Global Performance Sleeves Market

Global Performance Sleeves Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Arm Sleeves, Leg Sleeves, Medical/Therapeutic Sleeves, and UV?/Thermal/Compression Variants), By End?User (Athletes & Sports Performance, Medical / Rehabilitation, and Occupational & Everyday Use), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Performance Sleeves Market Summary, Size & Emerging Trends

According to Decision Advisors, The Global Performance Sleeves Market Size is Expected to Grow from USD 87.2 Million in 2024 to USD 306.4 Million by 2035, at a CAGR of 12.1% during the forecast period 2025-2035. Key trends include rising awareness of injury prevention and recovery, increasing fitness participation, aging populations demanding therapeutic use, integration of smart fabrics/materials, and growing customization and online accessibility.

Key Market Insights

- North America holds the largest share in 2024, driven by consumer fitness culture, established sportswear brands, and strong demand for athletic and medical?grade sleeves.

- Asia Pacific is set to be the fastest-growing region due to rising disposable incomes, increasing sports participation, and improving healthcare access.

- Among product types, arm sleeves represent a large and growing segment; medical or therapeutic sleeves are also expanding due to healthcare & rehabilitation demand.

- Usage by athletes and performance sports remains the dominant end?user segment; medical / rehab uses are growing steadily.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 87.2 Million

- 2035 Projected Market Size: USD 306.4 Million

- CAGR (2025-2035): 12.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Performance Sleeves Market

The performance sleeves market consists of a range of products including compression sleeves, UV-protection sleeves, thermal sleeves, and other variants engineered to enhance physical performance, accelerate recovery, and prevent injuries. These sleeves are commonly used by professional athletes, fitness enthusiasts, and individuals recovering from medical conditions such as lymphedema or post-surgical swelling. Everyday consumers also wear them for added support, sun protection, or aesthetic appeal. The materials typically include lightweight, stretchable synthetic fabrics like spandex and nylon. Technological innovations have introduced smart properties such as temperature regulation, moisture-wicking, and odor resistance. As health, fitness, and wellness trends grow globally, so does the demand for performance gear that blends comfort and function. Additionally, the rise of e-commerce, direct-to-consumer brands, and fashion-sport collaborations has boosted visibility and accessibility. This convergence of utility, design, and health-driven awareness continues to expand the global performance sleeves market at a steady pace.

Performance Sleeves Market Trends

- Increasing adoption of compression sleeves in sports performance (running, cycling, team sports) to improve recovery and reduce fatigue.

- Medical and rehabilitation applications becoming more common, driven by aging populations and awareness of circulatory and muscular disorders.

- Integration of materials with UV protection, antimicrobial finishes, thermal insulation and moisture wicking.

- Customization of fit, design, and compressive strength; personalization is becoming important.

- Improved online availability and direct?to?consumer distribution, pushing down cost and increasing reach.

Performance Sleeves Market Dynamics

Driving Factors: Growing use in medical and therapeutic applications like managing lymphedema

The performance sleeves market is propelled by the global rise in health and fitness awareness, with more individuals participating in sports and physical activity. These sleeves help reduce muscle fatigue, aid in recovery, and prevent injury, making them popular among athletes and everyday users. Growing use in medical and therapeutic applications like managing lymphedema or post-surgery swelling also boosts demand. Technological improvements in fabric design, including stretchability, breathability, and graduated compression, enhance comfort and effectiveness. Online retail and fitness influencers have made these products more visible and accessible, contributing to strong market momentum across both athletic and lifestyle segments.

Restrain Factors: Premium products often require costly

Despite growth, several restraints challenge the performance sleeves market. Premium products often require costly, high-tech materials or smart functionalities, limiting affordability for some consumers. Regulatory distinctions between medical-grade and athletic products vary by region, complicating compliance. Intense competition from low-cost, generic alternatives dilutes brand value. Additionally, poor sizing options and inconsistent product claims can reduce consumer satisfaction. In times of economic slowdown, these products may be seen as non-essential, affecting sales. Moreover, exaggerated marketing promises regarding performance enhancement can lead to skepticism and reduce consumer trust, especially among first-time buyers unfamiliar with proper usage.

Opportunities: Manufacturers are exploring eco-friendly

There are several untapped opportunities in the performance sleeves market. Expanding into emerging economies with rising sports culture and improved healthcare access could unlock new revenue streams. Manufacturers are exploring eco-friendly, sustainable materials to appeal to environmentally conscious consumers. Smart textiles, integrated sensors, and wearable tech for real-time monitoring open avenues for innovation. Collaborations with professional sports teams, fitness influencers, and healthcare providers can drive awareness and credibility. Moreover, the growing emphasis on recovery, injury prevention, and therapeutic applications post-surgery or post-exercise creates space for differentiated offerings that go beyond traditional athletic use.

Challenges: Companies must manage supply chain hurdles related to raw material sourcing, production costs

Key challenges include maintaining consistent compression levels and ensuring product quality across various sizes and uses. Obtaining medical-grade certifications adds complexity and cost for companies targeting healthcare markets. Balancing affordability with innovation remains a pressing concern, especially in price-sensitive regions. Consumer education is also critical, as improper use or unrealistic expectations can lead to dissatisfaction or injury. Additionally, companies must manage supply chain hurdles related to raw material sourcing, production costs, and inventory planning. Rising competition from new entrants and established athletic brands further intensifies pressure on margins and requires continuous innovation to stay relevant.

Global Performance Sleeves Market Ecosystem Analysis

The ecosystem includes manufacturers (sportswear/medical device/textile firms), raw material suppliers (synthetic stretch fabrics, antimicrobial / UV coatings), distributors & retailers (online, specialty sports shops, pharmacies), standardization & regulatory bodies (especially for therapeutic/medical sleeves), design & branding firms, athletes & physiotherapists (influencing product specs), and consumers. Innovation is driven by materials science, textile finishing, and demands from medical as well as performance segments.

Global Performance Sleeves Market, By Product Type

Arm sleeves account for the largest share of the global performance sleeves market, contributing approximately 62% of total market revenue in 2024. They are widely used in various sports including basketball, baseball, tennis, and golf, offering muscle compression, joint stabilization, and UV protection. Beyond athletics, arm sleeves are also worn for recovery, daily wear, and medical conditions such as lymphedema or post-surgical swelling. Their broad appeal, affordable pricing, and adaptability for both performance and casual use make them the most commercially successful product in this category.

Leg sleeves are emerging as the fastest-growing segment in the performance sleeves market, projected to expand at a CAGR of 8.1% from 2025 to 2035. This growth is driven by increased adoption among endurance athletes in sports like running, cycling, and CrossFit. These sleeves help improve blood flow, reduce fatigue, and speed up recovery after high-intensity workouts. With rising interest in fitness, physiotherapy, and post-exercise recovery tools, leg compression sleeves are becoming essential gear for both professionals and recreational athletes.

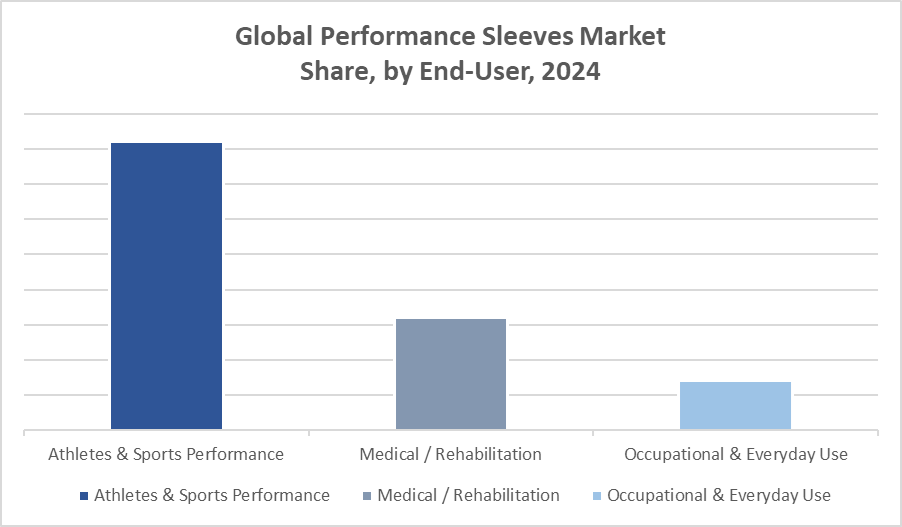

Global Performance Sleeves Market, By End?User

The athletes & sports performance segment holds the largest share of the global performance sleeves market, accounting for approximately 68% of total market revenue in 2024. These sleeves are widely adopted by professional athletes and fitness enthusiasts for enhanced muscle support, reduced fatigue, and performance optimization. Their use is common across high-impact sports such as basketball, running, cycling, and weight training. As awareness around injury prevention and recovery grows, demand continues to rise from both elite professionals and amateur athletes, keeping this segment at the forefront of the market.

The medical / rehabilitation segment is experiencing rapid growth and is expected to expand at a CAGR of 7.4% during the forecast period (2025–2035). Performance sleeves in this category are used for therapeutic purposes, including injury recovery, post-surgical support, and chronic condition management such as lymphedema and deep vein thrombosis. Increased medical awareness, improved patient access to non-invasive support solutions, and greater physician recommendations are driving adoption. As healthcare systems integrate more outpatient and home recovery tools, this segment is expected to capture a growing share of the market.

North America commands a significant share of the global performance sleeves market, contributing approximately 40% of total revenue in 2024. The United States leads this region, driven by high consumer awareness of fitness and health, well-established athletic communities, and advanced medical rehabilitation infrastructure. The US market benefits from widespread adoption in professional and amateur sports, as well as growing therapeutic use in healthcare facilities. Innovations in materials and smart textiles are rapidly embraced here, supported by strong e-commerce penetration and a culture focused on wellness and injury prevention.

Asia Pacific holds around 20% of the global market share in 2024 and is expected to register the highest growth rate over the forecast period. China stands out as a key driver in this region due to its expanding middle class, increasing participation in sports, rising health consciousness, and improving healthcare access. Investments in sports infrastructure and rising disposable incomes further fuel demand for performance sleeves in both athletic and medical segments. Rapid urbanization and the popularity of fitness culture contribute to accelerated market expansion across the region.

WORLDWIDE TOP KEY PLAYERS IN THE PERFORMANCE SLEEVES MARKET INCLUDE

- Nike, Inc.

- Adidas AG

- Under Armour, Inc.

- 2XU Pty Ltd

- Zensah

- McDavid Inc.

- Bauerfeind AG

- CEP Compression (medi GmbH)

- SKINS Compression

- Compressport

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the performance sleeves market based on the below-mentioned segments:

Global Performance Sleeves Market, By Product Type

- Arm Sleeves

- Leg Sleeves

- Medical/Therapeutic Sleeves

- UV?/Thermal/Compression Variants

Global Performance Sleeves Market, By End User

- Athletes & Sports Performance

- Medical / Rehabilitation

- Occupational & Everyday Use

Global Performance Sleeves Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the projected market size of the Global Performance Sleeves Market by 2035?

A: The Global Performance Sleeves Market is expected to reach USD 306.4 million by 2035, growing from USD 87.2 million in 2024.

Q: What is the expected CAGR for the Performance Sleeves Market during 2025–2035?

A: The market is projected to grow at a CAGR of 12.1% during the forecast period 2025–2035.

Q: Which region is currently the largest market for performance sleeves?

A: North America holds the largest market share in 2024, driven by a strong sports culture and high consumer awareness of fitness and wellness.

Q: Which product type holds the largest share in the market?

A: Arm sleeves dominate the market, accounting for approximately 62% of total revenue in 2024.

Q: Who are the top companies operating in the Global Performance Sleeves Market?

A: Key players include Nike, Adidas, Under Armour, 2XU, Zensah, McDavid, Bauerfeind AG, CEP Compression, SKINS Compression, and Compressport.

Q: Which end-user segment is leading the market?

A: Athletes & sports performance is the leading segment, accounting for around 68% of the market in 2024.

Q: What are the main drivers fueling growth in the performance sleeves market?

A: Key drivers include increasing fitness participation, rising demand for injury prevention and recovery products, medical rehabilitation use, and advancements in smart and sustainable fabrics.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 165 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |