Global Ostomy Drainage Bags Market

Global Ostomy Drainage Bags Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Colostomy Bags, Ileostomy Bags, Urostomy Bags, Continent Ileostomy Bags, and Continent Urostomy Bags), By System Type (One-piece System, and Two-piece System), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Global Ostomy Drainage Bags Market Size Insights Forecasts to 2035

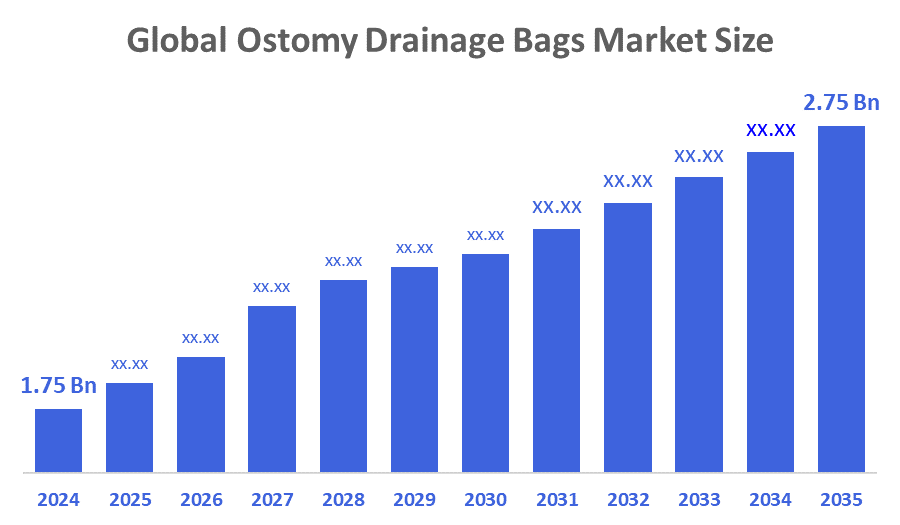

- The Global Ostomy Drainage Bags Market Size Was Estimated at USD 1.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.19 % from 2025 to 2035

- The Worldwide Ostomy Drainage Bags Market Size is Expected to Reach USD 2.75 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

According to a research report published by Decisions Advisors and Consulting, The Global Ostomy Drainage Bags Market Size Was Worth Around USD 1.75 Billion In 2024 And Is Predicted To Grow To Around USD 2.75 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 4.19 % From 2025 To 2035. This increase is a result of various factors, including higher incidences of colorectal cancer and inflammatory bowel diseases, as well as growing global awareness and use of ostomy care products. In the ostomy drainage bags devices market, one can witness a sharper turn towards patient, centric design. Improving the quality of life of those with ostomies is the main target of this trend.

Market Overview

Ostomy drainage bags are a very important medical device that collects waste from biological systems that have been surgically altered. These include colostomy, ileostomy, and urostomy procedures. They are vital to an individual's welfare if living with a stoma. A modern ostomy drainage bag's convenience, comfort, and discretion are significantly more attractive to many ostomates when compared to older versions of ostomy products. Furthermore, the development of breathable, flexible, and odour-controlling bags that are currently on the market has roused demand as well. The worldwide ostomy surgeries market, including colostomies, ileostomies, and urostomies, is growing rapidly, with the main segment of the population being elderlies as most of them suffer from these diseases with their increasing age. Moreover, changes in the design as well as materials of ostomy bags that allow better wear time, comfort, skin protection, and odour control have been of great use to the market. Also, because of the increased awareness of advanced ostomy care and a better quality of life after surgery, the demand for ostomy drainage bags has increased. Moreover, changes in the design as well as materials of ostomy bags that allow better wear time, comfort, skin protection, and odour control have been of great use to the market. Ostomy drainage bags are in high demand mainly due to the rising number of surgeries being done worldwide for various diseases, including colorectal cancer, Crohn's disease, and many other diseases of the gastrointestinal tract.

Report Coverage

This research report categorises the ostomy drainage bags market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ostomy drainage bags market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the ostomy drainage bags market.

Driving Factors

The market for ostomy drainage bag devices is going through a significant change right now. This change is mainly due to technological developments and increased knowledge about ostomy care. The manufacturers are coming up with new products that help users get more comfort and ease. Such a move is mainly due to the increasing number of people who have to undergo ostomy surgeries, which has caused a greater demand for efficient and trustworthy drainage products. Moreover, the focus on patient-centred care is leading the companies to do a lot of research and development so that they can come up with products that perfectly meet the needs of the users. Besides, the market scene is also being shaped by a rising tendency towards using environmentally friendly materials and adopting sustainable practices. As the buyers are getting more aware of the environment, the manufacturers are thinking of biodegradable and recyclable materials for the production of the ostomy bags.

Restraining Factors

Expensive advanced ostomy drainage bags equipped with features such as hydrocolloid barriers and integrated filters still limit access in developing areas. Moreover, their high price means they cannot be afforded by low-income patients and small healthcare facilities, resulting in these institutions having to depend on cheaper alternatives, which are less comfortable and effective in most cases. This monetary impedance not only restricts the equitable availability of the products but also deteriorates recovery and hence the general quality of life of the ostomy patients worldwide.

Market Segmentation

The ostomy drainage bags market share is classified into product type, and system type.

- The colostomy bags segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period.

Based on the product type, the ostomy drainage bags market is divided into colostomy bags, ileostomy bags, urostomy bags, continent ileostomy bags, and continent urostomy bags. Among these, the colostomy bags segment accounted for the largest market share in 2024 and is projected to grow at a substantial CAGR over the forecast period. The segment expansion is driven by a huge number of users and is widely accepted due to its familiarity and effectiveness, colostomy bags. They are provided with the most modern features that facilitate the comfort of the user and make the product very easy to use, thereby having a very strong position in the market. This segment is made up of people who had colostomy surgery and thus have a need for a device to control their waste.

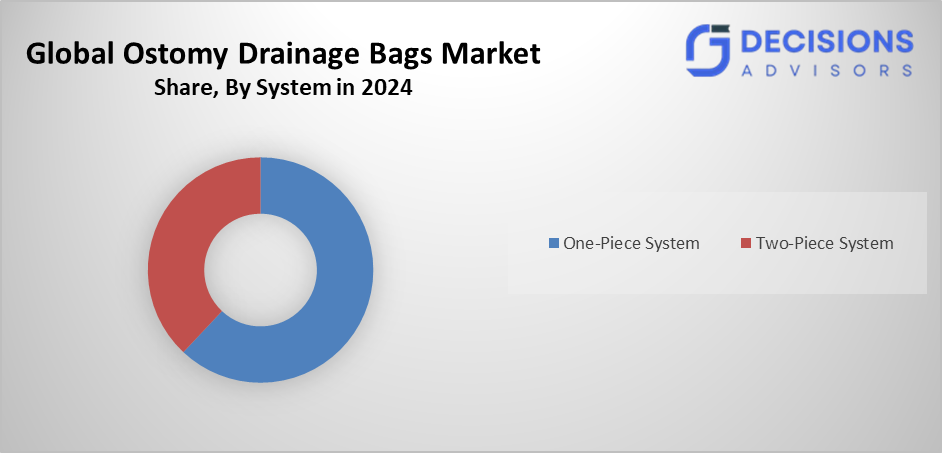

- The one-piece system segment accounted for the highest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period.

Based on the system type, the ostomy drainage bags market is segmented into one-piece system and two-piece system. Among these, the one-piece system segment accounted for the highest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period. The one piece system is mainly known for its single, all, in, one layout which is highly popular because of the system being so easy to use and being very minimalist. Moreover, their changing process and the lower chance of leakage that come with it play a key role in the ostomy drainage bags devices market.

Regional Segment Analysis of the Ostomy Drainage Bags Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the ostomy drainage bags market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the ostomy drainage bags market over the predicted timeframe. The Asia Pacific market for ostomy drainage bags is booming due to the increase in healthcare spending, better awareness of ostomy care, and socioeconomic development, leading to upgraded healthcare facilities.

India and China are prominent among the countries recording the highest demands largely because of their huge populations and the rising occurrence of chronic conditions. In addition, government authorities giving their nod to medical devices are making it easier for the market to be accessed and also promoting innovation. In this part of the world, main players like 3M Company and Cymed are setting up shop to take advantage of the booming market. Today, the competitive scene is changing with big multinational companies and local manufacturers both trying to grab a slice of the market. Moreover, as the area gets more advanced, patient-centric solutions and cutting-edge technologies will likely be the main factors of growth of the ostomy care market.

Europe is expected to grow at a rapid CAGR in the ostomy drainage bags market during the forecast period. The value of Europe's ostomy drainage bags devices market is driven by a broader trend of growing demand for innovative healthcare solutions. Amongst the factors leading to the rise of this market are the ageing of the population, the growing awareness of ostomy care, and the availability of favourable reimbursement policies. Besides, regulatory bodies are encouraging the use of advanced medical devices, which should positively influence market dynamics. Changes are happening in the region, with people-oriented products replacing those that are medically functional but uncomfortable, thus enhancing the patient satisfaction level.

Germany, the United Kingdom, and France are the leading countries in Europe, where the competitive landscape is further strengthened by the presence of established companies such as B. Braun Melsungen AG and Convatec Group PLC. The market is a blend of local and international players, thus facilitating mutual growth and collaboration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ostomy drainage bags market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ALCARE Co., Ltd.

- B. Braun SE

- Coloplast A/S

- Convatec Group PLC

- Flexicare (Group) Limited.

- Goodhealth Inc.

- Hollister Incorporated

- Marlen Manufacturing & Development Company.

- Nu-Hope Laboratories, Inc.

- Pelican Healthcare Limited

- Prowess Care

- Salts Healthcare Ltd.

- Torbot Group, Inc.

- Welland Medical Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Eakin Healthcare unveiled the world’s largest ostomy bag production line at its Cardiff Business Park facility, representing a £9 million investment that will quadruple output and meet rising global demand for its ModaVi brand. This milestone is part of a wider £60 million investment program aimed at modernising and expanding the company’s manufacturing capacity across the UK.

- In February 2024, Convatec launched the Esteem Body™ with Leak Defense™, a new one-piece soft convex ostomy system designed to provide a secure, longer-lasting seal and improved comfort for patients. The product was first introduced in Italy and later rolled out in the United States, addressing growing global demand for advanced ostomy care solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the ostomy drainage bags market based on the below-mentioned segments:

Global Ostomy Drainage Bags Market, By Product Type

- Colostomy Bags

- Ileostomy Bags

- Urostomy Bags

- Continent Ileostomy Bags

- Continent Urostomy Bags

Global Ostomy Drainage Bags Market, By System Type

- One-piece System

- Two-piece System

Global Ostomy Drainage Bags Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

- What is the current market size of global ostomy drainage bags?

The market was valued at USD 1.75 billion in 2024.

- What is the projected market size by 2035?

It is expected to reach USD 2.75 billion by 2035.

- What is the CAGR for the forecast period?

The market is projected to grow at a CAGR of 4.19% from 2025 to 2035.

- Which product type holds the largest market share?

Colostomy bags accounted for the largest share in 2024 and are expected to grow substantially.

- Which system type dominates the market?

The one-piece system held the highest market share in 2024 due to its ease of use and lower leakage risk.

- Which region is expected to grow the fastest?

North America is anticipated to grow the fastest during the forecast period.

- What are the main drivers of market growth?

Rising incidences of colorectal cancer, inflammatory bowel diseases, aging populations, and demand for patient-centric, comfortable designs.

- Who are some key companies in the market?

Major players include Coloplast A/S, Convatec Group PLC, Hollister Incorporated, and B. Braun SE.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 250 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Jan 2026 |

| Access | Download from this page |