Global Navigation Lighting Market

Global Navigation Lighting Market Size, Share, and COVID-19 Impact Analysis, By Type (Sidelights, Stern Light, All-Around Light, Masthead Light, Others), By Technology (LED, HID, Incandescent, Halogen, Solar), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Navigation Lighting Market Summary

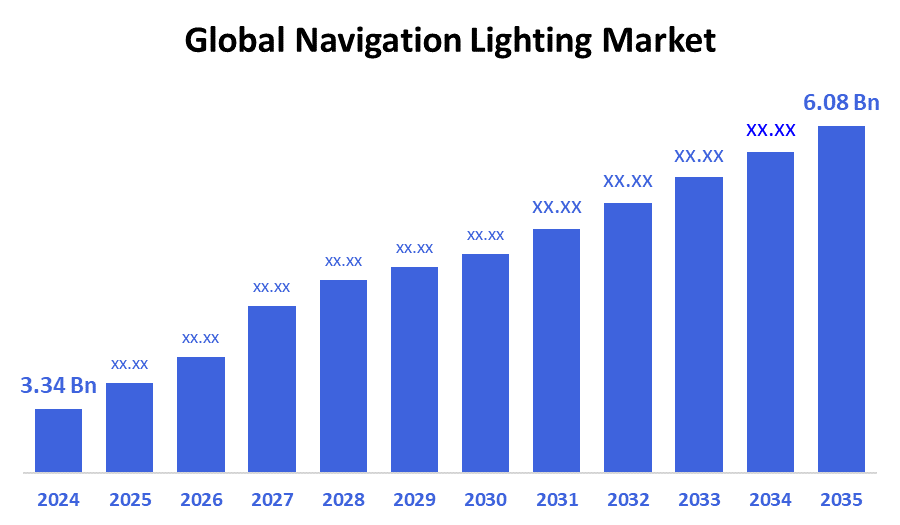

The Global Navigation Lighting Market Size Was Estimated at USD 3.34 Billion in 2024 and is Projected to Reach USD 6.08 Billion by 2035, Growing at a CAGR of 5.6% from 2025 to 2035. The market for navigation lighting is expanding as a result of growing international attention to safety standards and technological developments, particularly the use of LED lighting, which provides increased durability and energy efficiency.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 21.5% and dominated the market globally.

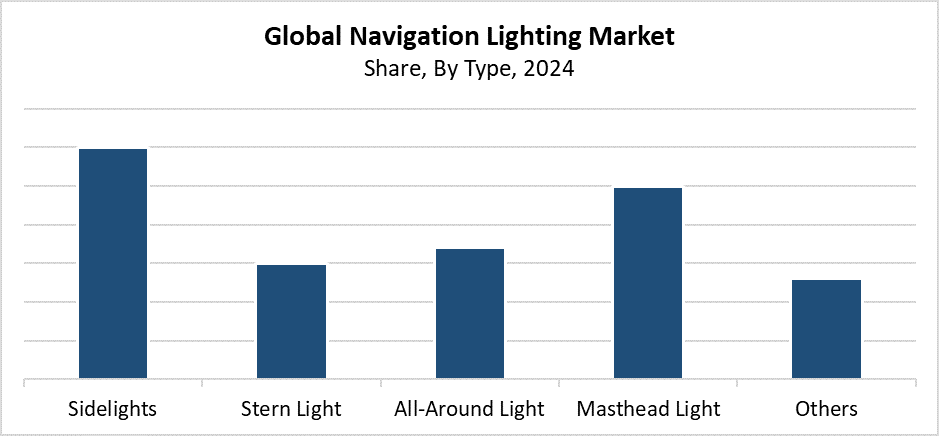

- In 2024, the sidelights segment had the highest market share by type, accounting for 30.8%.

- In 2024, the LED segment had the biggest market share by technology.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.34 Billion

- 2035 Projected Market Size: USD 6.08 Billion

- CAGR (2025-2035): 5.6%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market in 2024

The navigation lighting market consists of illumination systems that serve the aviation and maritime industries by making navigation safer during poor visibility periods, such as adverse weather and nighttime operations. These systems are essential to prevent collisions while showing the operational status of planes and ships and meeting worldwide safety standards. Market growth depends mainly on rising air traffic and international marine trade volume, as well as stringent safety standards that organizations like ICAO and IMO establish. Modern defense fleet upgrades, together with expanding commercial aviation sector and rising marine tourism demand reliable and energy-efficient navigation lighting solutions.

The navigation lighting market has experienced a transformation through technological innovations, which have driven LED-based solutions to become dominant because they consume minimal power while offering extended durability and better visibility. The combination of smart lighting systems with sensors and GPS technology, along with automation processes, creates operational efficiency while enhancing safety. Government programs function as essential drivers because various nations require adherence to new safety standards and dedicate funds toward modernizing port and airport infrastructure. Current regulations alongside performance-based incentives have driven swift adoption because transportation safety strategies worldwide now emphasize navigation lighting as their primary safety focus.

Type Insights

The sidelights segment held the dominant position in the navigation lighting market during 2024 with the largest revenue share of 30.8%. A vessel must display port (red) and starboard (green) lights of other ships to recognize its heading and direction of movement, especially during nighttime or poor visibility conditions. International maritime safety regulations mandate their use as essential components throughout commercial and defense, and recreational marine fleet operations. The segment remains dominant due to two main factors: the increasing global fleet size and rising marine safety awareness, combined with strict enforcement of regulations. The market continues to grow while preserving its leading position through the ongoing replacement of standard sidelights with energy-saving LED alternatives.

The masthead light segment is anticipated to grow at the fastest CAGR throughout the forecasted period. A white light from the masthead light mounted on a vessel's centerline forward section serves as a navigational signal that displays vessel presence and direction and operational status through an extensive viewing angle. The expansion of international maritime transport, together with stricter maritime safety regulations and expanding commercial naval operations, serves as the primary factor behind projected growth. Users are adopting advanced LED masthead lights because these products provide extended lifespan and simple servicing while saving power consumption. The masthead light market shows strong growth potential through both new vessel installations and retrofitting projects because vessel operators dedicate maximum attention to safety requirements and regulatory standards.

Technology Insights

The LED segment dominated the navigation lighting market with the largest revenue share in 2024. LED navigation lights have gained widespread acceptance because they deliver better energy efficiency and longer life span, along with better visibility than conventional incandescent or halogen lights. These specialized features make them perfect for use in maritime and aviation sectors where high performance and reliability matter most. The adoption of LED technology has grown substantially in both new construction and retrofit projects because organizations focus more on energy savings and cost-effective maintenance, and stand behind international safety requirements. The segment maintains its worldwide navigation lighting market leadership because of innovative developments in smart LED systems, which include built-in sensors and remote monitoring features.

The solar segment of the navigation lighting market is anticipated to grow at the fastest CAGR during the forecast period. Solar-powered navigation lights operate on renewable energy, which makes them cost-effective while being environmentally sustainable compared to power sources based on fuel and electrical grids. The equipment functions autonomously without maintenance requirements, which makes it suitable for installation on buoys and unmanned vessels as well as remote offshore locations. Green energy initiatives launched by governments, together with worldwide environmental sustainability priorities, are creating demand for solar navigation lighting solutions. The marine and aviation industries accelerate their adoption of these products because of progress in weather-resistant designs, battery storage, and solar panel efficiency, which result in improved performance and reliability.

Regional Insights

During 2024, the Asia Pacific navigation lighting market led globally with the largest revenue share of 36.4%. This market leadership stems from the region's thriving marine commerce alongside the expanding commercial shipping sector and growing military naval expenditures. Modernized port infrastructure, together with modernized fleets of major Asian economies, including China, Japan, South Korea, and India, drives increased demand for advanced navigation lighting systems. The market growth accelerates because of strict maritime safety regulations, together with the rising demand for energy-saving products, which include solar-powered lights and LED lighting solutions. Government programs supporting coastal surveillance and navigation safety alongside rising urbanization and increasing aviation traffic in the region enable the Asia Pacific to maintain its lead position in global navigation lighting markets.

Europe Navigation Lighting Market Trends

During the forecast timeframe, the European navigation lighting market is expected to grow at the fastest CAGR because of stringent marine and aviation safety standards, along with rising environmental awareness and rapid technological adoption. The European region's dedication to sustainability in coastal and inland waterway operations has accelerated the shift toward solar-powered and energy-efficient navigation lights. Defense fleets and naval fleets, along with rising commercial maritime traffic and smart port infrastructure investments, contribute to market expansion. The European Union, through funding programs and regulatory measures, helps nations such as the Netherlands, Germany, and France establish leading sustainable maritime technology standards. The technology innovations and stringent regulations present in Europe position this market as the fastest growing sector in the region.

North America Navigation Lighting Market Trends

The North American navigation lighting market is expected to grow significantly during the forecasted period because of expanding marine trade and aviation traffic alongside strict safety standards enforced by the FAA and U.S. Coast Guard organizations. Large commercial maritime fleets, alongside growing naval military expenditures and ongoing upgrades of ports and airports, serve as primary growth factors in this region. The growing use of energy-efficient technologies, including solar-powered navigation lights, together with LED lights, receives support from governmental incentives and sustainability measures. The US and Canada lead in deploying innovative navigation systems while maintaining global safety standards and driving increased aviation and maritime industry needs.

Key Navigation Lighting Companies:

The following are the leading companies in the navigation lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Accon Marine

- TecNiq Inc

- Lopolight ApS

- Attwood

- Lumitec LLC

- Fishmaster

- Hella Marine

- Seaview Global

- Phoenix Products LLC

- Livorsi Marine

- Marinebeam

- Perko Inc.

- TACO Marine

- Collins Aerospace

- T-H Marine Supplies

- Others

Recent Developments

- In April 2025, the distribution agreement for cabin interior parts was signed between Collins Aerospace and Satair. Through this strategic partnership, Collins Aerospace's superior cabin interior products are combined with Satair's strengths in forecasting, inventory management, and logistics. Emergency supplemental oxygen systems, galley equipment for in-flight beverage service, and a range of lighting options for both exterior and interior uses, including logo, wing, landing, navigation, emergency, anti-collision, and taxi lights, are all included under the deal.

- In April 2024, Perko Inc. and DuraBrite worked together to extend the application of cutting-edge LED technology to a wider range of commercial and recreational maritime vessels. To raise industry standards by producing solutions that offer outstanding performance, increased safety, and long-term durability, this strategic partnership represents a significant leap in marine lighting. with the integration of DuraBrite's patented features, including precision-engineered optical control, unique energy-efficient circuitry, and state-of-the-art thermal management.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the navigation lighting market based on the below-mentioned segments:

Global Navigation Lighting Market, By Type

- Sidelights

- Stern Light

- All-Around Light

- Masthead Light

- Others

Global Navigation Lighting Market, By Technology

- LED

- HID

- Incandescent

- Halogen

- Solar

Global Navigation Lighting Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |