Global Mobile Accessories Market

Global Mobile Accessories Market Size, Share, and COVID-19 Impact Analysis, By Product (Earphones/Headphones, Charger, Power Bank, Protective Cases, and Others), By Distribution Channel (Online, and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Mobile Accessories Market Size Insights Forecasts to 2035

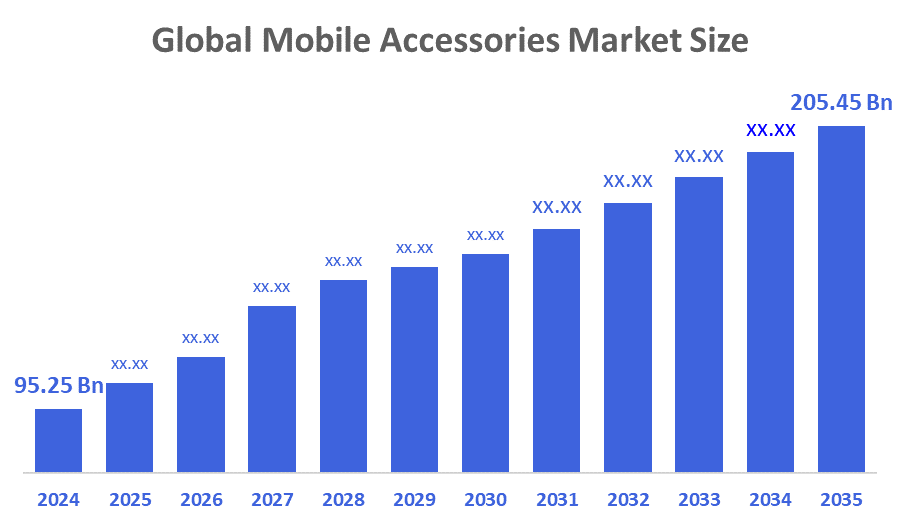

- The Global Mobile Accessories Market Size Was Estimated at USD 95.25 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.24% from 2025 to 2035

- The Worldwide Mobile Accessories Market Size is Expected to Reach USD 205.45 Billion by 2035

- Europe is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Mobile Accessories Market Size was worth around USD 95.25 Billion in 2024 and is predicted to Grow to around USD 205.45 Billion by 2035 with a compound annual growth rate (CAGR) of 7.24% from 2025 to 2035. The market is expected to grow due to the rising demand for smartphones, which are a useful tool for global communication. The need for accessories, including headphones and earbuds, chargers and cables, power banks, and protective cases, is rising as more individuals use smartphones.

Market Overview

The business sector that produces, supplies, and distributes add-ons intended to improve mobile phones' use, functionality, security, and customisation is known as the mobile accessories market. Chargers, headphones, power banks, protective cases, screen guards, memory cards, mounts, and wearable technology are a few examples of these. The industry players are providing more varieties of accessories to the market by integrating modern technologies and additional features for personalisation. The existence of counterfeit low-quality mobile accessories confuses consumers that they can buy genuine accessories. Besides, the purchase of counterfeit accessories is a brand threat as it causes negative brand perception and increases safety risks for the consumer's accessories.

Moreover, the market for mobile accessories has a large number of foreign and domestic sellers, making this market highly competitive and prone to cutthroat competition as well as low earnings. Apart from that, the problem of attracting new customers and creating differentiation for brands offering the same products and marketing technologies also exists. In order to survive competition, companies are spending money on advertising and inventing new products with the latest high technology to keep their mobile accessory market share and get the consumers' attention.

boAt announced a landmark $100 million investment from Warburg Pincus, marking a major milestone in its growth journey. The funding strengthens boAt’s leadership in India’s personal audio market and supports its ambitions in global wearables.

Report Coverage

This research report categorises the mobile accessories market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the mobile accessories market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the mobile accessories market.

Driving Factors

Recent technical developments have made it possible for consumers to use their devices for a variety of tasks, such as playing high-definition games, taking high-definition pictures and videos, and instantaneously accessing mobile applications. One of the most obvious market developments in the mobile phone accessory industry is the increased focus on improving telecoms network infrastructure. Governmental organisations, telecom service providers, and smartphone makers collaborate to modernise the communications network infrastructure to allow for high bandwidth capacity. This speeds up the creation of devices that are compatible with 4G and 5G, as well as investments in these networks. As more individuals use their phones to access the internet and audio and video material, the need for mobile phone accessories will grow. Furthermore, the already strong demand for mobile accessories is significantly increased by the advent of new technologies, such as wireless charging, quick Bluetooth-compatible chargers, and other wireless peripherals. Such cutting-edge technology encourages more tech-savvy consumers and generates demand for sophisticated accessories.

Restraining Factors

The market for mobile accessories is restricted by a number of issues, chief among them being price sensitivity, fake goods, and quick changes in technology. Despite the high demand for goods like wearables, cases, and chargers, these difficulties restrict expansion.

Market Segmentation

The mobile accessories market share is classified into product, and distribution channel.

- The earphones/headphones segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the mobile accessories market is divided into earphones/headphones, charger, power bank, protective cases, and others. Among these, the earphones/headphones segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Earphones and headphones accounted for the majority of the market in both the historical and future periods. The capacity of headphones to block sound so that only the wearer can hear it accounts for this. They can also provide sound quality that is better than that of loudspeakers at similar costs.

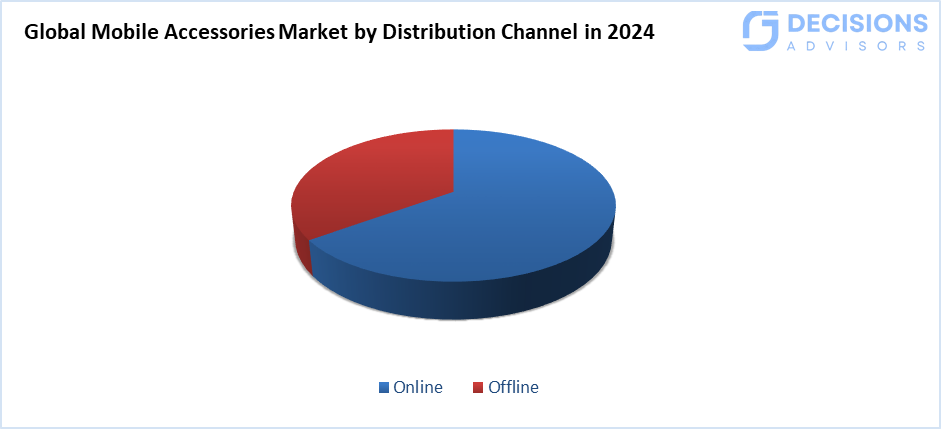

- The online segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the mobile accessories market is classified into online, and offline. Among these, the online segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment is being driven by replacement choices, faster and more reliable delivery via several online portals, and rising internet access in rural areas. Furthermore, because internet shopping is convenient and offers doorstep service, young, working consumers with busy schedules prefer it to physical shopping.

Regional Segment Analysis of the Mobile Accessories Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the mobile accessories market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the mobile accessories market over the predicted timeframe. Smartphone penetration has been very rapid, and it is mostly evident in large markets such as China, India, and Southeast Asia. This trend has had a ripple effect, essentially expanding the base that can be addressed with various accessories. A rising middle class and the increasing disposable incomes of the people are the major factors that have come together to produce a perfect storm of demand for the complementary devices that consumers may buy. Devices such as power banks, wireless earbuds, phone cases, and chargers are there to complement each other, and thus, the users end up spending a lot of money on such devices. Moreover, a lot has been done and is still being done in terms of technology to create new demands for the next generations of gadgets that will basically enable their users to a much higher level of the already available tech, for smartphone users.

Europe is expected to grow at a rapid CAGR in the mobile accessories market during the forecast period. Foldable phones, 5G connectivity, and wireless charging are just a few of the emerging smartphone technologies that consumers are spending more money on improved and high-end accessories to complement. This is driving cycles of accessory replacement and improvement. According to a local survey, products like smart cases, power banks, and wireless earphones are becoming more popular as lifestyle-driven accessories rather than just add-ons. Additionally, Europe's move to e-commerce and online shopping platforms has reduced barriers to accessory purchases, allowing for a wider selection, faster delivery, simpler comparison shopping, and more frequent purchases of several items per user.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the mobile accessories market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anket Power Core

- Apple Inc.

- Aukey

- Belkin International

- Bscstore Inc.

- Cambridge Soundworks Inc.

- Case Mate Inc.

- Groove Made Walnut

- Harman International

- Jvckenwood corporation

- Samsung

- SanDisk

- Xiaomi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, DailyObjects launched Stack, a modular ecosystem of iPhone accessories built around MagSafe, designed to add personalisation, convenience, and versatility to Apple devices. The new technology allows customers to easily connect accessories like wallets, grips, and stands to compatible phone cases by combining mechanical and magnetic attachments.

- In September 2025, Eveready Industries India Ltd. officially announced its strategic expansion into the mobile accessories segment, marking a major diversification beyond its legacy battery and flashlight business. The move positions Eveready to capture India’s fast-growing demand for chargers, cables, and power banks.

- In July 2025, U&i announced the launch of a new range of stylish, budget-friendly tech accessories, all backed by a minimum six-month warranty. This move strengthens its positioning in India’s competitive mobile accessories market by combining affordability with reliability.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the mobile accessories market based on the below-mentioned segments:

Global Mobile Accessories Market, By Product

- Earphones/Headphones

- Charger

- Power Bank

- Protective Cases

- Others

Global Mobile Accessories Market, By Distribution Channel

- Online

- Offline

Global Mobile Accessories Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global mobile accessories market?

The market was valued at USD 95.25 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 205.45 billion by 2035.

- What is the CAGR for the forecast period?

The market is forecasted to grow at a CAGR of 7.24% from 2025 to 2035.

- Which product segment leads the market?

Earphones/headphones dominated in 2024 and are projected to grow at a substantial CAGR.

- Which distribution channel has the highest revenue?

The online segment accounted for the highest revenue in 2024 and is expected to grow significantly.

- Which region holds the largest market share?

Asia-Pacific is anticipated to hold the largest share, driven by rapid smartphone penetration in China, India, and Southeast Asia.

- What drives growth in the mobile accessories market?

Rising smartphone demand, technical advancements like 5G and wireless charging, and increasing disposable incomes fuel expansion.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product

- Market Attractiveness Analysis By Distribution Channel

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rising demand for smartphones, the development of 4G and 5G compatible devices

- Restraints

- Competition from substitute products, and rapid technological shift

- Opportunities

- Via the Internet, audio and video material increases the demand

- Challenges

- Consumers' price sensitivity, and counterfeit goods

- Global Mobile Accessories Market Analysis and Projection, By Product

- Segment Overview

- Earphones/Headphones

- Charger

- Power Bank

- Protective Cases

- Others

- Global Mobile Accessories Market Analysis and Projection, By Distribution Channel

- Segment Overview

- Online

- Offline

- Global Mobile Accessories Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Mobile Accessories Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Mobile Accessories Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Anket Power Core

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Apple Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Aukey

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Belkin International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bscstore Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Cambridge Soundworks Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Case Mate Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Google

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Groove Made Walnut

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Harman International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Jvckenwood corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Samsung

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- SanDisk

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Xiaomi

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Anket Power Core

List of Table

- Global Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Global Earphones/Headphones, Mobile Accessories Market, By Region, 2024-2035(USD Billion)

- Global Charger, Mobile Accessories Market, By Region, 2024-2035(USD Billion)

- Global Power Bank, Mobile Accessories Market, By Region, 2024-2035(USD Billion)

- Global Protective Cases, Mobile Accessories Market, By Region, 2024-2035(USD Billion)

- Global Others, Mobile Accessories Market, By Region, 2024-2035(USD Billion)

- Global Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Global Online, Mobile Accessories Market, By Region, 2024-2035(USD Billion)

- Global Offline, Mobile Accessories Market, By Region, 2024-2035(USD Billion)

- North America Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- North America Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- U.S. Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- U.S. Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Canada Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Canada Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Mexico Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Mexico Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Europe Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Europe Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Germany Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Germany Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- France Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- France Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- U.K. Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- U.K. Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Italy Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Italy Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Spain Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Spain Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Asia Pacific Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Asia Pacific Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Japan Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Japan Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- China Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- China Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- India Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- India Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- South America Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- South America Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- Brazil Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- Brazil Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- The Middle East and Africa Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- The Middle East and Africa Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- UAE Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- UAE Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

- South Africa Mobile Accessories Market, By Product, 2024-2035(USD Billion)

- South Africa Mobile Accessories Market, By Distribution Channel, 2024-2035(USD Billion)

List of Figures

- Global Mobile Accessories Market Segmentation

- Mobile Accessories Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Mobile Accessories Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Mobile Accessories Market

- Mobile Accessories Market Segmentation, By Product

- Mobile Accessories Market For Earphones/Headphones, By Region, 2024-2035 ($ Billion)

- Mobile Accessories Market For Charger, By Region, 2024-2035 ($ Billion)

- Mobile Accessories Market For Power Bank, By Region, 2024-2035 ($ Billion)

- Mobile Accessories Market For Protective Cases, By Region, 2024-2035 ($ Billion)

- Mobile Accessories Market For Others, By Region, 2024-2035 ($ Billion)

- Mobile Accessories Market Segmentation, By Distribution Channel

- Mobile Accessories Market For Online, By Region, 2024-2035 ($ Billion)

- Mobile Accessories Market For Offline, By Region, 2024-2035 ($ Billion)

- Anket Power Core: Net Sales, 2024-2035 ($ Billion)

- Anket Power Core: Revenue Share, By Segment, 2024 (%)

- Anket Power Core: Revenue Share, By Region, 2024 (%)

- Apple Inc: Net Sales, 2024-2035 ($ Billion)

- Apple Inc: Revenue Share, By Segment, 2024 (%)

- Apple Inc: Revenue Share, By Region, 2024 (%)

- Aukey, Belkin International: Net Sales, 2024-2035 ($ Billion)

- Aukey, Belkin International: Revenue Share, By Segment, 2024 (%)

- Aukey, Belkin International: Revenue Share, By Region, 2024 (%)

- Belkin International: Net Sales, 2024-2035 ($ Billion)

- Belkin International: Revenue Share, By Segment, 2024 (%)

- Belkin International: Revenue Share, By Region, 2024 (%)

- Bscstore Inc: Net Sales, 2024-2035 ($ Billion)

- Bscstore Inc: Revenue Share, By Segment, 2024 (%)

- Bscstore Inc: Revenue Share, By Region, 2024 (%)

- Cambridge Soundworks Inc: Net Sales, 2024-2035 ($ Billion)

- Cambridge Soundworks Inc: Revenue Share, By Segment, 2024 (%)

- Cambridge Soundworks Inc: Revenue Share, By Region, 2024 (%)

- Case Mate Inc: Net Sales, 2024-2035 ($ Billion)

- Case Mate Inc: Revenue Share, By Segment, 2024 (%)

- Case Mate Inc: Revenue Share, By Region, 2024 (%)

- Google: Net Sales, 2024-2035 ($ Billion)

- Google: Revenue Share, By Segment, 2024 (%)

- Google: Revenue Share, By Region, 2024 (%)

- Groove Made Walnut.: Net Sales, 2024-2035 ($ Billion)

- Groove Made Walnut.: Revenue Share, By Segment, 2024 (%)

- Groove Made Walnut.: Revenue Share, By Region, 2024 (%)

- Harman International: Net Sales, 2024-2035 ($ Billion)

- Harman International: Revenue Share, By Segment, 2024 (%)

- Harman International: Revenue Share, By Region, 2024 (%)

- Jvckenwood corporation: Net Sales, 2024-2035 ($ Billion)

- Jvckenwood corporation: Revenue Share, By Segment, 2024 (%)

- Jvckenwood corporation: Revenue Share, By Region, 2024 (%)

- Samsung: Net Sales, 2024-2035 ($ Billion)

- Samsung: Revenue Share, By Segment, 2024 (%)

- Samsung: Revenue Share, By Region, 2024 (%)

- SanDisk: Net Sales, 2024-2035 ($ Billion)

- SanDisk: Revenue Share, By Segment, 2024 (%)

- SanDisk: Revenue Share, By Region, 2024 (%)

- Xiaomi: Net Sales, 2024-2035 ($ Billion)

- Xiaomi: Revenue Share, By Segment, 2024 (%)

- Xiaomi: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 189 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |