Global Microplastics Removal Technologies Market

Global Microplastics Removal Technologies Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Filtration Systems, Chemical Treatment, Biological Methods, and Electrochemical Processes), By Application (Municipal Water Treatment, Industrial Wastewater Treatment, Agricultural Runoff Management, Marine & Environmental Protection, and Research & Development), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Microplastics Removal Technologies Market Summary, Size & Emerging Trends

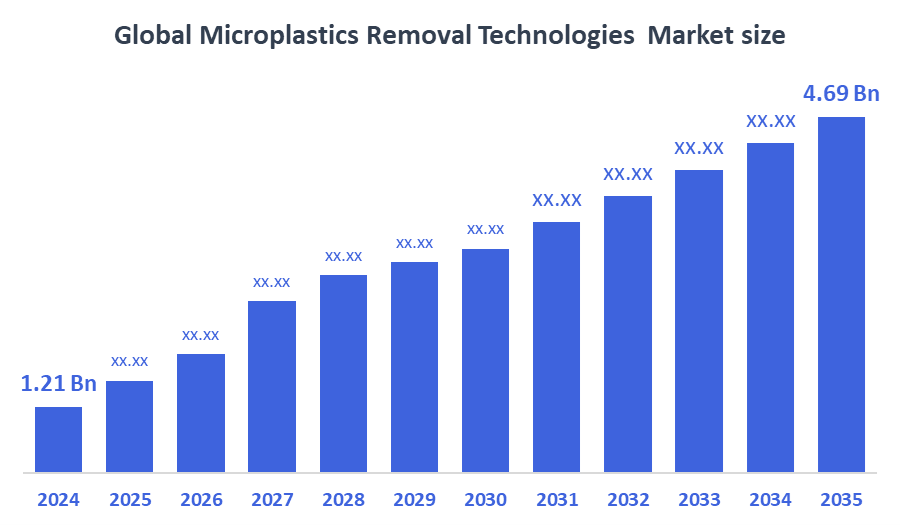

According to Decision Advisor, The Global Microplastics Removal Technologies Market Size is Expected to Grow from USD 1.21 Billion in 2024 to USD 4.69 Billion by 2035, at a CAGR of 13.11% during the forecast period 2025-2035. Increasing awareness of environmental pollution and stricter regulations for water quality are key driving factors for the microplastics removal technologies market.

Key Market Insights

- Asia Pacific is expected to account for the largest microplastic removal technologies market share during the forecast period.

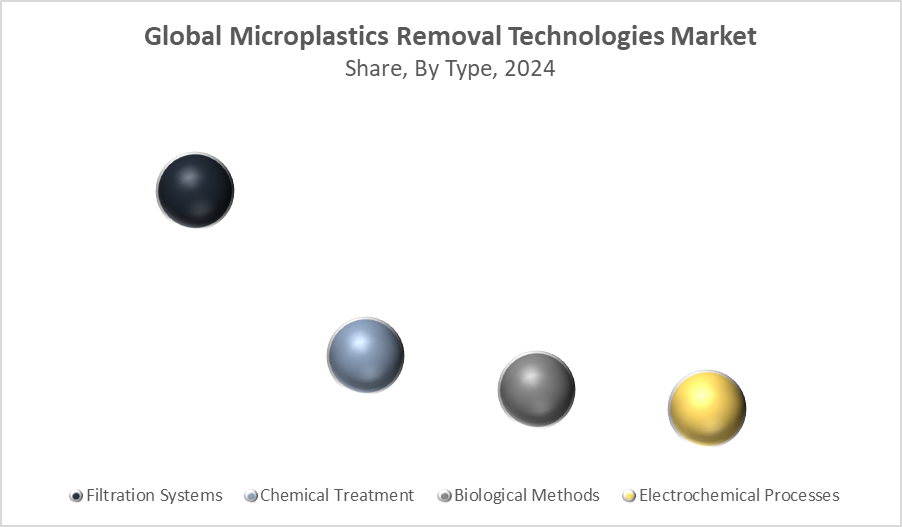

- In terms of type, the filtration systems segment dominated in terms of revenue during the forecast period.

- In terms of application, municipal water treatment accounted for the largest revenue share in the global microplastics removal technologies market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.21 Billion

- 2035 Projected Market Size: USD 4.69 Billion

- CAGR (2025-2035): 13.11%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Microplastics Removal Technologies Market

The microplastics removal technologies market focuses on advanced solutions to eliminate microplastic contaminants from water sources. These technologies include filtration, chemical, biological, and electrochemical methods that target microplastic particles in municipal, industrial, agricultural, and marine environments. With rising concerns about the ecological and health impacts of microplastics, governments and industries are investing heavily in effective removal techniques. Policies promoting water safety and environmental protection, along with increasing research and development, support market expansion. The market growth is further accelerated by industrial wastewater treatment mandates and the need for sustainable water management systems across the globe.

Microplastics Removal Technologies Market Trends

- Growing demand for eco-friendly and energy-efficient microplastic removal technologies to minimize environmental footprint.

- Increasing adoption of hybrid methods combining filtration and chemical treatment for enhanced removal efficiency.

- Expansion of research initiatives aimed at understanding microplastic pollution and developing innovative solutions.

Microplastics Removal Technologies Market Dynamics

Driving Factors: Increasing environmental regulations and public awareness

Governments worldwide are enacting stricter environmental regulations aimed at improving water quality by targeting contaminants like microplastics. These mandates often require municipal, industrial, and agricultural sectors to implement advanced treatment systems capable of effectively removing microplastics from wastewater and runoff. Alongside regulations, growing public awareness fueled by media, scientific studies, and advocacy campaigns has heightened concern about the environmental and health impacts of microplastics. This public pressure pushes organisations and governments to adopt more efficient removal technologies. Moreover, advancements in technology are making these removal systems more efficient and cost-effective, increasing their appeal.

Restrain Factors: High costs and technical limitations

Despite growing demand, the adoption of microplastic removal technologies faces significant hurdles. Advanced filtration systems, chemical treatments, and biological methods often require substantial capital investment and ongoing operational expenses, which can be prohibitive for many municipalities or industries, especially in developing regions. Technologically, it remains challenging to detect and capture very small (ultrafine) microplastic particles due to their size and diverse chemical compositions. This limitation affects the overall effectiveness of treatment systems.

Opportunity: Integration of AI and automation

A promising growth avenue lies in the integration of artificial intelligence (AI) and automation into microplastic detection and removal. AI can enhance the accuracy and speed of identifying microplastics in water, optimise treatment system performance, and predict maintenance needs, thereby improving efficiency and reducing costs. Emerging markets investing heavily in water infrastructure provide fertile ground for expanding microplastic removal technology adoption. Additionally, innovations like biodegradable filtration materials and enhanced biological degradation methods align with global sustainability goals, offering companies competitive advantages by addressing environmental concerns more holistically.

Challenges: Regulatory inconsistencies and supply chain issues

One of the main challenges limiting global market expansion is the lack of uniform regulatory standards for microplastic pollution and removal technologies. Different countries and regions have varying rules, which can create uncertainty and slow adoption by manufacturers and end-users who operate internationally. Supply chain disruptions pose another significant challenge. Key components such as advanced filtration membranes, chemical reagents, and specialised equipment can become scarce due to geopolitical tensions, manufacturing delays, or trade restrictions.

Global Microplastics Removal Technologies Market Ecosystem Analysis

The global microplastics removal technologies market ecosystem includes raw material suppliers (membranes, chemicals, biological agents), technology developers, manufacturers of filtration and treatment systems, and end-users such as municipal water authorities, industrial plants, agricultural agencies, and research institutions. Collaboration between regulatory bodies and technology providers is critical to establishing standards and driving innovation. The ecosystem’s growth depends on the balance of supply chain stability, technological advancements, and regulatory support worldwide.

Global Microplastics Removal Technologies Market, By Type

Why did the filtration systems segment account for approximately 45% of the total market share in microplastics removal technologies?

The filtration systems segment dominated the microplastics removal technologies market in 2024, accounting for approximately 45% of the total market share, due to its proven efficiency, scalability, and cost-effectiveness in removing microplastics from water sources. Filtration technologies offer reliable and adaptable solutions across various applications, including wastewater treatment and industrial effluent management. Their ability to capture a wide range of microplastic particle sizes, combined with increasing regulatory pressures and growing environmental awareness, fueled widespread adoption. These factors collectively positioned filtration systems as the leading technology in microplastics removal during the forecast period.

How did chemical treatment gain competitiveness in the microplastics removal technologies market?

The chemical treatment segment is witnessing growing adoption in the microplastics removal technologies market, holding around 25% market share, due to its effectiveness in breaking down microplastics and facilitating their removal from water bodies. Chemical treatment methods offer the advantage of targeting a wide variety of microplastic compositions and sizes, enhancing overall removal efficiency. Additionally, advancements in chemical agents and processes have improved their environmental safety and operational cost-effectiveness. These benefits, combined with increasing regulatory focus on water quality, have driven the expanding use of chemical treatment technologies in the microplastics removal market.

Global Microplastics Removal Technologies Market, By Application

What made the municipal water treatment segment the leading revenue contributor in the microplastics removal technologies market?

The municipal water treatment segment accounted for the largest revenue share of approximately 40% in the global microplastics removal technologies market during the forecast period due to increasing investments in public water infrastructure and stringent regulations on water quality. Municipal systems require efficient and reliable technologies to address the growing concern of microplastic contamination in drinking water supplies. The segment benefits from large-scale implementation, government funding, and public health initiatives aimed at ensuring safe and clean water.

Why do microplastics removal technologies see significant use in industrial wastewater treatment?

Industrial wastewater treatment is a key application area in the microplastics removal technologies market due to the significant discharge of microplastics from manufacturing and processing industries. These sectors generate complex wastewater streams containing various microplastic particles that require effective removal to prevent environmental contamination. The adoption of advanced removal technologies in industrial wastewater treatment helps meet regulatory standards and sustainability goals while protecting aquatic ecosystems.

Asia Pacific region is expected to dominate the microplastics removal technologies market during the forecast period, accounting for approximately 42% of the global market revenue.

This dominance is driven by rapid industrialization, accelerating urbanization, and significant investments in expanding and upgrading water treatment infrastructure across major economies such as China, India, and Japan. Governments in these countries are implementing stringent regulations to address rising water pollution, including microplastic contamination, which is pushing the adoption of advanced removal technologies.

India is also a key growth market, projected to grow at a CAGR of approximately 9% over the forecast period.

Growth in India is driven by increasing public and governmental awareness about microplastic pollution, stronger regulatory frameworks, and substantial investments in municipal and industrial wastewater infrastructure. Southern states like Tamil Nadu and Maharashtra are at the forefront of this growth, due to their vibrant industrial bases and extensive agricultural runoff management initiatives requiring efficient microplastics removal.

North America holds the second-largest regional market share, approximately 25%, and is expected to register a significant CAGR during the forecast period.

The United States is the primary driver of growth in this region, supported by strong federal and state environmental regulations targeting water pollution and microplastic contaminants. Significant investments in advanced water treatment technologies and ongoing research activities aimed at understanding and mitigating microplastic pollution further boost market growth. The presence of established technology providers and increasing adoption of automated and AI-integrated treatment solutions also contribute to the region’s expanding market share.

WORLDWIDE TOP KEY PLAYERS IN THE MICROPLASTICS REMOVAL TECHNOLOGIES MARKET INCLUDE

-

- Pall Corporation

- Evoqua Water Technologies

- Veolia Environnement S.A.

- Suez S.A.

- Pentair plc

- Ecolab Inc.

- Grundfos Holding A/S

- Xylem Inc.

- Danaher Corporation

- Others

Product Launches in Microplastics Removal Technologies Market

- In March 2024, Evoqua Water Technologies introduced an advanced membrane filtration system aimed at significantly improving the efficiency of microplastic removal in municipal water treatment plants across Europe and North America. This new system incorporates cutting-edge membrane technology that enhances the capture of a broader range of microplastic particle sizes, including ultrafine particles that are typically difficult to remove with conventional filters. The launch reflects Evoqua’s commitment to addressing rising environmental regulations and increasing demand for cleaner water in developed regions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the microplastics removal technologies market based on the below-mentioned segments:

Global Microplastics Removal Technologies Market, By Type

-

- Filtration Systems

- Chemical Treatment

- Biological Methods

- Electrochemical Processes

Global Microplastics Removal Technologies Market, By Application

-

- Municipal Water Treatment

- Industrial Wastewater Treatment

- Agricultural Runoff Management

- Marine & Environmental Protection

- Research & Development

Global Microplastics Removal Technologies Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the projected market size of the global microplastics removal technologies market by 2035?

The market is expected to reach approximately USD 4.69 billion by 2035, growing from USD 1.21 billion in 2024 at a CAGR of 13.11% during the forecast period 2025–2035.

Q. Which region held the largest market share in the microplastics removal technologies market in 2024?

Asia Pacific accounted for the largest share of the global market in 2024, driven by rapid industrialization, urbanization, and investments in water treatment infrastructure.

Q. What is the fastest-growing region in the microplastics removal technologies market?

North America, particularly the United States, is expected to be the fastest-growing region due to stringent environmental regulations and high adoption of advanced treatment technologies.

Q. Which technology type led the market in 2024?

The filtration systems segment dominated the market in 2024, accounting for approximately 45% of the total revenue due to its cost-effectiveness, scalability, and efficiency.

Q. Why is the chemical treatment segment gaining traction?

Chemical treatment holds around 25% of the market share and is gaining popularity for its ability to target diverse microplastic compositions with improved removal efficiency.

Q. Which application segment generated the highest revenue in 2024?

The municipal water treatment segment was the largest revenue contributor, making up around 40% of the global market, supported by public infrastructure investments and regulatory mandates.

Q. Why is industrial wastewater treatment a key application for microplastics removal?

Industries discharge significant volumes of microplastics, and effective removal is essential for meeting environmental standards and sustainability goals.

Q. What are the main drivers of the microplastics removal technologies market?

Key drivers include increasing environmental regulations, heightened public awareness of water pollution, and advancements in removal technologies.

Q. What are the main restraints in the market?

High installation and operational costs, along with technological limitations in detecting ultrafine microplastics, are major restraints.

Q. What opportunities exist for market growth?

Integration of AI and automation, adoption of biodegradable filtration materials, and expansion in emerging markets offer strong growth potential.

Q. Who are the leading players in the global microplastics removal technologies market?

Key players include Pall Corporation, Evoqua Water Technologies, Veolia Environnement S.A., Suez S.A., Pentair plc, Ecolab Inc., Grundfos Holding A/S, Xylem Inc., and Danaher Corporation.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 189 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |