Global Neurovascular Coiling Assist Devices Market

Global Neurovascular Coiling Assist Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Coil Assist Stents and Coil Assist Balloons), By Application (Aneurysms, Arteriovascular Malformations (AVMs), and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Neurovascular Coiling Assist Devices Market Size Insights Forecasts to 2035

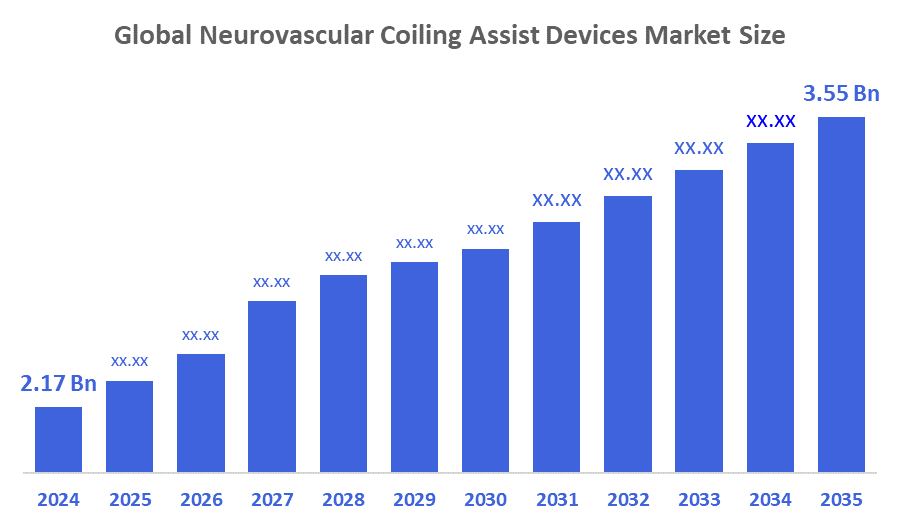

- The Global Neurovascular Coiling Assist Devices Market Size Was Estimated at USD 2.17 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.58% from 2025 to 2035

- The Worldwide Neurovascular Coiling Assist Devices Market Size is Expected to Reach USD 3.55 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Neurovascular Coiling Assist Devices Market Size Was Worth Around USD 2.17 Billion In 2024 And Is Predicted To Grow To Around USD 3.55 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 4.58% From 2025 To 2035. The growing prevalence of neurovascular conditions like intracranial aneurysms and arteriovenous malformations, the growing desire for minimally invasive endovascular procedures, and ongoing technological developments in coil-assist stents and balloons that improve procedural success and safety are all major factors driving market growth.

Market Overview

The Neurovascular Coiling Assist Devices Market Size includes production and distribution assistant devices, which are becoming essential ingredients of minimally invasive treatments for neurovascular disorders due to their superior procedural precision, safety, and potential to improve patient outcomes. The ease of minimally invasive procedures, combined with the higher precision of devices and safety improvements, are the reasons why coil assist devices are being adopted in hospitals and ambulatory surgical centres. There is a rapid upsurge in the demand for coiling assist devices that are integrated with advanced imaging and robotic capabilities in hospitals as well as specialised surgical centres because providers are now prioritising not only the safety of the procedures but also the clinical outcomes. The increasing demand for neurovascular coiling assist devices is mainly driven by the rising number of cases of intracranial aneurysms and arteriovenous malformations (AVMs), the trend of choosing minimally invasive procedures over open surgeries, and incessant innovations that lead to better device performance and higher procedural efficiency. Moreover, the development of healthcare facilities and the consequent rise in the number of neurointerventional programs in emerging regions is fostering the growth in the usage of coil assist balloons and stents.

Boston Scientific is re-entering the neurovascular market through a planned $14.5 billion acquisition of Penumbra, Inc., announced in January 2026. This deal gives Boston Scientific immediate scale in mechanical thrombectomy and stroke treatment devices, marking its return to a segment it exited more than a decade ago.

Report Coverage

This research report categorises the Neurovascular Coiling Assist Devices Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the neurovascular coiling assist devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the neurovascular coiling assist devices market.

Driving Factors

A major and accelerating trend in the Global Neurovascular Coiling Assist Devices Market Size is the integration of image-guided navigation and robotic-assisted systems, which together are making the procedures more precise, reducing the time of operations and improving the patient outcomes. Moreover, high-resolution imaging and guided technologies offer the visualisation of vascular structures in real-time, which means that coils and assist devices can be navigated more accurately, resulting in fewer procedures, related complications and better long-term outcomes. Besides, the use of robotics and imaging systems in conjunction with coil assist devices allows minimally invasive interventions, thus clinicians are able to carry out complex aneurysm treatments with less radiation exposure and higher procedural efficiency. The growing incidence of intracranial aneurysms and arteriovenous malformations, together with the strengthening trend of minimally invasive procedures, are the main reasons for the rising demand for neurovascular coiling assist devices.

Restraining Factors

Despite the high market growth, they could face several challenges, such as the high cost of coil-assist devices relative to traditional surgical treatments. Launches are further delayed by regulatory licensing procedures and strict validation protocols, and adoption is still hampered by upfront investment despite price stabilisation. Adoption in less specialised hospitals is further slowed by the scarcity of qualified neurointerventional specialists and concerns such as device migration or vascular puncture that limit penetration in developing regions.

Market Segmentation

The neurovascular coiling assist devices market share is classified into product type and application.

- The coil assist stents segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the product type, the neurovascular coiling assist devices market is segmented into coil assist stents and coil assist balloons. Among these, the coil assist stents segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. The segment growth is driven by its extensive use in the treatment of complex intracranial aneurysms and the high success rates of the procedures. Medical staff usually choose coil-assist stents because they can stabilise coils in wide-necked aneurysms, thus lowering the risk of coil migration, failure, or restenosis. Moreover, the segment has the advantage of robust clinical research backing better patient outcomes and fewer relapses.

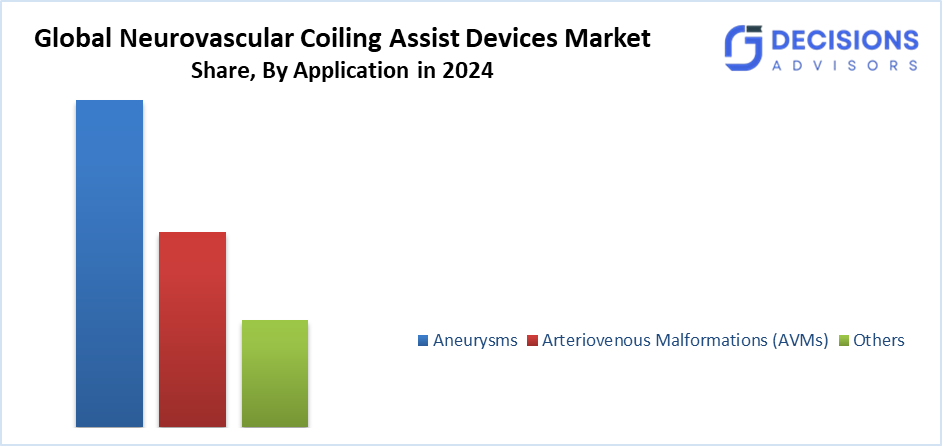

- The aneurysms segment accounted for the highest market share in 2024 and is anticipated to grow at a notable CAGR over the forecast period.

Based on the application, the neurovascular coiling assist devices market is divided into aneurysms, arteriovascular malformations (AVMS), and others. Among these, the aneurysms segment accounted for the highest market share in 2024 and is anticipated to grow at a notable CAGR over the forecast period. The segment growth is influenced by its extensive use in the treatment of complex intracranial aneurysms and the high success rates of the procedures. Medical staff usually choose coil-assist stents because they can stabilise coils in wide, necked aneurysms, lowering the risk of coil migration, failure, or restenosis. Medical institutions and specialised neurointerventional centres are progressively dependent on stent-assisted coiling as the norm for difficult aneurysm anatomies.

Regional Segment Analysis of the Neurovascular Coiling Assist Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the neurovascular coiling assist devices market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the neurovascular coiling assist devices market over the predicted timeframe. The primary drivers of this growth are the rising incidence of aneurysms and AVMs, the booming medical infrastructure, and the increasing availability of minimally invasive neurointerventional procedures in China, Japan, India, and other countries in the region. Adoption of the devices is being propelled by a shifting focus of the region towards endovascular treatment programs, which is supported by government healthcare initiatives. Benefits from technological innovations, making the products more affordable and training programs for neurointerventional specialists are also factors contributing to the growth of the market. Besides, the rise of private healthcare networks and the increasing awareness among patients are also major contributors to the market.

Europe is expected to grow at a rapid CAGR in the neurovascular coiling assist devices market during the forecast period. The major factors driving the market are growing awareness of minimally invasive neurointerventional procedures and the rising incidence of intracranial aneurysms. A robust healthcare infrastructure and greater investments in neurovascular programs are facilitating device adoption. The region is also witnessing an increased uptake of these devices in multi-hospital networks and private healthcare facilities. Market growth is further supported by technological advancements in imaging and continuous professional development initiatives. In addition, the European regulatory environment is favourable for endovascular interventions, which further motivates the use of neurovascular coiling assist devices.

Germany's neurovascular coiling assist devices market was one of the most prominent markets worldwide. Leading players operating in the market are Stryker, MicroVention, Medtronic, Cerenovus, and Balt. The demand is predominantly driven by an increasing number of intracranial aneurysm cases and the implementation of innovative coiling technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the neurovascular coiling assist devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- Acandis GmbH & Co. KG

- Balt Extrusion S.A.S.

- Boston Scientific Corporation

- Kaneka Corporation

- Lepu Medical Technology

- Medtronic

- MicroPort Scientific Corporation

- NeuroVasc Technologies Inc.

- Penumbra, Inc.

- Phenox GmbH

- Stryker

- Terumo Neuro

- Wallaby Medical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Kaneka Corporation launched its new i?ED COIL™ for brain aneurysm treatment in Europe after securing EU Medical Device Regulation (MDR) certification in July 2025. The device began commercial distribution through Kaneka Medical Europe N.V., marking a major expansion of the company’s neurovascular portfolio.

- In October 2025, Penumbra launched the SwiftSet™ Coil in a next-generation neurovascular embolisation device designed for adaptive vessel wall apposition, smooth deployment, and dense occlusion in small or tortuous vessels. It expands the company’s Swift™ Coil System, offering physicians enhanced control in treating intracranial aneurysms, arteriovenous malformations (AVMs), and fistulae.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the neurovascular coiling assist devices market based on the below-mentioned segments:

Global Neurovascular Coiling Assist Devices Market, By Product Type

- Coil Assist Stents

- Coil Assist Balloons

Global Neurovascular Coiling Assist Devices Market, By Application

- Aneurysms

- Arteriovascular Malformations (AVMs)

- Others

Global Neurovascular Coiling Assist Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current size of the global neurovascular coiling assist devices market?

The market was valued at USD 2.17 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 3.55 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 4.58% from 2025 to 2035.

- Which product type holds the largest share?

Coil-assist stents accounted for the largest share in 2024, driven by their use in complex aneurysms.

- Which application segment dominates the market?

The aneurysms segment held the highest share in 2024 and is expected to grow notably.

- Which region is expected to grow the fastest?

Europe is anticipated to grow at the fastest CAGR, supported by advanced healthcare and rising aneurysm cases.

- What region holds the largest market share?

Asia-Pacific is expected to hold the largest share, fueled by expanding medical infrastructure in China, Japan, and India.

- What are the main growth drivers?

Rising neurovascular conditions like aneurysms and AVMs, plus advancements in minimally invasive procedures and imaging tech.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |