Global Palmaria Palmata Bacon Market

Global Palmaria Palmata Bacon Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Format (Crispy Vegan Bacon Strips, Dulse Seasoning Powder, Rehydrated Dulse Packs, and Fermented Dulse Condiments), By Use Case (Retail Consumer Packaged Goods, Foodservice & Restaurants, Functional Wellness Products, and Gourmet & Artisanal Culinary Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Palmaria Palmata Bacon Market Size Summary, Size & Emerging Trends

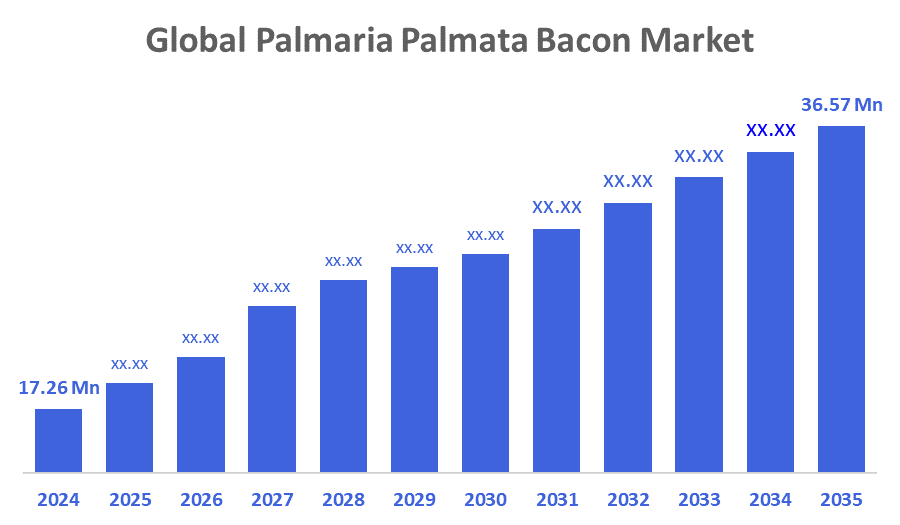

According to Decisions Advisors, The Global Palmaria Palmata Bacon Market Size is expected to Grow from USD 17.26 Million in 2024 to USD 36.57 Million by 2035, at a CAGR of 7.06% during the forecast period 2025-2035. Demand is being driven by health-conscious consumers, plant-based lifestyle adoption, and interest in nutrient-rich marine superfoods.

Key Market Insights

- Crispy Vegan Bacon Strips dominate format sales due to demand in plant-based meat alternatives.

- Retail Consumer Packaged Goods (CPG) is the leading use case, driven by direct-to-consumer health food brands.

- Europe holds the largest market share, supported by traditional consumption and seaweed innovation.

- North America is witnessing the fastest growth with a surge in vegan snacks and wellness foods.

- Product diversification into condiments, wellness shots, and gourmet products is accelerating.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 17.26 Million

- 2035 Projected Market Size: USD 36.57 Million

- CAGR (2025-2035): 7.06%

- Europe: Largest market in 2024

- North America: Fastest growing market

Palmaria Palmata Bacon Market

Palmaria palmata, commonly known as dulse, is a red seaweed prized for its naturally smoky flavor and rich nutritional profile. When pan-fried, it crisps up with a texture and taste similar to bacon, making it highly favored in plant-based and vegan cooking. Beyond being a meat alternative, Palmaria palmata is used in various forms such as seasoning powders, rehydrated packs, and fermented condiments, broadening its appeal across food, wellness, and gourmet sectors. Its high mineral content, including iodine and antioxidants, contributes to growing interest from health-conscious consumers. The market benefits from rising demand for sustainable, ocean-derived ingredients that align with clean-label and eco-friendly trends. Increasing innovation in seaweed farming and product development further positions Palmaria palmata as a versatile ingredient in functional foods, snacks, and wellness products. This convergence of taste, nutrition, and sustainability is fueling the market’s robust growth globally.

Palmaria Palmata Bacon Market Trends

- Expansion of Dulse into snack formats like crispy chips and bacon-style strips.

- Fermented Dulse condiments are gaining popularity for gut health and gourmet appeal.

- Increased investment in regenerative ocean farming to ensure sustainable supply.

- Culinary innovation in plant-based dining, with chefs introducing Dulse into gourmet vegan recipes.

Palmaria Palmata Bacon Market Dynamics

Driving Factors: Consumer demand for plant-based

Consumer demand for plant-based, ocean-sourced ingredients is rapidly growing. Palmaria palmata offers unique taste and nutrition, making it highly suitable for vegan bacon-style products and seasoning powders. Rising awareness of iodine-rich foods, marine minerals, and natural umami flavors boosts its inclusion in health products. Additionally, sustainability concerns around meat and soy production are encouraging exploration of seaweed-based alternatives.

Restrain Factors: Inconsistent consumer awareness of Dulse

The limited scalability of wild harvesting and the underdeveloped state of dulse aquaculture in many regions pose supply constraints. Additionally, inconsistent consumer awareness of Dulse and its applications in some markets, coupled with high production and processing costs, may limit adoption. Flavor adaptation for mainstream consumers remains a challenge.

Opportunities: Technological advances in controlled seaweed cultivation

The market is ripe for product development in condiments, fortified foods, and supplements. Fermented and liquid Dulse products for gut and immune health are underexplored. Technological advances in controlled seaweed cultivation can enhance year-round supply and quality consistency. Cross-industry collaborations in wellness, functional nutrition, and gourmet food innovation offer untapped commercial potential.

Challenges: Climate-driven harvesting risks

Climate-driven harvesting risks, regulatory inconsistency for seaweed products, and varying iodine limits across countries can affect product approval and consumer messaging. Limited infrastructure for large-scale drying, fermenting, and distribution in emerging markets remains a challenge. Educating consumers about the benefits and uses of Palmaria palmata is essential for category growth.

Global Palmaria Palmata Bacon Market Ecosystem Analysis

The market ecosystem includes wild seaweed harvesters, aquaculture innovators, processors, plant-based food manufacturers, wellness brands, and gourmet culinary producers. Sustainable sourcing, traceability, and organic certifications play a central role in consumer trust. D2C brands are pushing growth through storytelling and clean-label positioning. Distribution channels span from health food stores to online platforms and high-end restaurants, forming a dynamic ecosystem built around marine nutrition and sustainability.

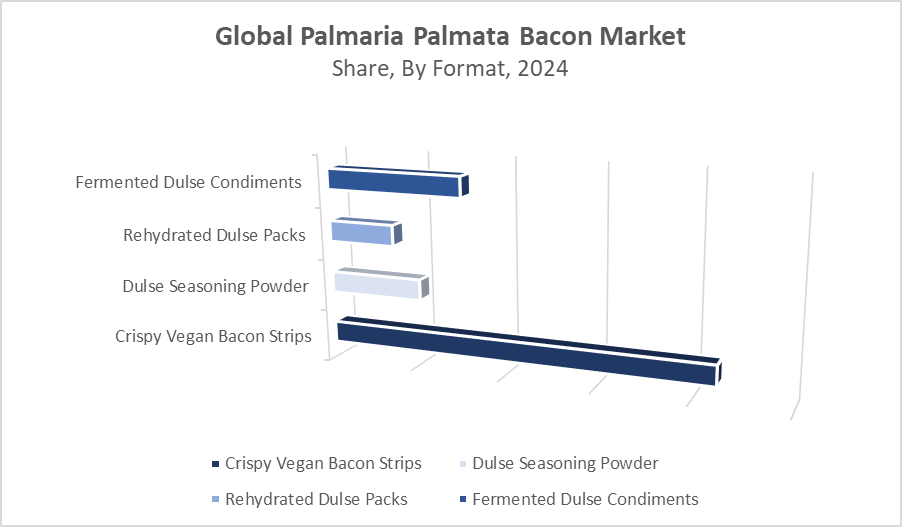

Global Palmaria Palmata Bacon Market, By Format

What key advantages helped the crispy vegan bacon strips segment outperform others in the Palmaria palmata bacon market in 2024?

The crispy vegan bacon strips segment emerged as the largest format in the Palmaria palmata bacon market in 2024, accounting for approximately 38% of the market share. This growth was driven by increasing consumer demand for plant-based, sustainable, and tasty alternatives to traditional meat products. The unique texture and flavor profile of these bacon strips appealed to both vegan and flexitarian consumers seeking healthier snack options. Additionally, rising awareness of environmental and health benefits associated with seaweed-based foods contributed to the segment’s popularity. Innovative product development, easy availability, and effective marketing strategies further strengthened its position as the market leader.

How did fermented dulse condiments capture significant market attention in 2024?

Fermented dulse condiments held around 12% of the market in 2024 but stood out as the fastest-growing format segment due to increasing consumer interest in fermented and probiotic-rich foods. The unique tangy flavor and health benefits associated with fermentation, such as improved digestion and enhanced nutrient availability, attracted health-conscious consumers. Additionally, the trend toward innovative, natural, and artisanal food products fueled demand. Advances in fermentation techniques and product development made fermented dulse condiments more appealing and accessible, driving rapid market expansion despite their relatively smaller current market share.

Global Palmaria Palmata Bacon Market, By Use Case

How did the retail consumer packaged goods (CPG) segment achieve a 42% market share in the Palmaria palmata bacon market in 2024?

The retail consumer packaged goods (CPG) segment led the Palmaria palmata bacon market in 2024 with a 42% share, driven by widespread consumer access through supermarkets, specialty stores, and online channels. The segment’s dominance was fueled by increasing consumer preference for convenient, ready-to-use seaweed products and growing awareness of the health and sustainability benefits of Palmaria palmata. Effective branding, attractive packaging, and innovative product offerings helped capture consumer interest and loyalty. Moreover, the expanding plant-based and health food trends further boosted demand within retail channels, enabling the CPG segment to outperform other segments in the market.

Why was the foodservice & restaurants segment preferred over other channels in the Palmaria palmata bacon market in 2024?

The foodservice & restaurants segment held about 28% of the Palmaria palmata bacon market share in 2024, driven by the growing popularity of seaweed-based dishes among chefs and consumers seeking innovative and healthy menu options. Restaurants and foodservice providers increasingly incorporate Palmaria palmata due to its unique flavor, nutritional benefits, and sustainability appeal. The trend toward plant-based and eco-friendly foods further supported the segment’s growth. Additionally, partnerships between seaweed producers and the hospitality industry helped improve supply chain efficiency and product availability, contributing to the segment’s strong market presence.

Europe stands as the largest market for Palmaria palmata bacon, contributing over 40% of the global revenue in 2024.

The region benefits from strong consumer awareness and a rich tradition of seaweed consumption, especially in Nordic and Celtic countries. Government initiatives promoting sustainable ocean farming and marine biodiversity support the expansion of seaweed industries. Additionally, the increasing demand for plant-based and sustainable foods among European consumers reinforces the region’s leadership in the market.

North America is the fastest-growing region, with a projected CAGR of 11.5% during the forecast period.

Growth is driven by the rising popularity of plant-based diets, innovation in vegan bacon alternatives, and the clean-label movement emphasising natural, minimally processed ingredients. The surge of startups focusing on seaweed-based products and expanding retail distribution channels across the U.S. and Canada further accelerates market expansion.

Asia Pacific holds a significant market share,

Due to growing interest in fusion cuisine, seaweed snacks, and marine nutrition. Countries like Japan, South Korea, and coastal regions of China are key adopters of Palmaria palmata, incorporating it into both traditional recipes and contemporary food products. The region’s culinary diversity and increasing health awareness support steady market growth.

WORLDWIDE TOP KEY PLAYERS IN THE PALMARIA PALMATA BACON MARKET INCLUDE

- Ocean Harvest

- Atlantic Sea Farms

- Maine Coast Sea Vegetables

- Ocean’s Halo

- The Seaweed Bath Co.

- Algaia

- Ocean’s Balance

- Dulse Company

- Seagreens

- Seaweed & Co.

- Others

Product Launches in Palmaria palmata Market

- In March 2024, OceanKind Naturals launched a crispy vegan bacon product under the brand “SeaBacon Bites”, available in U.S. health stores and online platforms. The product features organic dulse with natural smoke seasoning and zero preservatives, positioned for flexitarian and vegan snackers. It reflects rising demand for whole-food, clean-label marine-based alternatives to traditional processed meat products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Palmaria palmata bacon market based on the below-mentioned segments:

Global Palmaria Palmata Bacon Market, By Format

- Crispy Vegan Bacon Strips

- Dulse Seasoning Powder

- Rehydrated Dulse Packs

- Fermented Dulse Condiments

Global Palmaria Palmata Bacon Market, By Use Case

- Retail Consumer Packaged Goods (CPG)

- Foodservice & Restaurants

- Functional Wellness Products

- Gourmet & Artisanal Culinary Applications

Global Palmaria Palmata Bacon Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 170 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |