Global Needle Coke Market

Global Needle Coke Market Size, Share, and COVID-19 Impact Analysis, By Grade (Super-Premium, Premium-Grade, Intermediate Grade), By Application (Electrode, Silicon Metals & Ferroalloys, Carbon Black, Rubber Compounds, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Needle Coke Market Summary

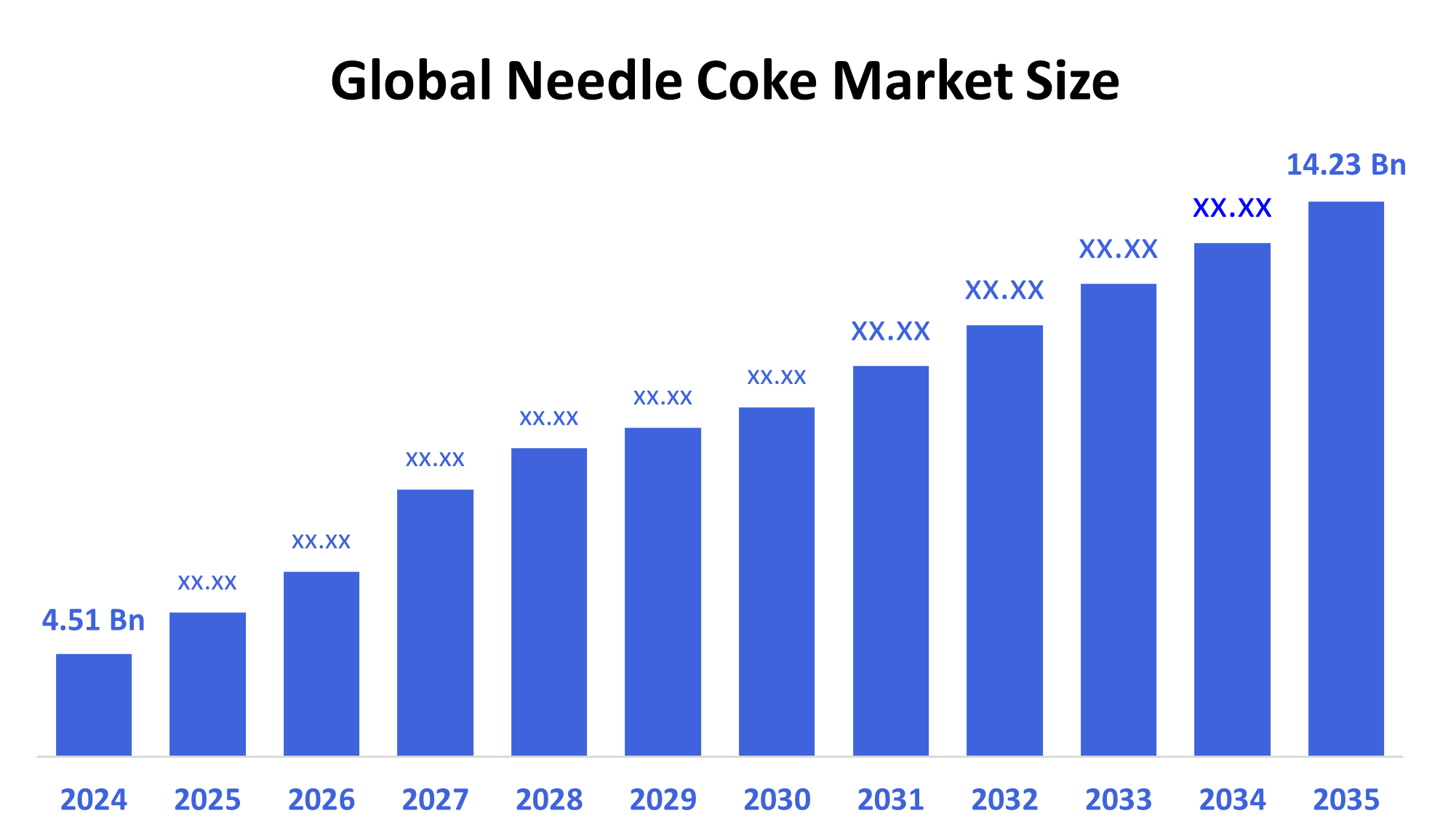

The Global Needle Coke Market Size Was Estimated at USD 4.51 Billion in 2024 and is Projected to Reach USD 14.23 Billion by 2035, Growing at a CAGR of 11.01% from 2025 to 2035. The growing demand for graphite electrodes in electric arc furnaces, the expansion of steel production, the growing popularity of electric vehicles, the growing need for lithium-ion batteries, and technological advancements in the refining processes for high-quality coke are all driving growth in the needle coke market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 62.4% and dominated the market globally.

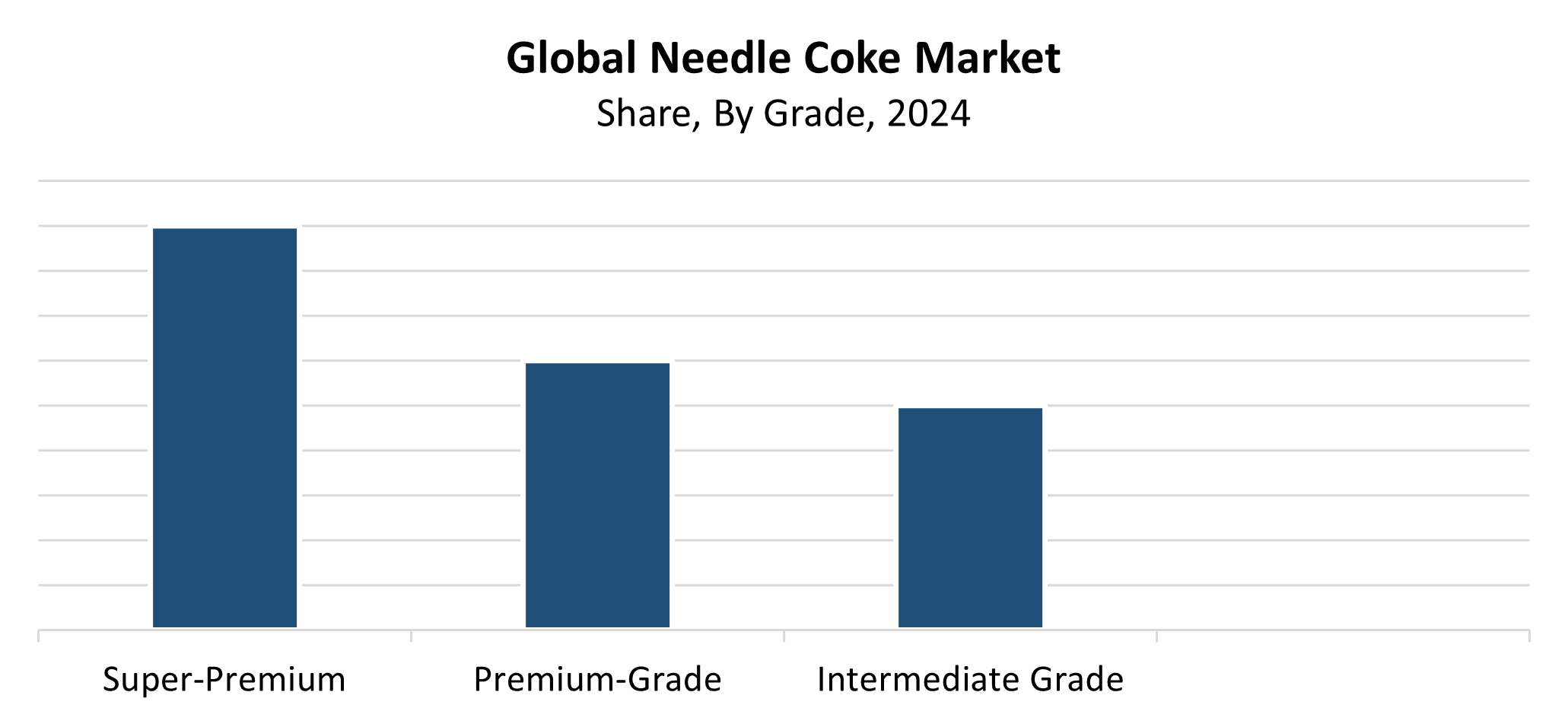

- In 2024, the super-premium segment had the highest market share by grade, accounting for 45.6%.

- In 2024, the electrode segment had the biggest market share by application, accounting for 64.3%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.51 Billion

- 2035 Projected Market Size: USD 14.23 Billion

- CAGR (2025-2035): 11.01%

- Asia Pacific: Largest market in 2024

The needle coke market exists as the industry that manufactures and distributes high-quality carbon materials, which primarily serve steel manufacturers to build graphite electrodes for electric arc furnaces (EAFs). The essential component, needle coke, serves multiple established and emerging industries by functioning as a key material to manufacture lithium-ion battery anodes. The primary factors driving the market expansion include rising global steel production through EAFs, alongside increasing electric vehicle demand and expanding lithium-ion battery applications in consumer electronics and energy storage systems. The requirement for top-quality needle coke has grown because of the transition to cleaner steel manufacturing methods, along with increased attention to power efficiency.

The implementation of advanced delayed coking and coal tar distillation methods by refiners has significantly improved needle coke production while simultaneously enhancing product purity. The development of custom needle coke for advanced anodes receives its momentum from ongoing battery technology enhancements. The worldwide shift toward energy storage and electric vehicle adoption receives support from government policies that include subsidies and emission regulations, along with battery production investments, which drive up needle coke requirements. These combined elements are expected to sustain the rising market trajectory during the next several years.

Grade Insights

The super-premium segment leads the needle coke market with the largest revenue share of 45.6% in 2024. Needle coke market growth primarily stems from its outstanding attributes, which make it the best choice for manufacturing ultra-high-power (UHP) graphite electrodes for electric arc furnaces. The essential properties of this material consist of its high crystallinity along with a low thermal expansion coefficient and outstanding electrical conductivity. The market growth has been significantly driven by the increasing worldwide demand for premium steel, which mainly targets the automotive and infrastructure industries. The expanding usage of electric vehicles, together with the need for advanced lithium-ion batteries, drives higher demand for super-premium needle coke. The material serves as the preferred choice for both existing and emerging applications because it meets precise quality requirements.

The premium grade segment of the needle coke market is anticipated to grow at a significant CAGR during the forecast period because of its wide range of applications and its optimal cost-to-performance ratio. The production of graphite electrodes for electric arc furnaces, along with lithium-ion battery anodes, requires premium-grade needle coke. The worldwide steel demand increase, together with the fast-growing consumer electronics and electric vehicle sectors, drives up the requirement for premium needle coke at affordable prices. Battery and electrode manufacturing technology advancements have enhanced the usability of high-end products. Its favorable characteristics, combined with reduced costs relative to super-premium grades, make it suitable for multiple industrial applications.

Application Insights

The electrode segment dominated the needle coke market by generating the largest revenue share of 64.3% in 2024. Needle coke functions as a vital base ingredient for producing graphite electrodes, which serve as the main components of electric arc furnaces (EAFs) used in steel manufacturing. The adoption of electric arc furnace steel production methods instead of traditional blast furnaces has significantly boosted needle coke demand because EAFs require graphite electrodes, which use needle coke as a raw material. The rising popularity of recycled steel, coupled with worldwide infrastructure development, has driven the rise in usage of EAF-based steel manufacturing. The market leadership of needle coke as the primary electrode material stems from its thermal and electrical conductive properties, which make it the top choice for creating high-performance electrodes.

The needle coke market's Silicon Metals & Ferroalloys segment is predicted to experience growth at a significant rate throughout the forecasted period. The rising demand for silicon metals together with ferroalloys by various industries such as electronics, automotive, renewable energy, and construction serves as the principal growth factor for this market segment. Electric arc furnace smelting of ferroalloys and silicon metal requires carbon electrodes, which are produced using needle coke. The growing steel and alloy production sector, together with increasing silicon usage in semiconductors and solar panels, drives the rising demand. The growing application segment will continue its expansion because of both increasing investments in renewable energy infrastructure and metallurgical process technology advancements.

Regional Insights

The Asia Pacific needle coke market dominated worldwide with the largest revenue share of 62.4% throughout 2024. The market lead of the region stems from its substantial steel production levels, particularly in China, India, and Japan, where electric arc furnaces (EAFs) function as typical manufacturing methods. The needle coke market has surged strongly because the steel industry needs more graphite electrodes for its operations. The market growth receives additional support from the fast-growing electronics and electric vehicle (EV) sectors, which have elevated lithium-ion battery requirements. The region's leading market position stems from its industrial growth combined with supportive government frameworks and its strategic industrial base. The Asia Pacific region strengthens its global market leadership through continuous infrastructure and technological advancement.

North America Needle Coke Market Trends

During the forecast period, the North American needle coke market will experience substantial growth because of increasing demand from steel producers and electric vehicle manufacturers. The steel industry of the region needs a consistent supply of needle coke electrodes for established electric arc furnace (EAF) production. The rising popularity of electric vehicles, together with growing battery manufacturing operations in North America, drives increased demand for performance-critical anode materials, including needle coke. Market growth receives a boost from increased investments in clean energy alongside technological advancements and government initiatives supporting sustainable business operations. The worldwide needle coke market positions itself strategically when North America focuses on domestic production.

Europe Needle Coke Market Trends

The needle coke market grows significantly in Europe because of the increasing needs across the steel and automotive sectors, as well as energy storage. The transition to electric arc furnace (EAF) steel production in the region has caused the need for graphite electrodes to increase, which directly impacts needle coke demand. European battery manufacturing and electric vehicle adoption drive the demand for high-quality needle coke used in anode production. Government regulations focused on reducing carbon emissions and advancing green technologies promote the use of efficient, sustainable materials. The European market expansion is expected to continue due to major steel and battery manufacturing facilities and ongoing technological developments.

Key Needle Coke Companies:

The following are the leading companies in the needle coke market. These companies collectively hold the largest market share and dictate industry trends.

- Phillips 66

- C-Chem Co., Ltd.

- JXTG Nippon Oil & Energy Corp.

- Asbury Carbon Inc.

- Graftech International

- Sojitz Ject Corp.

- Sumitomo Chemical Company

- Indian Oil Corporation Limited

- Seadrift Coke L.P.

- Mitsubishi Chemical Corp.

- Baosteel Group

- Others

Recent Developments

- In November 2023, HEGLTD revealed its strategic plans to improve operations in key areas, such as the market for needle coke. The business underlined its dedication to growing its impact in high-demand sectors, including energy and steel manufacturing, where needle coke is essential. They described continuous technological developments and environmental initiatives meant to satisfy these markets' changing demands. The initiatives of HEGLTD are in line with worldwide patterns that indicate a rise in the market for premium materials, particularly needle coke, for a range of applications.

- In April 2023, as part of its strategic expansion, GrafTech International Ltd. announced the launch of a new sales office in Dubai. The goal of this action is to meet the region's increasing requirement for needle coke while bolstering GrafTech's footprint in the Middle East. The business emphasized its dedication to strengthening client connections and offering premium needle coke products used in the manufacturing of steel and other vital industries. An important part of GrafTech's global business plan is this expansion.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the needle coke market based on the below-mentioned segments:

Global Needle Coke Market, By Grade

- Super-Premium

- Premium-Grade

- Intermediate Grade

Global Needle Coke Market, By Application

- Electrode

- Silicon Metals & Ferroalloys

- Carbon Black

- Rubber Compounds

- Others

Global Needle Coke Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |