Global Oral Solid Dosage Pharmaceutical Market

Global Oral Solid Dosage Pharmaceutical Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Dosage Form (Tablets, Capsules, Powders & Granules, and Lozenges & Pastilles), By Drug Release Mechanism (Immediate Release, Extended/Sustained Release, and Delayed/Enteric Release), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Oral Solid Dosage Pharmaceutical Market Size Summary, Size & Emerging Trends

According to Decisions Advisors, The Global Oral Solid Dosage Pharmaceutical Market Size is expected to Grow from USD 618.34 Billion in 2024 to USD 1210.24 Billion by 2035, at a CAGR of 6.3% during the forecast period 2025-2035. Major trends include rising prevalence of chronic diseases, growth in generic formulations, increased access to healthcare in developing regions, and growing demand for patient?friendly and controlled release solid oral dosage forms.

Key Market Insights

- North America is expected to account for the largest share in the oral solid dosage pharmaceutical market during the forecast period.

- In terms of dosage form, the tablets segment dominated in terms of revenue during the forecast period.

- In terms of drug release mechanism, the immediate release segment held the largest revenue share.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 618.34 Billion

- 2035 Projected Market Size: USD 1210.24 Billion

- CAGR (2025-2035): 6.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Oral Solid Dosage Pharmaceutical Market

The oral solid dosage pharmaceutical market encompasses medications administered in solid forms such as tablets, capsules, powders, and granules. These dosage forms are widely preferred due to their ease of administration, cost-effectiveness, chemical stability, and enhanced patient compliance. The market is driven by continuous innovations in formulation technologies, including extended-release and enteric-coated products, aimed at improving therapeutic efficacy and patient convenience. Manufacturing processes are also evolving to increase efficiency and maintain stringent quality standards. Regulatory frameworks emphasize excipient compatibility, dissolution testing, and bioequivalence to ensure safety and effectiveness. The market experiences strong competition between generic manufacturers and branded or reformulated products, particularly in regions with growing healthcare infrastructure and demand, influencing pricing and accessibility dynamics.

Oral Solid Dosage Pharmaceutical Market Trends

- Continued dominance of tablet forms due to established manufacturing infrastructure and patient familiarity.

- Growth in modified or controlled/extended release formulations, which allow less frequent dosing and better patient adherence.

- Increasing involvement of contract development and manufacturing organizations (CDMOs) in producing oral solids.

- Rising demand for online pharmacy distribution and expansion of retail pharmacy access in emerging economies.

Oral Solid Dosage Pharmaceutical Market Dynamics

Driving Factors: Rising prevalence of chronic diseases and increasing generic drug adoption boost market growth.

The oral solid dosage pharmaceutical market is propelled by the growing prevalence of chronic diseases such as hypertension and diabetes, alongside an aging global population. Healthcare systems increasingly prefer cost-effective treatments, boosting generic drug adoption. Oral solid dosage forms offer advantages like ease of storage, transport, and administration, making them ideal for outpatient care and enhancing patient adherence. These factors collectively drive robust demand for oral solid pharmaceuticals worldwide.

Restrain Factors: Strict regulatory compliance and raw material supply constraints limit production flexibility.

Strict regulatory standards on dissolution, stability, impurity limits, and bioavailability increase compliance costs and extend approval timelines. Supply chain challenges, including shortages of raw materials and specialty excipients, further constrain production flexibility. Complex formulations, especially those involving modified release technologies, require advanced testing and validation, which can delay product launches. These factors collectively hinder market growth despite strong demand.

Opportunity: Innovations in modified release and patient-centric formulations alongside emerging market growth drive expansion.

Innovation in modified release technologies (sustained release, enteric coatings) and patient-centric formulations like chewables and orally disintegrating tablets offers significant market potential. Customization for pediatric and geriatric patients is rising. Emerging markets in Asia Pacific, Latin America, and the Middle East benefit from expanding healthcare infrastructure and rising pharmaceutical consumption. Additionally, collaborations with Contract Development and Manufacturing Organizations (CDMOs) and efforts to optimize costs open new avenues for market expansion.

Challenges: Intellectual property issues, pricing pressures, and manufacturing capacity limitations hinder market progress.

Intellectual property issues including patent expiries and litigation create market uncertainty. Fierce competition from generic manufacturers pressures pricing and profit margins. Ensuring adequate manufacturing capacity while maintaining stringent quality standards is difficult, particularly for complex formulations. Regional regulatory variations and approval delays complicate product launches and global market entry. These challenges demand strategic planning and investment to sustain growth in the oral solid dosage segment.

Global Oral Solid Dosage Pharmaceutical Market Ecosystem Analysis

The ecosystem includes pharmaceutical companies (brand & generic), CDMOs and contract manufacturers, excipient and raw material suppliers, regulatory authorities, retailers & pharmacies (both hospital & retail), healthcare providers, and technology solutions (for formulation, testing, packaging). Innovation often stems from partnerships between manufacturers and formulation technology firms. Regulatory bodies set guidelines for safety, bioequivalence, and manufacturing standards. Retail & online pharmacy networks influence distribution reach and patient access.

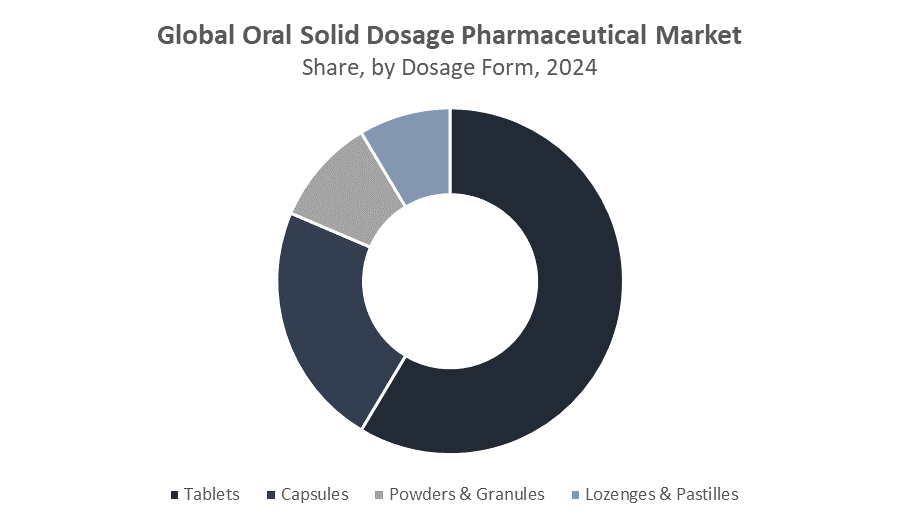

Global Oral Solid Dosage Pharmaceutical Market, By Dosage Form

The tablets segment dominates the market, accounting for approximately 60% of the total revenue in 2024. This dominance is due to tablets being highly cost-efficient to manufacture, easy to store and transport, and offering convenient administration for patients. Tablets are widely preferred in both developed and emerging markets for various therapeutic applications, ranging from chronic disease management to acute conditions. Their formulation flexibility, including extended-release and coated tablets, also drives sustained demand, making this segment the most significant contributor to the overall market revenue.

Capsules hold a substantial market share, second only to tablets, and are particularly preferred when there is a need for taste masking or multiparticulate drug release. Capsules provide advantages such as ease of swallowing and faster dissolution, which make them ideal for certain active pharmaceutical ingredients (APIs). Innovations like soft gelatin capsules and liquid-filled capsules have further boosted this segment’s appeal. While its revenue share is slightly lower than tablets, the capsules segment continues to grow steadily due to these benefits and increasing application in specialized therapies.

Global Oral Solid Dosage Pharmaceutical Market, By Drug Release Mechanism

The immediate release segment held the largest market share, accounting for approximately 57% of revenue in 2024. This segment dominates due to its widespread use in therapies requiring rapid drug onset and quick therapeutic action. Immediate release formulations are simpler to develop and manufacture, which supports their broad adoption across various therapeutic areas including pain management, infections, and acute conditions. The high patient preference for quick relief and the cost-effectiveness of these products contribute to this segment’s significant market presence.

The extended or sustained release segment is experiencing steady growth, driven primarily by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and neurological conditions. These formulations allow for controlled drug release over an extended period, improving patient adherence by reducing dosing frequency. Though smaller in market share compared to immediate release, the segment’s CAGR is robust due to increasing demand for convenience and improved therapeutic outcomes in long-term treatments. Pharmaceutical companies are investing in new technologies to enhance sustained release capabilities.

North America held the largest market share, approximately 40% in 2024,

driven by its well-established pharmaceutical industry, strong intellectual property (IP) protections, and high per capita consumption of medicines. The presence of major pharmaceutical companies and extensive healthcare infrastructure supports robust demand for oral solid dosage forms. Additionally, regulatory frameworks and reimbursement policies encourage innovation and market growth. The U.S. dominates this region, benefiting from advanced R&D and a high prevalence of chronic diseases requiring oral medications.

Asia Pacific is the fastest-growing region, exhibiting a high CAGR of around 6.7%.

Growth is fueled by increasing pharmaceutical manufacturing capacity, favorable government regulations, and expanding healthcare access across emerging economies such as China and India. The rising middle class, improving healthcare infrastructure, and growing awareness about health contribute significantly to market expansion. This region is also becoming a hub for generic drug production, further accelerating market growth.

Europe maintains a stable market share

Supported by mature demand, especially for modified release formulations and generic oral solid drugs. Countries like Germany, France, and the UK drive growth due to stringent regulatory oversight and increasing adoption of cost-effective generics. The region benefits from a strong healthcare system and ongoing investments in pharmaceutical innovation, though market growth is relatively moderate compared to Asia Pacific.

WORLDWIDE TOP KEY PLAYERS IN THE ORAL SOLID DOSAGE PHARMACEUTICAL MARKET INCLUDE

- Pfizer Inc.

- Novartis AG

- Johnson & Johnson

- Teva Pharmaceuticals

- Merck & Co. Inc.

- AstraZeneca Plc.

- Gilead Sciences

- Bayer AG

- Takeda Pharmaceutical Company Ltd.

- Sun Pharma

- Others

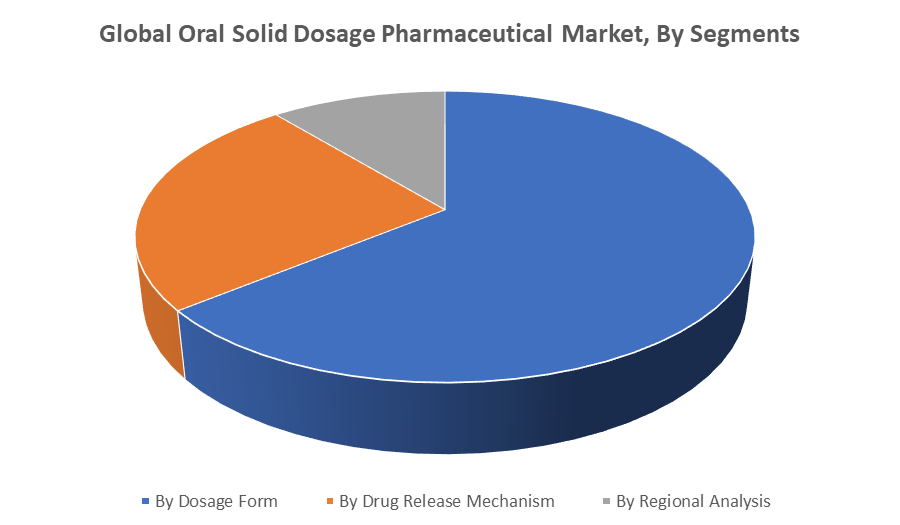

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the oral solid dosage pharmaceutical market based on the below-mentioned segments:

Global Oral Solid Dosage Pharmaceutical Market, By Dosage Form

- Tablets

- Capsules

- Powders & Granules

- Lozenges & Pastilles

Global Oral Solid Dosage Pharmaceutical Market, By Drug Release Mechanism

- Immediate Release

- Extended/Sustained Release

- Delayed/Enteric Release

Global Oral Solid Dosage Pharmaceutical Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 248 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |