Global Overflow Staffing Services Market

Global Overflow Staffing Services Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Deployment Type (Onshore, Nearshore, and Offshore), By Application (IT & Telecom, Healthcare, Retail, and BFSI), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Overflow Staffing Services Market Summary, Size & Emerging Trends

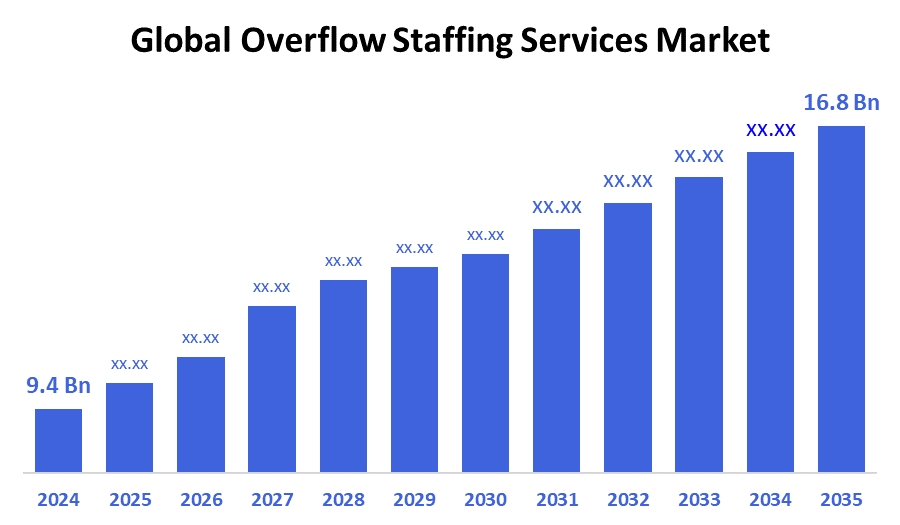

According to Decision Advisors, The Global Overflow Staffing Services Market Size is expected to grow from USD 9.4 Billion in 2024 to USD 16.8 Billion by 2035, at a CAGR of 5.4% during the forecast period 2025-2035. Increasing demand for flexible workforce solutions, especially in IT and healthcare sectors, along with growing adoption of gig and contract staffing models, are key driving factors for the overflow staffing services market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the overflow staffing services market during the forecast period.

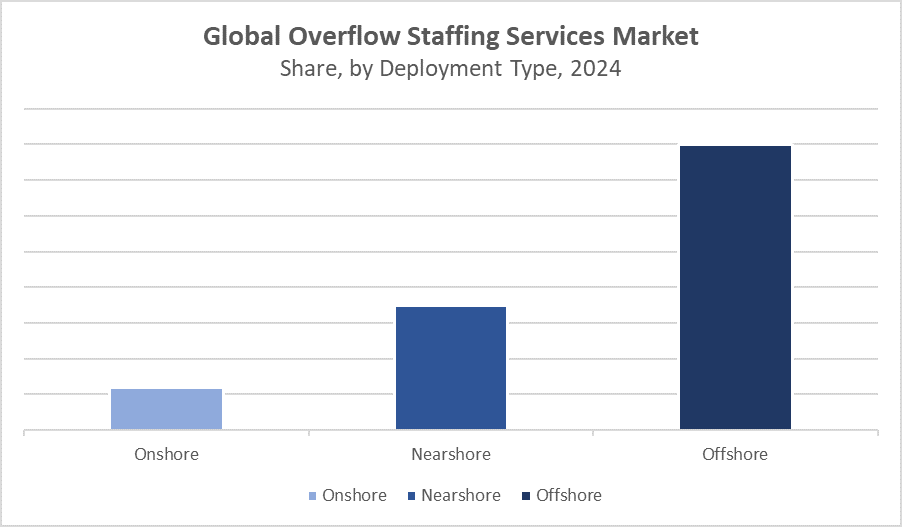

- In terms of deployment type, the offshore segment dominates due to cost advantages and availability of skilled talent pools.

- In terms of application, IT & Telecom segment accounted for the largest revenue share in the global overflow staffing services market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 9.4 Billion

- 2035 Projected Market Size: USD 16.8 Billion

- CAGR (2025-2035): 5.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Overflow Staffing Services Market

The overflow staffing services market focuses on providing flexible workforce solutions to businesses needing temporary or contract-based talent to manage peak workloads or specialized projects. These services are essential in industries such as IT, healthcare, retail, and banking where demand fluctuates seasonally or unpredictably. Overflow staffing allows companies to reduce costs associated with permanent hiring and improve operational agility. Government initiatives promoting flexible employment and digital workforce platforms further support market growth. The shift toward hybrid and remote work models has accelerated adoption, particularly in North America and Asia Pacific, where businesses increasingly rely on technology-driven staffing solutions to meet fluctuating talent demands. As companies worldwide prioritize cost efficiency and scalability, overflow staffing services are positioned to become a critical component of workforce management strategies.

Overflow Staffing Services Market Trends

- Increasing use of AI and automation tools to match talent with demand efficiently.

- Growing popularity of gig economy and freelance platforms supporting overflow staffing.

- Consolidation among staffing providers to offer integrated workforce management solutions.

Overflow Staffing Services Market Dynamics

Driving Factors: The overflow staffing market is driven primarily by increasing demand in sectors such as IT

The overflow staffing market is driven primarily by increasing demand in sectors such as IT, healthcare, and retail, which often experience labor shortages and fluctuating workloads. These industries require flexible staffing solutions to maintain business continuity and reduce operational costs. The COVID-19 pandemic significantly accelerated the adoption of remote work, making contract-based and overflow staffing models more widely accepted worldwide. Governments are also supporting this trend through labor law reforms and initiatives promoting gig work and flexible employment. This combination of evolving workforce needs, pandemic-induced shifts, and regulatory encouragement is fueling robust market growth.

Restrain Factors: Despite strong growth potential, the overflow staffing market faces several challenges that restrain expansion

Despite strong growth potential, the overflow staffing market faces several challenges that restrain expansion. Companies must navigate complex compliance requirements that vary across regions, adding administrative burdens and costs. Data security and confidentiality concerns in outsourced staffing create hesitancy among businesses to fully adopt these models. Additionally, the fluctuating availability of skilled contract workers can limit the ability to meet demand. Economic downturns, corporate hiring freezes, or budget cuts can also reduce demand for overflow staffing services temporarily, impacting the market’s steady growth trajectory.

Opportunity: The overflow staffing market has significant opportunities due to ongoing technological

The overflow staffing market has significant opportunities due to ongoing technological innovations and expanding geographic reach. AI-driven talent platforms are revolutionizing recruitment by efficiently matching skills with job requirements, while blockchain technology offers enhanced security and transparency in workforce management. Emerging markets, with increasing digital adoption and industrial growth, represent untapped potential for staffing service providers. Moreover, the development of sector-specific staffing solutions tailored to unique industry needs, as well as integrated workforce management services combining multiple staffing models, create additional avenues for differentiation, expansion, and long-term growth in the market.

Challenges: Geopolitical tensions disrupt offshore staffing operations

Several challenges threaten the overflow staffing market’s growth prospects. Geopolitical tensions disrupt offshore staffing operations, affecting the supply of skilled talent and increasing costs. Supply chain disruptions, caused by political instability or global crises, also impact the consistent availability of qualified contract workers. Furthermore, the rise of automation technologies, such as Robotic Process Automation (RPA), offers businesses alternative ways to manage workforce needs, potentially reducing reliance on human contract labor. These factors create competitive pressure on staffing firms, requiring continuous innovation and adaptation to sustain market share and profitability.

Global Overflow Staffing Services Market Ecosystem Analysis

The overflow staffing services ecosystem comprises staffing agencies, technology platform providers, end-users from diverse industries, and regulatory bodies. Staffing firms collaborate with software companies offering AI-enabled matching platforms to improve service efficiency. Key industries served include IT & telecom, healthcare, retail, BFSI, and manufacturing. Government policies on labor laws and data protection shape market dynamics. The ecosystem’s growth hinges on the ability to integrate technology, maintain compliance, and respond quickly to fluctuating workforce demands.

Global Overflow Staffing Services Market, By Deployment Type

The offshore segment dominated the overflow staffing services market in terms of revenue during the forecast period. This is primarily due to significant cost advantages offered by offshore locations, such as India, the Philippines, and Eastern Europe, where labor costs are substantially lower. Additionally, offshore staffing provides access to a large, skilled talent pool capable of handling diverse roles. Companies also benefit from time zone differences, enabling 24/7 operations and increased productivity. These factors make offshore staffing highly attractive for businesses looking to optimize costs while maintaining quality, thereby driving its dominant market share.

The nearshore segment is gaining traction in the overflow staffing services market due to its proximity to client locations. Nearshoring offers advantages such as cultural and language similarities, which improve communication and collaboration between clients and staff. Additionally, nearshore staffing reduces travel costs and enables quicker response times compared to offshore models. Businesses are increasingly preferring nearshore solutions for projects that require closer coordination and faster turnaround. This growing preference is helping the nearshore segment expand its market share steadily, positioning it as a strong competitor to traditional offshore staffing in the evolving overflow staffing landscape.

Global Overflow Staffing Services Market, By Application

The IT & Telecom segment accounted for the largest revenue share in the overflow staffing services market, capturing approximately 40% of the market during the forecast period. This dominance is driven by the rapid digital transformation, increasing demand for skilled IT professionals, and the need for flexible workforce solutions to manage project-based and fluctuating workloads. Companies in this sector often face talent shortages and fast-changing technology requirements, making overflow staffing an ideal solution. The segment’s size reflects the critical role of IT & Telecom in modern business operations and their reliance on agile staffing models to maintain competitiveness.

The healthcare segment follows closely behind, accounting for roughly 30% of the overflow staffing services market revenue. Rising demand for temporary and contract nurses, especially driven by healthcare facility expansions and seasonal fluctuations in patient volume, is a key growth factor. The COVID-19 pandemic further accelerated the need for flexible healthcare staffing to address workforce shortages and manage patient surges. Additionally, ongoing healthcare reforms and increased focus on patient care quality are fueling demand for specialized temporary staff, making healthcare a rapidly growing and significant segment in the overflow staffing market.

Asia Pacific is expected to account for the largest share of the overflow staffing services market during the forecast period, holding approximately 38% of the global market revenue.

This dominance is driven by the region’s vast and cost-effective labor pool, rapid growth of business process outsourcing (BPO) and shared services centers, and rising demand for overflow staffing in countries such as India, the Philippines, and China. India, in particular, is experiencing significant growth with a projected CAGR of around 11.2%, fueled by its expanding IT services sector, healthcare infrastructure development, and increasing adoption of gig-based staffing solutions. Key metropolitan hubs like Bangalore, Hyderabad, and Chennai are emerging as important centers for overflow staffing activities supporting both domestic and international clients.

North America is anticipated to register the fastest growth rate in the overflow staffing services market during the forecast period, with an estimated CAGR of approximately 5.8%.

This growth is primarily driven by the widespread shift toward remote and hybrid work models following the COVID-19 pandemic, coupled with high demand for flexible, on-demand talent in sectors such as IT, healthcare, and retail.

Europe holds a significant share of the market, supported by countries like Germany, the United Kingdom, and France.

Growth in this region is propelled by labor law reforms that facilitate contract and flexible work arrangements, as well as rising demand for overflow staffing in healthcare and manufacturing sectors. However, stringent regulatory environments and employee protection laws may slow rapid market expansion compared to Asia Pacific and North America.

WORLDWIDE TOP KEY PLAYERS IN THE OVERFLOW STAFFING SERVICES MARKET INCLUDE

- Adecco Group

- Randstad NV

- ManpowerGroup

- Kelly Services

- Robert Half International

- Allegis Group

- TrueBlue, Inc.

- Insperity, Inc.

- Allegis Global Solutions

- Pontoon Solutions

- Others

Product Launches in Overflow Staffing Services Market

- In June 2024, Adecco Group launched an advanced AI-driven platform designed to revolutionize talent matching and workforce analytics. This new technology leverages artificial intelligence to analyze vast amounts of candidate data, enabling more precise and faster matching of talent with client requirements. By improving the efficiency of staffing processes, the platform helps reduce time-to-hire and increases the quality of placements. Additionally, enhanced workforce analytics provide clients with deeper insights into their staffing needs and performance metrics. This innovation aims to boost client satisfaction and operational effectiveness across multiple sectors globally, reinforcing Adecco’s position as a market leader.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the overflow staffing services market based on the below-mentioned segments:

Global Overflow Staffing Services Market, By Deployment Type

- Onshore

- Nearshore

- Offshore

Global Overflow Staffing Services Market, By Application

- IT & Telecom

- Healthcare

- Retail

- BFSI

Global Overflow Staffing Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: Who are the leading companies operating in the Global Overflow Staffing Services Market?

A: Key players include Adecco Group, Randstad NV, ManpowerGroup, Kelly Services, Robert Half International, Allegis Group, TrueBlue, Inc., Insperity, Inc., Allegis Global Solutions, and Pontoon Solutions.

Q: What are the main drivers of growth in the Overflow Staffing Services Market?

A: Rising demand for flexible staffing in IT, healthcare, and retail sectors, increased adoption of gig and contract workforce models, and government labor reforms promoting flexible employment.

Q: What challenges are limiting growth in the Overflow Staffing Services Market?

A: Complex compliance across regions, data security concerns, fluctuating availability of skilled contract workers, and competition from automation.

Q: Which technological trends are shaping the Overflow Staffing Services Market?

A: AI-driven talent matching platforms, blockchain for secure workforce management, and integrated workforce management solutions.

Q: What is the revenue potential of India in this market?

A: India is projected to grow at a CAGR of approximately 11.2%, driven by its expanding IT and healthcare sectors and increasing digital adoption.

Q: What are the top investment opportunities in the Overflow Staffing Services Market?

A: Opportunities include expansion into emerging markets, development of AI and automation tools, and sector-specific staffing services.

Q: Which industries are adopting Overflow Staffing Services most extensively?

A: IT & Telecom, Healthcare, Retail, BFSI, and Manufacturing are major adopters.

Q: How have COVID-19 and trade tensions impacted the Overflow Staffing Services Market?

A: The market faced disruptions but recovered strongly due to increased remote work adoption and flexible staffing needs.

Q: What is the long-term outlook for the Overflow Staffing Services Market?

A: The market is expected to grow steadily through 2035, driven by digital transformation, workforce flexibility trends, and technological innovations.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |