Global Orthopedic Imaging Equipment Market

Global Orthopedic Imaging Equipment Market Size, Share, and COVID-19 Impact Analysis, By Modality (X-ray, CT, MRI, Ultrasound, Nuclear Imaging), By End-use (Hospitals, Diagnostic Imaging Centers, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Orthopedic Imaging Equipment Market Summary

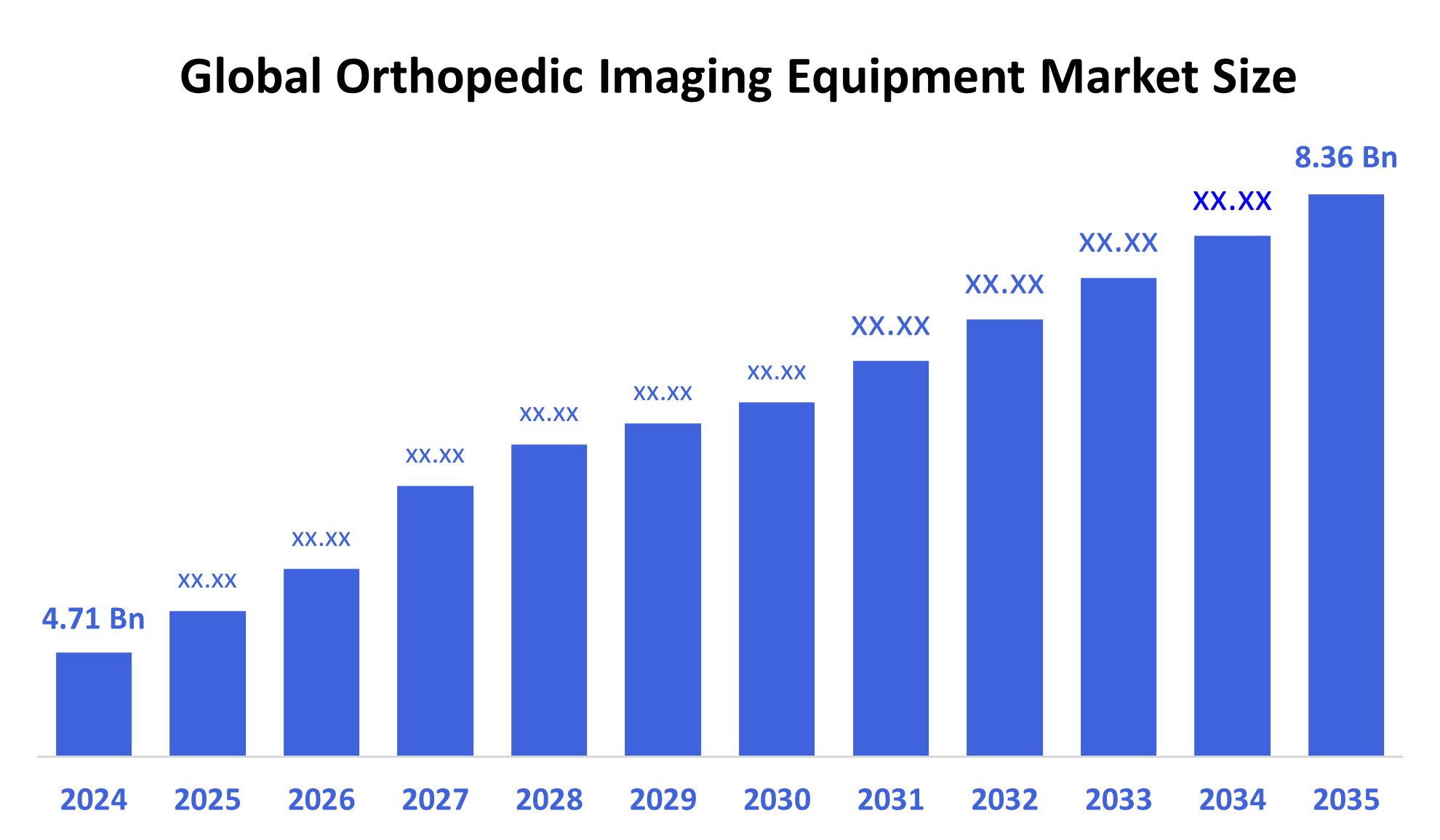

The Global Orthopedic Imaging Equipment Market Size Was Estimated at USD 4.71 Billion in 2024 and is Projected to Reach USD 8.36 Billion by 2035, Growing at a CAGR of 5.35% from 2025 to 2035. The market for orthopedic imaging equipment is expanding due to the rise in musculoskeletal conditions, the increase in orthopedic procedures, the development of new imaging modalities, the aging population, and the growing need for precise diagnosis and minimally invasive treatments, all of which encourage the use of sophisticated imaging equipment.

Key Regional and Segment-Wise Insights

- In 2024, the orthopedic imaging equipment market in North America had the largest revenue share, accounting for 33.7%.

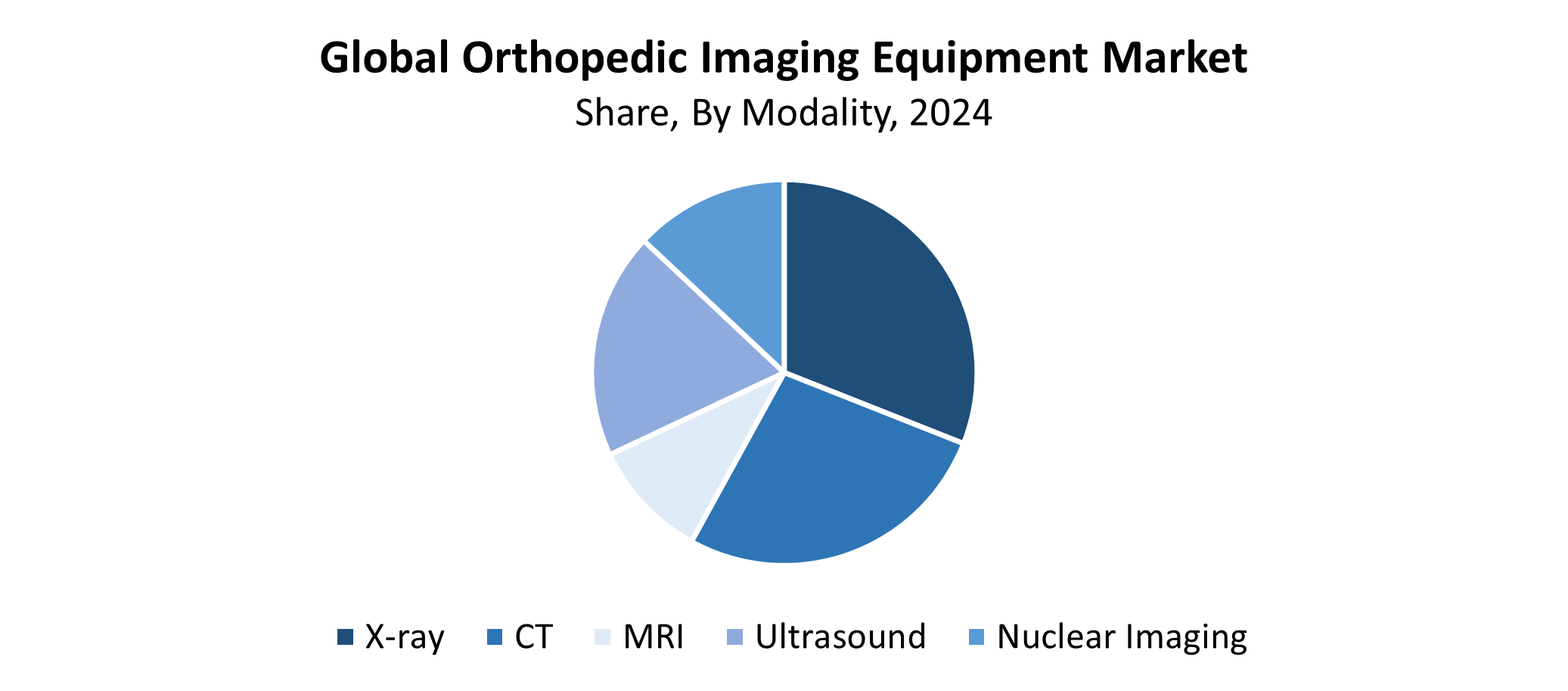

- In 2024, the X-ray segment had the largest market share, accounting for 31.75% and led the market by modality.

- In 2024, the hospitals segment dominated the market by holding the largest revenue share of 45.42% by end-use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.71 Billion

- 2035 Projected Market Size: USD 8.36 Billion

- CAGR (2025-2035): 5.35%

- North America: Largest market in 2024

The orthopedic imaging equipment market includes devices together with technologies that serve to observe bones together with joints, and musculoskeletal structures for diagnosis and treatment purposes. The imaging technologies, including fluoroscopy together with MRI and CT scans and ultrasound, and X-rays, enable precise diagnosis of cancers, arthritis, fractures, and other bone-related conditions. The main driving forces behind market growth include increasing musculoskeletal disorder cases, rising orthopedic surgeries, and an aging population susceptible to bone diseases and more sports-related injuries. Medical professionals adopt advanced imaging technology because they need exact diagnostic tools and minimally invasive treatment methods.

The market expands significantly through technological advancements that include 3D imaging together with portable electronics and AI integration, and improved picture resolution, which enhances both procedural outcomes and diagnostic precision. The market incorporates low-dose radiation technology to solve various safety concerns. Government initiatives, along with investment programs that focus on musculoskeletal disorder early detection and healthcare facility improvements, help expand the market. The worldwide orthopedic imaging equipment market shows growth due to supportive regulations and increasing healthcare funding in developing countries.

Modality Insights

The X-ray segment held the largest market share of 31.75% in 2024 and led the orthopedic imaging equipment market. The widespread adoption of X-ray technology as the primary diagnostic tool for detecting bone fractures, joint dislocations, and other musculoskeletal disorders contributes to this market dominance. The healthcare system heavily depends on X-ray systems for orthopedic diagnostics since these devices offer affordable pricing and quick imaging results, along with widespread availability. Digital X-ray technology advancements, including superior image quality and reduced radiation exposure, have driven the increased adoption of these systems. The market dominance of X-rays stems from its ability to operate effectively in both hospital-based and outpatient medical environments. The X-ray market leads orthopedic imaging modalities because it offers affordable pricing combined with effective performance and ongoing technical progress.

The orthopedic imaging equipment market's CT segment is expected to grow at the fastest CAGR during the forecast period. The rapid growth of CT imaging stems from its advanced ability to generate precise cross-sectional images, which enable accurate diagnoses of joint disorders and bone malignancies, together with complex fractures. Technological progress has led to superior CT imaging quality, together with enhanced patient safety through faster scanning procedures and improved resolution, and reduced radiation exposure. The demand for CT continues to grow due to its expanding use in surgical planning procedures and postoperative assessments. The expanding healthcare infrastructure in developing countries, alongside rising provider understanding of CT benefits, drives this category's strong development path.

End-use Insights

The hospitals segment led the orthopedic imaging equipment market by holding 45.42% revenue share during 2024. Hospitals represent the primary end users of orthopedic imaging equipment because they manage complex musculoskeletal cases and serve large patient populations with comprehensive healthcare services. Hospitals utilize advanced imaging technology alongside expert medical personnel to deliver precise diagnoses and successful treatment of orthopedic disorders. Hospitals dedicate substantial funding to modern imaging equipment, which supports multiple procedures, including orthopedic surgeries, along with rehabilitation and trauma care. The market leader status of this sector receives additional support from the increasing number of orthopedic procedures in hospitals, along with their focus on precise diagnostics. The worldwide demand for orthopedic imaging equipment remains concentrated in hospitals, which serve as primary medical centers.

During the forecast period, the diagnostic imaging centers segment of the orthopedic imaging equipment market will experience significant growth. The market growth stems from the rising requirement for specialized imaging services, which are available at lower costs outside traditional hospital settings. Diagnostic imaging clinics experience patient growth because they deliver fast and accessible, and cost-effective orthopedic imaging services for patients, including those who need basic scans and additional evaluations. Modern technology advancements, such as digital and portable imaging equipment, have enabled these clinics to deliver superior diagnostic services. The rising patient awareness about early diagnosis, coupled with outpatient service convenience, fuels market expansion in diagnostic imaging centers and drives increased demand for these services.

Regional Insights

The North American orthopedic imaging equipment market held the largest revenue share of 33.7% during 2024 and dominated the worldwide market. The region maintains its leadership position because of advanced medical facilities, together with high usage rates of advanced imaging systems and substantial financial commitments towards orthopedic, diagnostic, and therapeutic care. The growing elderly population, together with expanding orthopedic medical procedures and musculoskeletal disease prevalence, drives market demand. Market expansion occurs through strong government backing, together with favorable reimbursement policies and continuous imaging technology development. North America's leadership position as a worldwide market leader is established through its substantial market players and research institutions, which accelerate the implementation of advanced orthopedic imaging solutions.

Europe Orthopedic Imaging Equipment Market Trends

The European orthopedic imaging equipment market held a substantial market share in 2024 because of its steady regional growth. The main drivers behind this expansion include Europe's aging population, increasing musculoskeletal disorder cases, and rising understanding of early diagnosis benefits and minimally invasive orthopedic treatments. Modern imaging devices, such as MRI, CT, and digital X-ray systems, receive support from Europe's established healthcare infrastructure and its focus on state-of-the-art medical technologies. Government initiatives that promote medical innovation alongside funding for musculoskeletal research drive market expansion. Europe holds essential importance in the global orthopedic imaging equipment market because it houses key medical device manufacturers and experiences increasing demand for outpatient diagnostic services.

Asia Pacific Orthopedic Imaging Equipment Market Trends

During the forecast period, the Asia Pacific orthopedic imaging equipment market is expected to grow significantly. The rapid increase stems from higher healthcare expenses and growing musculoskeletal disease cases alongside developing medical diagnostic awareness in China, India, and Japan. The rising elderly population, alongside growing orthopedic surgical procedures, creates additional market requirements. The region's rapid growth stems from increased investments by leading market players together with governmental initiatives to enhance medical facilities and better healthcare infrastructure. The technological advancements, along with affordable imaging equipment distribution across cities and rural areas, form an essential growth factor.

Key Orthopedic Imaging Equipment Companies:

The following are the leading companies in the orthopedic imaging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Shimadzu Corporation

- Fujifilm Healthcare Solutions

- Philips Healthcare

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- United Imaging Healthcare Co.

- Canon Medical Systems Corporation

- Esaote

- Carestream Health

- Siemens Healthineers

- Hologic, Inc.

- Others

Recent Developments

- In June 2023, the FDA approved and released Sonic DL, a deep learning-based technology from GE HealthCare that greatly speeds up picture capture in magnetic resonance imaging (MRI).

- In May 2023, Carestream Health introduced the DRX-Rise Mobile X-ray System, a fully integrated digital X-ray machine that offers clients an affordable way to switch to digital imaging.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the orthopedic imaging equipment market based on the below-mentioned segments:

Global Orthopedic Imaging Equipment Market, By Modality

- X-ray

- CT

- MRI

- Ultrasound

- Nuclear Imaging

Global Orthopedic Imaging Equipment Market, By End Use

- Hospitals

- Diagnostic Imaging Centers

- Others

Global Orthopedic Imaging Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |