Global Natural Gas-Fired Electricity Generation Market

Global Natural Gas-Fired Electricity Generation Market Size, Share, and COVID-19 Impact Analysis, By Technology (Open Cycle, Combined Cycle), By Application (Power & Utility, Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Natural Gas-Fired Electricity Generation Market Summary

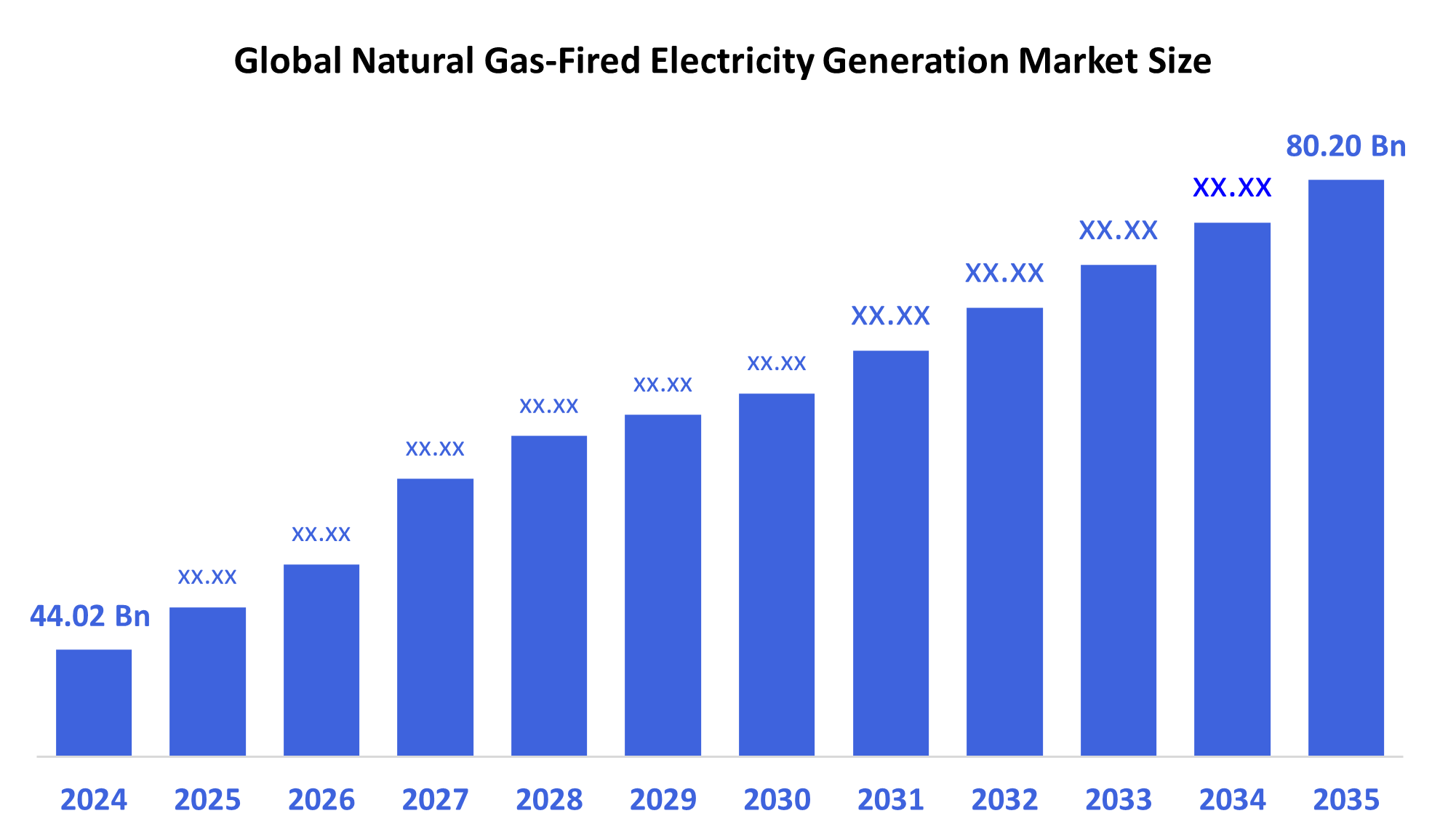

- The Global Natural Gas-Fired Electricity Generation Market Demand Was 44.02 Billion in 2024 and is Projected to Reach USD 80.20 Billion by 2035, Growing at a CAGR of 5.6% from 2025 to 2035.

- Market driven shifts towards gas as a transition fuel for renewable energy integration, its flexibility and dependability, its role as a cleaner alternative to coal and oil, supportive government policies, and rising energy demand from population growth and industrialization are all factors driving the growth of the natural gas-fired electricity generation market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific natural gas-fired electricity generation market held the biggest revenue share of 35.8% and dominated the global market.

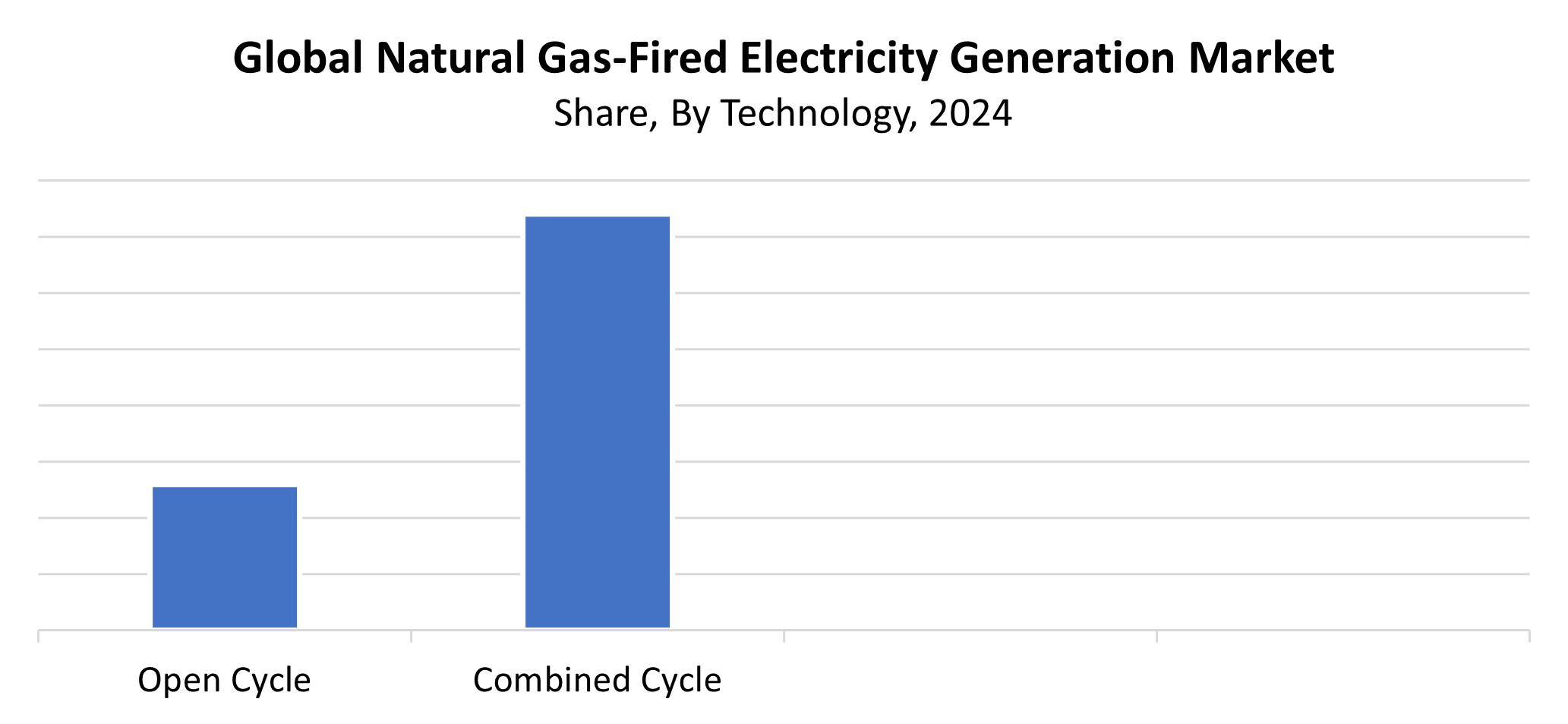

- In 2024, the combined cycle segment held the biggest revenue share of 74.4% and led the market by technology.

- In 2024, the power & utility segment held the biggest revenue share of 72.5% and dominated the global natural gas-fired electricity generation market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 44.02 Billion

- 2035 Projected Market Size: USD 80.20 Billion

- CAGR (2025-2035): 5.6%

- Asia Pacific: Largest market in 2024

The natural gas-fired electricity generation market represents the industry sector that uses natural gas as its primary energy source for power production. Natural gas stands as the top choice because it exists in vast quantities while costs less, and produces fewer carbon emissions compared to coal and oil. The market grows because of two main drivers: the requirement for cleaner energy along with enhanced efficiency, and the implementation of stricter environmental regulations aimed at greenhouse gas reduction, as well as the expanding worldwide energy demand. Natural gas facilities function as flexible power sources that enable quick start-up times that help match renewable energy sources such as wind and solar power. Natural gas power generation has expanded because of the clean energy shift, while coal-fired power plants are being phased out.

Technology has driven major improvements in power plant performance and environmental protection for natural gas facilities. The industry standard for power generation today uses Combined Cycle Gas Turbine (CCGT) technology, which combines gas and steam turbines to achieve both high efficiency and low emission levels. Modern digital monitoring systems and improved turbine designs, together with advanced materials, enable better plant reliability and reduced operating costs. Natural gas receives worldwide governmental support through tax incentives and subsidies, along with regulations that push energy systems toward cleaner alternatives. The sector benefits from regulations that target emission reduction, together with infrastructure development, which includes pipeline networks for its expansion. The combined effects of governmental support and technological progress accelerate the shift toward sustainable power generation through natural gas.

Technology Insights

Why Did the Combined Cycle Segment Dominate the Natural Gas-Fired Electricity Generation Market with a 74.4% Revenue Share in 2024?

During 2024, the combined cycle segment dominated the natural gas-fired electricity generation market with the largest revenue share of 74.4%. A dual operation approach in combined cycle power plants enables superior efficiency together with lower emissions compared to conventional single-cycle systems because it operates both gas and steam turbines on the same fuel source. Power generation facilities operating on this dual-turbine method find great appeal because they deliver better fuel efficiency and lower operational costs. The rapid output adjustment feature of this system makes it ideal for integrating with variable renewable energy sources. The expanding population's need for cleaner energy solutions, together with supportive government policies, has driven both advanced and developing countries to build more combined cycle plants.

The open cycle segment is anticipated to grow at a significant CAGR throughout the forecasted period. The simple cycle turbines known as Open Cycle Gas Turbines (OCGTs) operate mostly as backup and peaking power generators because they start quickly to meet peak electricity requirements. The lower cost of construction, combined with their compact design and fast operational start, makes them ideal for applications requiring quick deployment and flexibility, although they operate at lower efficiency than combined cycle systems. The anticipated growth of the open cycle segment will be driven by key factors such as increased grid stability investments and decentralised power system development, together with rising requirements for fast-response generation capacity in emerging and remote markets.

Application Insights

What Factors Enabled the Power & Utility Segment to Dominate the Global Natural Gas-Fired Electricity Generation Market with a 72.5% Revenue Share in 2024?

The power & utility segment dominated the global natural gas-fired electricity generation market with the largest revenue share of 72.5% in 2024. The power & utility sector has taken control of this market because utilities operate many natural gas power plants that fulfill growing electricity demand while complying with environmental regulations. Utilities select natural gas power generation because it provides cost-effective operation, together with minimal environmental emissions, and maintains both transient power capacity and continuous base power output. The increasing reliance on natural gas for grid stability stems from the coal power plant phase-out and renewable energy integration. The power & utility sector has secured its primary revenue generation position within the natural gas electricity generation market because of these contributing factors.

The industrial segment is anticipated to grow at a substantial CAGR throughout the forecast period. The fundamental reason behind this growth stems from increasing energy requirements within manufacturing and chemical and refining, and food processing sectors that need reliable and efficient power delivery. Industries that use natural gas-fired power instead of diesel or coal-based systems achieve sustainability targets and lower their operational expenses because natural gas provides cleaner and cheaper energy. The increasing usage of cogeneration systems alongside captive power generation in industrial settings drives additional demand within this market. Industry adoption of natural gas-fired power solutions continues to grow because companies focus on reducing carbon emissions and securing a stable energy supply.

Regional Insights

The Asia Pacific natural gas-fired electricity generation market dominated the global market with the largest revenue share of 35.8% in 2024. The main drivers behind this expansion include rising power requirements and rapid industrial development, together with population shifts in China, India, Japan, and Southeast Asian countries. Regional governments are implementing a transition toward sustainable energy sources because they wish to decrease emissions and improve their air quality standards. The development of gas-fired power plants alongside pipeline networks and LNG infrastructure receives accelerated attention from investors. The market growth benefits from supportive government rules, together with national energy diversification strategies and simplified natural gas import procedures. The Asia Pacific region dominates the global natural gas-fired power generation industry because it focuses on delivering reliable energy with minimal environmental impact.

North America Natural Gas Fired Electricity Generation Market Trends

The natural gas-fired electricity generation market in North America will experience a substantial CAGR during the forecast period because of large natural gas reserves and coal plant retirements, combined with growing demand for environmentally friendly power generation. Natural gas has replaced coal as the primary energy source because of its economic advantages and reduced carbon output. The availability and dependability of fuel supplies have also been improved by the growth of shale gas production and upgrades to pipeline infrastructure. The market continues its expansion because of sustained investments in combined cycle power plants, together with supportive regulatory frameworks and growing demand for flexible generation systems to support renewable energy integration. North America will hold a major position within the global natural gas power generation market because of these circumstances.

Europe Natural Gas-Fired Electricity Generation Market Trends

Throughout the forecast period European market for natural gas power generation is expected to grow substantially because of the continuing energy transformation and carbon emission reduction initiatives. Natural gas functions as a transitional fuel to preserve both grid stability and energy security because nations are currently moving away from nuclear and coal power sources. The increasing need for natural gas-fired power plants emerges from the expansion of solar and wind power, which creates instability in the electricity grid. New gas turbine advancements and increasing LNG imports, combined with EU legislation supporting low-carbon operations, result in more investments for natural gas infrastructure. These elements work together to enable Europe’s gradual move toward clean and reliable power generation systems.

Key Natural Gas Fired Electricity Generation Companies:

The following are the leading companies in the natural gas fired electricity generation market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric

- Man Energy Solutions

- Bharat Heavy Electricals Limited

- Siemens AG

- Kawasaki Heavy Industries, Ltd.

- Ansaldo Energia S.P.A.

- Opra Turbines B.V.

- Mitsubishi Hitachi Power Systems, Ltd.

- Centrax Gas Turbines

- Others

Recent Developments

- In December 2024, Siemens Energy and SSE established a partnership called "Mission H2 Power," which aims to advance gas turbine technology such that it can run entirely on hydrogen. Currently using natural gas, SSE's Keadby 2 Power Station is being decarbonized with the help of this effort. The goal of the partnership was to create a combustion system for Siemens' SGT5-9000HL turbine that would allow it to operate on both natural gas and hydrogen. This initiative is essential to improving energy security and lowering dependency on fossil fuels as the UK moves towards a greener energy system.

- In January 2024, the next stage of GE Vernova and IHI Corporation's partnership began with the development of a gas turbine combustion system that can burn only ammonia, which could revolutionize the production of power from natural gas. By 2030, this collaborative development agreement, which was signed on January 24, 2024, intends to convert current F-class turbines to run on ammonia. In order to lower nitrogen oxide emissions and increase the feasibility of ammonia as a low-carbon fuel substitute in power generation, the project involves intensive combustion testing in Japan.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the natural gas-fired electricity generation market based on the below-mentioned segments:

Global Natural Gas-Fired Electricity Generation Market, By Technology

- Open Cycle

- Combined Cycle

Global Natural Gas-Fired Electricity Generation Market, By Application

- Power & Utility

- Industrial

Global Natural Gas-Fired Electricity Generation Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |