Global Novel Treatment in Cancer Market

Global Novel Treatment in Cancer Market Size, Share, and COVID-19 Impact Analysis, By Therapy Type (Targeted Therapy, Immunotherapy, Checkpoint Inhibitors, Cancer Vaccines, Gene Cell Therapy, and Antibody-Drug Conjugates (ADCs)), By Modality (Monotherapy, and Combination Therapy), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Novel Treatment in Cancer Market Insights Forecasts to 2035

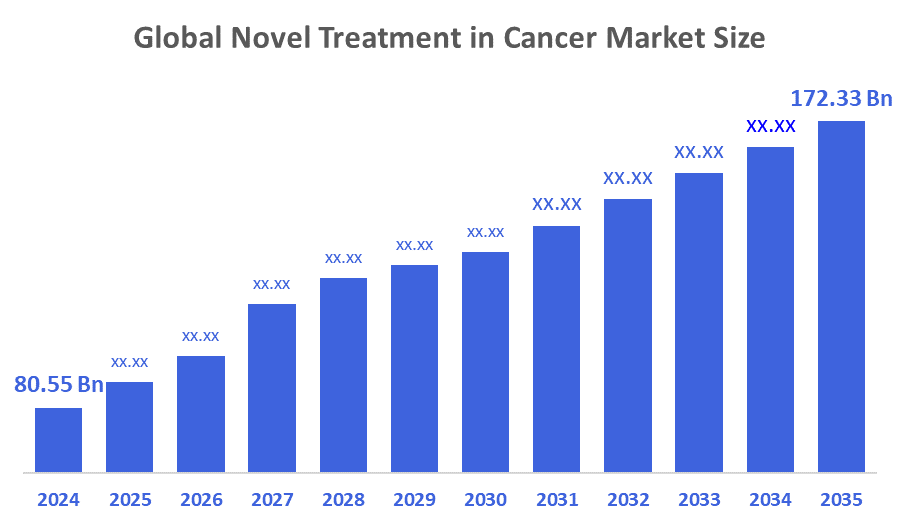

- The Global Novel Treatment in Cancer Market Size Was Estimated at USD 80.55 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.16% from 2025 to 2035

- The Worldwide Novel Treatment in Cancer Market Size is Expected to Reach USD 172.33 billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Novel Treatment in Cancer Market Size was worth around USD 80.55 Billion in 2024 and is predicted to grow to around USD 172.33 Billion by 2035 with a compound annual growth rate (CAGR) of 7.16% from 2025 to 2035. Next-generation cancer treatment market expansion is primarily linked to innovations in immunotherapy, cancer incidence worldwide, and generous government financial support. Market growth in the foreseeable future is forecasted by the augmented need for personalised therapies and progress in mRNA technology.

Market Overview

The novel treatment in cancer market refers to the global industry segment focused on the development, commercialisation, and adoption of innovative cancer therapies beyond traditional options like surgery, chemotherapy, and radiation. It includes immunotherapies, targeted therapies, cell-based therapies, gene therapies, and radiopharmaceuticals, all designed to improve survival outcomes, reduce side effects, and personalise treatment for diverse cancer types. Cancer is a serious and often life-threatening disease that demands a variety of treatments to eliminate cancer cells. The treatment of cancer has been developed by the use of several therapies, such as surgery, chemotherapy, and radiation therapy, due to the advantages emanating from them in terms of providing both curative and palliative effects in cancer treatment. Besides that, the escalating need for a variety of cancer therapies can be explained by the rise in cancer cases that may require different kinds of treatments. Artificial intelligence (AI) is transforming the entire ecosystem for next-generation cancer therapeutics. It is doing this by rapidly conducting drug discovery, translational research, and patient stratification for clinical trials. AI can analyse a large number of genomic and proteomic datasets to identify new drug targets. In drug discovery, AI algorithms forecast the effectiveness and safety of drug candidates, thus lessening the occurrence of side effects. In clinical trials, AI models make predictions on how patients will respond to a particular drug, which in turn leads to the implementation of more personalised treatment regimens.

In December 2025, Johnson & Johnson (J&J) completed its $3.05 billion acquisition of Halda Therapeutics, gaining access to its proprietary RIPTAC™ (Regulated Induced Proximity Targeting Chimaera) platform. This acquisition strengthens J&J’s oncology pipeline with next-generation oral therapies, including the lead candidate HLD-0915 for prostate cancer.

In November 2025, Iambic Therapeutics raised over $100 million in an oversubscribed financing round to advance clinical trials of its AI-discovered cancer drugs, including its lead HER2-targeted candidate IAM1363 for breast cancer.

Report Coverage

This research report categorises the novel treatment in cancer market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the novel treatment in cancer market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the novel treatment in cancer market.

Driving Factors

Advances in drug delivery technologies, such as the creation of nanoparticles and targeted therapies, are playing a major role in making cancer treatments more effective. Further, the support from the public and private sectors is funding research and investing in it, which leads to increased research and development activities focused on innovative cancer treatments. The growth of the market is also supported by awareness and acceptance of alternative therapies. The knowledge of healthcare professionals and patients about the advantages of novel drug delivery systems leads to a change towards personalised medicine in which therapies are adapted to the needs of each patient. The demand for advanced drug delivery solutions is also supported by appropriate reimbursement policies in developed countries that provide incentives to healthcare providers for the adoption of novel drug delivery systems. The ever-changing nature of the market, affected by regulatory approvals and technological advancements, still determines its expansion pace.

In a deal worth $11 billion, Bristol Myers Squibb joined forces with BioNTech to develop PD-1, 1/L1xVEGF, A bispecific antibody in immuno-oncology. Sanofi was among the investors when Immuneering Corporation raised a total of $225 million for the development of atebimetinib in pancreatic cancer, a drug that led to 86% survival at 9 months.

Restraining Factors

Despite high-growth market concerns with its high development costs, complicated regulatory processes, and protracted approval processes that impede patient access, novel cancer medicines confront growth constraints. Adoption is hampered by limited price and reimbursement issues, particularly in areas with low and moderate incomes. Widespread market penetration is further hampered by issues with long-term safety, limited patient eligibility, and competition from well-established biologics.

Market Segmentation

The novel treatment in cancer market share is classified into therapy type and modality.

- The targeted therapy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the therapy type, the novel treatment in cancer market is segmented into targeted therapy, immunotherapy, checkpoint inhibitors, CAR-T cell therapy, cancer vaccines, gene cell therapy, and antibody-drug conjugates (ADCS). Among these, the targeted therapy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The most widely used next-generation cancer treatments are still small molecular inhibitors. They have the benefit of specifically targeting cancer-specific signalling pathways and proteins. Numerous malignancies, including colorectal, lung, and breast cancer, are treated using small-molecule inhibitors. They can handle acquired resistance, are easily incorporated into current therapy paradigms, are administered orally, and address the increasing trend of precision oncology.

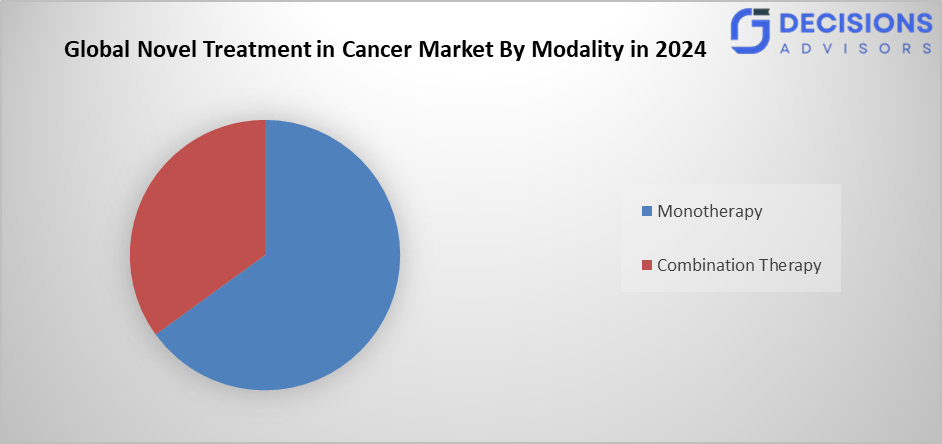

- The monotherapy segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the modality, the novel treatment in cancer market is divided into monotherapy, and combination therapy. Among these, the monotherapy segment dominated the market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because it works specifically, has fewer side effects, and is used in immune checkpoint inhibitor treatments as well as tailored therapy for diseases, including lung cancer and melanoma. Further, it is comparatively simple production procedures and the anticipated long-term clinical performance, monotherapy continues to dominate the market.

Regional Segment Analysis of the Novel Treatment in Cancer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the novel treatment in cancer market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the novel treatment in cancer market over the predicted timeframe. The need for cutting-edge treatments is fueled by the growing incidence of cancer. The governments of South Korea, China, India, and Japan are increasing domestic biotech R&D and streamlining approval processes. China has the fastest growth in the region thanks to investments in R&D and regulatory change. In addition to providing priority review, expedited approvals, and commercial planning, which shortens delays, the NMPA now takes into account global trial data.

NexCAR19 is now India's first locally produced CAR, T therapy for blood cancers, resulting from a collaboration between IIT Bombay and Tata Memorial.

In February 2025, the Press Information Bureau (PIB) Delhi published the initiative “Towards a Cancer-Free India: Commitment to Prevention, Treatment & Innovation”, highlighting the government’s focus on strengthening cancer care through prevention, early detection, advanced treatment, and innovation-driven research.

North America is expected to grow at a rapid CAGR in the novel treatment in cancer market during the forecast period. North America is the market leader because of its government support, research infrastructure, and innovation-friendly atmosphere. Novel medicines that boost the product pipeline in targeted and next-generation immune-mediated therapies have been approved by the U.S. FDA. Through funding, the National Cancer Institute supports oncology initiatives that encompass all stages of research. A market for next-generation treatments is created by concentrating clinical trials and collaborations in biotech centres located in Boston, California, and Texas.

In December 2025, the U.S. FDA approved six new cancer therapies, expanding treatment options for blood cancers, prostate cancer, lung cancer, and supportive care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the novel treatment in cancer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amgen Inc.

- AstraZeneca plc

- BeiGene, Ltd.

- BioNTech SE

- Bluebird Bio, Inc.

- Eli Lilly and Company

- Genentech, Inc.

- Gilead Sciences, Inc.

- Immatics Biotechnologies

- Innovent Biologics

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, the U.S. FDA approved sevabertinib, the first cancer drug based on Broad Institute science, developed in collaboration with Bayer. It is an oral therapy for a hard-to-treat form of lung cancer, marking a major milestone in translating academic genetic discoveries into patient treatments.

- In February 2025, Advancell announced a strategic collaboration with Eli Lilly to advance novel targeted alpha therapies (TATs) for cancer treatment. The partnership aims to combine Advancell’s expertise in radiopharmaceutical innovation with Lilly’s global oncology capabilities to accelerate the development of next-generation therapies.

- In August 2024, the U.S. FDA granted accelerated approval to afamitresgene autoleucel (Tecelra). It is the first engineered T-cell receptor (TCR) cell therapy for cancer, specifically for adults with advanced synovial sarcoma who have already undergone chemotherapy.

- In January 2024, Glenmark Pharmaceuticals and its subsidiary Ichnos Sciences announced the creation of the alliance “Ichnos Glenmark Innovation (IGI)”, a strategic collaboration aimed at accelerating breakthroughs in cancer treatment. The alliance combines Glenmark’s expertise in small molecules with Ichnos’ biologics platform to develop cutting-edge therapies for haematological malignancies and solid tumours.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the novel treatment in cancer market based on the below-mentioned segments:

Global Novel Treatment in Cancer Market, By Therapy Type

- Targeted Therapy

- Immunotherapy

- Checkpoint Inhibitors

- Cancer Vaccines

- Gene Cell Therapy

- Antibody-Drug Conjugates (ADCs)

Global Novel Treatment in Cancer Market, By Modality

- Monotherapy

- Combination Therapy

Global Novel Treatment in Cancer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the projected market size by 2035?

The market is expected to reach USD 172.33 billion by 2035, growing from USD 80.55 billion in 2024.

- What is the CAGR during the forecast period?

The market will grow at a CAGR of 7.16% from 2025 to 2035.

- Which therapy type holds the largest share in 2024?

Targeted therapy accounted for the largest share and is expected to grow at a significant CAGR.

- What are the main therapy types covered?

They include targeted therapy, immunotherapy, checkpoint inhibitors, cancer vaccines, gene cell therapy, and antibody-drug conjugates (ADCs).

- Which modality dominated the market in 2024?

Monotherapy held the dominant share due to its specificity, fewer side effects, and ease of use.

- Which region is expected to grow the fastest?

North America is projected to grow at the fastest CAGR, driven by strong research infrastructure and FDA approvals.

- Which region will hold the largest market share?

Asia-Pacific is anticipated to hold the largest share, fueled by rising cancer cases and government R&D investments in countries like China and India.

- What are the key growth drivers?

Innovations in immunotherapy, rising global cancer incidence, government funding, and advances in personalised therapies like mRNA technology.

- Who are some major companies in this market?

Key players include Amgen Inc., AstraZeneca plc, Merck & Co., Inc., Novartis AG, Pfizer Inc., and BioNTech SE.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Therapy Type

- Market Attractiveness Analysis By Modality

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Innovations in immunotherapy, cancer incidence worldwide, and government financial support

- Restraints

- High development costs, complicated regulatory processes, and approval processes

- Opportunities

- Need for personalised therapies and progress in mRNA technology

- Challenges

- Long-term safety, limited patient eligibility, and competition

- Global Novel Treatment in Cancer Market Analysis and Projection, By Therapy Type

- Segment Overview

- Targeted Therapy

- Immunotherapy

- Checkpoint Inhibitors

- Cancer Vaccines

- Gene Cell Therapy

- Antibody-Drug Conjugates (ADCs)

- Global Novel Treatment in Cancer Market Analysis and Projection, By Modality

- Segment Overview

- Monotherapy

- Combination Therapy

- Global Novel Treatment in Cancer Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Novel Treatment in Cancer Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Novel Treatment in Cancer Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Coverage Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Amgen Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- AstraZeneca plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BeiGene, Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BioNTech SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- BioNTech SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Bluebird Bio, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Eli Lilly and Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Genentech, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Gilead Sciences, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Immatics Biotechnologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Innovent Biologics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Merck & Co., Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Novartis AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Pfizer Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Others

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Coverage Portfolio

- Recent Developments

- SWOT Analysis

- Amgen Inc.

List of Table

- Global Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Global Targeted Therapy, Novel Treatment in Cancer Market, By Region, 2024-2035(USD Billion)

- Global Immunotherapy, Novel Treatment in Cancer Market, By Region, 2024-2035(USD Billion)

- Global Checkpoint Inhibitors, Novel Treatment in Cancer Market, By Region, 2024-2035(USD Billion)

- Global Cancer Vaccines, Novel Treatment in Cancer Market, By Region, 2024-2035(USD Billion)

- Global Gene Cell Therapy, Novel Treatment in Cancer Market, By Region, 2024-2035(USD Billion)

- Global Antibody-Drug Conjugates (ADCs), Novel Treatment in Cancer Market, By Region, 2024-2035(USD Billion)

- Global Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Global Monotherapy, Novel Treatment in Cancer Market, By Region, 2024-2035(USD Billion)

- Global Combination Therapy, Novel Treatment in Cancer Market, By Region, 2024-2035(USD Billion)

- North America Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- North America Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- U.S. Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- U.S. Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Canada Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Canada Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Mexico Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Mexico Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Europe Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Europe Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Germany Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Germany Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- France Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- France Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- U.K. Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- U.K. Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Italy Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Italy Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Spain Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Spain Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Asia Pacific Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Asia Pacific Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Japan Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Japan Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- China Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- China Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- India Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- India Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- South America Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- South America Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- Brazil Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- Brazil Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- The Middle East and Africa Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- The Middle East and Africa Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- UAE Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- UAE Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

- South Africa Novel Treatment in Cancer Market, By Therapy Type, 2024-2035(USD Billion)

- South Africa Novel Treatment in Cancer Market, By Modality, 2024-2035(USD Billion)

List of Figures

- Global Novel Treatment in Cancer Market Segmentation

- Novel Treatment in Cancer Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top investment pocket in the Novel Treatment in Cancer Market

- Top Winning Strategies, 2024-2035

- Top Winning Strategies, By Development, 2024-2035(%)

- Top Winning Strategies, By Company, 2024-2035

- Moderate Bargaining power of Buyers

- Moderate Bargaining power of Suppliers

- Moderate Bargaining power of New Entrants

- Low threat of Substitution

- High Competitive Rivalry

- Top Player Positioning, 2024

- Market Share Analysis, 2024

- Restraint and Drivers: Novel Treatment in Cancer Market

- Novel Treatment in Cancer Market Segmentation, By Therapy Type

- Novel Treatment in Cancer Market For Targeted Therapy, By Region, 2024-2035 ($ Billion)

- Novel Treatment in Cancer Market For Immunotherapy, By Region, 2024-2035 ($ Billion)

- Novel Treatment in Cancer Market For Checkpoint Inhibitors, By Region, 2024-2035 ($ Billion)

- Novel Treatment in Cancer Market For Cancer Vaccines, By Region, 2024-2035 ($ Billion)

- Novel Treatment in Cancer Market For Gene Cell Therapy, By Region, 2024-2035 ($ Billion)

- Novel Treatment in Cancer Market For Antibody-Drug Conjugates (ADCs), By Region, 2024-2035 ($ Billion)

- Novel Treatment in Cancer Market Segmentation, By Modality

- Novel Treatment in Cancer Market For Monotherapy, By Region, 2024-2035 ($ Billion)

- Novel Treatment in Cancer Market For Combination Therapy, By Region, 2024-2035 ($ Billion)

- Amgen Inc.: Net Sales, 2024-2035 ($ Billion)

- Amgen Inc.: Revenue Share, By Segment, 2024 (%)

- Amgen Inc.: Revenue Share, By Region, 2024 (%)

- AstraZeneca plc: Net Sales, 2024-2035 ($ Billion)

- AstraZeneca plc: Revenue Share, By Segment, 2024 (%)

- AstraZeneca plc: Revenue Share, By Region, 2024 (%)

- BeiGene, Ltd.: Net Sales, 2024-2035 ($ Billion)

- BeiGene, Ltd.: Revenue Share, By Segment, 2024 (%)

- BeiGene, Ltd.: Revenue Share, By Region, 2024 (%)

- BioNTech SE: Net Sales, 2024-2035 ($ Billion)

- BioNTech SE: Revenue Share, By Segment, 2024 (%)

- BioNTech SE: Revenue Share, By Region, 2024 (%)

- BioNTech SE: Net Sales, 2024-2035 ($ Billion)

- BioNTech SE: Revenue Share, By Segment, 2024 (%)

- BioNTech SE: Revenue Share, By Region, 2024 (%)

- Bluebird Bio, Inc.: Net Sales, 2024-2035 ($ Billion)

- Bluebird Bio, Inc.: Revenue Share, By Segment, 2024 (%)

- Bluebird Bio, Inc.: Revenue Share, By Region, 2024 (%)

- Eli Lilly and Company: Net Sales, 2024-2035 ($ Billion)

- Eli Lilly and Company: Revenue Share, By Segment, 2024 (%)

- Eli Lilly and Company: Revenue Share, By Region, 2024 (%)

- Genentech, Inc.: Net Sales, 2024-2035 ($ Billion)

- Genentech, Inc.: Revenue Share, By Segment, 2024 (%)

- Genentech, Inc.: Revenue Share, By Region, 2024 (%)

- Gilead Sciences, Inc.: Net Sales, 2024-2035 ($ Billion)

- Gilead Sciences, Inc: Revenue Share, By Segment, 2024 (%)

- Gilead Sciences, Inc: Revenue Share, By Region, 2024 (%)

- Immatics Biotechnologies: Net Sales, 2024-2035 ($ Billion)

- Immatics Biotechnologies: Revenue Share, By Segment, 2024 (%)

- Immatics Biotechnologies: Revenue Share, By Region, 2024 (%)

- Innovent Biologics: Net Sales, 2024-2035 ($ Billion)

- Innovent Biologics: Revenue Share, By Segment, 2024 (%)

- Innovent Biologics: Revenue Share, By Region, 2024 (%)

- Merck & Co., Inc.: Net Sales, 2024-2035 ($ Billion)

- Merck & Co., Inc.: Revenue Share, By Segment, 2024 (%)

- Merck & Co., Inc.: Revenue Share, By Region, 2024 (%)

- Novartis AG: Net Sales, 2024-2035 ($ Billion)

- Novartis AG: Revenue Share, By Segment, 2024 (%)

- Novartis AG: Revenue Share, By Region, 2024 (%)

- Pfizer Inc.: Net Sales, 2024-2035 ($ Billion)

- Pfizer Inc.: Revenue Share, By Segment, 2024 (%)

- Pfizer Inc.: Revenue Share, By Region, 2024 (%)

- Others: Net Sales, 2024-2035 ($ Billion)

- Others: Revenue Share, By Segment, 2024 (%)

- Others: Revenue Share, By Region, 2024 (%)

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |