Global Optical Comparator Market

Global Optical Comparator Market Size, Share, and COVID-19 Impact Analysis, By System Type (Floor Standing and Bench Top), By The Part View Orientation (Shadow Screen Type, Vertical, and Horizontal) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Optical Comparator Market Size Insights Forecasts to 2035

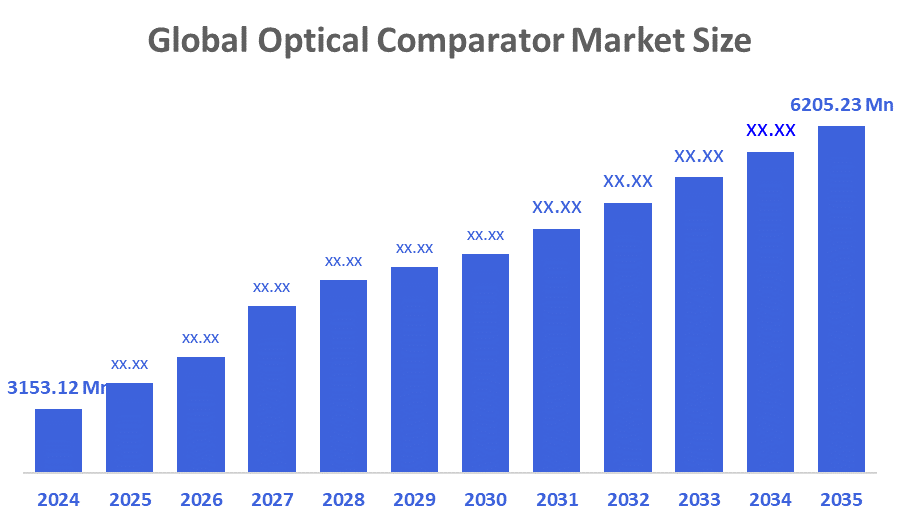

- The Global Optical Comparator Market Size Was valued at USD 3153.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.35% from 2025 to 2035

- The Worldwide Optical Comparator Market Size is Expected to Reach USD 6205.23 Million by 2035

- Asia-Pacific is expected to Grow the fastest during the forecast period.

According to a Research Report Published by Decisions Advisors and Consulting, The Global Optical Comparator Market Size was worth around USD 3153.12 Million in 2024 and is predicted to Grow to around USD 6205.23 Million by 2035 with a compound annual growth rate (CAGR) of 6.35% from 2025 to 2035. There are chances of growth in the areas of automation integration, digital imaging, and IoT-enabled inspection systems, the opening up of new manufacturing hubs, acceptance in industries like aerospace, automotive, and electronics, and a requirement for quality control solutions that are both high-precision and cost-efficient.

Market Overview

The global optical comparator market pertains to the sector associated with the optical comparators’ design, manufacturing, and selling, which are precision measuring tools that are used for inspecting, measuring, and comparing the sizes and shapes of the produced parts. Such instruments exhibit the enlarged images of the parts on a screen, so the very precise visual measurement and quality checking become possible, which is a need of industries that are very strict with their precision, for instance: automobile, aerospace, electronics, and medical devices. The major reasons for the market’s growth are the ever-increasing quality control requirement, the wide acceptance of automated and digital inspection technologies, and the technological breakthroughs in imaging and measurement precision. In addition, the steady growth in the manufacturing industries in developing countries and the requirement for economical yet very precise inspection methods are also helping the market to grow. The incorporation of IoT and software-based data analysis improves the efficiency, accuracy, and traceability of production processes across the globe.

Report Coverage

This research report categorizes the optical comparator market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the optical comparator market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the optical comparator market.

Driving Factors

The ongoing progress in technology is among the biggest opportunities for the Automatic Optical Comparator market. Digital imaging, software integration, and automated measurement capabilities are the main areas of innovation that are increasing the performance and functionality of these devices. Companies that take advantage of the new features can sell more accurate, faster, and easier-to-use optical comparators, hence, they will appeal to a larger market. Using artificial intelligence (AI) and machine learning (ML) is also a rising trend in the optical comparators segment that comes with awesome support for growth. Through this technology, high precision and performance of the measurements can be achieved, thus, making optical comparators even more necessary for industrial applications.

Restraining Factors

The Optical Comparator Market, though very optimistic about its growth, has to deal with some limitations. The high prices that come along with advanced optical comparators may turn some small and medium-sized companies (SMEs) away from these new technologies. The large initial investment along with maintenance costs can really add up and this will affect the overall acceptance of such technologies in markets that are sensitive to costs.

Market Segmentation

The optical comparator market share is classified into system type and the part view orientation.

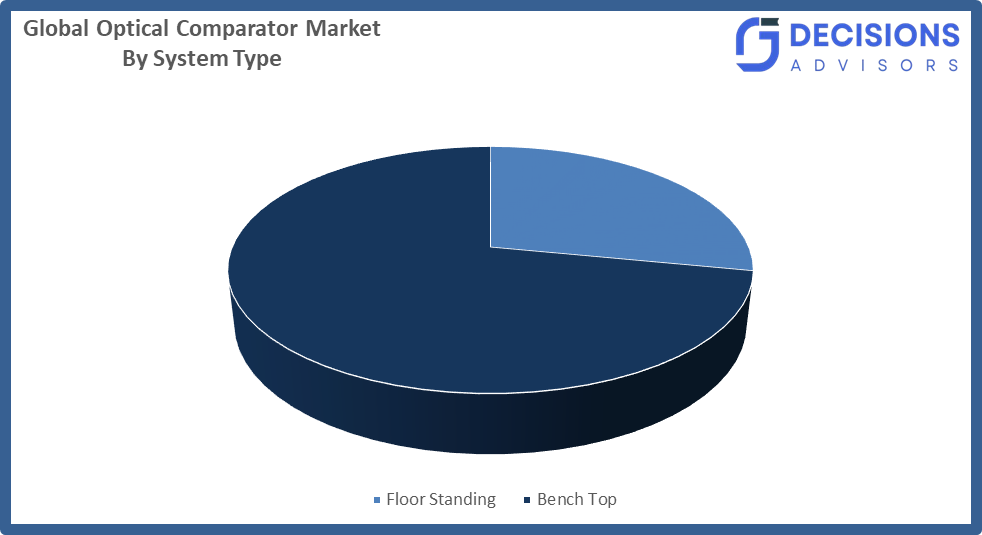

- The bench top segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the system type, the optical comparator market is divided into floor standing and bench top. Among these, the bench top segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The device's small footprint, low cost, simple installation, and multiple applications made it perfectly suited for small- to medium-sized manufacturing operations, laboratories, and quality control, while still providing accurate measurements in restricted space situations.

- The shadow screen type segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the the part view orientation, the optical comparator market is divided into shadow screen type, vertical, and horizontal. Among these, the shadow screen type segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The factors that contributed to its high accuracy of measurement, the ability to display clear part profiles, versatility in dealing with complex components, user-friendliness, and a strong presence in the automotive, aerospace, and electronics sectors, which resulted in revenue growth and the establishment of a broad market preference are the main driving forces.

Regional Segment Analysis of the Optical Comparator Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Optical Comparator market over the predicted timeframe.

North America is anticipated to hold the largest share of the optical comparator market over the predicted timeframe. The North American market for measurement tools is mainly pushed by the solid industrial and manufacturing bases in the US and Canada. One of the major reasons for the market growth is the region's continuous effort to keep the quality standards high along with using advanced manufacturing technologies. North America, having considerable presence of automotive, aerospace and electronics sectors, is about to face a huge demand for high-precision measurement tools.

Asia-Pacific is expected to grow at a rapid CAGR in the optical comparator market during the forecast period. The major force behind the market growth has been the rapid industrialization and the rise in manufacturing activities in countries like China, Japan, India, and South Korea. The growing attention towards quality control coupled with the use of modern manufacturing technologies in this area are the main factors responsible for the increase in demand in the market. In this case, the automotive and electronics sectors are getting considerable demand for high-precision measuring instruments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the optical comparator market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nikon

- Mitutoyo Corporation

- J&L Metrology, Inc.

- Harmond Company

- S-T Industries Inc.

- Suburban Tool Inc.

- Keyence Corporation

- Quality Vision International Inc.

- Starrett, Vision Gauge

- VISIONx

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, A new AI tool called A11yShape enabled blind and low?vision programmers to independently create, inspect, and refine 3D models, enhancing accessibility in design and coding by providing descriptive feedback and workflow support.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the optical comparator market based on the below-mentioned segments:

Global Optical Comparator Market, By System Type

- Floor Standing

- Bench Top

Global Optical Comparator Market, By The Part View Orientation

- Shadow Screen Type

- Vertical

- Horizontal

Global Optical Comparator Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the CAGR of the optical comparator market over the forecast period?

A: The global optical comparator market is projected to expand at a CAGR of 6.35% during the forecast period.

- What is the market size of the optical comparator market?

A: the global optical comparator market size is estimated to grow from USD 3153.12 million in 2024 to USD 6205.23 million by 2035, at a CAGR of 6.35% during the forecast period 2025-2035.

- Which region holds the largest share of the optical comparator market?

A: North America is anticipated to hold the largest share of the Optical Comparator market over the predicted timeframe.

- Who are the top 10 companies operating in the global optical comparator market?

A: Nikon, Mitutoyo Corporation, J&L Metrology, Inc., Harmond Company, S-T Industries Inc., Suburban Tool Inc., Keyence Corporation, Quality Vision International Inc., Starrett, Vision Gauge, VISIONx, and Others.

- What are the market trends in the optical comparator market?

A: The optical comparator market's key market trends are the growing need for high-precision inspection, digital imaging and automation technologies' integration, the increase in automotive and aerospace quality control, and the worldwide adoption of these comparators in emerging industrial sectors.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 158 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |