North America Beauty Market

North America Beauty Market Size, Share, and COVID-19 Impact Analysis, By Product Category (Makeup, Skincare, Haircare, Fragrance, and Personal Grooming), By Age Group (Gen Z, Millennials, Gen X, and Boomers), By Gender (Women and Men), By Distribution Channel (Grocery Stores/Mass Market, Specialty Stores, and Online Stores), and North America Beauty Market Insights, Industry Trend, Forecasts to 2035

Report Overview

Table of Contents

North America Beauty Market Size Insights Forecasts to 2035

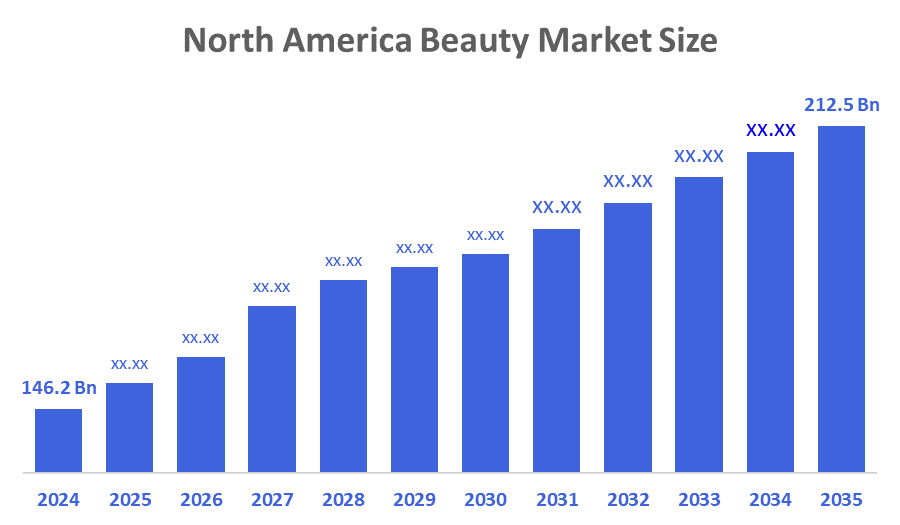

- The North America Beauty Market Size was estimated at USD 146.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.46% from 2025 to 2035

- The North America Beauty Market Size is Expected to Reach USD 212.5 Billion by 2035

According to a Research Report Published by Decisions Advisors & Consulting, The North America Beauty Market Size is anticipated to Reach USD 212.5 Billion by 2035, growing at a CAGR of 3.46% from 2025 to 2035. An increasing skin & hair-related issues, awareness about oral & dental hygiene, the influence of social media, awareness about vegan & cruelty-free beauty standards, and emphasis on anti-ageing products are several factors that are driving the beauty market in the North America region.

Market Overview

The North America beauty market refers to the industry encompassing the development, manufacturing, and selling of consumer goods like skincare, makeup, haircare, and fragrances. Consumers' growing awareness about their appearance is anticipated to drive the demand for beauty products, and increasing investment in self-care, mainly including haircuts, makeup, and skincare, by both men and women. For instance, it was estimated that women in the US spend an average of just over $10 per day on beauty, while American men spend an average of $2,928 per year. Social media platforms are influencing the consumer interest towards beauty, cosmetics, and personal care, which is considered beneficial for brands, with the growth of the digital advertising channel over television. It was estimated that the annual growth in beauty ad-spend was 1 to 2 per cent per year in North American regions like Canada and the US. The expanding e-commerce platform, which is driving beauty sales and changing inclination towards online shopping with consumer changing behaviour, especially among younger generations, is bolstering the market opportunities.

Report Coverage

This research report categorizes the market for the North America beauty market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America beauty market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America beauty market.

Driving Factors

The market for North America beauty is primarily driven by the increasing consumer hair health awareness, along with the influence of social media and e-commerce accessibility. The changing inclination towards innovative oral hygiene products and the use of sustainable fluoride-free products are contributing to promoting market growth. An increasing concern regarding animal welfare and prioritisation towards cruelty-free products is enhancing the popularity of vegan cosmetics, thereby supporting the market growth.

Restraining Factors

The availabiity of counterfeit products and supply chain disruptions is restraining market growth. Further, the price sensitivity of premium products is challenging the beauty market.

Market Segmentation

The North America beauty market share is classified into product category, age group, gender, and distribution channel.

- The personal grooming segment dominated the market with a major share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America beauty market is segmented by product category into makeup, skincare, haircare, fragrance, and personal grooming. Among these, the personal grooming segment dominated the market with a major share in 2024 and is expected to grow at a significant CAGR during the forecast period. Personal care products include shampoos, soaps, deodorants, and toothpaste, for hygiene and grooming purposes. Consumers' increasing preference towards daily wellness routines is contributing to driving the market demand in the personal care segment.

- The millennials segment held a significant revenue share in 2024 and is expected to grow at the fastest CAGR during the forecast period.

The North America beauty market is segmented by age group into gen Z, millennials, gen X, and boomers. Among these, the millennials segment held a significant revenue share in 2024 and is expected to grow at the fastest CAGR during the forecast period. Millennials are those between the age group of 18 to 34 years old, and as per a survey, they have an increasing preference for beauty products with natural or organic ingredients. The growing purchasing power and the influence of social media platforms among millennials are contributing factors that are driving the market.

- The women segment dominated the market with a major share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America beauty market is segmented by gender into women and men. Among these, the women segment dominated the market with a major share in 2024 and is expected to grow at a significant CAGR during the forecast period. Women are the primary consumers of beauty products, with an estimated 70-80% global spending worldwide. The convergence of aesthetic aspirations and emphasis on holistic self-care is propelling the beauty market.

- The specialty stores segment dominated the beauty market with a significant revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America beauty market is segmented by distribution channel into grocery stores/mass market, specialty stores, and online stores. Among these, the specialty stores segment dominated the beauty market with a significant revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Speciality stores aid in selecting the right cosmetics for their needs and provide adequate knowledge about beauty ingredients. Further, the store carries a collection of brands, styles, or models within a relatively narrow category of products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America beauty market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L'Oréal Group

- The Estée Lauder Companies Inc

- Procter & Gamble

- Coty Inc

- Shiseido Company

- LVMH

- Kendo Brands (LVMH)

- Unilever

- Others

Recent Developments:

- In April 2025, Aveda unveiled its latest innovation in professional haircare. This revolutionary launch features TRIS colourIntegrity Technology, a patent-pending breakthrough that optimizes colour deposition while preserving hair health.

- In January 2025, Credo Beauty is entering the competitive body care market with its first own-brand range powered by fermentation. The beauty retailer has launched its first three-piece, kelp-powered Credo Body Care range due to consumer demand for ‘cleaner’ hydration-focused products.

- In November 2024, CeraVe announced the launch of Anti-dandruff and Gentle Hydrating Products, leading its planned expansion into haircare. The new product line is designed to bridge a crucial gap in the market for effective dandruff treatment while promoting overall scalp health.

- In October 2024, Estee Lauder, the flagship brand of The Estee Lauder Companies Inc., announced its official launch in the U.S. Amazon Premium Beauty store, bringing its high-performance skincare, makeup and legendary fragrances to Amazon shoppers across the country.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the North America Beauty Market based on the below-mentioned segments:

North America Beauty Market, By Product Category

- Makeup

- Skincare

- Haircare

- Fragrance

- Personal Grooming

North America Beauty Market, By Age Group

- Gen Z

- Millennials

- Gen X

- Boomers

North America Beauty Market, By Gender

- Women

- Men

North America Beauty Market, By Distribution Channel

- Grocery Stores/Mass Market

- Specialty Stores

- Online Stores

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Regional |

| Pages | 175 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |