Global Molded Interconnect Device Market

Global Molded Interconnect Device Market Size, Share, and COVID-19 Impact Analysis, By Device (Laser Direct Structuring (LDS), Two-Shot Molding, Others), By Product (Sensor Housings, Antennas, Connectors & Switches, Lighting, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Molded Interconnect Device Market Size Summary

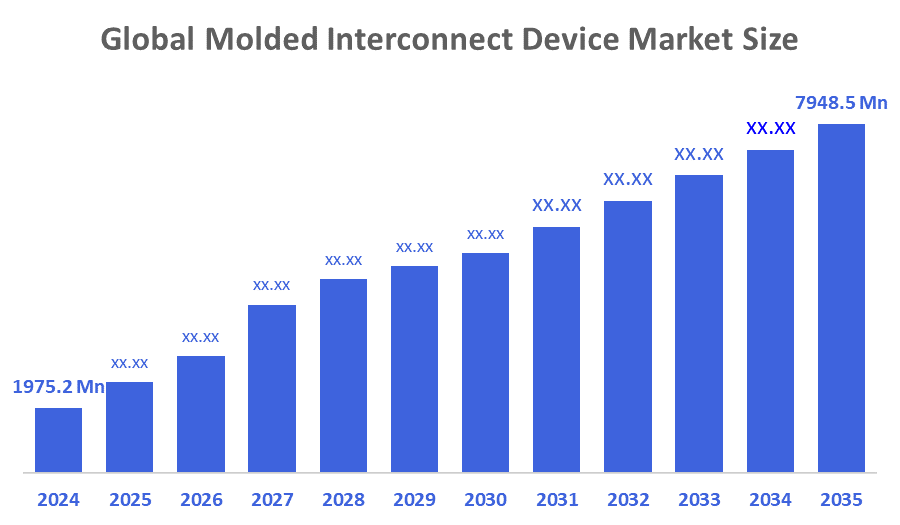

The Global Molded Interconnect Device Market Size Was Estimated at USD 1975.2 Million in 2024 and is Projected to Reach USD 7948.5 Million by 2035, Growing at a CAGR of 13.49% from 2025 to 2035. The market for molded interconnect devices is expanding because of the growing need for small, multipurpose electronic components, the development of 3D packaging technology, the growing use of these devices in consumer and automotive electronics, and the demand for small, light devices with improved performance and dependability.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific molded interconnect device market held the largest revenue share of 34.7%, dominating the global market.

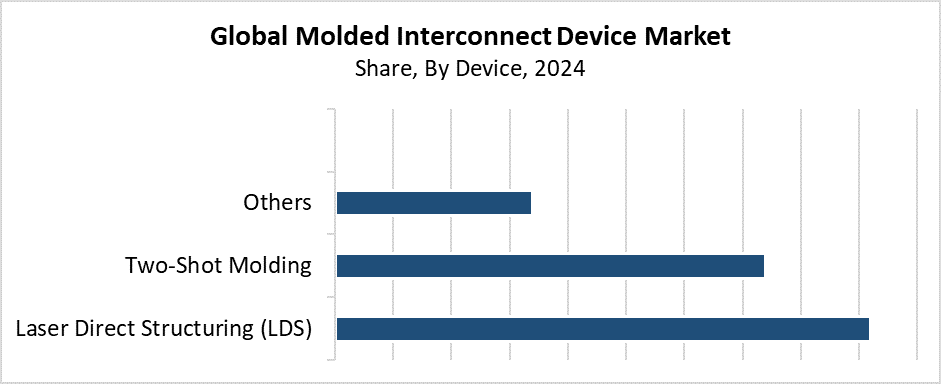

- In 2024, the laser direct structuring (LDS) segment had the most revenue share of 46.8% and led the market by device.

- In terms of product, the sensor housings segment led the market and generated the highest revenue share of 27.5% in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1975.2 Million

- 2035 Projected Market Size: USD 7948.5 Million

- CAGR (2025-2035): 13.49%

- Asia Pacific: Largest market in 2024

The Molded Interconnect Device (MID) market functions by producing and using devices which combine mechanical and electrical circuits into one molded plastic component. The automotive industry, together with consumer electronics, medical and telecommunications sectors, utilises MIDs to create compact, lightweight, multifunctional designs. The main drivers consist of two factors, which include the rising need for electronic component integration and size reduction, and the adoption of new manufacturing methods and the increasing number of smart connected devices. The mid-market expansion receives support from the automotive sector because it requires smart systems and electric vehicles. These need reliable, compact, high-performance electronic components.

The development of MIDs has advanced through technological progress, which includes 3D printing, laser direct structuring (LDS), and material improvements. The new technologies provide enhanced electrical performance and allow for creating more complex designs. The market growth speed increases because of government programs which help Industry 4.0 adoption. They support electronic manufacturing innovation. MIDs gain global popularity because of policies that focus on energy conservation, technological waste reduction, and sustainable product development. MIDs will serve as essential components for next-generation electronic systems because research and development activities continue to drive technological advancement in this field.

Device Insights

What Factors Enabled the Laser Direct Structuring (LDS) Segment to Capture a 46.8% Revenue Share in the Molded Interconnect Device (MID) Market in 2024?

The Laser Direct Structuring (LDS) segment held the largest revenue share of 46.8% and dominated the molded interconnect device (MID) market in 2024. LDS technology works best for producing intricate small electronic components because it enables exact three-dimensional circuit pattern creation on plastic substrates. The automotive sector, along with consumer electronics and medical device industries, uses this technology because it enables them to build mechanical and electronic components into one single molded part. The LDS market experiences growth because of its requirement for devices that combine small size with light weight and multiple functions. The development of laser technology and materials has resulted in better quality and extended lifespan of LDS-based MIDs. This has established their dominance in the market. The manufacturing process of MID benefits from LDS because it provides both cost savings and the ability to produce at large-scale production volumes.

The two-shot molding segment of the molded interconnect device (MID) market is expected to grow at a significant rate during the forecast period. The technology allows for the creation of single components which combine mechanical and electronic functions through dual material molding during one manufacturing step. Two-shot molding attracts the automotive industry, consumer electronics, and medical device sectors because it delivers enhanced design options, superior product strength, and reduced production costs. The method finds its application because devices require a small size and a lightweight design, and multiple functions. Growth is also being accelerated by improvements in molding tools and materials, which are improving production effectiveness. This improves product quality. The MID market continues to adopt two-shot molding because it allows for the production of complex shapes with exact precision.

Product Insights

How did the Sensor Housing Segment Achieve the Largest Revenue Share of 27.5% in the molded interconnect device Market in 2024?

The sensor housings segment leads the molded interconnect device (MID) market with the largest revenue share of 27.5% in 2024. The sensor technology sector dominates because consumer electronics, industrial, and automotive applications need advanced sensors. The manufacturing of small lightweight constructions benefits from MID technology sensor housings because they deliver superior precision, extended durability, and integrated electrical circuits. The need for dependable sensor housings has grown because smart sensors now power automation systems, electric vehicles, and Internet of Things devices. The sensor housings based on MID technology deliver optimal signal transmission and environmental protection. This makes them necessary for high-performance sensing applications. The market segment will grow because sensor technology continues to improve and investors keep putting money into it.

The antennas segment of the molded interconnect device (MID) market is expected to grow at a significant CAGR throughout the forecast period. The demand for compact high-performance antennas continues to rise because they serve as essential components for wearable technology, smartphones, automotive electronics, and Internet of Things devices. The integration of antennas into 3D plastic structures becomes possible through MID technology, which reduces space needs while improving signal performance. The increasing use of 5G technology, connected vehicles, and smart devices requires fresh antenna solutions. These need to be reduced their size while keeping their performance intact. The manufacturing of lightweight, customizable antenna components at scale through affordable production methods has become more accessible, which drives market expansion for MIDs.

Regional Insights

The Asia Pacific molded interconnect device (MID) market held the largest revenue share of 34.7% and dominated the worldwide market in 2024. The region's strong electronics manufacturing base, which includes China, Japan, South Korea, and Taiwan, enables its leading position in the market. The demand for small high-performance parts in consumer electronics, automotive, and industrial applications drives the widespread adoption of MID technology. The market expansion receives support through the presence of major OEMs and inexpensive production capabilities. The region experiences rapid IoT adoption and automotive electronics growth. 5G infrastructure development. The Asia Pacific region will maintain its position as the MID industry leader because government programs will keep supporting research and development and advanced manufacturing.

North America Molded Interconnect Device Market Trends

The North American molded interconnect device (MID) market experiences steady growth because different industries, such as consumer electronics, automotive, aerospace, and medical, require small multifunctional components. The region's excellent manufacturing capabilities and strong focus on innovation support the growing adoption of MID technology throughout the area. The growing number of connected devices and electric vehicles creates a need for compact and lightweight solutions, which MIDs effectively provide. The development of next-generation MID applications benefits from higher research and development funding. This is, together with supportive government policies that promote local manufacturing. The North American MID industry experiences major growth because the region strongly supports sustainable practices and smart product development through electronic component integration.

Europe Molded Interconnect Device Market Trends

The European market for molded interconnect devices (MIDs) experiences significant growth because industrial automation, medical device manufacturing, and automotive electronics development. The United Kingdom, together with France and Germany, lead the world in MID technology adoption because they have strong engineering and manufacturing capabilities. The demand for small integrated components that stay lightweight continues to grow because these parts serve essential functions in smart medical devices and electric vehicles. European laws promote sustainable and energy-efficient technologies. They endorse MIDs because they reduce material usage and improve recycling capabilities. The research and industrial deployment of technology move forward because of Industry 4.0 initiatives, government innovation support, and large R&D funding.

Key Molded Interconnect Device Companies:

The following are the leading companies in the molded interconnect device market. These companies collectively hold the largest market share and dictate industry trends.

- TE Connectivity

- MID Solutions GmbH

- Sumitomo Electric Industries, Ltd.

- HARTING Technology Group

- KYOCERA AVX Components Corporation

- Molex

- Taoglas

- LPKF

- Amphenol Corporation

- TEPROSA

- Others

Recent Developments

- In September 2025, in the United States, a private equity group called Cogenuity Partners purchased Interconnect Solutions Company (ISC), which offers complicated and customised interconnect solutions, such as molded strain reliefs and custom overmolded solutions. With this acquisition, Cogenuity's advanced industrial portfolio is strengthened, particularly in the high-performance connection segment that serves data centres and the aerospace industry.

- In November 2023, in Katowice, Poland, Molex established a new campus to increase the size of its production footprint. It has a 23,000 square meter starting space devoted to manufacturing electric car solutions and cutting-edge medical products. Molex's expansion in Europe will be aided by this facility, which is expected to grow to 85,000 square meters. sophisticated capabilities, such as sophisticated injection molding, drug handling, packaging, and medical device assembly will be available at the site.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the molded interconnect device market based on the below-mentioned segments:

Global Molded Interconnect Device Market, By Device

- Laser Direct Structuring (LDS)

- Two-Shot Molding

- Others

Global Molded Interconnect Device Market, By Product

- Sensor Housings

- Antennas

- Connectors & Switches

- Lighting

- Others

Global Molded Interconnect Device Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 175 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |