Global Online Food Delivery Services Market

Global Online Food Delivery Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Restaurant-to-Consumer, Platform-to-Consumer), By Payment Method (Cash on Delivery, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Online Food Delivery Services Market Summary

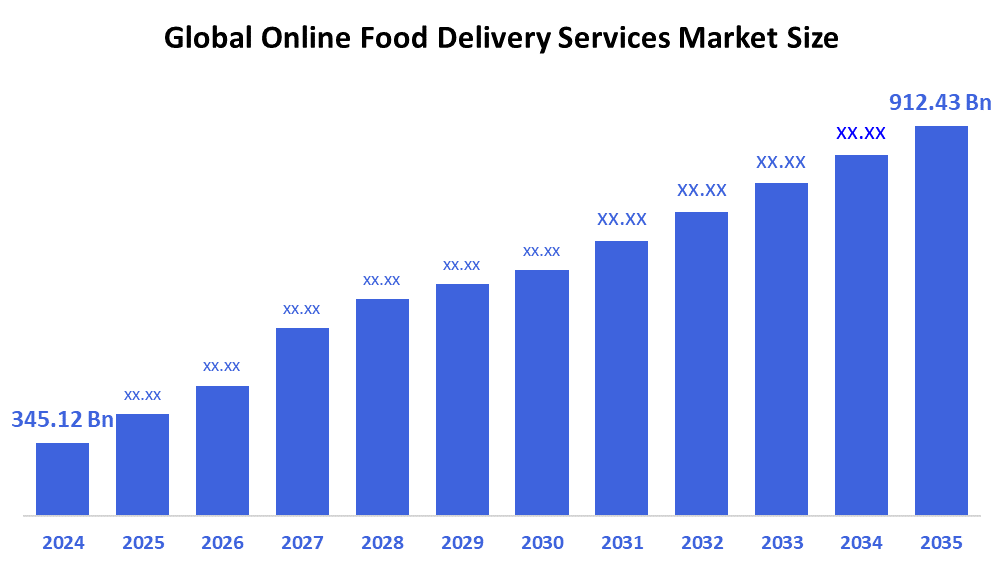

The Global Online Food Delivery Services Market Size Was Estimated at USD 345.12 Billion in 2024 and is Projected to Reach USD 912.43 Billion by 2035, Growing at a CAGR of 9.24% from 2025 to 2035. The market for online food delivery is expanding due to factors like shifting consumer habits that prioritize speed and convenience, technological advancements like artificial intelligence (AI), personalized recommendations, new delivery methods like robots and drones, and rising digital penetration from smartphones, the internet, and digital payments.

Key Regional and Segment-Wise Insights

- In 2024, the North American market for online food delivery services accounted for the largest market share of 24.7%.

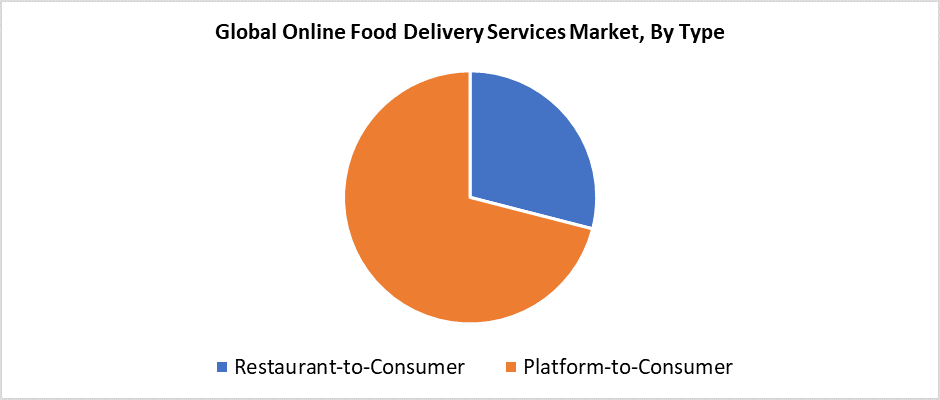

- In 2024, the platform-to-consumer segment dominated the market with the largest revenue share of 71.5% by type.

- In 2024, the online payment segment held the greatest market share, accounting for 78.3% based on payment methods.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 345.12 Billion

- 2035 Projected Market Size: USD 912.43 Billion

- CAGR (2025-2035): 9.24%

- North America: Largest market in 2024

The online food delivery market represents digital platforms that enable customers to purchase food from restaurants or food suppliers and receive delivery through website or mobile application services. The market has experienced rapid growth because of increasing smartphone adoption, together with internet access and rising demand for efficient and convenient solutions. The market growth has been supported by rising demand from cloud kitchens as well as increasing urbanization and a lifestyle that operates at high speed. The worldwide market is expanding because more people are entering the workforce and their disposable income is increasing alongside their shift to digital food ordering.

The online food delivery industry receives substantial influence from technological innovations. Contactless payment systems, along with drone and autonomous vehicle delivery trials and real-time order tracking and AI recommendation engines, enhance both user experience and operational efficiency. The market expansion receives support through government programs, which advance small business development alongside startup ecosystems and digital infrastructure, such as the SME digitization programs in Europe and "Digital India" in India. The development of ethical, sustainable growth for the industry depends on laws that protect data security and food safety, as well as regulations for gig economy labor standards.

Type Insights

The platform-to-consumer segment held the largest market share of 71.5% in the online food delivery services industry during 2024. The delivery process, along with restaurant connections to customers, happens through third-party companies, including Uber Eats, DoorDash, and Swiggy. Its success comes from customers being able to easily explore various food options through a user-friendly app interface, which also offers real-time order tracking and customized recommendations. Companies have increased their market reach and customer retention through extensive geographic presence and loyalty programs combined with their strategic marketing approaches. The scalable design of this model, together with its ability to serve both large retail chains and small neighborhood restaurants, positions it as the preferred choice for customers and restaurants, while maintaining its market leadership position.

The restaurant-to-consumer segment of the online food delivery services market will experience a significant CAGR during the forecast period because of increasing investments in direct-to-customer digital platforms and in-house delivery infrastructure. The ordering and delivery cycle is independently managed by restaurants through their own online platforms including websites and mobile applications, in this business approach. The growth primarily stems from restaurants gaining better control of client experiences, as well as stronger brand loyalty and enhanced profit margins by eliminating third-party commission expenses. Restaurant chains leverage consumer data to develop personalized marketing strategies and loyalty programs, which strengthen both customer engagement and repeat business. The market growth will experience further acceleration because of technological advances alongside rising consumer tendencies to order directly from well-known restaurant brands.

Payment Method Insights

The online payment segment holds the dominant position in the online food delivery services market with the largest market share of 78.3% in 2024. This market dominance stems from customers preferring digital wallets and credit/debit cards along with UPI and other cashless payment systems, which deliver speed, security, and convenience. The rise in online payment usage occurred mainly because contactless purchasing became widespread during and after the pandemic. Delivery apps that link payment gateways with their platforms and provide cashback rewards along with discounts motivate users to opt for digital payment solutions. The demand for effortless and secure checkout processes drives the increasing adoption of online payments in both advanced and developing markets.

The online food delivery market's cash on delivery (COD) segment will experience a significant CAGR throughout the projected timeframe, mainly within emerging markets that lack digital payment infrastructure. The reasons customers in rural and semi-urban areas prefer cash on delivery (COD) include limited digital payment access and online transaction security concerns, and their natural preference for this method. Customers who feel hesitant about paying up front receive the freedom and assurance of COD payments. Food delivery companies maintain COD services to reach a wider customer base and promote service inclusiveness, even though digital payments dominate urban markets. The steady growth of the industry will continue throughout the forecast period.

Regional Insights

The online food delivery services market in North America held the largest market share, accounting for 24.7% globally in 2024. The market dominance stems from high internet and smartphone penetration rates along with the presence of DoorDash, Uber Eats, and Grubhub as major competitors. Modern urban living, combined with the increasing demand for convenience services, has driven the market demand substantially. The area's superior digital payment infrastructure, together with an efficient delivery network, ensures timely, dependable delivery services to customers. Advanced technologies, including contactless delivery systems and artificial intelligence recommendation systems, enhance the customer experience. North America's leadership position in the global online meal delivery market stems from the combined strength of these market drivers.

Europe Online Food Delivery Services Market Trends

During the forecasted period, the European market for online food delivery services is anticipated to experience substantial growth. Urbanization growth, together with expanding smartphone adoption and shifting consumer lifestyles, drives the regionwide demand for convenient, speedy meal delivery options. European consumers now rely more heavily on digital food ordering platforms because of improved internet networks and increased interest in diverse culinary options. The market expansion occurs because delivery platforms join forces with restaurants while cloud kitchen operations grow. The implementation of food safety regulations and government initiatives that promote digital innovation generates a supportive market environment. The online meal delivery industry in Europe will experience rapid growth during the upcoming years.

Asia Pacific Online Food Delivery Services Market Trends

The Asia Pacific online food delivery services market will experience significant expansion during the forecasted period. The increasing population of smartphone users, alongside expanding internet connectivity, rising consumer spending power, and quick urban development, drives this market growth. The online food delivery sector thrives across the region because numerous young individuals dedicate themselves to digital technology. The rising number of cloud kitchens, together with expanding service options now available from domestic and foreign operators, promotes increased market accessibility. Government support for startup ecosystems, together with digital infrastructure development across China, India, and Southeast Asia, propels industry growth. The Asia Pacific region will maintain its position as one of the fastest-growing areas within the global online food delivery market throughout the forecast period.

Key Online Food Delivery Services Companies:

The following are the leading companies in the online food delivery services market. These companies collectively hold the largest market share and dictate industry trends.

- Deliveroo PLC

- Yelp Inc.

- DoorDash Inc.

- Delivery.com LLC

- Just Eat Limited

- Swiggy

- Zomato

- Uber Technologies Inc.

- Amazon.com Inc.

- Delivery Hero Group

- Rappi Inc.

- Others

Recent Developments

- In May 2024, Zomato extended its "priority food delivery services" to Bengaluru and Mumbai, among other cities. Customers may receive their food up to five minutes sooner with priority delivery than with regular delivery.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the online food delivery services market based on the below-mentioned segments:

Global Online Food Delivery Services Market, By Type

- Restaurant-to-Consumer

- Platform-to-Consumer

Global Online Food Delivery Services Market, By Payment Method

- Cash on Delivery

- Online

Global Online Food Delivery Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |