Global Natural Gas Generator Market

Global Natural Gas Generator Market Size, Share, and COVID-19 Impact Analysis, By Type (Low Power Genset, Medium Power Genset, High Power Gensets), By Application (Industrial, Residential, Commercial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 ? 2035

Report Overview

Table of Contents

Natural Gas Generator Market Summary

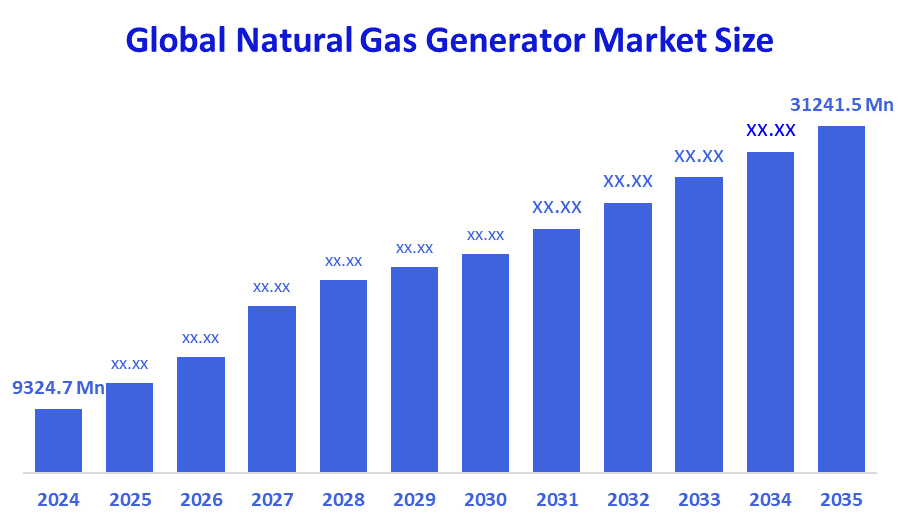

The Global Natural Gas Generator Market Size Was Estimated at USD 9324.7 Million in 2024 and is Projected to Reach USD 31241.5 Million by 2035, Growing at a CAGR of 11.62% from 2025 to 2035. The market for natural gas generators is expanding because of factors including increased demand for dependable backup power, reduced emissions when compared to diesel, growing industrialization, increased availability of natural gas, more stringent environmental regulations, cost-effectiveness, and increased adoption in both consumer and business sectors worldwide.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 21.5% and dominated the market globally.

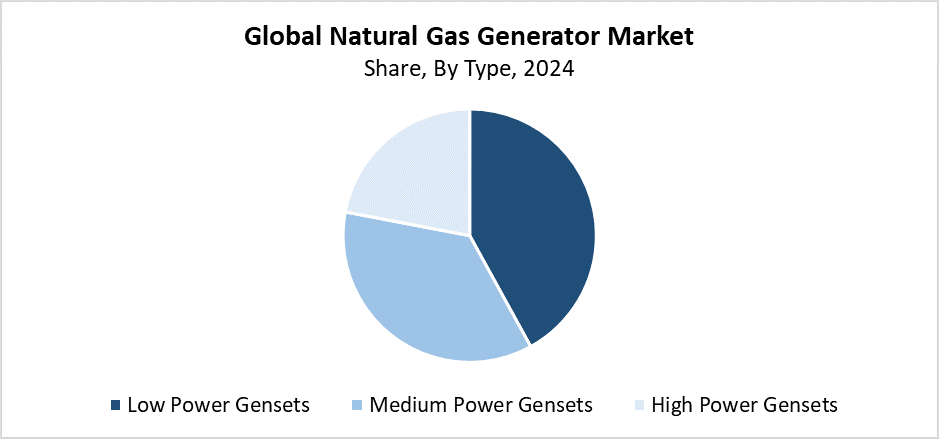

- In 2024, the low-power genset segment had the highest market share and led the market by type, accounting for 42.8%.

- In 2024, the commercial segment had the biggest market share and led the market by application, accounting for 44.3%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 9324.7 Million

- 2035 Projected Market Size: USD 31241.5 Million

- CAGR (2025-2035): 11.62%

- North America: Largest market in 2021

The natural gas generator market represents the industrial sector that manufactures and distributes natural gas-powered continuous and backup power generators to commercial, industrial, and residential customers. The generators are selected over diesel models because they emit less pollution while costing less to operate and using readily available fuel sources. The market experiences fast growth because of increasing requirements for reliable electrical power, mainly in locations that experience regular power interruptions or unstable electricity systems. The market growth is supported by the expanding data center infrastructure alongside increasing urbanization and industrial growth. Natural gas generator adoption continues to grow because environmental factors and tougher emission standards push the shift toward greener power sources.

Technological progress has improved natural gas generator capabilities as well as their operational efficiency and their ability to scale operations. Advanced control systems and remote monitoring capabilities, together with enhanced fuel efficiency, make contemporary systems appealing to various applications. The market receives advantages from government initiatives that promote clean energy solutions while offering incentives to develop natural gas infrastructure. Policies that support lower carbon footprints and sustainable energy investments are driving businesses and homeowners to choose natural gas generators as permanent, environmentally friendly power backup solutions.

Type Insights

The low power genset segment led the global natural gas generator market with the largest revenue share of 42.8% in 2024. The primary factor behind this market leadership stems from rising needs for reliable yet affordable backup power and business and residential power solutions. The small size, together with easy installation and fuel efficiency of low-power gensets, makes them the preferred choice for local power needs. The emission levels of these generators stand lower than diesel generators, which matches the rising environmental standards across different regions worldwide. The growing urban population and expanding small to medium business sector create strong demand for low-power gensets, which maintains their leading position in the natural gas generator industry.

The natural gas generator market's medium power gensets segment is expected to grow at a significant CAGR throughout the forecast timeframe. The primary growth factor for this segment stems from commercial and industrial facilities that need moderate power generation with optimal efficiency. The medium power gensets offer advantages to large commercial buildings, manufacturing facilities, and data centers through their ability to scale and achieve better fuel efficiency, along with decreased emissions. The requirement for trustworthy backup power during power grid failures, together with rising infrastructure development spending, drives the utilization of medium power gensets. The segment's strong growth prospects for the upcoming years stem from technological advancements, which include improved control systems together with remote monitoring capabilities.

Application Insights

The commercial segment led the natural gas generator market with the largest revenue share of 44.3% in 2024. The leadership position exists because commercial buildings need reliable power solutions for offices, retail stores, hospitals, and data centers. Natural gas generators serve as a better alternative to diesel systems in commercial buildings because they produce fewer emissions while maintaining affordability for regular power source requirements. The worldwide growth of commercial infrastructure, together with rising urban populations, drives the market expansion. The sector receives benefits from technological advancements in generator systems through smart control development and fuel efficiency improvements that enhance operational performance and reduce expenses, which drives greater use of natural gas generators in commercial operations.

The industrial segment of the natural gas generator market is expected to grow at a significant CAGR during the forecast period. This growth stems from rising power needs among heavy industrial and processing facilities, along with manufacturing establishments that require dependable power solutions. The environmentally friendly nature of natural gas generators enables businesses to comply with strict environmental standards when replacing conventional diesel generators. The market is expanding because of rising demand for uninterrupted power supply to stop costly outages and maintain operational efficiency. Industrial infrastructure investments, together with technological developments in remote monitoring and fuel economy improvements, drive the expansion of the natural gas generator market within the industrial segment.

Regional Insights

The North American natural gas generator market held the largest revenue share of 29.5% during 2024 and dominated the market globally. The region's established natural gas system, together with abundant fuel reserves and environmental regulations that promote sustainable energy solutions, drives its market leadership. The market continues to grow through increased requirements for reliable backup power in business and industrial facilities and residential properties. The trend toward diesel replacement with environmentally friendly alternatives and carbon emission reduction efforts in North America promotes natural gas generator adoption. The region maintains its leadership position because of increasing energy infrastructure spending, alongside government support and technological progress. The combination of these factors establishes North America as the leading global market for natural gas generators in terms of size and activity.

Asia Pacific Natural Gas Generator Market Trends

The Asia Pacific natural gas generator market is expected to grow at a substantial CAGR during the forecast period because of the area's rapid industrial development, along with urban growth and rising power demand. The increasing need for reliable power backup systems emerges from the substantial infrastructure development investments which emerging economies, including China, India and Southeast Asian nations, have undertaken. Natural gas generators gain support from the region's rising dedication to carbon emission reduction and transition to environmentally friendly power sources. The industry growth continues because of government initiatives that promote natural gas utilization and improvements in fuel delivery infrastructure. The Asia Pacific market gains momentum through both advanced generator efficiency technology and rising environmental sustainability consciousness.

Europe Natural Gas Generator Market Trends

The European market for natural gas generators will experience substantial growth during the forecast period because of environmental constraints, together with the region's commitment to reducing carbon emissions. Natural gas generators gain support from European governments because they serve as environmentally better alternatives to diesel-powered energy systems. Market expansion results from the rising demand for dependable backup power across commercial, industrial, and residential sectors. New technological advancements, which include advanced monitoring systems together with improved fuel efficiency, enhance the attractiveness of natural gas generators. The market expansion receives support from both natural gas infrastructure investments and supportive regulatory frameworks, which provide incentives and subsidies. The various factors combine to establish Europe as a prime location for substantial growth in the natural gas generator market.

Key Natural Gas Generator Companies:

The following are the leading companies in the natural gas generator market. These companies collectively hold the largest market share and dictate industry trends.

- Cummins Inc.

- Yanmar Co., Ltd

- MTU Onsite Energy

- Caterpillar Inc.

- Cooper Corp.

- Mitsubishi Heavy Industries, Ltd

- General Electric

- Kohler Co. Inc.

- Generac Power Systems, Inc.

- Mahindra Powerol

- Others

Recent Developments

- In October 2024, in Madrid, Spain, HIMOINSA unveiled its HGY Series of natural gas generators, introducing a fresh power option for demanding applications. These efficient, low-emission generators, which vary in capacity from 1250kVA to 3500kVA, were developed in partnership with Yanmar Power Technology. In line with sustainability objectives, the HGY Series supports alternative fuels like hydrogen and natural gas. These generators, which are outfitted with cutting-edge features for peak performance, are expected to increase HIMOINSA's market share in the global power production industry.

- In February 2023, aiming to satisfy North America's increasing need for dependable and effective power solutions, Cummins Inc. announced the release of its new 175 kW and 200 kW natural gas generator sets. Lower emissions and lower operating costs are provided by these generator sets, which are designed for sustainability and performance. The launch of these natural gas generators is a testament to Cummins' dedication to offering cutting-edge energy solutions that cater to a range of uses, including commercial and industrial sectors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the natural gas generator market based on the below-mentioned segments:

Global Natural Gas Generator Market, By Type

- Low Power Gensets

- Medium Power Gensets

- High Power Gensets

Global Natural Gas Generator Market, By Application

- Industrial

- Commercial

- Residential

Global Natural Gas Generator Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |