Global Nanosheet FETs Market

Global Nanosheet FETs Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Technology Node (5 nm & Below, 7?10 nm, and Above 10 nm), By Application (High-Performance Computing & AI Accelerators, Smartphones & Mobile Devices, Automotive & Transportation, and IoT & Edge Devices), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 ? 2035.

Report Overview

Table of Contents

Nanosheet FETs Market Summary, Size & Emerging Trends

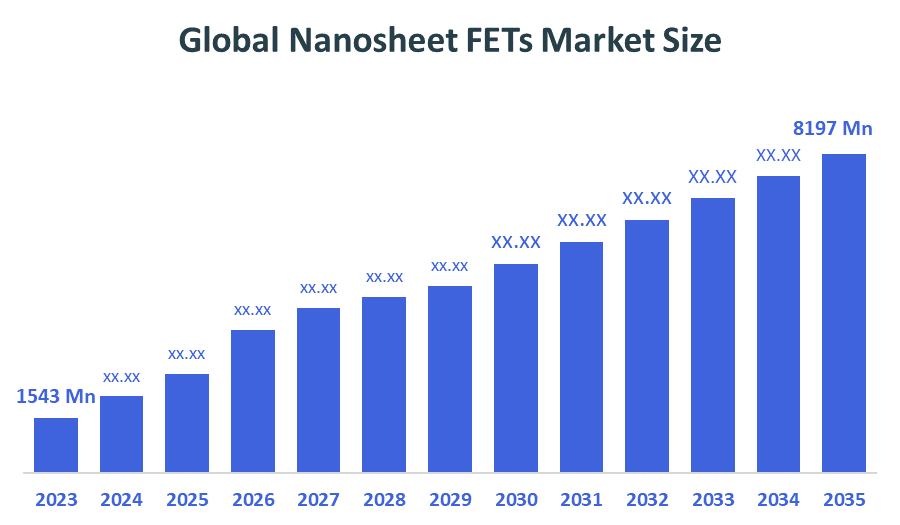

According to Decision Advisor, the Global Nanosheet FETs Market Size is expected to grow from USD 1543 million in 2024 to USD 8197 million by 2035, at a CAGR of 16.4% during the forecast period 2025-2035. The transition from FinFET to gate-all-around (GAA) architecture is a key driving factor, offering enhanced performance, lower leakage, and energy efficiency critical to applications in AI, mobile, and automotive electronics.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the nanosheet FETs market during the forecast period.

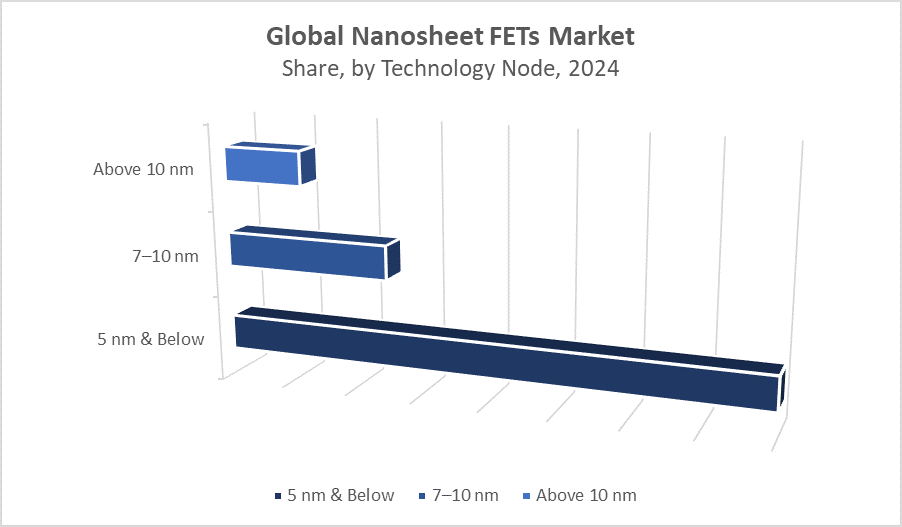

- In terms of technology node, the 5 nm & below segment dominated in terms of revenue during the forecast period.

- In terms of application, the high-performance computing & AI accelerators segment accounted for the largest revenue share in the global nanosheet FETs market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1543 Million

- 2035 Projected Market Size: USD 8197 Million

- CAGR (2025-2035): 16.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Nanosheet FETs Market

The nanosheet FETs market centers around the development and commercialization of next-generation gate-all-around transistor technology. Nanosheet FETs are replacing FinFETs in advanced nodes below 5 nm due to superior electrostatic control, scalability, and power-performance efficiency. These transistors are being rapidly adopted in AI chips, mobile SoCs, and automotive-grade processors. As semiconductor manufacturers push the limits of Moore’s Law, nanosheet FETs enable denser logic designs and higher throughput with reduced leakage. Leading foundries and design houses are investing in pilot production and ecosystem partnerships to ensure smooth transition and yield improvements. Market growth is further supported by strategic R&D initiatives and government incentives focused on semiconductor innovation.

Nanosheet FETs Market Trends

- Growing transition from FinFET to nanosheet-based GAA architectures at sub-5 nm nodes.

- Increased R&D in nanosheet process technology, EDA tools, and IP integration.

- Strong demand from AI and HPC applications requiring high-density logic and low power consumption.

- Emerging collaborations between foundries, material suppliers, and fab toolmakers to advance nanosheet manufacturing.

Nanosheet FETs Market Dynamics

Driving Factors: Rising demand for performance and energy-efficient semiconductor devices

The nanosheet FETs Market is propelled by the growing need for transistor architectures that deliver enhanced performance and reduced power consumption at advanced technology nodes below 5 nm. Increasing adoption of AI, machine learning, and edge computing demands transistors with superior gate control and minimized short-channel effects, both of which nanosheet FETs provide. Their scalability and efficiency make them ideal for future high-performance applications. Leading semiconductor foundries are aggressively transitioning to nanosheet technology to meet these computational requirements, driving widespread industry adoption and market growth.

Restrain Factors: Manufacturing complexity and integration challenges

Despite its potential, the nanosheet FETs Market faces notable barriers due to manufacturing intricacies. Precision etching, consistent stacking of nanosheets, and defect management demand advanced fabrication processes, escalating production costs and variability. Additionally, integrating nanosheet technology with existing electronic design automation (EDA) tools and system-on-chip (SoC) design flows introduces compatibility challenges. These technical complexities may slow the pace of commercialization and deter cost-sensitive manufacturers from early adoption. Overcoming these hurdles is essential for market penetration but remains a significant restraint during initial market phases.

Opportunity: Expansion into AI, mobile, and automotive sectors

The nanosheet FETs Market offers substantial growth opportunities through its applications in AI accelerators, mobile chipsets, and automotive-grade processors. The increasing demand for highly integrated, power-efficient semiconductors in smart devices, data centers, and electric vehicles drives this expansion. Foundries achieving competitive yields with nanosheet fabrication stand to capture major market share. Additionally, government support and semiconductor policies in key regions like Asia and North America incentivize investments in nanosheet technology, further catalyzing growth and fostering innovation in emerging sectors reliant on advanced transistor architectures.

Challenges: Tooling costs, skilled labor shortage, and supply chain risks

The nanosheet FETs Market contends with high entry barriers, including expensive extreme ultraviolet (EUV) lithography tools required for nanosheet production. A shortage of skilled process engineers exacerbates manufacturing difficulties, affecting yields and scalability. Furthermore, the semiconductor supply chain’s fragility, influenced by geopolitical tensions, threatens consistent material availability and international collaboration. These factors hinder foundry expansions and slow technology adoption. Competitive pressure from alternative transistor technologies, such as forksheet and complementary FETs (CFETs), also challenges nanosheet FETs’ market dominance, necessitating continuous innovation and risk management.

Global Nanosheet FETs Market Ecosystem Analysis

The global nanosheet FETs market ecosystem includes key stakeholders such as advanced foundries (TSMC, Samsung, Intel), EDA software providers, IP vendors, fab equipment suppliers, and semiconductor design firms. Foundries are collaborating with material science and equipment firms to improve nanosheet fabrication and scaling. Strategic alliances focus on pilot production, IP certification, and design tool compatibility. Public-private initiatives in the U.S., South Korea, and Taiwan are fueling ecosystem development, creating a strong foundation for long-term growth.

Global Nanosheet FETs Market, By Technology Node

What factors enabled the 5 nm & below segment to dominate the nanosheet FETs market in terms of revenue during the forecast period?

The 5 nm & below segment dominated the nanosheet FETs market in terms of revenue during the forecast period, holding approximately 55% of the global market share due to several critical factors. The push for smaller, more efficient semiconductor nodes has driven demand for 5 nm and below technologies, which offer superior performance, lower power consumption, and higher transistor density. These advantages make them highly attractive for use in advanced computing, mobile devices, and AI applications. Additionally, significant investments in R&D and manufacturing capabilities by leading semiconductor companies have accelerated the development and adoption of this technology.

Why did the 7–10 nm segment maintain a moderate share of around 30% in the global nanosheet FETs market?

The 7–10 nm segment holds a moderate share of approximately 30% in the nanosheet FETs market during the forecast period due to several important factors. This segment strikes a balance between advanced performance and cost-effectiveness, making it attractive for applications that require high efficiency without the complexity and expense of smaller node sizes. The 7–10 nm technology offers reliable performance with reduced power consumption compared to larger nodes, appealing to a broad range of electronics, including consumer devices and mid-range computing.

Global Nanosheet FETs Market, By Application

How did the high-performance computing & AI accelerators segment gain a competitive edge in the nanosheet FETs market during the forecast period?

The high-performance computing (HPC) & AI accelerators segment accounted for the largest revenue share of approximately 48% during the forecast period due to several key factors. The rapid growth of AI applications and the increasing demand for powerful computational capabilities have driven substantial investments in HPC and AI accelerator technologies. These accelerators offer superior processing speed, enhanced energy efficiency, and optimized performance for complex AI workloads and data-intensive tasks. Additionally, ongoing innovations in hardware architecture and growing adoption across sectors such as healthcare, automotive, and finance have boosted market demand.

What made the smartphones & mobile devices segment a preferred choice in the nanosheet FETs market?

The smartphones & mobile devices segment held a significant share of around 35% during the forecast period due to several important factors. The continuous growth in smartphone adoption and advancements in mobile technologies, such as 5G and enhanced processing capabilities, have driven strong demand. Consumers’ increasing reliance on mobile devices for communication, entertainment, and productivity has further fueled market expansion.

Asia Pacific is expected to account for the largest share of the nanosheet FETs market during the forecast period, holding approximately 45% of the global market revenue. The region’s dominance is attributed to the presence of advanced semiconductor foundries and strong fabrication infrastructure across Taiwan, South Korea, China, and Japan. Aggressive node transitions by leading players aiming for sub-5 nm technologies further drive market growth. Additionally, strategic investments, a highly skilled workforce, and supportive government policies focused on semiconductor innovation bolster Asia Pacific’s leading position in the nanosheet FETs market.

North America is anticipated to register the fastest CAGR in the nanosheet FETs market, holding approximately 30% of the global market revenue during the forecast period. The U.S. spearheads innovation through significant investments in research and development, equipment manufacturing, and chip design. Key companies such as Intel and IBM are pioneering nanosheet transistor technologies. Furthermore, government initiatives like the CHIPS Act provide incentives that boost local semiconductor fabrication capabilities, accelerating growth and establishing North America as a critical hub for nanosheet FET advancements.

WORLDWIDE TOP KEY PLAYERS IN THE NANOSHEET FETS MARKET INCLUDE

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Samsung Electronics

- Intel Corporation

- GlobalFoundries

- IBM

- Texas Instruments

- Synopsys

- Cadence Design Systems

- ASML Holding

- Applied Materials

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the nanosheet FETs market based on the below-mentioned segments:

Global Nanosheet FETs Market, By Technology Node

- 5 nm & Below

- 7–10 nm

- Above 10 nm

Global Nanosheet FETs Market, By Application

- High-Performance Computing & AI Accelerators

- Smartphones & Mobile Devices

- Automotive & Transportation

- IoT & Edge Devices

Global Nanosheet FETs Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What about the smartphones & mobile devices application segment?

A: The smartphones & mobile devices segment held a significant share of approximately 35% of the market, driven by demand for advanced mobile processing and edge capabilities.

Q: Who are the top key players operating in the Global Nanosheet FETs Market?

A: Key players include Taiwan Semiconductor Manufacturing Company (TSMC); Samsung Electronics; Intel Corporation; GlobalFoundries; IBM; Texas Instruments; Synopsys; Cadence Design Systems; ASML Holding; and Applied Materials.

Q: What are the main drivers of growth in the nanosheet FETs market?

A: Major drivers include the transition from FinFET to gate-all-around architectures (especially below 5 nm), increasing demand for performance and energy efficiency in AI, mobile, and automotive devices, and strong investment in R&D and supportive government policies.

Q: What challenges are limiting adoption of nanosheet FET technology?

A: Challenges include manufacturing complexity (e.g. precision etching, defect control), integration with EDA tools and existing flows, high production costs, and supply chain risks coupled with skilled labor shortages.

Q: What emerging trends are present in the nanosheet FETs market?

A: Trends include increasing R&D in process technologies and EDA tools, collaborations between foundries/material suppliers/equipment manufacturers, and accelerating adoption of nanosheet-based designs for AI, edge, mobile, and automotive use cases.

Q: What opportunities exist in this market?

A: Opportunities lie in high growth applications (AI accelerators, mobile SoCs, automotive processors), achieving yield improvements and mature fabs for sub?5 nm nanosheet production, and benefiting from government incentives, especially in regions with strong semiconductor policies.

Q: What is the long?term outlook (2025–2035) for the nanosheet FETs market?

A: The market is expected to experience robust growth, supported by rising demand for high-performance, energy-efficient devices, increasing adoption in AI/HPC applications, and broad industry momentum toward gate?all?around nanosheet architectures.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 225 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |