Global Pallet Handling Equipment Market

Global Pallet Handling Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Pallet Jacks, Pallet Trucks, Pallet Stackers, Pallet Conveyors, Others), By Automation Level (Automatic, Semi-automatic, Manual), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Pallet Handling Equipment Market Summary

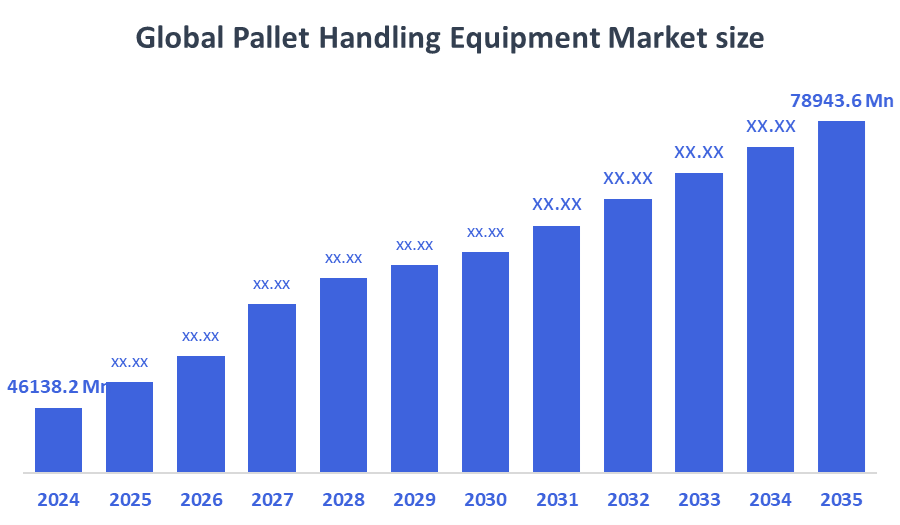

The Global Pallet Handling Equipment Market Size Was Valued at USD 46138.2 Million in 2024 and is Projected to Reach USD 78943.6 Million by 2035, Growing at a CAGR of 5.00% from 2025 to 2035. The market for pallet handling equipment is expanding due to factors like growing e-commerce, warehouse automation, the need for effective material handling, and the need to increase workplace productivity, safety, and operational efficiency in the manufacturing, retail, and logistics sectors.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific pallet handling equipment market held the largest revenue share of 37.5% and dominated the global market.

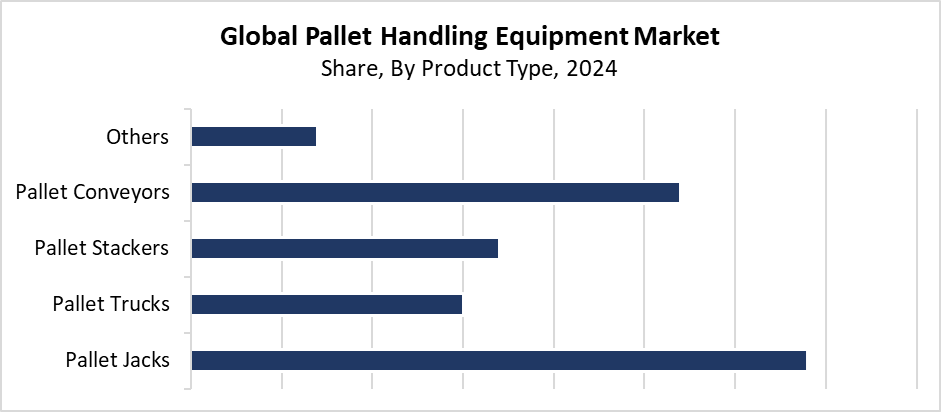

- In 2024, the pallet jacks segment held the highest revenue share of 34.6% and dominated the global market by product type.

- With the biggest revenue share of 51.4% in 2024, the manual segment led the worldwide market by automation level.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 46138.2 Million

- 2035 Projected Market Size: USD 78943.6 Million

- CAGR (2025-2035): 5.00%

- Asia Pacific: Largest market in 2024

The market for pallet handling equipment includes all devices which serve manufacturing, warehousing, logistics, retail, and food and beverage sectors for moving, storing, and handling palletised goods. The system includes pallet jacks, conveyors, pallet dispensers, and automated palletizers. The market functions based on rising requirements for material handling systems, which deliver workplace safety improvements, cost savings, and efficiency gains. The market advances because international trade increases at the same time e-commerce grows. Businesses need better supply chain management systems. The combination of industrial automation and smart warehousing growth requires companies to spend on state-of-the-art pallet handling systems, which deliver both speed and reliability.

The market for pallet handling equipment undergoes substantial changes because of technological progress in the industry. The combination of robotic palletizers with automated guided vehicles (AGVs) and Internet of Things tracking systems improves operational efficiency, precision and provides better transparency. System performance is improved and downtime is decreased by integration with predictive maintenance tools and warehouse management systems (WMS). Through tax breaks, subsidies, and smart industry initiatives, governments from all over the world are encouraging the deployment of automation and sophisticated logistical infrastructure. These programs aim to develop a market environment for pallet handling equipment growth through improved production efficiency and competitive market expansion.

Product Type Insights

What Factors Enabled the Pallet Jacks Segment to Capture a 34.6% Revenue Share in the Pallet Handling Equipment Market in 2024?

The pallet jacks segment leads the pallet handling equipment market with the largest revenue share of 34.6% in 2024. These machines dominate operations because they move palletised goods across short distances inside manufacturing plants, retail stores, and warehouses. Small and medium-sized businesses choose pallet jacks because these machines provide an affordable solution which requires minimal maintenance. It delivers easy operation. Their attractiveness in a variety of industrial contexts is further enhanced by their adaptability, small size, and capacity to operate in confined locations. Their dominant position in the global market is further supported by the increasing need for simple yet dependable material handling equipment like pallet jacks brought on by the constant expansion of e-commerce, logistics, and warehousing operations.

The pallet conveyors segment of the pallet handling equipment market is anticipated to grow at the fastest CAGR during the forecast period. The rise of automation in warehouses and manufacturing facilities has increased demand for pallet conveyors because these systems speed up material movement while improving operational efficiency. The technologies enable continuous, fast transport of palletised goods while reducing both human involvement and errors. The expanding e-commerce market requires businesses to establish automated solutions with pallet conveyors for fast order processing. The incorporation of smart technologies, including sensors, Internet of Things (IoT), and real-time tracking, into conveyor systems makes them the preferred choice for modern, high-volume logistics and distribution centres.

Automation Level Insights

What Made the Manual Segment the Top Revenue Contributor in the Pallet Handling Equipment Market in 2024?

The manual segment led the pallet handling equipment market with the largest revenue share of 51.4% in 2024. The primary factor behind this control stems from the wide application of manual equipment, such as pallet jacks and hand trucks, which mainly operate in small-scale production facilities and medium-sized businesses. Facilities with limited funds and restricted space requirements find manual pallet handling solutions to be their best option because these systems provide affordable and straightforward maintenance needs. The systems operate best in situations where human control needs to be maintained. Adaptable behaviour is required. Manual equipment continues to find use in various industries because it provides a basic and affordable solution for material handling tasks, although automation systems have gained popularity in the market.

The automatic segment of the pallet handling equipment market is expected to grow at a significant rate during the forecast period. The market expands because companies need automation to enhance production accuracy and reduce costs while achieving better operational efficiency in manufacturing, logistics, and warehousing operations. The automated systems include pallet conveyors, robotic palletizers, and automated guided vehicles (AGVs), which enable continuous material handling with minimal human intervention. Businesses must select advanced pallet handling systems because e-commerce expansion needs fast order delivery. The integration of automation with IoT and warehouse management systems (WMS) has enhanced capabilities. This makes automated equipment an attractive choice for modern high-volume operations.

Regional Insights

The North American pallet handling equipment market is expected to grow at a significant CAGR because manufacturing facilities and food and beverage plants, e-commerce operations, and pharmaceutical companies need better material handling equipment. The fast expansion of warehousing and distribution facilities in the United States and Canada drives the need for advanced pallet handling systems. The shortage of workers, together with rising labour expenses, has led companies to implement automated systems, which include pallet conveyors, robotic palletizers, and automated guided vehicles (AGVs). The region achieves economic success through its strong infrastructure network. This supports major market players and governmental programs that back smart manufacturing and industrial automation development. Sustainability programs work to support the use of equipment that combines ergonomic design with energy-saving features.

Europe Pallet Handling Equipment Market Trends

The European pallet handling equipment market experiences significant growth because manufacturing automation and storage and logistics process automation continue to expand throughout the region. Germany, France, and the UK lead the way by adopting advanced material handling systems that increase production rates while reducing human involvement to meet the growing industrial and e-commerce sector requirements. The Industry 4.0 movement toward smart warehousing solutions has driven up demand for automated pallet handling systems, which include conveyors, robotic palletizers, and AGVs. Businesses need to invest in eco-friendly modern technology and ergonomic solutions because of strict workplace safety and energy efficiency regulations. The European pallet handling equipment market shows ongoing growth because governments support digital transformation.

Asia Pacific Pallet Handling Equipment Market Trends

The Asia Pacific pallet handling equipment market held the largest revenue share of 37.5% and led the market globally in 2024. The leadership position stems from China, India, Japan, and South Korea because of their fast industrial growth, expanding manufacturing industry, and thriving e-commerce markets. The region sees rising demand for pallet jacks, conveyors, and automated systems because of the growing need for efficient logistics and warehouse operations. Businesses are deploying automated and semi-automated material handling systems because labour costs have increased and organisations now understand the importance of workplace safety. The sector growth receives additional support from government initiatives, which promote both smart manufacturing. This promotes infrastructure expansion. The Asia Pacific region controls the global pallet handling equipment market because it hosts major manufacturers who produce products at low costs.

Key Pallet Handling Equipment Companies:

The following are the leading companies in the pallet handling equipment market. These companies collectively hold the largest market share and dictate industry trends.

- KION Group AG

- Hyundai Heavy Industries Co., Ltd.

- NACCO Industries, Inc.

- Hangcha Group Co., Ltd.

- Anhui Heli Co., Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Clark Material Handling Company

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- Raymond Corporation

- Others

Recent Developments

- In January 2025, Toyota Material Handling has added environmentally friendly electric forklifts to its pallet handling line, including mid-to-large electric pneumatic forklifts and improved Core Electric models. These models improve sustainability, increase operating efficiency, and effectively manage large loads. The expanding trend of automation and energy-efficient solutions in logistics and warehouses is reflected in their acceptance. This breakthrough demonstrates Toyota's emphasis on innovation in the market for pallet handling equipment worldwide.

- In October 2024, Eurofork S.p.A. and KION Group teamed up to distribute the E4CUBE pallet shuttle system throughout the EMEA area. Improved warehouse automation is possible with the modular plug-and-play technology, which can be swiftly deployed. In addition to supporting high throughput, it guarantees traceability and improves safety. There are many different warehouse operations that our system effectively supports.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the pallet handling equipment market based on the below-mentioned segments:

Global Pallet Handling Equipment Market, By Product Type

- Pallet Jacks

- Pallet Trucks

- Pallet Stackers

- Pallet Conveyors

- Others

Global Pallet Handling Equipment Market, By Automation Level

- Automatic

- Semi-automatic

- Manual

Global Pallet Handling Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 240 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |