Global Neuromorphic Hardware Market

Global Neuromorphic Hardware Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Hardware Type (Digital CMOS Neuromorphic, Analog / Mixed-signal Neuromorphic, Memristive / Resistive, Photonic Neuromorphic, Spintronic / MTJ-based), By Component (Processors / Chips, Sensors, Memory, SDKs & Dev Tools, Reference Designs & Evaluation Kits), and By Region (Asia Pacific, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Neuromorphic Hardware Market Summary, Size & Emerging Trends

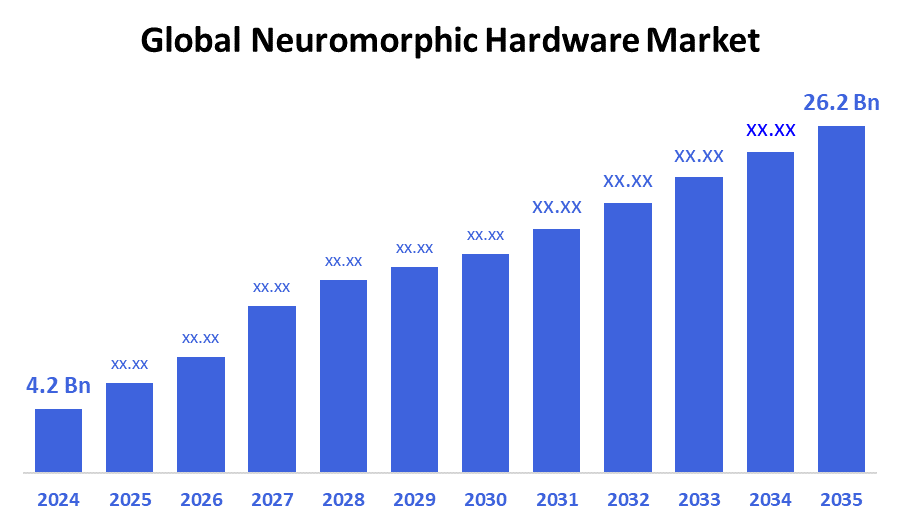

According to Decision Advisors, The Global Neuromorphic Hardware Market Size is expected to grow from USD 4.2 Billion in 2024 to USD 26.2 Billion by 2035, at a CAGR of 20.1% during the forecast period 2025-2035. The rising demand for energy-efficient, brain-inspired computing architectures in AI, robotics, and IoT applications is a key factor propelling market growth. Continuous advancements in chip design and increasing investments by tech giants to develop next-generation neuromorphic processors further support market expansion.

Key Market Insights

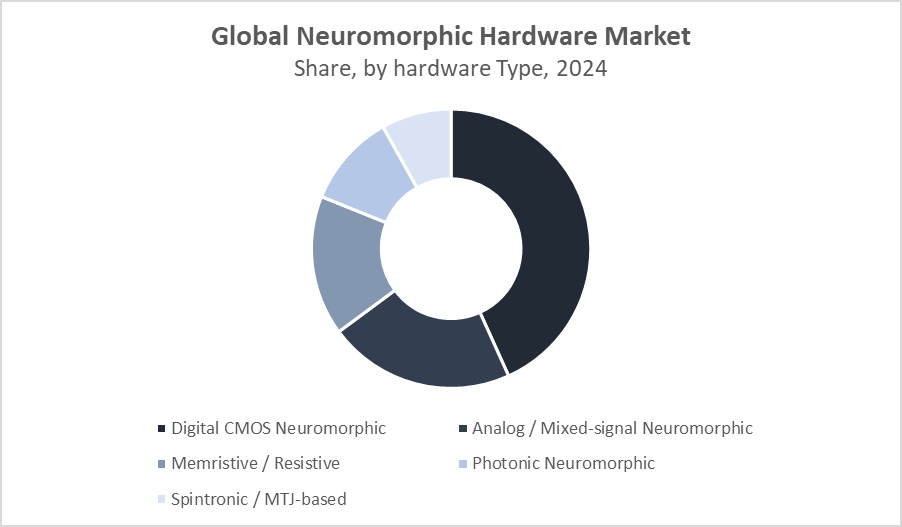

- Digital CMOS neuromorphic hardware dominates the market due to maturity and wide adoption in research and commercial products.

- Processors/chips segment holds the largest revenue share, driven by demand for specialized neuromorphic computing units.

- Asia Pacific is projected to be the fastest-growing region fueled by technological investments and increasing AI applications.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.2 Billion

- 2035 Projected Market Size: USD 26.2 Billion

- CAGR (2025-2035): 20.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Neuromorphic Hardware Market

The neuromorphic hardware market centers on developing computing devices inspired by the human brain's neural architecture to enhance computing efficiency and mimic cognitive functions. These devices use specialized chips designed to process information in parallel, enabling low power consumption and real-time data processing ideal for AI, robotics, autonomous vehicles, and edge computing. Growing challenges in classical computing, including power inefficiency and latency, have accelerated adoption of neuromorphic hardware. Moreover, collaborations between semiconductor firms and AI companies are accelerating innovations in neuromorphic components and systems, expanding application possibilities.

Neuromorphic Hardware Market Trends

- Growing integration of memristive and spintronic devices for enhanced synaptic emulation.

- Increasing adoption of mixed-signal neuromorphic designs to balance accuracy and power efficiency.

- Expansion of developer tools and SDKs simplifying neuromorphic hardware programming.

Neuromorphic Hardware Market Dynamics

Driving Factors: Demand for energy-efficient computing in AI and robotics

Neuromorphic hardware is increasingly sought after due to the limitations of traditional von Neumann architectures, especially their high energy consumption and latency issues. Neuromorphic devices mimic the human brain’s efficiency, enabling ultra-low power usage, adaptability, and real-time learning. These features make them ideal for AI edge devices, autonomous vehicles, and robotics applications where speed and energy savings are critical. Furthermore, significant investments by tech giants and government agencies in neuromorphic research are accelerating the technology’s adoption and commercialization across multiple industries, driving market growth.

Restrain Factors: High development costs and manufacturing complexities

Developing neuromorphic hardware involves complex fabrication processes and costly R&D, making it financially feasible mainly for large corporations and academic institutions. The absence of standardized architectures complicates the integration of neuromorphic chips into existing computing systems. Additionally, the software ecosystem supporting these devices is still limited compared to conventional computing, which slows down widespread adoption. Scaling production to mass market levels is challenging, further restricting growth as smaller companies and startups struggle to enter this capital-intensive field.

Opportunity: Advancements in memristive and photonic neuromorphic technologies

New technologies like memristors and photonic neuromorphic systems offer breakthroughs in speed and energy efficiency, closely replicating biological neurons and synapses. These innovations can enable higher-density, more powerful neuromorphic chips, paving the way for next-generation AI hardware platforms. Collaboration between neuromorphic hardware developers and AI software companies is fostering innovative solutions that can unlock new applications and accelerate market expansion. As these technologies mature, they hold the potential to revolutionize computing across sectors such as healthcare, autonomous systems, and IoT.

Challenges: Standardization and programming complexity

A key obstacle is the lack of unified industry standards for neuromorphic hardware architectures, which hampers device interoperability and broad adoption. Programming neuromorphic systems is highly specialized, requiring expertise not commonly found in the general developer community. This restricts the pace of application development and commercialization. While progress is being made to improve software development kits (SDKs) and other tools, the current ecosystem still poses a steep learning curve. Overcoming these challenges is critical for scaling neuromorphic computing in practical, widespread use cases.

Global Neuromorphic Hardware Market Ecosystem Analysis

The neuromorphic hardware market ecosystem comprises chip manufacturers, AI software developers, semiconductor foundries, research institutions, and end-users such as robotics and automotive firms. Close cooperation among these stakeholders is driving innovation in hardware design and software compatibility. Investments in R&D and government initiatives to promote AI hardware development foster market growth. Regulatory bodies ensure safety and compliance for neuromorphic components used in critical applications, sustaining confidence and adoption.

Global Neuromorphic Hardware Market, By Hardware Type

Digital CMOS neuromorphic hardware dominated the market in 2024, mainly because it benefits from mature technology and well-established manufacturing processes. These chips are easier to integrate with existing digital systems, making them a preferred choice for both research and commercial AI applications. Their reliability and compatibility with current semiconductor fabrication infrastructure enable faster development and deployment. This widespread use in AI and machine learning tasks, especially in environments where precision and scalability are important, solidifies their leading position in the neuromorphic hardware market.

Analog and mixed-signal neuromorphic devices are gaining significant attention due to their ability to offer a good balance between computational accuracy and energy efficiency. They are particularly suited for real-time edge applications, where low power consumption and fast response times are critical. These systems mimic the brain’s analog processing, enabling efficient handling of sensory data and adaptive learning in compact devices. As demand grows for AI solutions in IoT, robotics, and wearable tech, analog/mixed-signal neuromorphic hardware is poised to expand its market share.

Global Neuromorphic Hardware Market, By Component

Processors and chips hold the largest revenue share in the neuromorphic hardware market, primarily because they serve as the core computation units designed specifically for neuromorphic tasks. These specialized chips emulate the neural structures of the human brain, enabling highly efficient and parallel data processing. The growing demand for energy-efficient AI processing in devices such as autonomous robots, edge computing systems, and smart sensors is driving the adoption of these neuromorphic processors. Their ability to deliver real-time learning and low-latency responses makes them central to the expanding applications of neuromorphic technology.

Sensors are crucial components that work alongside neuromorphic processors to capture real-time environmental data. These sensors feed sensory information, such as visual, auditory, or tactile inputs, directly into the neuromorphic system for immediate processing. Their integration enables applications like autonomous navigation, robotics, and smart monitoring systems to react quickly and adapt to changing surroundings. By mimicking biological sensory processing, these sensors enhance the overall efficiency and functionality of neuromorphic hardware solutions in dynamic, real-world environments.

North America dominated the neuromorphic hardware market in 2024, accounting for approximately 40% of the total revenue.

This leadership is driven by strong R&D investments, early adoption of advanced technologies, and the presence of leading semiconductor companies in the U.S. and Canada. The region benefits from close collaboration between academia, government, and industry, accelerating product development and commercialization. These factors have positioned North America as a hub for AI, robotics, and autonomous systems leveraging neuromorphic computing, driving sustained market growth.

Asia Pacific is the fastest-growing region in the neuromorphic hardware market, projected to grow at a CAGR of approximately 15.2% between 2025 and 2035.

Growth is supported by expanding AI research, industrial automation, and strong government initiatives in countries like China, Japan, and South Korea. Increasing investments in smart manufacturing, autonomous vehicles, and IoT ecosystems fuel demand for energy-efficient neuromorphic processors. Rising tech infrastructure and a skilled workforce contribute to Asia Pacific’s rapid market expansion.

Europe holds a significant market share of around 25% in 2024

driven by strategic investments in AI hardware research and automotive innovation, particularly in Germany and France. The region focuses on robotics and smart manufacturing applications, integrating neuromorphic hardware to enhance efficiency and safety. Supportive government policies and strong research collaborations between institutions and private companies are key to Europe’s steady growth in the neuromorphic market.

WORLDWIDE TOP KEY PLAYERS IN THE NEUROMORPHIC HARDWARE MARKET INCLUDE

- Intel Corporation

- IBM Corporation

- BrainChip Holdings Ltd.

- Qualcomm Technologies, Inc.

- SynSense AG

- General Vision, Inc.

- Knowm Inc.

- Innatera Nanosystems GmbH

- Applied Brain Research (ABR)

- Neurala, Inc.

- Others

Product Launches in Neuromorphic Hardware Market

- In February 2025, Intel unveiled its next-generation Loihi neuromorphic chip, which features significantly improved learning capabilities and enhanced power efficiency. This new chip is specifically designed to meet the demands of AI edge applications, where low power consumption and real-time processing are critical. By advancing the performance of neuromorphic processors, Intel aims to accelerate the adoption of brain-inspired computing in fields like autonomous vehicles, robotics, and smart devices. This launch underscores Intel’s commitment to leading innovation in energy-efficient AI hardware.

- In December 2024, BrainChip introduced an advanced neuromorphic software development kit (SDK) aimed at simplifying the programming of its hardware platforms. This SDK helps developers deploy AI algorithms more efficiently on neuromorphic chips, overcoming some of the traditional challenges related to programming complexity. By providing better tools and resources, BrainChip is enabling faster development cycles and broader adoption of neuromorphic computing technology across various industries, from robotics to IoT and beyond.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the neuromorphic hardware market based on the below-mentioned segments:

Global Neuromorphic Hardware Market, By Hardware Type

- Digital CMOS Neuromorphic

- Analog / Mixed-signal Neuromorphic

- Memristive / Resistive

- Photonic Neuromorphic

- Spintronic / MTJ-based

Global Neuromorphic Hardware Market, By Component

- Processors / Chips

- Sensors

- Memory

- SDKs & Dev Tools

- Reference Designs & Evaluation Kits

Global Neuromorphic Hardware Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q1: What is neuromorphic hardware?

A: Neuromorphic hardware refers to computing devices designed to mimic the neural architecture of the human brain, enabling efficient, parallel, and low-power processing ideal for AI, robotics, and IoT applications.

Q2: What is the expected market size for the neuromorphic hardware market by 2035?

A: The global neuromorphic hardware market is projected to reach USD 26.2 billion by 2035.

Q3: Which hardware type dominates the neuromorphic hardware market?

A: Digital CMOS neuromorphic hardware dominates the market due to its maturity and wide adoption in research and commercial products.

Q4: What are the key drivers for growth in the neuromorphic hardware market?

A: Key drivers include rising demand for energy-efficient AI and robotics computing, advancements in chip design, and increasing investments by tech giants and governments.

Q5: What are the main challenges facing the neuromorphic hardware market?

A: Challenges include high development costs, manufacturing complexities, lack of standardization, and programming complexity.

Q6: Which region is the largest market for neuromorphic hardware?

A: North America is the largest market in 2024, driven by strong R&D investments and early technology adoption.

Q7: Which region is the fastest-growing market?

A: Asia Pacific is the fastest-growing region with a projected CAGR of approximately 15.2% from 2025 to 2035.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |