Global Orthopedic Contract Manufacturing Market

Global Orthopedic Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Type (Implants, Instruments, Cases, Trays), By Service (Forging/Casting, Hip Machining & Finishing, Knee Machining & Finishing, Spine & Trauma, Instrument Machining & Finishing, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Orthopedic Contract Manufacturing Market Summary

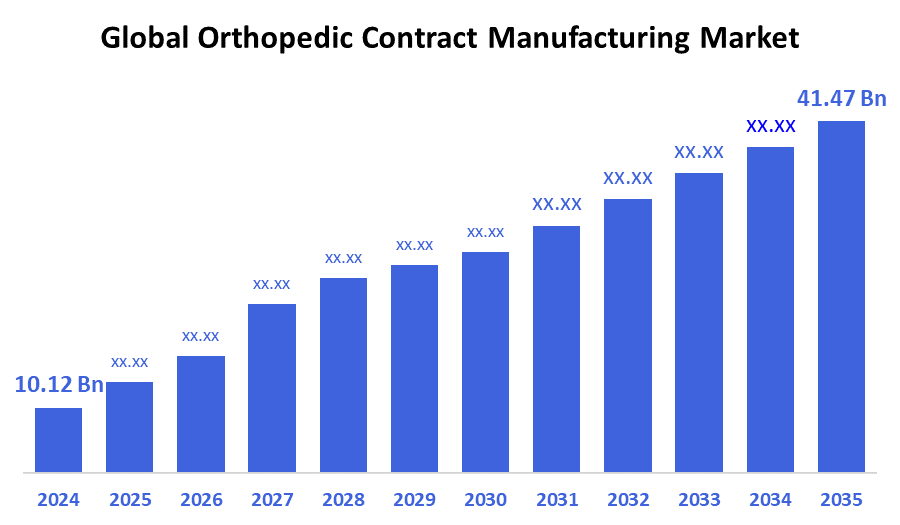

The Global Orthopedic Contract Manufacturing Market Size Was Estimated at USD 10.12 Billion in 2024 and is Projected to Reach USD 41.47 Billion by 2035, Growing at a CAGR of 13.68% from 2025 to 2035. The market for orthopedic contract manufacturing is expanding due to the growing prevalence of orthopedic illnesses, the aging of the world's population, and the growing need for individualized and less invasive orthopedic procedures and equipment.

Key Regional and Segment Wise Insights

- In 2024, the orthopedic contract manufacturing market in the Asia Pacific accounted for 44.18% and led the global market.

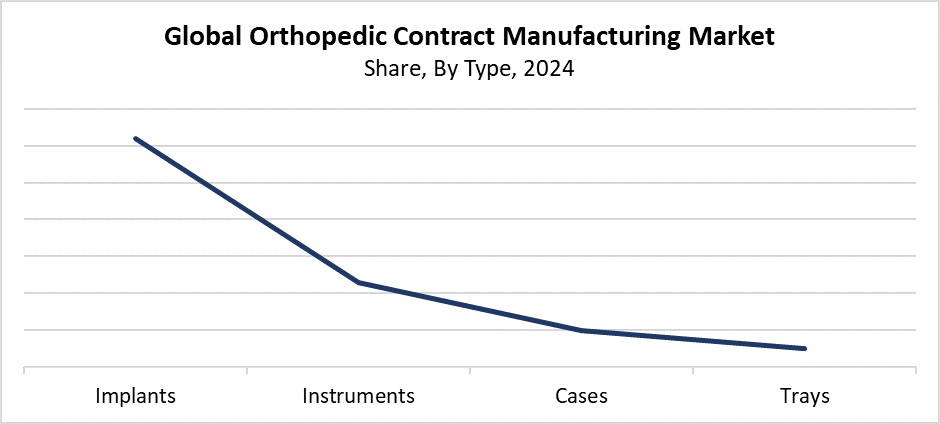

- In 2024, the implants segment had the largest market share by type, accounting for 62.36%.

- In 2024, the forging/casting segment had the largest market share based on services.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 10.12 Billion

- 2035 Projected Market Size: USD 41.47 Billion

- CAGR (2025-2035): 13.68%

- Asia Pacific: Largest market in 2024

The orthopedic contract manufacturing market functions through specialized third-party manufacturers who produce orthopedic products, including implants, prosthetics, and surgical instruments. The market provides affordable, superior production solutions that allow orthopedic businesses to focus their efforts on research, development, and marketing activities. The growing awareness about musculoskeletal health, together with population aging and rising sports injury rates, creates a rising demand for orthopedic disorder treatment. Major factors that spur the worldwide market growth include production cost reduction and operational efficiency improvement alongside advanced orthopedic implant requirements. Contract manufacturing services experience growth because of the expanding healthcare sector, specifically within emerging and developing countries.

The orthopedic contract manufacturing market receives substantial influence from technological progress, which produces automation alongside additive manufacturing and 3D printing to improve precision and customization, together with production efficiency. Smart implants paired with biocompatible materials are gaining rising acceptance in medical applications. Healthcare infrastructure development, along with strict quality controls and medical device manufacturing support through government programs, drives contract manufacturing forward. These elements combine to advance market growth through their impact on product excellence, reduced market entry duration, and expanded production capabilities for orthopedic businesses worldwide.

Type Insights

What Factors Enabled the Implants Segment to Capture a 62.36% Revenue Share in the Orthopedic Contract Manufacturing Market in 2024?

In 2024, the implants segment led the orthopedic contract manufacturing market with the largest revenue share of 62.36%. The market dominance stems from rising orthopedic implant requirements, including spinal implants, joint replacements, and trauma fixation devices, due to population aging and increasing musculoskeletal disease rates. Orthopedic companies send their manufacturing work to specialized contract manufacturers who possess advanced technology capabilities because implant production demands both complex and precise operations. The implant market expands through increased adoption of biocompatible customized implants alongside growing research and development investments. The segment maintains its market supremacy through its ability to deliver cost-effective, high-quality production services that meet rigorous regulatory standards.

During the forecast period, the orthopedic contract manufacturing market's instruments segment is anticipated to experience substantial growth. The expanding demand for innovative surgical instruments, including robotic and minimally invasive procedures in orthopedics, drives this market growth. Modern orthopedic surgeries require precise instruments, which makes manufacturers turn to specialized contract manufacturers who possess advanced technology to produce superior products. The demand for surgical instruments continues to rise because healthcare facilities receive more investment while orthopedic surgical centers expand globally. The instruments segment of orthopedic contract manufacturing experiences rapid expansion because of technological advancements that include both durable lightweight materials and stringent regulatory requirements.

Services Insights

How Did the Forging/Casting Segment Dominate the Orthopedic Contract Manufacturing Market in 2024?

The forging/casting segment led the orthopedic contract manufacturing market, accounting for the highest revenue share. The essential importance of forging and casting procedures in manufacturing enduring high-strength orthopedic implants, together with components, drives this market leadership. These manufacturing techniques serve as essential methods to create complex shapes together with distinctive designs, which spinal implants, trauma devices, and joint replacements require. Precise forging and casting services delivered by contract manufacturers guarantee the exceptional mechanical properties along with biocompatible characteristics of orthopedic devices. The requirement for scalable and cost-effective production solutions drives orthopedic businesses to outsource these specialized manufacturing services. The market leadership of this segment continues to grow because of both technological advancements in forging and casting and rigorous quality control standards.

Over the course of the forecast period, the orthopedic contract manufacturing market's spine and trauma category is anticipated to expand at the fastest CAGR. The rapid expansion of this market stems from both rising spinal disease incidents worldwide and increasing requirements for advanced spinal implants, along with trauma fixation devices. The market for specialized manufacturing services grows because of advances in minimally invasive surgical procedures and customized implant manufacturing. The healthcare industry investments, together with worldwide trauma care facility development, also drive market demand. Contract manufacturers proving regulatory compliance and expertise in developing complex spine and trauma devices will secure success in this growing market segment.

Regional Insights

The Asia Pacific region led the global orthopedic contract manufacturing market by holding a 43.52% revenue share in 2024. The region's market leadership stems from its expanding healthcare facilities, together with growing medical device production investments and the increasing number of orthopedic conditions linked to population aging and lifestyle transitions. The rising demand for tools and implants stems from the substantial increase in orthopedic procedures across China, India, and Japan. The affordable manufacturing capabilities within this region enable international orthopedic companies to outsource production through contracts with Asia Pacific manufacturers. Market growth stems from supportive regulatory frameworks together with expanding medical tourism and government initiatives to promote healthcare development. The combination of these factors establishes Asia Pacific as a key orthopedic contract manufacturing hub, which will continue to grow throughout the forecast period.

North America Orthopedic Contract Manufacturing Market Trends

The North American orthopedic contract manufacturing market is anticipated to grow at a substantial CAGR because of increasing demand for advanced orthopedic devices and higher healthcare expenditures during the projected period. High orthopedic treatment numbers, together with important medical device manufacturers in the area, create a strong demand for reliable manufacturing partners. The growing adoption of robotic technology and 3D printing, alongside minimally invasive surgical tools, has driven businesses to work with specialized manufacturers for complex production methods. The production of orthopedic devices in North America thrives because the region maintains strict regulatory rules while prioritizing quality standards and compliance measures.

Europe Orthopedic Contract Manufacturing Market Trends

The European orthopedic contract manufacturing market shows steady growth because of its strong medical device industry and aging population, along with increasing orthopedic disease rates. Numerous orthopedic companies turn to specialized production partners because they need to maintain high-quality standards and cost-efficiency while following strict EU compliance rules for premium implants and surgical tools. The region's production facilities advance through technological enhancements, which include biocompatible materials together with additive manufacturing and precision machining. Market growth benefits from the combination of leading contract manufacturers operating in the area and increasing orthopedic treatment numbers and public investment in healthcare innovation. Europe maintains its position as a key global player in orthopedic contract manufacturing because of rising interest in advanced and minimally invasive orthopedic procedures.

Key Orthopedic Contract Manufacturing Companies:

The following are the leading companies in the orthopedic contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Tecomet, Inc

- Norman Noble, Inc.

- Paragon Medical

- Orchid Orthopedic Solutions

- LISI Medical

- Viant

- Avalign Technologies

- Cretex companies

- ARCH Medical Solutions Corp.

- Autocam Medical

- Others

Recent Developments

- In July 2025, the completion of Medin Technologies' acquisition was mentioned by Straits Orthopaedics. With locations in Totowa, New Jersey, and Manchester, New Hampshire, Medin is a U.S.-based company that manufactures sterilization cases and trays for the orthopedic industry.

- In March 2025, Jabil announced intentions to open its second location in India, a new manufacturing facility in Gujarat. The MoU, which was signed in November 2024 with the intention of investigating long-term goals, prospective opportunities, and regional assistance within Gujarat, was followed by this expansion. Serving industries like automotive, consumer electronics, medtech, and pharmaceuticals, Jabil has more than 100 sites across the globe, with its headquarters located in St. Petersburg, Florida. Orthopedics, surgical instruments, robotics, in-vitro diagnostics, chronic disease management products, including insulin pumps, and autoinjectors for GLP-1 therapies are all included in its portfolio of medical devices.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the orthopedic contract manufacturing market based on the below-mentioned segments:

Global Orthopedic Contract Manufacturing Market, By Type

- Implants

- Instruments

- Cases

- Trays

Global Orthopedic Contract Manufacturing Market, By Service

- Forging/Casting

- Hip Machining & Finishing

- Knee Machining & Finishing

- Spine & Trauma

- Instrument Machining & Finishing

- Others

Global Orthopedic Contract Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |