Global Orphan Disease Biomarkers Market

Global Orphan Disease Biomarkers Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Type (Protein Biomarkers, Genetic Biomarkers, and Metabolic Biomarkers), By Application (Drug Discovery, Diagnostics, and Personalised Medicine), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Orphan Disease Biomarkers Market Summary, Size & Emerging Trends

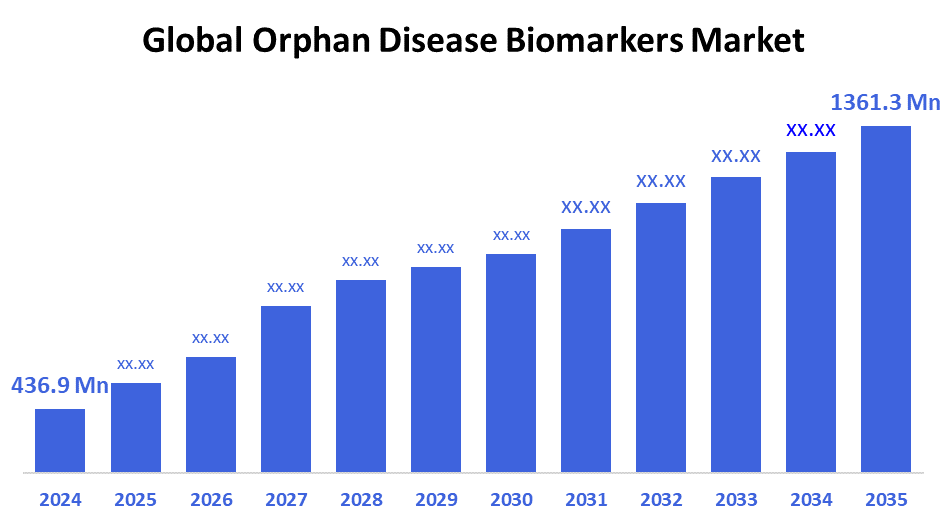

According to Decision Advisor, The Global Orphan Disease Biomarkers Market Size is expected to grow from USD 436.9 Million in 2024 to USD 1361.3 Million by 2035, at a CAGR of 10.88% during the forecast period 2025-2035. The increasing focus on rare disease diagnostics, growing funding for orphan drug research, and demand for personalized therapies are primary growth drivers for the orphan disease biomarkers market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the orphan disease biomarkers market during the forecast period.

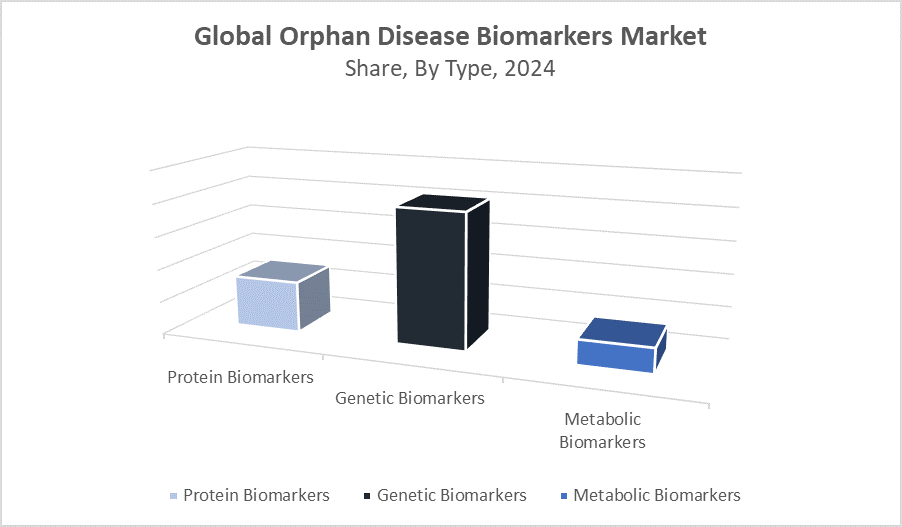

- By type, the genetic biomarkers segment dominated revenue generation in 2024 and is expected to continue its lead.

- By application, the diagnostics segment held the highest revenue share globally in 2024 due to rising early detection efforts.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 436.9 Million

- 2035 Projected Market Size: USD 1361.3 Million

- CAGR (2025-2035): 10.88%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Orphan Disease Biomarkers Market

The orphan disease biomarkers market focuses on identifying and utilizing specific biological indicators to detect and monitor rare diseases. These biomarkers play a critical role in enabling early diagnosis, tracking disease progression, and developing targeted therapies. With over 7,000 known rare diseases affecting more than 400 million people globally, the demand for effective diagnostic tools and treatment strategies has never been higher. Governments and private organizations are increasing investments in orphan drug development, driving research into biomarker identification. Biomarkers also offer pharmaceutical companies a way to streamline clinical trials by stratifying patient groups, thus accelerating drug approvals. The integration of AI and bioinformatics is enhancing biomarker discovery, improving accuracy and reducing costs. As precision medicine gains momentum, especially in rare diseases, the orphan disease biomarkers market is poised for accelerated growth throughout the next decade.

Orphan Disease Biomarkers Market Trends

- Rising use of AI and machine learning in biomarker discovery to improve diagnostics and clinical trial efficiency.

- Growing collaborations between biotech firms and academic institutions for orphan biomarker research.

- Expansion of biobanking infrastructure globally to support biomarker validation and sample collection.

Orphan Disease Biomarkers Market Dynamics

Driving Factors: Rising prevalence of rare diseases worldwide

The orphan disease biomarkers market is propelled by the rising prevalence of rare diseases worldwide. Increased focus on biomarker-driven drug discovery enables the development of targeted therapies, enhancing treatment effectiveness. Personalized medicine applications are expanding rapidly, driving demand for precise biomarkers. Government regulations supporting rare disease research, alongside substantial funding, further accelerate growth. Technological advances in biomarker identification improve diagnostic accuracy and speed, facilitating early detection and better patient outcomes, thus fostering sustained market expansion.

Restraint Factors: High costs associated with biomarker research

High costs associated with biomarker research and development pose significant barriers, especially for rare diseases with limited patient populations, making clinical validation challenging. Regulatory pathways are often stringent and complex, delaying product approvals. Furthermore, the lack of standardized validation protocols across regions creates inconsistencies. Data privacy concerns, particularly with genetic information, also restrict data sharing and collaboration. These factors combined hamper widespread adoption and slow the overall growth trajectory of the orphan disease biomarkers market.

Opportunity: Emerging technologies like artificial intelligence (AI) and machine learning (ML)

Emerging technologies like artificial intelligence (AI) and machine learning (ML) offer promising avenues to streamline biomarker discovery and data interpretation, significantly accelerating research timelines. Expanding clinical applications in diagnostics and therapeutics create growing demand for specialized biomarkers. Increasing investments in rare disease research worldwide, coupled with the development of healthcare infrastructure in emerging economies, open new markets. These trends collectively present vast growth opportunities for companies innovating within the orphan disease biomarkers sector.

Challenges: Regulatory frameworks vary significantly across countries

The complex biology of orphan diseases makes biomarker discovery and validation difficult, requiring sophisticated research approaches. Recruiting sufficient patients for clinical trials is challenging due to the rarity of these conditions, limiting data availability. Regulatory frameworks vary significantly across countries, causing fragmented approval processes and delays. Additionally, reimbursement policies for biomarker tests are often unclear or restrictive. Limited awareness among healthcare professionals about rare disease biomarkers further hinders adoption, creating barriers to market growth and patient access.

Global Orphan Disease Biomarkers Market Ecosystem Analysis

The market ecosystem comprises raw material suppliers (biotech reagents and sequencing kits), biomarker discovery firms, contract research organizations (CROs), pharmaceutical and biotech companies, and end-users such as diagnostic laboratories and healthcare providers. Key players focus on innovation, strategic partnerships, and expanding biomarker portfolios to meet increasing demand. Regulatory agencies enforce standards to ensure biomarker efficacy and safety, fostering trust and market credibility.

Global Orphan Disease Biomarkers Market, By Type

Why did genetic biomarkers hold a dominant position in the market with approximately 45% share?

Genetic biomarkers dominate the market with a share of around 45% due to their ability to provide precise information about hereditary factors, disease predisposition, and patient-specific genetic variations. Advances in genomic technologies, such as next-generation sequencing, have improved the accuracy and cost-effectiveness of genetic testing, making genetic biomarkers a critical tool in personalized medicine and targeted therapies. These factors collectively contribute to their strong market position and widespread adoption.

What factors enabled protein biomarkers to hold approximately 40% of the orphan disease biomarkers market share?

Protein biomarkers hold approximately 40% of the orphan disease biomarkers market share due to their high specificity and sensitivity in detecting disease states, their critical role in early diagnosis and personalized treatment, and advancements in proteomic technologies that have enhanced their identification and validation. These factors collectively provide protein biomarkers with a competitive edge over other biomarker types, making them the preferred choice in orphan disease research and market applications.

Global Orphan Disease Biomarkers Market, By Application

How did the drug discovery segment gain a competitive edge to capture approximately 50% of the orphan disease biomarkers market?

The drug discovery segment holds about 50% of the orphan disease biomarkers market share due to its critical role in identifying novel biomarkers that enable the development of targeted therapies. Increased investment in research and development, the rising need for precision medicine in rare diseases, and advancements in biomarker technologies have positioned drug discovery as a leading segment. These factors contribute to its dominant market share and ongoing growth.

What made the diagnostics segment the top choice in the market with approximately 40% share?

The diagnostics segment accounts for approximately 40% of the market share due to its essential role in early disease detection, accurate monitoring, and guiding treatment decisions. Technological advancements in diagnostic tools, growing awareness about the importance of timely diagnosis, and increasing demand for non-invasive and rapid testing methods have driven the growth of this segment. These factors collectively contribute to its significant market share and preference in the healthcare sector.

Asia Pacific is projected to hold the largest market share, estimated at around 45%, driven by rising healthcare expenditure and rapid expansion of the biotech industry. Countries like China, India, and Japan are investing heavily in rare disease research, supported by favorable government initiatives and policies. Growing awareness and improved healthcare infrastructure further contribute to market growth. The region’s large patient population and increasing access to advanced diagnostics and personalized medicine make Asia Pacific a key market for orphan disease biomarkers.

India is emerging as a significant market within Asia Pacific, with a projected CAGR of around 11% driven by increasing healthcare investments and government support for rare disease research. Rapid industrialization and expanding biotech capabilities in metropolitan hubs like Bengaluru and Hyderabad are fueling growth. The country’s large genetic diversity makes it a vital region for biomarker discovery. Moreover, rising awareness and improved diagnostic facilities in urban and semi-urban areas enhance adoption of orphan disease biomarkers across healthcare sectors.

North America is expected to witness the fastest growth, with a CAGR higher than other regions, fueled by substantial R&D investments and a well-established healthcare infrastructure. The presence of leading biotech and pharmaceutical companies accelerates innovation in biomarker research and orphan drug development. Strong regulatory support and access to advanced technologies enhance market adoption. Additionally, increased funding for rare disease research and awareness campaigns contribute to rapid market expansion in the United States and Canada.

The United States is a dominant player in the North American orphan disease biomarkers market, accounting for a substantial share due to its advanced healthcare system and robust R&D ecosystem. Major biotech and pharmaceutical firms headquartered in the U.S. invest heavily in biomarker-driven orphan drug development. Strong regulatory frameworks, extensive clinical trial networks, and substantial government funding for rare disease research support rapid innovation. Additionally, growing patient advocacy and personalized medicine adoption accelerate market growth.

WORLDWIDE TOP KEY PLAYERS IN THE ORPHAN DISEASE BIOMARKERS MARKET INCLUDE

- Thermo Fisher Scientific

- Roche Diagnostics

- QIAGEN N.V.

- Bio-Rad Laboratories, Inc.

- Novartis AG

- Illumina, Inc.

- Abbott Laboratories

- Agilent Technologies

- BioMérieux

- Siemens Healthineers

- Others

Product Launches in Orphan Disease Biomarkers Market

- In March 2024, Illumina introduced a cutting-edge next-generation sequencing (NGS) panel tailored specifically for rare genetic disorders. This innovative product enhances early diagnosis by providing highly accurate and comprehensive genetic profiling. The new panel supports faster identification of disease-causing mutations, enabling timely and targeted interventions. Illumina’s launch strengthens its position in the orphan disease biomarkers market and addresses the growing demand for advanced diagnostic tools in rare disease research and personalized medicine.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the orphan disease biomarkers market based on the below-mentioned segments:

Global Orphan Disease Biomarkers Market, By Type

- Protein Biomarkers

- Genetic Biomarkers

- Metabolic Biomarkers

Global Orphan Disease Biomarkers Market, By Application

- Drug Discovery

- Diagnostics

- Personalized Medicine

Global Orphan Disease Biomarkers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Which startups are disrupting the Orphan Disease Biomarkers Market?

A: Emerging startups in the rare disease biomarker space are focusing on AI-powered discovery platforms, personalized genomics, and data-driven diagnostics, though the market remains dominated by established biotech and diagnostics firms.

Q: Can you provide company profiles for the leading Orphan Disease Biomarkers manufacturers?

A: Yes. For example, Illumina specializes in genomic sequencing tools and recently launched an NGS panel tailored for rare diseases. Thermo Fisher Scientific offers a broad portfolio of proteomic and genomic solutions used in biomarker research and diagnostics.

Q: What are the main drivers of growth in the Orphan Disease Biomarkers Market?

A: Key growth drivers include the rising prevalence of rare diseases, growing investments in orphan drug R&D, demand for personalized medicine, and technological advances in biomarker discovery using AI and machine learning.

Q: What challenges are limiting the adoption of Orphan Disease Biomarkers?

A: High R&D costs, limited patient populations, complex regulatory pathways, and lack of standardized validation protocols are major challenges hindering wider adoption.

Q: Which regulations are affecting this market?

A: Regulatory frameworks from agencies such as the FDA, EMA, and other national health bodies govern biomarker validation, patient data protection, and clinical trial standards, directly impacting market approvals and timelines.

Q: Which application segment is expected to grow the fastest over the next 10 years?

A: The drug discovery segment is expected to record the fastest growth due to increased demand for targeted therapies and precision medicine in the rare disease space.

Q: Which industries are adopting Orphan Disease Biomarkers most extensively?

A: Biotechnology companies, pharmaceutical manufacturers, diagnostic laboratories, and academic research institutions are the primary adopters of orphan disease biomarkers.

Q: How do Asia-Pacific and North America compare in terms of market growth?

A: Asia-Pacific holds the largest share due to increased government support and biotech expansion, while North America is expected to grow the fastest, driven by strong R&D investment and innovation.

Q: What are the latest trends in the Orphan Disease Biomarkers Market?

A: Emerging trends include the integration of AI and ML in biomarker discovery, increased biobanking capabilities, and stronger collaborations between biotech firms and academic institutions.

Q: What are the top investment opportunities in the Global Orphan Disease Biomarkers Market?

A: Attractive opportunities lie in AI-enabled discovery platforms, next-gen sequencing tools for rare diseases, and expanding diagnostic infrastructure in emerging economies.

Q: What is the long-term outlook (2025–2035) for the Orphan Disease Biomarkers Market?

A: The market is expected to experience sustained growth through 2035, driven by advances in precision medicine, increased awareness of rare diseases, and continuous innovation in diagnostic and therapeutic biomarker technologies.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |