Global Midline Catheter Market

Global Midline Catheter Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Single Lumen Catheters, Double Lumen Catheters, Triple Lumen Catheters, and Ultrasound Guided Catheters), By Material (Polyurethane, Polyvinyl Chloride, and Silicone), By Application (Oncology, Antibiotic Therapy, and Fluid and Blood Product Administration), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

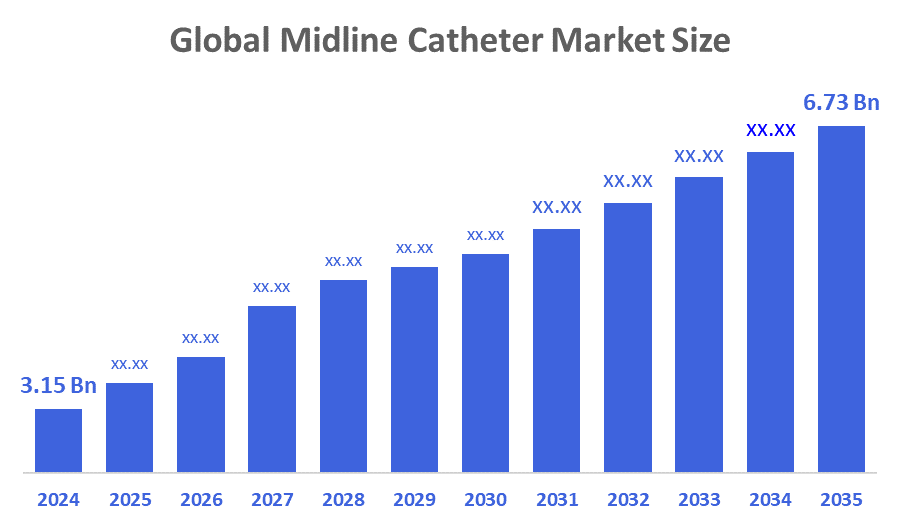

Global Midline Catheter Market Size Insights Forecasts to 2035

- The Global Midline Catheter Market Size Was Estimated at USD 3.15 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.15 % from 2025 to 2035

- The Worldwide Midline Catheter Market Size is Expected to Reach USD 6.73 billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Midline Catheter Market Size Was Worth Around USD 3.15 Billion In 2024 And Is Predicted To Grow To Around USD 6.73 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 7.15 % From 2025 To 2035. The growing number of hospital admissions, advancements in catheter technology, and the increasing incidence of chronic illnesses requiring long-term intravenous medication are the primary factors driving this industry. The need for midline catheters is largely being driven by the world's ageing population, which is more prone to chronic conditions like diabetes, heart disease, and cancer.

Market Overview

The Global Midline Catheter Market Size is the worldwide industry segment that deals with the creation, production, sales, and medical usage of midline catheters. These are vascular access pieces of equipment that are inserted into a peripheral vein of the patient's upper arm, and the tip of the catheter is left near the axilla (without going into the central veins). A midline catheter is a narrow tube that can be used to give treatments and take blood samples. The tube is inserted into a vein in the arm. The length of a midline's tip inside the body does not go beyond the area of the armpit. You can use a midline catheter for a period of 30 days. A midline catheter (MCs) is an intravenous (IV) catheter or line type that is used to give medications, fluids, blood products, or parenteral nutrition. MCs have been the first choice as a compromise solution between peripherally inserted central catheters (PICCs) and central venous catheters (CVCs), and their usage is rapidly increasing. These catheters can be found in single and double lumens that give an option to deliver multiple medications separately. Compared to short peripheral IVs, which need to be replaced frequently, midline catheters bring fewer needle sticks to patients and thus can be more comfortable, and the risk of complications such as phlebitis and infiltration is also lowered. Moreover, in comparison with central venous catheters, midline catheters carry a significantly smaller risk of severe infections, such as central line-associated bloodstream infections. As healthcare systems globally are under continuous pressure to deliver better results at lower cost and with less procedural complexity, the call for midline catheters indeed escalates following the ever-growing number of hospital-based care and surgical procedures.

In October 2023, Access Vascular, Inc. announced that it raised USD 22 million in a Series C financing round to expand production of its MIMIX biomaterial vascular access devices, including HydroMID and HydroPICC. The funding will support scaling manufacturing, research into reducing catheter-related infections, and broadening its product portfolio.

Catheter Precision, Inc. announced it secured USD 15 million in funding to accelerate global advances in medical technology, focusing on innovative solutions for cardiac electrophysiology and catheter-based procedures.

Report Coverage

This research report categorises the midline catheter market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the midline catheter market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the midline catheter market.

Driving Factors

The midline catheter market is presently witnessing a significant change, with the help of advanced medical technologies and patient comfort being given the utmost consideration. Consequently, healthcare institutions are purchasing these devices and using them as part of the daily operation, which, in turn, is a sign of the care sector becoming more efficient as well as patient-oriented. The midline catheter market is being impacted by a heightened recognition of the role of vascular access in medical treatment. As chronic diseases are on the rise, the need for a reliable health care system for long-term vascular access goes up, and hence, it acts as another factor leading to greater use of midline catheters. Furthermore, the present R&D initiatives are expected to result in brand-new concepts and types of material that might help improve the performance and safety of such medical devices. Moreover, the midline catheter market is set to grow further by being fueled by technological breakthroughs as well as changing healthcare demands. This trend provides a potential profitable avenue to manufacturers for creating easy, to, use and safe midline catheter devices specifically designed for home applications. Moreover, combining telemedicine with home healthcare can significantly improve the care and surveillance of patients with midline catheters, thus generating additional growth opportunities.

Restraining Factors

The midline catheters market has numerous promising growth opportunities, but it is also challenged by the risk of catheter-related infections and complications. The development of catheter materials and coatings has resulted in a lesser occurrence of these risks, but widespread adoption remains a challenge. Among the infections, catheter-related bloodstream infections (CRBSIs) are critical concerns, and they can result in increased healthcare costs, besides severe complications. Regulatory bodies are putting more and more emphasis on patient safety, which has resulted in very strict standards and guidelines for catheter use.

Market Segmentation

The midline catheter market share is classified into product type, material, and application.

- The single lumen catheters segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the product type, the midline catheter market is divided into single lumen catheters, double lumen catheters, triple lumen catheters, and ultrasound-guided catheters. Among these, the single lumen catheters segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. Single lumen catheters have established themselves as the most popular type in the midline catheter market due to the fact that they are easy to use and flexible for different procedures. Mainly, they are employed for intravenous therapy and thus become a must in the hospital world.

- The polyurethane segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the midline catheter market is classified into polyurethane, polyvinyl chloride, and silicone. Among these, the polyurethane segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Polyurethane is known as the main material in the midline catheter market. Its great performance qualities, such as flexibility, strength and resistance to kinking, have made it the preferred choice for long-term use. It permits longer dwell time than other materials; thus, catheter replacements are less frequent.

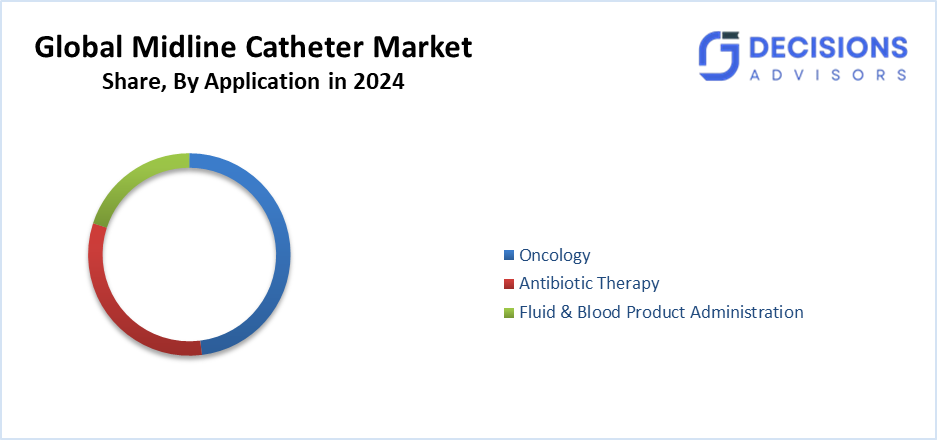

- The oncology segment accounted for the highest revenue share in 2024 and is expected to grow at a notable CAGR over the forecast period.

Based on the application, the midline catheter market is segmented into oncology, antibiotic therapy, and fluid and blood product administration. Among these, the oncology segment accounted for the highest revenue share in 2024 and is expected to grow at a notable CAGR over the forecast period. The segment contributed to market expansion due to oncology is their necessity of oncology in the provision of effective chemotherapeutic drug delivery. Midline catheters are becoming a cancer patient's extended access to the flesh. Thus, the increasing number of cancer cases is leading to the expanded demand for these catheters.

Regional Segment Analysis of the Midline Catheter Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the midline catheter market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the midline catheter market over the predicted timeframe. The region's fast economic development, rising healthcare spending, and upgrading of healthcare facilities are the main reasons why the market is getting bigger. Among these are leading countries such as China, India, and Japan. The spreading of chronic disorders, the enlarging of the old age population, and the governments' programs to improve healthcare accessibility are some of the factors that are leading to the increased demand for midline catheters in the Asia Pacific region.

In September 2025, Terumo launched Japan’s first indwelling needle-type midline catheter, called SurFlo Midela. This innovation provides a minimally invasive vascular access option, designed to reduce patient burden and simplify procedures for healthcare workers.

North America is expected to grow at a rapid CAGR in the midline catheter market during the forecast period. North America commands the largest share of the midline catheters market, attributable to its advanced medical services, the extensive occurrence of chronic conditions, and the availability of major players in the market. The United States, especially, is responsible for a major part of the North American market. North America is predicted to continue its leadership, with these points along with favourable reimbursement policies, a rise in healthcare spending, and technological innovations that are continuously happening.

In October 2025, the FDA officially cleared Access Vascular’s HydroMid and HydroPICC catheters with a new anti-thrombogenic indication, recognising their proprietary hydrogel material as reducing the risk of blood clot formation on catheter surfaces. This marks a significant advancement in vascular access technology, as the devices achieve clot resistance without relying on drug coatings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the midline catheter market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AngioDynamics, Inc.

- Argon Medical Devices

- BD

- Boston Scientific Corporation

- Cook

- Fresenius Kabi AG

- Haolang Technology (Foshan) Limited Co.

- Harsoria Healthcare Pvt Ltd

- Health Line Medical Products

- ICU Medical, Inc.

- Medtronic plc

- Smiths Medical

- Spectrum Vascular

- Teleflex

- VYGON

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, Teleflex launched its new Arrow Pressure Injectable Midline Catheter across Europe, the Middle East, and Africa (EMEA), offering clinicians a safer and more efficient option for midline vascular access. The device is designed to reduce infusion errors, improve line identification, and support pressure injections up to 5 mL/second per lumen.

- In February 2021, Access Vascular’s HydroMID Midline Catheter received FDA clearance with a new anti-thrombogenic indication, recognising its proprietary hydrogel material as reducing the risk of blood clot formation on catheter surfaces. This positions HydroMID as a breakthrough in vascular access technology, offering drug-free clot resistance.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the midline catheter market based on the below-mentioned segments:

Global Midline Catheter Market, By Product Type

- Single Lumen Catheters

- Double Lumen Catheters

- Triple Lumen Catheters

- Ultrasound Guided Catheters

Global Midline Catheter Market, By Material

- Polyurethane

- Polyvinyl Chloride

- Silicone

Global Midline Catheter Market, By Application

- Oncology

- Antibiotic Therapy

- Fluid and Blood Product Administration

Global Midline Catheter Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global midline catheter market?

The market was estimated at USD 3.15 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 6.73 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 7.15% from 2025 to 2035.

- Which product type leads the market?

Single lumen catheters held the largest share in 2024 and are expected to grow substantially.

- What material dominates the market?

Polyurethane dominated in 2024 due to its flexibility, strength, and resistance to kinking.

- Which application segment has the highest revenue share?

Oncology accounted for the highest share in 2024, driven by demand for chemotherapeutic drug delivery.

- Which region is expected to grow the fastest?

North America is projected to grow at the fastest CAGR, supported by advanced healthcare and chronic disease prevalence.

- What are the main growth drivers?

Key drivers include rising hospital admissions, chronic illnesses, an ageing population, and advancements in catheter technology.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |