Global Octocrylene Market

Global Octocrylene Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Purity Type (Above 98% and Below 98%), By Application (Sunscreens, Hair Care Products, Moisturizers, and Anti-Aging Creams), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Octocrylene Market Summary, Size & Emerging Trends

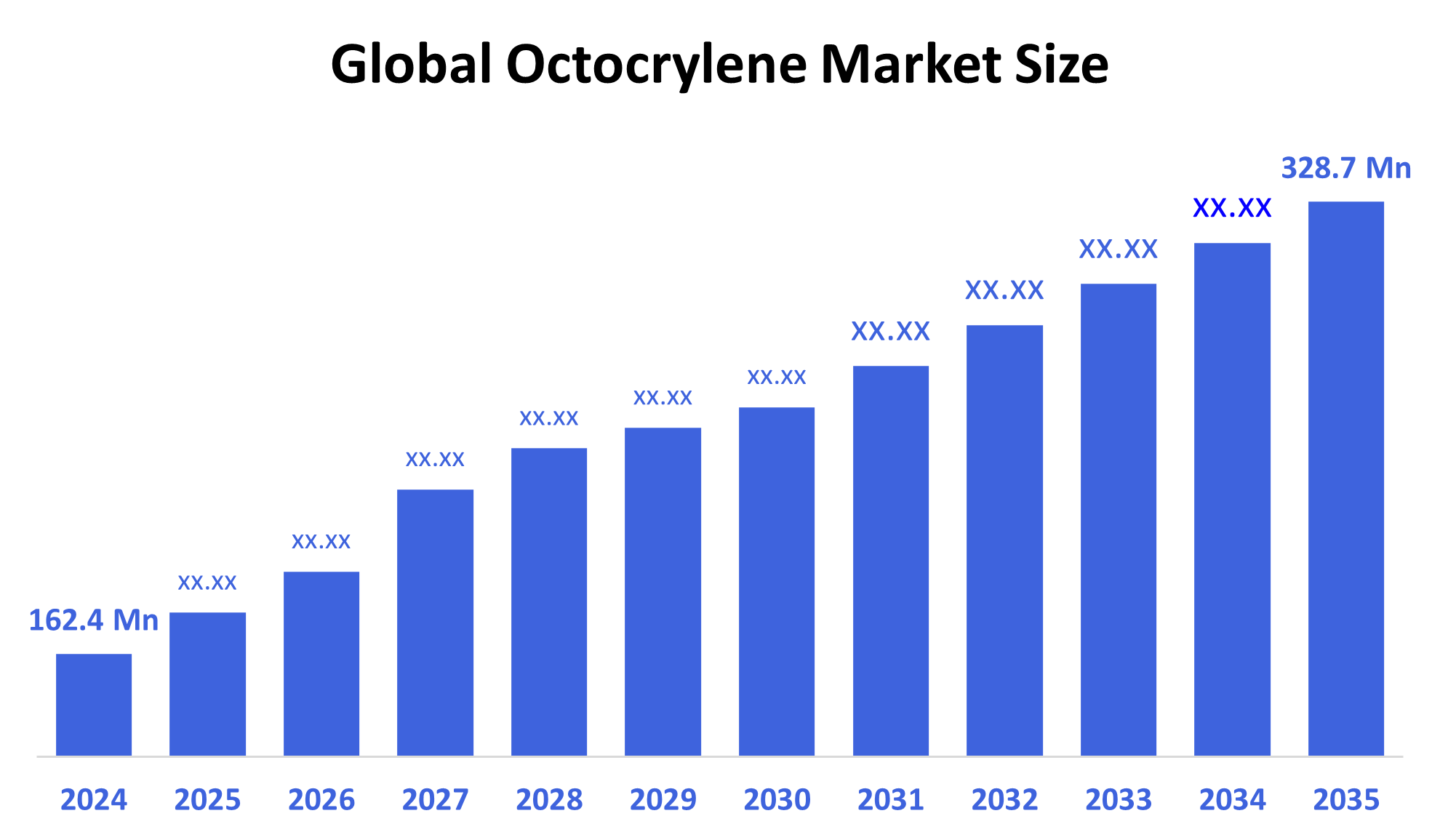

- According to Spherical Insights, The Global Octocrylene Market Size is Expected To Grow From USD 162.4 Million in 2024 to USD 328.7 Million by 2035, at a CAGR of 6.6% during the Forecast Period 2025-2035.

- Rising demand for UV filters in personal care products, especially sunscreens, is a key growth driver.

- Increased awareness of skin protection and rising incidence of skin-related disorders due to UV exposure have propelled the demand for octocrylene-based formulations.

Key Market Insights

- Europe dominated the octocrylene market in 2024, driven by strong cosmetic product manufacturing and regulatory standards.

- Purity above 98% held the largest market share due to its suitability for high-quality formulations.

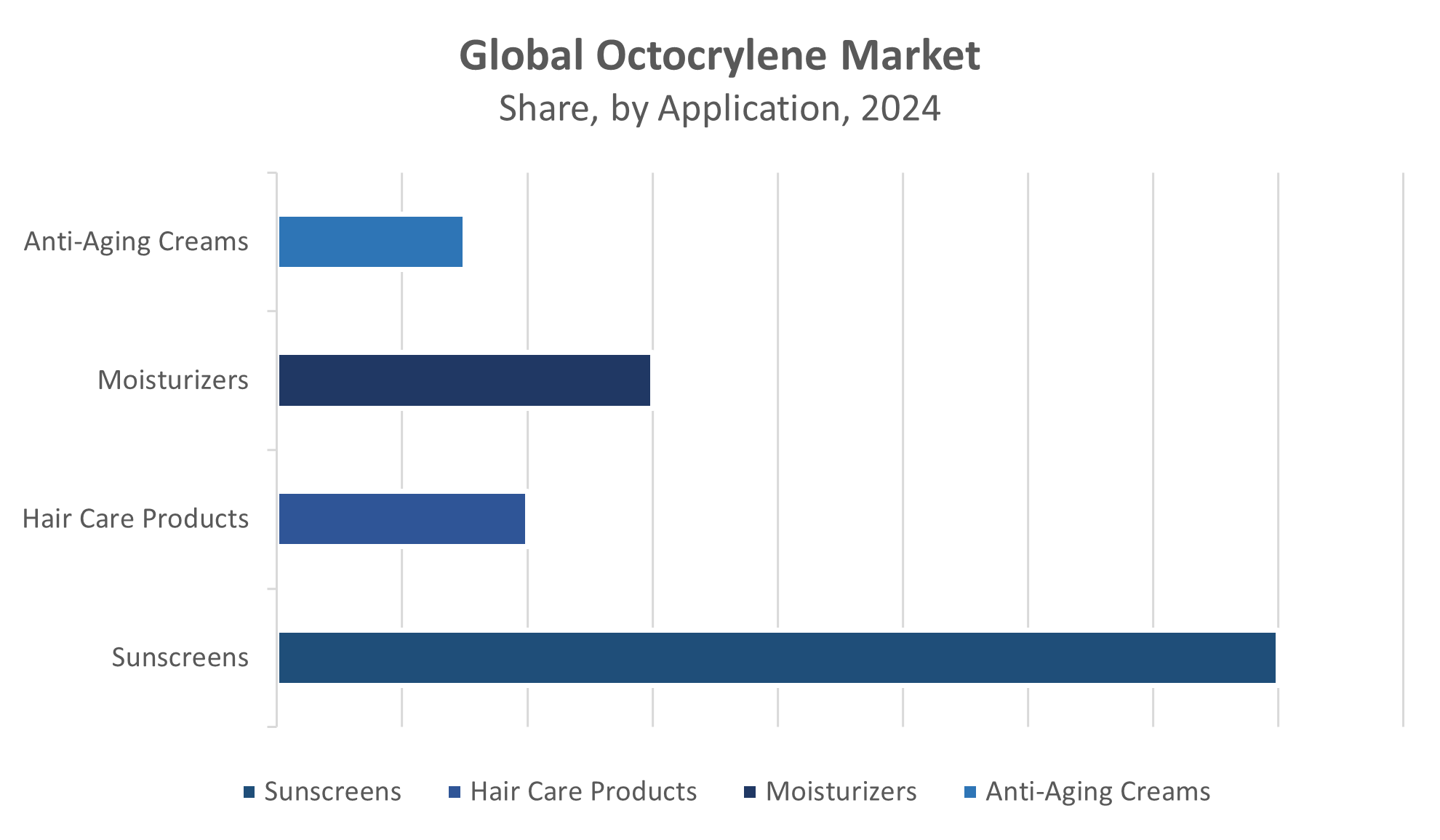

- Sunscreens emerged as the leading application segment, accounting for the highest revenue share globally.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 162.4 Million

- 2035 Projected Market Size: USD 328.7 Million

- CAGR (2025-2035): 6.6%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Octocrylene Market

The octocrylene market revolves around the manufacturing and utilization of octocrylene, a chemical compound commonly used as a UV filter in sunscreens, moisturizers, and other personal care products. Known for its ability to absorb UVB and short UVA rays, octocrylene offers broad-spectrum sun protection and enhances the photostability of other active ingredients such as avobenzone. Its water-resistant properties make it ideal for products designed for outdoor use and beachwear. The rising demand for multifunctional skincare, such as anti-aging sunscreens and daily moisturizers with SPF, is fueling market growth. Furthermore, increased awareness of skin damage due to UV exposure and the need for preventive skincare are driving adoption. Technological advancements in cosmetic formulations and expanding cosmetic markets in Asia Pacific and Latin America offer further growth opportunities. As consumer preferences shift toward long-lasting and high-performance sun care, octocrylene continues to play a critical role in global personal care product development.

Octocrylene Market Trends

- Rising demand for multi-functional personal care and sun care products

- Increased awareness about UV-related skin issues and premature aging

- Growth of organic and clean-label cosmetics incorporating octocrylene as a stable UV filter

Octocrylene Market Dynamics

Driving Factors: The octocrylene market is driven by increasing consumer awareness about skin protection

The octocrylene market is driven by increasing consumer awareness about skin protection, especially against harmful UV radiation. Rising participation in outdoor and recreational activities has led to higher demand for effective sun care products. Octocrylene’s ability to absorb UVB and short UVA rays, while stabilizing other sunscreen ingredients, makes it an essential compound in many formulations. The growth of the global cosmetics industry, combined with expanding product portfolios from major brands, further boosts market adoption. Additionally, regulatory approvals supporting its safe use and the preference for long-lasting, water-resistant sunscreens significantly contribute to the overall market expansion.

Restrain Factors: Octocrylene faces growing scrutiny due to potential side effects

Despite its widespread use, octocrylene faces growing scrutiny due to potential side effects, including skin sensitivity and suspected hormonal disruption, particularly with prolonged exposure. Regulatory bodies in some regions are reevaluating its safety, which may impact market confidence. Moreover, environmentally conscious consumers and activists have raised concerns about its effects on marine ecosystems, especially coral reefs, leading to restrictions in coastal areas. The rising preference for natural, mineral-based alternatives such as zinc oxide or titanium dioxide further challenges its market position. These health and environmental concerns could limit future use in certain formulations and regions.

Opportunity: Significant opportunities lie in the development of reef-safe

Significant opportunities lie in the development of reef-safe, non-toxic, and clean-label formulations of octocrylene to meet evolving consumer demands. Brands that innovate around these standards can capture market share among health-conscious and eco-friendly consumers. In emerging economies, increasing disposable income and growing awareness of skin health are creating strong demand for affordable, high-performance sun care products. Additionally, the rise of e-commerce platforms and direct-to-consumer beauty brands allows for greater product visibility and targeted marketing. Companies that invest in R&D to enhance safety and versatility of octocrylene-based formulations can leverage these opportunities for sustained growth.

Challenges: Consumers are shifting toward mineral-based and natural sunscreen ingredients

The octocrylene market faces notable challenges, especially from tightening regulatory frameworks in key markets like Europe and North America. New legislation and increased scrutiny over UV filters may restrict usage in certain products or require reformulations. Simultaneously, consumers are shifting toward mineral-based and natural sunscreen ingredients, perceiving them as safer and more environmentally friendly. There is also pressure to balance product performance with minimal skin irritation and allergen risk. For manufacturers, ensuring compliance while maintaining efficacy, affordability, and user satisfaction is a complex task, particularly as competition intensifies and consumer expectations continue to evolve.

Global Octocrylene Market Ecosystem Analysis

The ecosystem includes chemical manufacturers, personal care product formulators, regulatory agencies, distribution networks, and R&D institutions. Chemical suppliers ensure consistent purity and availability of octocrylene, while cosmetic companies integrate it into product lines for UV protection. Regulatory bodies govern product safety and labeling, ensuring public health. R&D continues to drive product innovation, developing more efficient and skin-friendly formulations that comply with evolving global safety standards.

Global Octocrylene Market, By Purity Type

The above 98% purity segment dominated the octocrylene market in 2024, accounting for approximately 62% of total revenue. This high-purity grade is preferred in premium cosmetic and personal care products due to its superior performance, safety, and consistency. It ensures optimal UV protection and photostability, making it ideal for high-quality sunscreens and skincare formulations. Manufacturers targeting the mass and premium skincare markets favor this segment because it meets stringent regulatory and consumer expectations, driving its dominance in revenue and demand.

The below 98% purity segment holds a smaller share of the market, primarily serving industrial or economy-grade applications. This lower-purity octocrylene is generally used in non-cosmetic products or where cost-effectiveness is a priority over premium quality. It caters to industries requiring bulk quantities for formulations that do not demand the highest purity standards, such as certain coatings or plastics. Due to its limited use in high-end skincare products, this segment contributes less to overall market revenue.

Global Octocrylene Market, By Application

Sunscreens led the octocrylene market in 2024, contributing nearly 55% of the global revenue. Octocrylene is a vital ingredient in sunscreen formulations due to its excellent ability to absorb UVB and short UVA rays, providing broad-spectrum protection. Its photostabilizing properties help enhance the effectiveness and longevity of other UV filters in sunscreens. Additionally, octocrylene contributes to water resistance, making it highly desirable for sun protection products designed for outdoor use. The rising consumer focus on sun safety and increasing outdoor activities drive strong demand for octocrylene-containing sunscreens globally.

Moisturizers and creams also represent a significant share of the octocrylene market. These products incorporate octocrylene to offer additional UV protection while providing hydration and skin nourishment. With growing awareness about daily sun protection and anti-aging benefits, consumers increasingly prefer multifunctional skincare products. The inclusion of octocrylene in moisturizers helps protect the skin from UV damage, boosting product appeal and expanding market demand in this segment.

Europe led the global octocrylene market in 2024 with a revenue share of approximately 38%.

This leadership is driven by strong consumer demand for advanced skincare products and rigorous cosmetic research and development activities. The region’s stringent safety and regulatory standards encourage manufacturers to produce high-quality, effective formulations, boosting market confidence and growth. Additionally, a well-informed consumer base that prioritizes skin protection and anti-aging benefits further fuels demand for octocrylene-containing products across Europe.

Asia Pacific is the fastest-growing region in the octocrylene market.

Rising disposable incomes, increasing beauty consciousness, and expanding awareness about sun protection contribute to strong growth. Countries like China, India, and Japan are witnessing heightened usage of sun care products, supported by urbanization and lifestyle changes. The region’s growing middle-class population and rising investments in the personal care industry create significant opportunities for octocrylene market expansion.

North America holds a significant share in the octocrylene market

due to high consumer awareness regarding skin health and UV protection. The region benefits from a mature and well-established personal care industry with widespread adoption of advanced skincare products. Consumers actively seek innovative, effective sun protection solutions, sustaining steady demand for octocrylene in sunscreens, moisturizers, and other cosmetic applications.

WORLDWIDE TOP KEY PLAYERS IN THE OCTOCRYLENE MARKET INCLUDE

- BASF SE

- Ashland Global Holdings Inc.

- Croda International Plc

- Merck KGaA

- Seppic SA

- Symrise AG

- Spectrum Chemical Mfg. Corp.

- Salicylates and Chemicals Pvt. Ltd.

- Hallstar

- DSM Nutritional Products

- Others

Product Launches in Octocrylene Market

- In January 2025, BASF SE launched a next-generation high-purity octocrylene for use in sensitive skin formulations, addressing rising consumer demand for gentle UV filters. The product features enhanced photostability and complies with both U.S. and EU safety standards, strengthening BASF’s position in the premium skincare ingredients market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the octocrylene market based on the below-mentioned segments:

Global Octocrylene Market, By Purity Type

- Above 98%

- Below 98%

Global Octocrylene Market, By Application

- Sunscreens

- Hair Care Products

- Moisturizers

- Anti-Aging Creams

Global Octocrylene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is driving the growth of the global octocrylene market?

Rising consumer awareness about skin protection from harmful UV radiation, increasing demand for multifunctional personal care products, and the growth of the global cosmetics industry are key growth drivers.

Q. Which region held the largest market share in 2024 for octocrylene?

Europe dominated the octocrylene market in 2024, driven by strong cosmetic manufacturing, regulatory standards, and a well-informed consumer base.

Q. Why is octocrylene widely used in sunscreens?

Octocrylene effectively absorbs UVB and short UVA rays, offers broad-spectrum sun protection, enhances photostability of other ingredients, and provides water resistance, making it ideal for sunscreen formulations.

Q. What are the main challenges faced by the octocrylene market?

Growing scrutiny over potential side effects such as skin sensitivity and environmental concerns (especially coral reef impact), along with shifting consumer preference toward mineral-based and natural sunscreen ingredients.

Q. Which purity type of octocrylene dominates the market and why?

Octocrylene with purity above 98% dominates the market due to its superior performance, safety, and suitability for premium cosmetic and personal care formulations.

Q. What opportunities exist in the octocrylene market?

Development of reef-safe, non-toxic, and clean-label octocrylene formulations, along with growth in emerging markets fueled by rising disposable incomes and awareness of skin health.

Q. Who are some of the key players in the global octocrylene market?

Leading companies include BASF SE, Ashland Global Holdings Inc., Croda International Plc, Merck KGaA, Seppic SA, and Symrise AG among others.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 200 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |