Global Neurovascular Embolisation Devices Market

Global Neurovascular Embolization Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Embolic Coils, Flow Diversion Devices, Liquid Embolic Agents, and Aneurysm Clips), By End-use (Hospitals, Specialty Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Neurovascular Embolisation Devices Market Insights Forecasts to 2035

- The Global Neurovascular Embolisation Devices Market Size Was Estimated at USD 1.19 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.42% from 2025 to 2035

- The Worldwide Neurovascular Embolisation Devices Market Size is Expected to Reach USD 2.36 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Neurovascular Embolisation Devices Market Size Was Worth Around Usd 1.19 Billion In 2024 And Is Predicted To Grow To Around Usd 2.36 Billion By 2035 With A Compound Annual Growth Rate (Cagr) Of 6.42% From 2025 To 2035. The rising prevalence of neurovascular diseases, technological developments in the devices, better diagnostic methods, and increased patient and healthcare professional awareness of the early detection and treatment of neurovascular diseases are the main factors driving market growth.

Market Overview

Neurovascular embolisation devices such as coils, flow diverters, liquid embolic agents, and stents have become essential tools in the modern treatment of cerebrovascular diseases. This is mainly because these devices allow for minimally invasive procedures, they are very accurate in the treatment of intracranial aneurysms and arteriovenous malformations (AVMs), and they are capable of lowering complications compared to traditional open surgeries in Neurovascular embolization. The main factors driving the demand for neurovascular embolisation devices include the continuously increasing number of patients with cerebrovascular disorders, the rising trend of using minimally invasive techniques, and the higher level of knowledge about the availability of sophisticated interventional treatments among healthcare professionals and patients that goes beyond them. Industry players are putting more and more emphasis on creating cutting-edge embolisation solutions such as high-precision coils, liquid embolics, intrasaccular devices, and next-generation flow diverters designed to improve navigability, increase occlusion efficiency, and facilitate complex aneurysm and AVM interventions. Manufacturers are stepping up their R&D efforts towards microcatheter innovation, improved visibility materials, and device systems combined with real-time imaging guidance to facilitate procedural accuracy and safety.

The World Health Organisation (WHO) warns that neurological disorders cause over 11 million deaths annually worldwide, with more than 3 billion people, about 40% of the global population, living with neurological conditions. The report highlights a severe shortage of neurologists, especially in low-income countries, and calls for urgent global action to prioritise brain health.

Boston Scientific announced a definitive agreement to acquire Penumbra, Inc. in a cash-and-stock deal valued at approximately USD 14.5 billion, pricing Penumbra shares at USD 374 each. The acquisition significantly expanded Boston Scientific’s cardiovascular and neurovascular portfolio, particularly in mechanical thrombectomy and stroke treatment.

Report Coverage

This research report categorises the neurovascular embolisation devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the neurovascular embolisation devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the neurovascular embolisation devices market.

Driving Factors

The neurovascular embolisation devices market is booming as a result of the upsurge in neurovascular disorders such as brain aneurysms, arteriovenous malformations, and stroke. It is estimated that neurological disorders impact 15% of the world's population, thus necessitating the availability of effective treatment options. Besides that, the market is receiving additional support from key players who are collaborating in various forms to develop embolisation technologies and, thus, management of vascular conditions with the help of new techniques. Alongside, significant advances in diagnostic imaging, including MRI and CT angiography, have made it possible to detect diseases quickly, accurately, and thus, the treatment becomes more individualised and timely. Besides that, awareness, education, and training initiatives by healthcare organisations are widely disseminated, meeting the objectives of earlier diagnosis and providing referrals, which in turn, become one of the factors impacting the market positively.

Restraining Factors

The neurovascular embolisation devices market is confronted with several compromising factors, including high procedural cost, inadequate reimbursement, and the requirement of specialised skills, which together impede the spread of the technology. Moreover, regulatory barriers, device complications (e.g., migration, recanalisation) and restricted continuance of advanced neurointerventional facilities in low- and middle-income regions also hamper the market growth.

Market Segmentation

The neurovascular embolisation devices market share is classified into product, and end use.

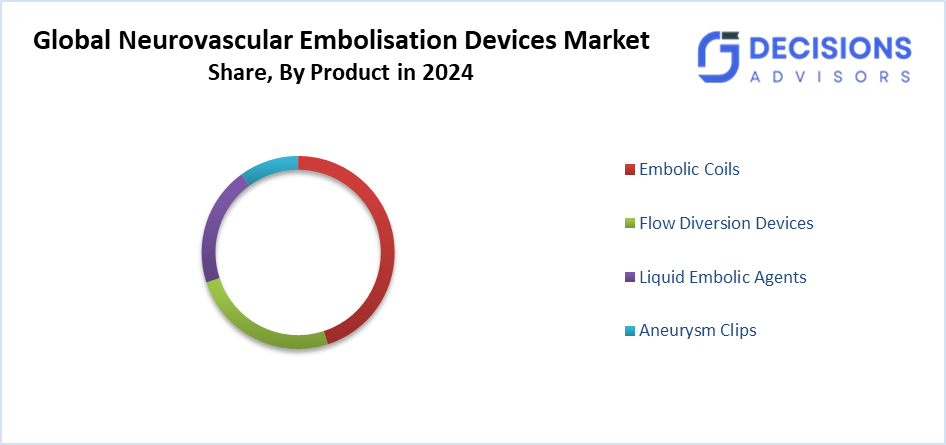

- The embolic coils segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the product, the neurovascular embolisation devices market is divided into embolic coils, flow diversion devices, liquid embolic agents, and aneurysm clips. Among these, the embolic coils segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. Embolisation coils are among the oldest embolisation devices now in use, and interventional radiologists are more adept at utilising them than other embolisation devices. Their rapid uptake and growing demand make them indispensable for a range of embolisation treatments. The market is expanding due to developments in neurological illness treatment items created by major industry players.

- The hospitals segment accounted for the highest market revenue in 2024 and is expected to grow at a remarkable CAGR over the forecast period.

Based on the end use, the neurovascular embolisation devices market is differentiated into hospitals, speciality clinics, and others. Among these, the hospitals segment accounted for the highest market revenue in 2024 and is expected to grow at a remarkable CAGR over the forecast period. The diagnosis and treatment of neurological disorders are among the many medical services provided by these hospitals. Embolisation devices are used by hospitalised neurosurgeons and neurointerventional radiologists to perform minimally invasive aneurysm treatments. Hospitals use highly skilled and specialised medical personnel, such as vascular surgeons, neurosurgeons, and neurointerventional radiologists, who are trained to use neurovascular embolisation devices safely and effectively.

Regional Segment Analysis of the Neurovascular Embolisation Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the neurovascular embolisation devices market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the neurovascular embolisation devices market over the predicted timeframe. The regional market is driven by increased health care investment, quick infrastructure renovations, and the region's growing emphasis on minimally invasive neurovascular interventions. China, Japan, India, and South Korea, among others, are boosting their neurosurgical capabilities via new stroke centres, more hybrid operating rooms, and national stroke care programs. Besides that, the rising number of brain aneurysms and strokes should be the major reasons behind the supply of advanced embolisation devices such as coils, liquid embolics, and flow diverters to hospitals. On the other hand, medical tourism hubs such as India, Thailand, and Malaysia are also stimulating demand by providing cheap neurointerventional procedures.

India’s government announced financial support for the country’s first indigenous thrombectomy device, marking a major step in stroke care innovation. The facility will create and produce sophisticated mechanical thrombectomy kits, a potentially life-saving treatment for individuals with acute ischemic stroke as a result of major vascular blockage.

North America is expected to grow at a rapid CAGR in the neurovascular embolisation devices market during the forecast period. This is due to its well-established healthcare infrastructure, widespread access to advanced neurointerventional technologies, and a high concentration of specialised neurosurgeons and neurointerventional radiologists. The U.S. is the dominant market. Moreover, the clinical use is also strong in the region, for flow diverters, detachable coils, and next-generation liquid embolics, which are backed by early regulatory approvals and fast acceptance of new devices in hospital systems. The increase in the occurrence of intracranial aneurysms, AVMs, ischemic stroke, and other cerebrovascular diseases, which is also partly due to an ageing population, is the main reason for the continued rise in the number of minimally invasive neurovascular procedures performed per year. In addition, the presence of top manufacturers, vigorous R&D, and constant product launches are factors that add to the market competitiveness.

The Canadian government announced major funding for neuroscience research through the Canada Brain Research Fund, with allocations reaching up to USD 200 million in partnership with Brain Canada. This investment is designed to strengthen infrastructure for brain and neurovascular research, supporting innovations such as embolisation and aneurysm treatment devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the neurovascular embolisation devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- Acandis GmbH

- B. Braun SE

- Balt

- Cerenovus

- Integra LifeSciences Corporation

- Johnson & Johnson

- Medtronic

- MicroVention Inc

- Penumbra Inc.

- phenox GmbH

- Resonetics

- Stryker Corporation

- Terumo Neuro

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Kaneka Medical America officially launched Enlight Medical’s WaveSelect 1014 Neurovascular Guidewire in the United States through an exclusive distribution agreement, strengthening its portfolio in neurovascular interventions. The device features a proprietary polymer?metal matrix technology designed for improved microcatheter deliverability, torque transmission, and versatility across complex neurovascular procedures.

- In December 2025, Johnson and Johnson (through its neurovascular division, Cerenovus) received FDA approval for the TRUFILL n?BCA Liquid Embolic System to treat symptomatic chronic subdural hematoma (cSDH). In addition to surgery, a system for embolizing the middle meningeal artery (MMA) is used to treat symptomatic subacute and chronic subdural hematomas (cSDH).

- In October 2025, Penumbra launched the SwiftSET Neuro Embolisation Coil, a next-generation complex coil engineered for precise anchoring and secure vessel occlusion in neurovascular procedures. The device expands the company’s Swift Coil System, offering physicians enhanced control and adaptability in treating aneurysms, AVMs, and other neurovascular abnormalities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the neurovascular embolisation devices market based on the below mentioned segments:

Global Neurovascular Embolisation Devices Market, By Product

- Embolic Coils

- Flow Diversion Devices

- Liquid Embolic Agents

- Aneurysm Clips

Global Neurovascular Embolisation Devices Market, By End Use

- Hospitals

- Speciality Clinics

- Others

Global Neurovascular Embolisation Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

1. What is the current size of the global neurovascular embolisation devices market?

The market was valued at USD 1.19 billion in 2024.

2. What is the projected market size by 2035?

It is expected to reach USD 2.36 billion by 2035.

3. What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 6.42% from 2025 to 2035.

4. Which product segment holds the largest market share?

Embolic coils accounted for the largest share in 2024 and are expected to grow substantially.

5. Which end-use segment generated the highest revenue in 2024?

Hospitals led with the highest revenue and are set for remarkable growth.

6. Which region is expected to grow the fastest?

North America is anticipated to grow at the fastest CAGR during the forecast period.

7. What are the main drivers of market growth?

Rising neurovascular diseases, minimally invasive techniques, better diagnostics, and awareness fuel expansion.

8. Which region holds the largest market share?

Asia Pacific is expected to hold the largest share over the forecast period.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |