technology is demonstrated by this launch.

- In January 2025, at Photonics West 2025, IPG Photonics will present its most recent fibre laser technologies, emphasising their use in research, cleaning, and micromachining. Better integration and performance are provided by the YLS-RI high-power platform. There will also be high-brightness sources and ultrafast lasers for directed energy and medicinal applications. We will demonstrate specialised single-frequency lasers for quantum computing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the micromachining equipment market based on the below-mentioned segments:

Global Micromachining Equipment Market, By Machine type

- Micro-milling & Micro-turning

- Laser micro-machining

- Electrical Discharge Machining (EDM)

- Electrochemical Machining (ECM)

- Water Jet Cutting

- Hybrid Micromachining

- Others

Global Micromachining Equipment Market, By End Use

- Semiconductors & Electronics

- Automotive

- Medical Devices

- Aerospace & Defense

- Optics & Photonics

- Energy & Power

- Others

Global Micromachining Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |