Global Organic Deodorant Market

Global Organic Deodorant Market Size, Share, and COVID-19 Impact Analysis, By Type (Roll Ons, Sticks/Creams, Sprays), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2024-2035.

Report Overview

Table of Contents

Organic Deodorant Market Summary

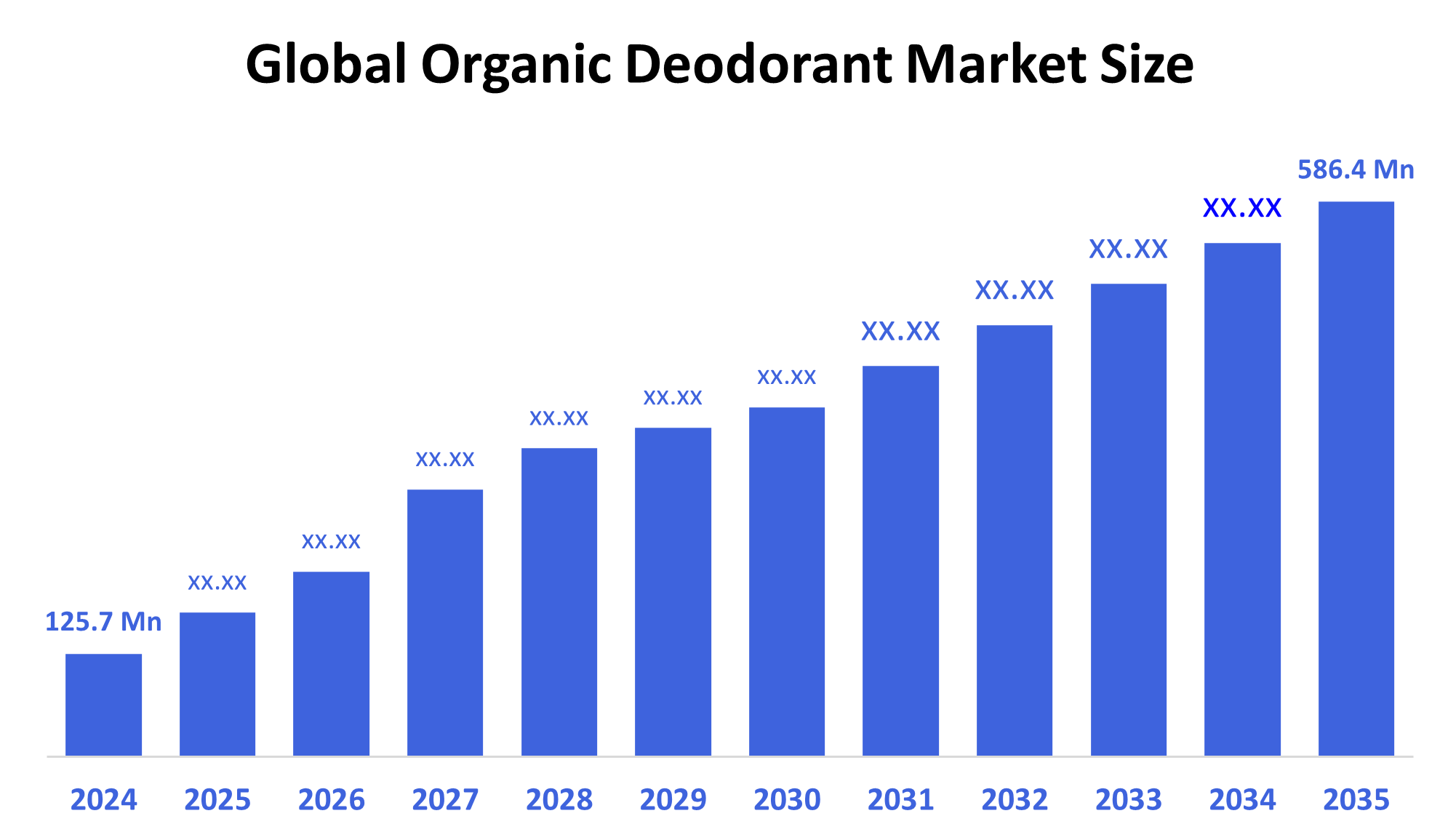

The Global Organic Deodorant Market Size Was Valued at USD 125.7 Million in 2024 and is Projected to Reach USD 586.4 Million by 2035, Growing at a CAGR of 15.03% from 2025 to 2035. Rising consumer awareness of chemical-free products, growing concerns about health and skin sensitivity, demand for eco-friendly and sustainable packaging, growing consumer preference for natural ingredients, and increased availability through retail and online channels are all driving growth in the organic deodorant market.

Key Regional and Segment-Wise Insights

- With a 33.6% revenue share in 2024, the organic deodorant market is dominated by the European region.

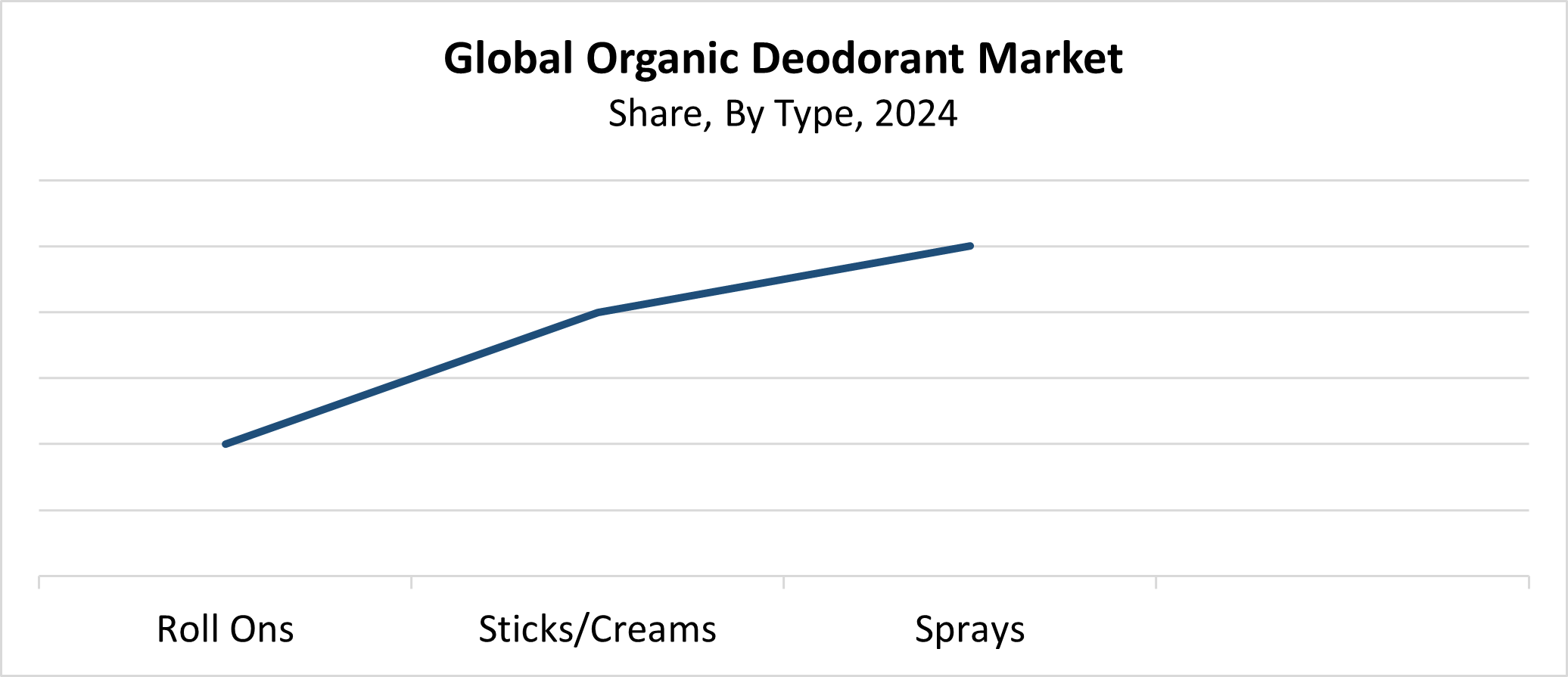

- With the largest revenue share of 47.6% in 2024, the sprays segment led the market by type.

- The supermarkets and hypermarkets segment held the largest revenue share in 2024, dominating the market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 125.7 Million

- 2035 Projected Market Size: USD 586.4 Million

- CAGR (2025-2035): 15.03%

- Europe: Largest market in 2024

The organic deodorant market includes products that use natural materials and exclude aluminum, parabens, synthetic chemicals, and artificial fragrances. These products serve to remove body odor while maintaining both skin and environmental protection. The market expansion accelerates because consumers recognize potential health risks from conventional deodorants, which cause skin problems and hormonal imbalances. The market expansion occurs due to consumers seeking both cruelty-free and clean-label personal care products and adopting environmental sustainability practices. Wellness trends, together with social media influence, have made millennials and Gen Z consumers lead the transition to natural and organic personal care products.

The functionality and attractiveness of natural deodorants have been significantly enhanced through recent technological innovations. New formulations based on plant-based ingredients such as baking soda and shea butter, combined with coconut oil and essential oils, provide extended odor control. The packaging industry has developed recyclable and biodegradable solutions that tackle environmental issues. Government programs that support sustainable product development, along with clean beauty standards and stronger laws on dangerous cosmetic chemicals, motivate manufacturers to implement natural alternatives. The market for organic deodorants experiences positive growth due to favorable policies and increased green innovation investments.

Type Insights

Why Did the Sprays Segment Dominate the Organic Deodorant Market with a 47.6% Revenue Share in 2024?

The sprays segment dominated the organic deodorant market with the largest revenue share of 47.6% in 2024. The market dominance of sprays derives from customer preferences for deodorant products that are light-weight and fast-drying, and user-friendly. Spray deodorants enable quick coverage because they minimize skin contact during application, which makes them more hygienic according to user perception. The market segment has grown because consumers want natural aluminum-free sprays with essential oil scents. The environmental consciousness of consumers has increased their interest in organic spray deodorants because of both recyclable packaging and environmentally friendly aerosol technology. The segment maintains its worldwide market leadership because of its extensive range of spray products, which retailers and online stores carry.

The sticks and creams segment of the organic deodorant market is expected to grow at the fastest CAGR throughout the forecast period. The increasing customer preference for deodorant products that combine portability with long-lasting effects and gentle skin formulas drives this growth. The application control benefits and hydrating components, including shea butter, coconut oil, and natural waxes, make sticks and creams suitable for sensitive skin. People switch to organic stick and cream deodorants because they understand the dangerous ingredients in conventional deodorants. Consumers who care about the environment choose zero-waste and plastic-free packaging solutions, which include glass jars and compostable tubes. The segment's worldwide growth receives additional momentum from its expanding distribution through specialized retail outlets and online sales channels.

Distribution Channel Insights

What Factors Enabled Supermarkets and Hypermarkets to Capture the Highest Revenue Share in the Organic Deodorant Market in 2024?

The supermarket and hypermarket segment held the highest revenue share and dominated the organic deodorant market during 2024. Their widespread adoption stems from the convenience they offer, along with their extensive product selection and easy accessibility to consumers. Customers choose to purchase deodorants and personal care products through physical stores to evaluate brand options and ingredient lists while examining product quality before their purchase decision. The product range of supermarkets and hypermarkets consists of both popular and niche organic deodorant brands, which serve diverse customer needs. The implementation of loyalty programs and incentives, along with in-store promotions, serves as a method to build customer loyalty. The strong position of this segment in the organic deodorant market stems from increasing natural product awareness among consumers and the widespread distribution of retail locations in urban and semi-urban areas.

The organic deodorant market's online segment is expected to grow at the fastest CAGR throughout the forecast period. The rapid expansion of the online market is mainly driven by increasing internet access and smartphone usage, as well as consumer trends toward convenient purchasing methods. Customers can find an expanded selection of organic deodorant brands, which include specialty and foreign products that are not typically available in physical retail stores, through online platforms. Through detailed product information, user feedback, and straightforward price comparisons, online shoppers gain better confidence in their buying decisions. The rising trend of doorstep delivery and subscription services helps boost online sales. Digital marketing efforts combined with social media influence, particularly targeting Gen Z and millennial consumers, are accelerating the worldwide expansion of organic deodorant markets.

Regional Insights

In 2024, Europe dominated the worldwide organic deodorant market with the largest revenue share of 33.6%. The high levels of customer awareness regarding wellness and health, together with the advantages of natural personal care products, enable this leadership position. The European market shows increasing consumer interest in organic deodorants because people want to avoid toxic chemicals in conventional products that cause skin sensitivity. The region's strict environmental and cosmetic safety regulations drive customers toward using organic and sustainable products. Well-known organic beauty brands together with specialized shops, supermarkets, and growing e-commerce platforms support the industry in this region. The combination of rising disposable income and environmentally conscious consumer behavior establishes Europe as a leading global center for organic deodorant market growth.

North America Organic Deodorant Market Trends

The North American organic deodorant market will experience substantial growth in 2024 because of increasing consumer interest in chemical-free and natural personal care items. People are choosing organic deodorants because of increased understanding about conventional product health risks, which include skin problems and toxic chemical exposure. The area achieves success through numerous established organic brands together with newly launched products, which incorporate natural ingredients such as plant-based extracts and essential oils. The growth of e-commerce platforms has expanded the distribution of organic deodorants to younger, health-conscious consumers. The rising environmental issues alongside consumer preference for products that are cruelty-free and sustainable have driven market expansion. The market experiences strong growth because consumers trust organic deodorants more after government regulations and safety standards provide their support.

Asia Pacific Organic Deodorant Market Trends

The Asia Pacific organic deodorant market is expected to grow at a significant CAGR during the forecast period because consumers are becoming more health-conscious. People are shifting their preference to natural deodorants because of rising concerns about synthetic chemicals present in conventional deodorants. The rising middle-class population, together with increasing disposable incomes and rapid urbanization in China, India, and Southeast Asian countries, drives market demand. Social media platforms and e-commerce channels increase both product accessibility and consumer awareness of available products. The market growth receives support from the expanding beauty and personal care industry and rising consumer preferences for products that are cruelty-free and environmentally friendly. Government initiatives supporting sustainability, along with safety measures in the region, help increase the use of organic deodorants.

Key Organic Deodorant Companies:

The following are the leading companies in the organic deodorant market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever

- Lavanila

- Laverana Digital GmbH & Co. KG

- Elsa's Organic Skinfoods

- Alverde

- EO Products

- Weleda

- Buyindusvalley

- Speick Naturkosmetik

- Sebamed

- Others

Recent Developments

- In August 2024, Women's personal care brand Jukebox, which specializes in natural deodorants and handcrafted soaps, formally debuted its goods on Walmart.com and in Walmart stores around the country. This creative company offers a wide range of 14 SKUs with different aroma options in an effort to make personal care routines fun. Jukebox goods, which were created with the modern woman in mind, include deodorants that have undergone extensive testing and are devoid of aluminum, promising long-lasting freshness. These deodorants pair well with the brand's nourishing soaps to provide a whole sensory experience.

- In March 2024, Silab unveiled Deolya, a ground-breaking natural deodorant made from Spiraea ulmaria L. that relieves underarm irritations and combines skincare and hygiene.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the organic deodorant market based on the below-mentioned segments:

Global Organic Deodorant Market, By Type

- Roll Ons

- Sticks/Creams

- Sprays

Global Organic Deodorant Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

Global Organic Deodorant Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |