Global Offshore Wind Turbine Market

Global Offshore Wind Turbine Market Size, Share, and COVID-19 Impact Analysis, By Capacity (Up to 3 MW, 3 MW?5 MW, Above 5 MW), By Water Depth (Shallow Water (<30 M Depth), Transitional Water (30-60 M Depth), Deepwater (More than 60 M Depth)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Offshore Wind Turbine Market Summary

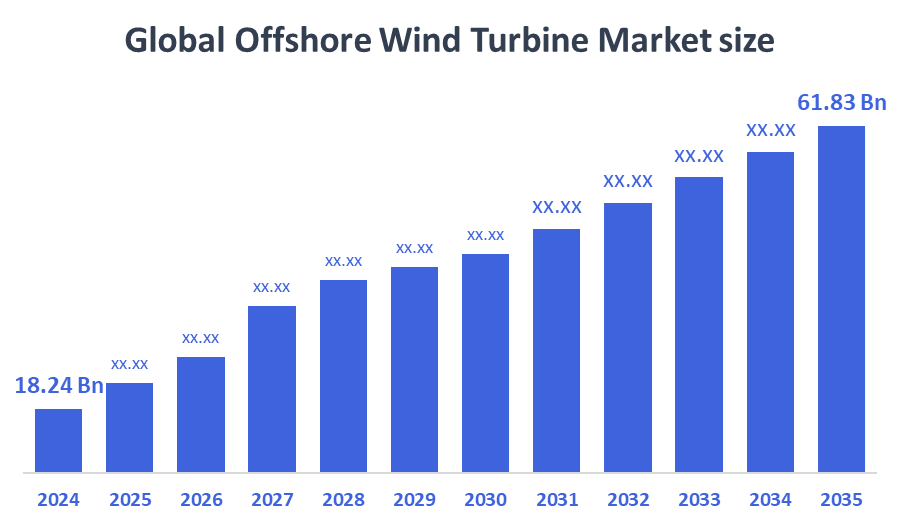

The Global Offshore Wind Turbine Market Size Was Estimated at USD 18.24 Billion in 2024 and is Projected to Reach USD 61.83 Billion by 2035, Growing at a CAGR of 11.74% from 2025 to 2035. The market for offshore wind turbines is expanding because of the growing demand for clean energy around the world, government support in the form of incentives and policies, technological advancements in turbines, falling installation costs, and the availability of high wind speeds in offshore locations for effective power generation.

Key Regional and Segment-Wise Insights

- In 2024, Europe held the greatest revenue share of 46.3% and led the worldwide offshore wind turbine market.

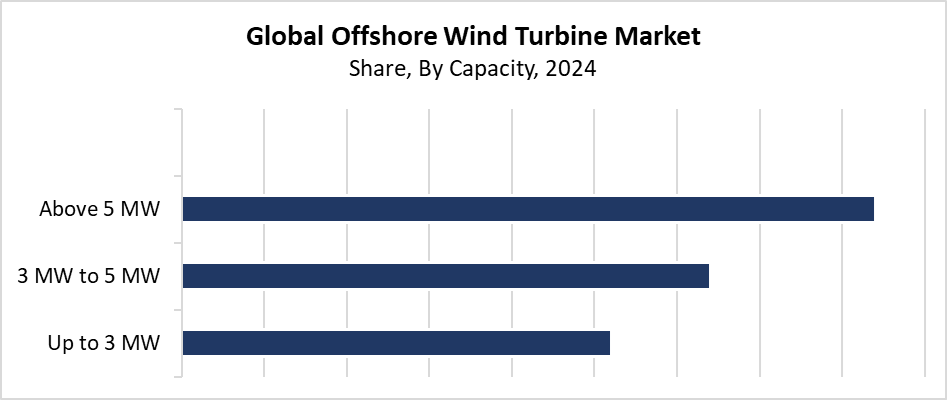

- In 2024, the above 5 MW segment had the highest market share by capacity, accounting for 42.5%.

- In 2024, the shallow water (<30 m depth) segment had the biggest market share by water depth.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 18.24 Billion

- 2035 Projected Market Size: USD 61.83 Billion

- CAGR (2025-2035): 11.74%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The offshore wind turbine market refers to the industry that designs, builds, and maintains power generation turbines located in oceanic or sea environments. The turbines tap into the consistently strong winds of offshore locations to generate a sustainable high-capacity power supply. The market experiences rapid growth because of the urgent need to reduce greenhouse gas emissions, along with the growing worldwide need for clean, sustainable energy. Coastal nations select offshore wind as a viable solution because it enhances energy security and provides source diversification while helping them reach their climate objectives. The industry expands because of onshore project land limitations and improved offshore wind farm efficiency, together with increasing renewable infrastructure investments.

The offshore wind turbine market continues to grow because of technological advancements. The offshore wind industry gains efficiency and scalability through floating wind turbines combined with larger rotor diameters, improved grid interconnection capabilities, and better blade materials. Governments worldwide support the industry by establishing supportive laws, together with financial assistance and renewable energy targets. Europe stands as the region with the highest offshore wind capacity, yet North America and the Asia-Pacific demonstrate rapid growth. Offshore wind represents a vital element of worldwide energy transformation, and its deployment receives acceleration through international partnerships, investments in port facilities, and public-private partnerships.

Capacity Insights

Why Did the Above 5 MW Segment Dominate the Offshore Wind Turbine Market by Capturing 42.5% Revenue Share in 2024?

The above 5 MW segment led the offshore wind turbine market with the largest revenue share of 42.5% in 2024. The rising need for substantial power generators that achieve maximum energy production while minimizing total project costs and delivering increased electricity through fewer installations explains their market supremacy. Large turbines fit perfectly with massive offshore wind installations and deepwater platforms that need efficient space utilization. The advancement of technology enables the creation of turbines with capacities exceeding 10 MW, which deliver enhanced reliability and operational performance under tough marine conditions. The rising need to meet challenging climate targets, along with public support for large-scale renewable projects, drives the installation of high-capacity offshore wind turbines, which fuels the market growth.

The 3 MW to 5 MW segment of the offshore wind turbine market will experience substantial growth during the forecast period because it delivers optimal cost-performance ratios for medium-scale offshore wind projects. Such turbines represent the ideal choice for wind power generation in locations where massive turbines are either unnecessary or too expensive to deploy and where wind conditions are moderate and water depths are shallow. The industry advances its performance through ongoing advances in turbine efficiency and blade design, alongside improved grid integration, which boosts both output and reliability. Multiple developing offshore wind markets throughout Asia and Europe, along with other regions, focus on this capacity range to accelerate development while minimizing installation and infrastructure costs. Favorable government policies, together with declining levelized cost of energy (LCOE), contribute to driving the expansion of this market.

Water Depth Insights

How Did the Shallow Water (<30 m Depth) Segment Achieve the Largest Revenue Share in the Offshore Wind Turbine Market in 2024?

The offshore wind turbine market is dominated by the shallow water (<30 m depth) segment with the largest revenue share during 2024. The main reason for this market dominance stems from the reduced expenses involved in installing and maintaining projects in shallow waters compared to deep-water installations. The construction vessels find shallow water sites more accessible, thus allowing developers to deploy their projects at faster rates. The sites contain well-established infrastructure along with suitable seabed conditions for fixed-bottom turbines, which minimizes both complexity and cost. Many successful offshore wind farms established their operations in shallow waters during their early stages and remain dominant in the European and Asian markets, which strengthens the market position of this segment. This segment will sustain its market dominance because of ongoing expansion in relevant regions.

During the forecasted period, the transitional water (30–60 M depth) segment is expected to experience substantial growth in the offshore wind turbine market. Nearshore shallow water sites have reached their capacity limits, so developers focus on transitional depths to unlock untapped wind resources and increase project capacity. These specific locations provide wind patterns with greater strength and stability, which results in higher energy production. The development of advanced turbine foundation technologies, including jacket and monopile structures, has reduced costs and enhanced the feasibility of transitional water installations. The development of offshore wind power in deeper waters receives additional encouragement from government policies that provide support and incentives. The segment experiences increased growth because of European, Asian-Pacific, and North American requirements for renewable energy targets and their growing need for substantial offshore wind installations.

Regional Insights

The offshore wind turbine market in North America experiences significant expansion because government initiatives promote offshore wind production, along with increasing renewable energy investments. The United States plans to install 30 GW of offshore wind capacity by 2030, which drives multiple major offshore wind projects across its East Coast. The states of New Jersey, along with Massachusetts and New York, lead the way through their beneficial laws and incentives and organized lease auctions. The advancement of floating wind turbine technology enables the development of offshore wind projects in deep-water areas along the West Coast. The adoption of this technology is accelerating because people are increasingly concerned about carbon emissions, energy security, and grid reliability. International energy corporations work together with government bodies to strengthen industry growth.

Europe Offshore Wind Turbine Market Trends

Europe led the worldwide offshore wind turbine market in 2024 with the largest revenue share of 46.3%. The region leads because it adopted offshore wind technology early, while having established infrastructure and strong government support through renewable energy targets and beneficial policies. The UK and Germany, along with Denmark and the Netherlands, have developed extensive offshore wind farms by taking advantage of favorable wind conditions and modern port facilities in their shallow coastal areas. Europe's offshore wind market success grows stronger through its reliable supply chains and continuous advancements in turbine size and performance. The offshore capacity expansion occurs through major investments in grid connection projects, together with floating wind technology development. Europe will maintain its leadership position in offshore wind turbine markets because it pursues both energy security and decarbonization goals.

Asia Pacific Offshore Wind Turbine Market Trends

The Asia Pacific offshore wind turbine market is anticipated to experience the fastest growth during the forecast period because of the region's accelerating industrialization and urbanization, and increasing energy demand. Several Asian nations, including China, Taiwan, South Korea, and Japan, invest heavily in offshore wind projects to achieve energy source diversification and lower carbon emissions. The market growth accelerates because numerous suitable coastal and shallow water areas exist alongside favorable government incentives and regulatory frameworks. The advancement of floating wind turbine technology enables new market expansion because it allows installations in deeper waters. The fast-paced growth receives support from rising infrastructure investments as well as partnerships between domestic and international businesses. The global offshore wind industry will experience substantial growth because the Asia Pacific region focuses on developing sustainable energy solutions.

Key Offshore Wind Turbine Companies:

The following are the leading companies in the offshore wind turbine market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric Company

- ABB

- Goldwind

- Equinor ASA

- Nordex SE

- Siemens

- Naval Group

- Iberdrola, S.A.

- Mitsubishi Heavy Industries, Ltd

- MODEC, Inc.

- Others

Recent Developments

- In May 2025, Norwegian offshore wind contractor Havfram was purchased by clean energy business DEME for USD 1,028.9, which included all of Havfram's shares. Through this acquisition, DEME should be able to increase its market share in the offshore wind energy sector and enhance its capacity to install foundations and turbines.

- In March 2025, Plenitude, CDP, and Copenhagen Infrastructure Partners are part of the Divento consortium, which teamed with the Italian engineering firm Saipem. For offshore wind projects in Sardinia and Sicily, they intend to combine Saipem's STAR 1 floating wind technology to produce 1.6 terawatt-hours of power annually.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the offshore wind turbine market based on the below-mentioned segments:

Global Offshore Wind Turbine Market, By Capacity

- Up to 3 MW

- 3 MW to 5 MW

- Above 5 MW

Global Offshore Wind Turbine Market, By Water Depth

- Shallow Water (<30 M Depth)

- Transitional Water (30-60 M Depth)

- Deepwater (More than 60 M Depth)

Global Offshore Wind Turbine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |