Global Monolithic Integration Market

Global Monolithic Integration Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Technology (Silicon Photonics, CMOS, and III-V Semiconductors), By End-Use (Telecommunications, Data Centers, Consumer Electronics, and Automotive), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Monolithic Integration Market Summary, Size & Emerging Trends

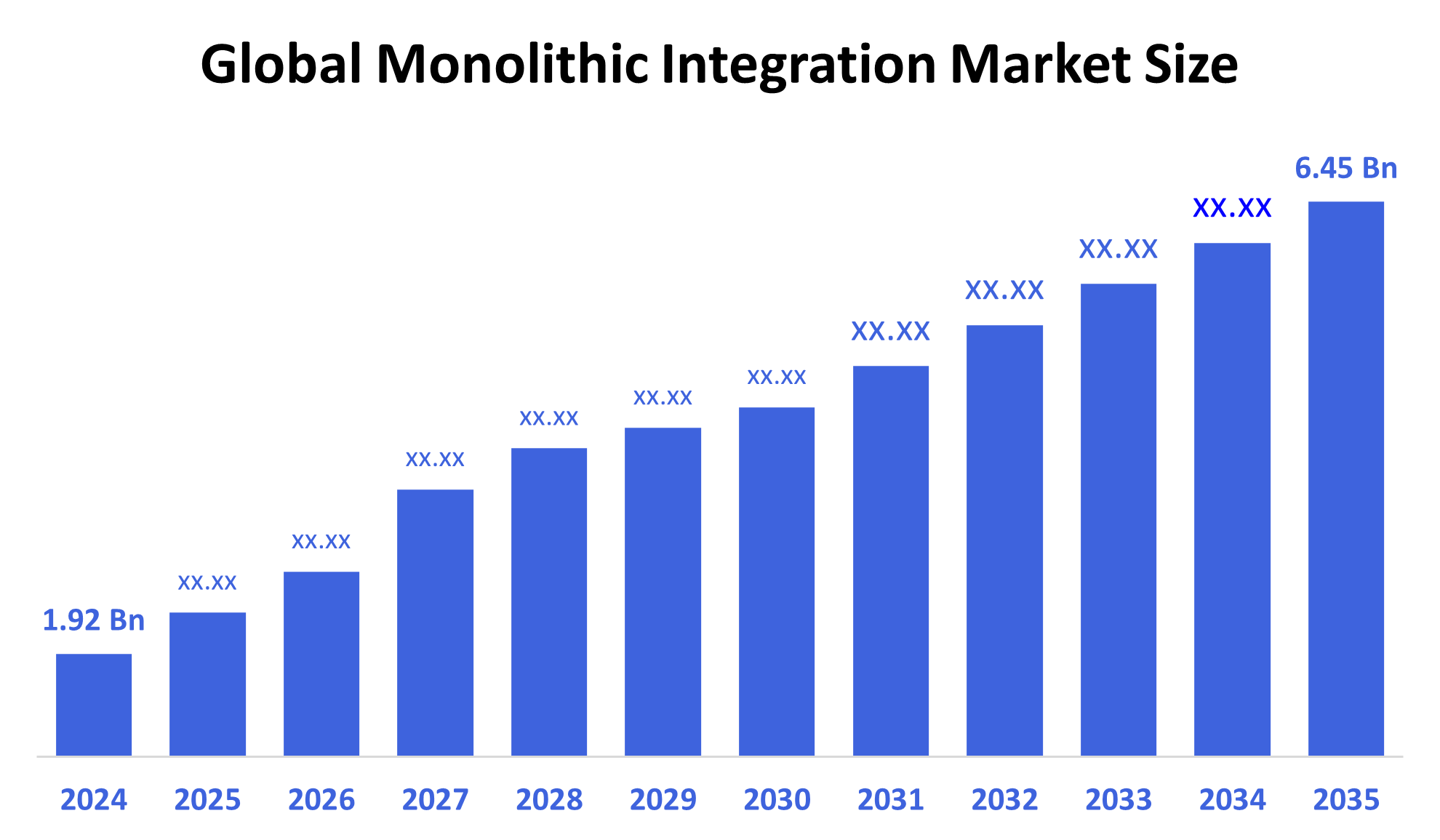

According to Spherical Insights, The Global Monolithic Integration Market Size is Expected To Grow from USD 1.92 Billion in 2024 to USD 6.45 Billion by 2035, at a CAGR of 11.7% during the Forecast Period 2025-2035. Growth is fueled by rising demand for compact, energy-efficient, and high-speed electronic components, especially in telecommunications and data centers.

Key Market Insights

- North America is expected to dominate the monolithic integration market in 2024.

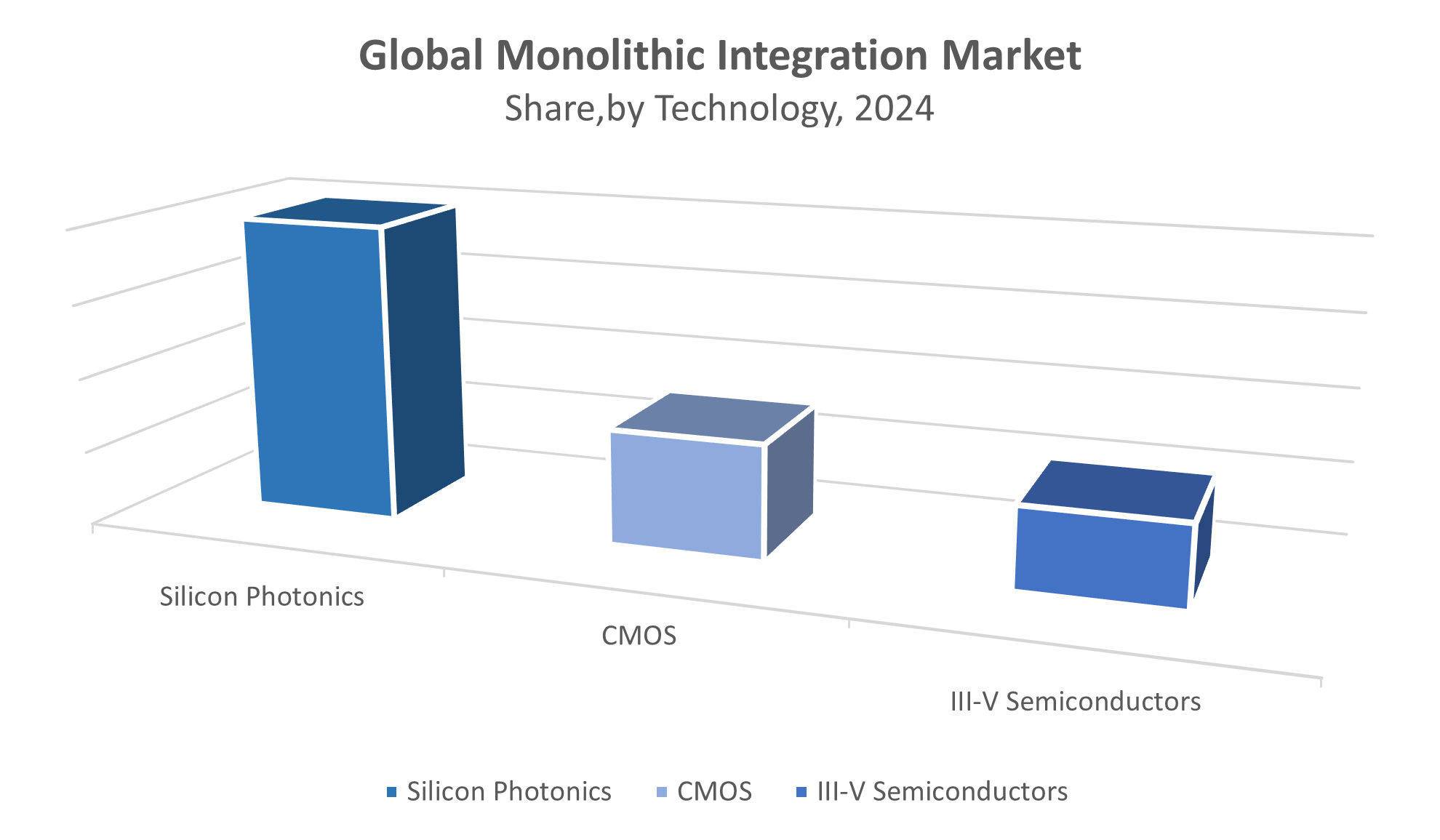

- In terms of technology, the silicon photonics segment generated the highest revenue.

- In terms of end-use, the telecommunications segment held the largest market share in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.92 Billion

- 2035 Projected Market Size: USD 6.45 Billion

- CAGR (2025-2035): 11.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Monolithic Integration Market

The monolithic integration market involves embedding multiple electronic or photonic functions into a single semiconductor chip, leading to improved performance, reduced power consumption, and minimized device size. This integration is vital for high-speed data transmission and is widely used in applications such as fiber-optic communication, data centers, consumer electronics, and automotive systems. As industries demand more compact and energy-efficient solutions, the adoption of monolithic integration continues to grow. Technologies like silicon photonics and III-V semiconductors are at the forefront of innovation, offering enhanced speed and functionality. The global shift toward digital infrastructure, driven by the rollout of 5G, cloud computing, AI, and IoT, is accelerating the demand for advanced integrated chips. This trend positions monolithic integration as a core enabler of next-generation electronic and communication systems.

Monolithic Integration Market Trends

- Increased R&D in silicon photonics and hybrid integration.

- Rising demand for high-speed optical communication systems in data centers.

- Growing use in electric vehicles (EVs) and autonomous driving technologies.

- Emergence of AI-integrated chips for edge computing and IoT applications.

Monolithic Integration Market Dynamics

Driving Factors: Rapid adoption in 5G, AI, and miniaturized electronics

The monolithic integration market is driven by the growing need for compact, high-performance components in advanced technologies. The rapid rollout of 5G infrastructure and fiber-optic networks increases demand for integrated chips that enable faster data transmission. In telecom and consumer electronics, there’s a strong push for miniaturization without compromising performance. Additionally, data-heavy industries like cloud computing and artificial intelligence are adopting monolithic integration to improve efficiency and processing speed. These trends are supported by technological advances in silicon photonics and semiconductor materials, making integration a vital part of next-generation communication and computing systems.

Restraint Factors: High complexity and integration limitations

Despite strong demand, the monolithic integration market faces several restraints. Manufacturing monolithically integrated chips is highly complex and requires advanced fabrication technologies, leading to high initial costs. Efficient thermal management is difficult when multiple high-speed components are packed into a single chip, often limiting performance. Another challenge is the limited compatibility between different semiconductor materials used in heterogeneous integration. These issues make development time-consuming and costly, particularly for smaller companies. As a result, adoption is slower in industries that lack the infrastructure or expertise to manage such complex integration processes, restricting the market’s growth potential in some regions.

Opportunities: Growth in data centers, edge computing, and emerging markets

The monolithic integration market presents significant opportunities, especially in expanding data centers and edge computing. Monolithic integration helps reduce power consumption and improves processing speed—critical for handling massive data volumes. Additionally, using CMOS technology allows for cost-effective, large-scale chip production. Emerging markets in Asia, Latin America, and Africa are also investing heavily in digital infrastructure, increasing the demand for integrated semiconductor solutions. As these regions digitize rapidly, they offer new markets for monolithic integration. Innovation in AI, IoT, and 5G applications further expands the use of these chips, creating more room for technological adoption and commercial growth globally.

Challenges: Material, supply chain, and standardization issues

The monolithic integration market faces key challenges that slow down wider adoption. One major issue is the technological difficulty of combining diverse materials like silicon, GaAs, and InP into a single chip, which can impact performance and reliability. The semiconductor supply chain is also vulnerable to global disruptions, which can lead to delays and cost increases. Moreover, there’s a lack of industry-wide standardization for integration processes, making it hard for companies to scale production efficiently. Without clear standards, collaboration and compatibility across sectors become difficult, hindering the streamlined development of next-generation integrated systems.

Global Monolithic Integration Market Ecosystem Analysis

The global monolithic integration ecosystem consists of semiconductor material suppliers, foundries, chip designers, telecom operators, and OEMs in electronics and automotive sectors. Key industry players focus on advancing silicon photonics, photonic integrated circuits, and heterogeneous integration platforms to improve performance. Collaboration between fabless companies, foundries, and research institutions is essential for scaling production, improving yields, and enhancing efficiency. These partnerships drive innovation and help overcome technical challenges, ensuring the ecosystem supports the growing demand for integrated semiconductor solutions worldwide.

Global Monolithic Integration Market, By Technology

Silicon photonics holds the largest share of approximately 45% in the monolithic integration market. Its popularity stems from its ability to handle very high data rates, which is crucial for modern communication systems. It is also compatible with CMOS manufacturing, making it easier to produce at scale. Silicon photonics is widely used in optical communication networks and high-performance computing, where fast and efficient data transmission is essential. This technology’s advantages make it a leading choice for many applications.

CMOS technology accounts for a significant share of around 30% in the market. It is favored for its cost-effectiveness and scalability, allowing for the integration of numerous electronic components on a single chip. CMOS is widely used in consumer electronics and telecom devices due to its ability to support large-scale production while maintaining good performance. This makes CMOS essential for developing affordable, high-volume products in various industries requiring integrated semiconductor solutions.

Global Monolithic Integration Market, By End-Use

The telecommunications segment is the largest in the monolithic integration market, holding around 40% share. This growth is driven by the increasing demand for faster, more reliable data transmission through fiber-optic networks. As telecom operators upgrade infrastructure to support 5G and beyond, they rely heavily on monolithic integration technologies for efficient, high-speed communication. This segment’s importance is fueled by the global push for enhanced connectivity and bandwidth in both consumer and enterprise networks.

Data centers account for approximately 30% of the market share in monolithic integration. The rapid expansion of cloud computing, big data analytics, and AI applications is driving demand for low-latency, high-performance communication solutions. Monolithic integration enables efficient data processing and transmission within data centers, helping reduce power consumption and increase speed. As data traffic grows exponentially, this segment’s significance continues to rise, making it a critical area for technological advancements and investment.

North America dominates the global monolithic integration market, contributing around 40% of total revenue

driven by the presence of major technology companies and a strong research and development infrastructure. Significant government investments in 5G networks and data center expansions further accelerate market growth. The Silicon Valley ecosystem plays a crucial role by fostering innovation and rapid commercialization of advanced monolithic integration technologies. These factors combined position North America as the key market leader in this sector.

The United States leads the North American monolithic integration market

supported by its advanced technology ecosystem and significant investment in semiconductor R&D. Major tech hubs like Silicon Valley drive innovation in integrated photonics and semiconductor manufacturing. The U.S. government’s focus on expanding 5G infrastructure, data centers, and defense applications further boosts demand. Additionally, collaborations between leading companies, universities, and research institutions foster rapid development and commercialization of cutting-edge monolithic integration solutions, solidifying the country’s position as a global market leader.

Europe is expected to experience moderate growth in the monolithic integration market

supported by strong regulatory initiatives promoting digital infrastructure, smart manufacturing, and sustainability. Key countries like Germany, France, and the Netherlands are leading efforts to advance integrated photonics and next-generation semiconductor technologies. Investments in research and development, along with collaborations between industry and government, are driving innovation. Europe’s focus on energy-efficient and sustainable solutions further fuels demand for monolithic integration across telecom, automotive, and industrial sectors.

Germany is a key player in Europe’s monolithic integration market

driven by its strong industrial base and leadership in advanced manufacturing technologies. The country invests heavily in research and development, especially in semiconductor technologies and integrated photonics. Germany’s push for Industry 4.0 and smart factories fuels demand for monolithic integration solutions to enhance automation and connectivity. Supportive government policies and collaborations between academia and industry accelerate innovation, making Germany a crucial hub for market growth in Europe.

WORLDWIDE TOP KEY PLAYERS IN THE MONOLITHIC INTEGRATION MARKET INCLUDE

- Intel Corporation

- Cisco Systems, Inc.

- Broadcom Inc.

- Infinera Corporation

- STMicroelectronics

- MACOM Technology Solutions

- NeoPhotonics Corporation

- Lumentum Holdings Inc.

- GlobalFoundries

- Tower Semiconductor

- Others

Product Launches in Monolithic Integration Market

- In February 2024, Intel launched a new silicon photonics transceiver featuring monolithic integration. This innovation supports ultra-fast data transfer speeds up to 1.6 Tbps, designed for next-generation data centers. The breakthrough enhances high-speed computing capabilities. It also reinforces Intel’s leadership in advanced semiconductor technologies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the monolithic integration market based on the below-mentioned segments:

Global Monolithic Integration Market, By Technology

- Silicon Photonics

- CMOS

- III-V Semiconductors

Global Monolithic Integration Market, By End-Use

- Telecommunications

- Data Centers

- Consumer Electronics

- Automotive

Global Monolithic Integration Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Monolithic Integration Market in 2024?

A: The Global Monolithic Integration Market size was estimated at USD 1.92 billion in 2024.

Q: What is the forecasted CAGR of the Global Monolithic Integration Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of around 11.7% during the period 2025–2035.

Q: What is the projected market size of the Global Monolithic Integration Market by 2035?

A: The market is projected to reach USD 6.45 billion by 2035.

Q: Which technology segment holds the largest market share in monolithic integration?

A: Silicon photonics holds the largest share of approximately 45% in the monolithic integration market.

Q: Which end-use segment dominates the Global Monolithic Integration Market?

A: The telecommunications segment held the largest market share, accounting for around 40% in 2024.

Q: Which region is the largest market for monolithic integration in 2024?

A: North America is the largest market in 2024, contributing around 40% of total revenue.

Q: Which region is the fastest growing market for monolithic integration?

A: Asia Pacific is the fastest growing region due to rapid digital infrastructure expansion and emerging market demand.

Q: Who are the top key players operating in the Global Monolithic Integration Market?

A: Key players include Intel Corporation, Cisco Systems, Broadcom Inc., Infinera Corporation, STMicroelectronics, MACOM Technology Solutions, NeoPhotonics Corporation, Lumentum Holdings Inc., GlobalFoundries, and Tower Semiconductor.

Q: What are the main factors driving growth in the monolithic integration market?

A: Growth is driven by rapid adoption of 5G, AI technologies, miniaturization of electronics, and increasing demand for high-speed optical communication.

Q: What challenges are limiting the adoption of monolithic integration technologies?

A: Key challenges include high manufacturing complexity, thermal management issues, material compatibility, supply chain disruptions, and lack of standardization.

Q: What recent innovation has Intel introduced in the monolithic integration market?

A: In February 2024, Intel launched a silicon photonics transceiver featuring monolithic integration that supports ultra-fast data transfer speeds up to 1.6 Tbps for next-generation data centers.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |