Global Pet Hard Goods Market

Global Pet Hard Goods Market Size, Share, and COVID-19 Impact Analysis, By Product (Bedding & Furniture, Pet Toys, Collars, Leashes & Harnesses, Feeding Supplies, Grooming Products & Tools, Cleaning & Waste Management, Training & Behavior Aids, Clothing & Apparel, Aquarium & Terrarium Supplies, Pet Safety, Containment & Travel), By Distribution Channel (Store-driven/Brick-and-Mortar, Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Pet Hard Goods Market Summary

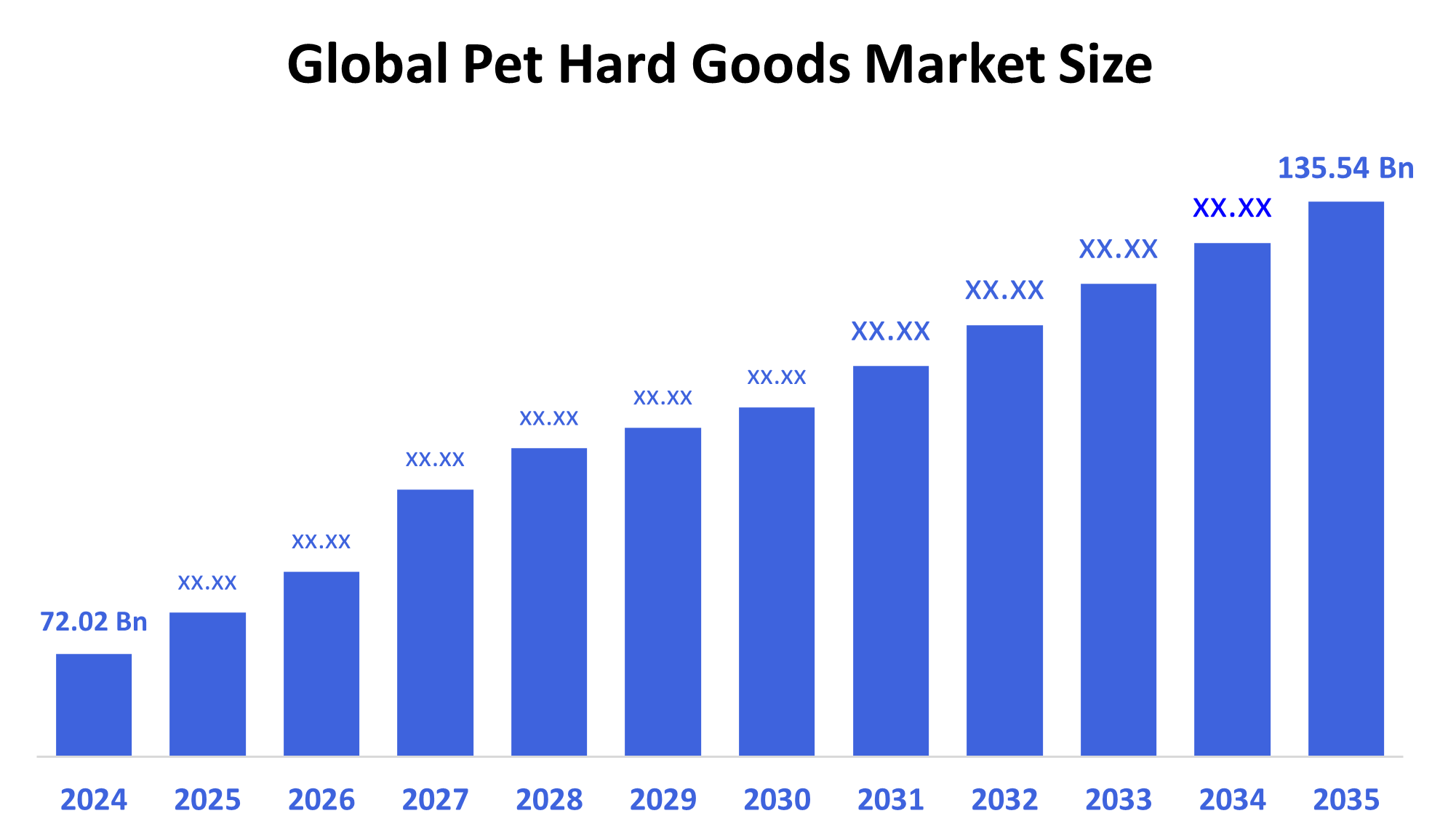

- The Global Pet Hard Goods Market Size Was Estimated at USD 72.02 Billion in 2024 and is Projected to Reach USD 135.54 Billion by 2035, Growing at a CAGR of 5.92% in the forecast period from 2025 to 2035.

- The market for pet hard goods is expanding due to factors like growing pet ownership, the humanization of pets, rising pet care expenses, and consumer demand for long-lasting, cutting-edge, and lifestyle-improving pet items.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 44.57% and dominated the pet hard goods market globally.

- In 2024, the pet toys segment had the highest market share by product, accounting for 27.53%.

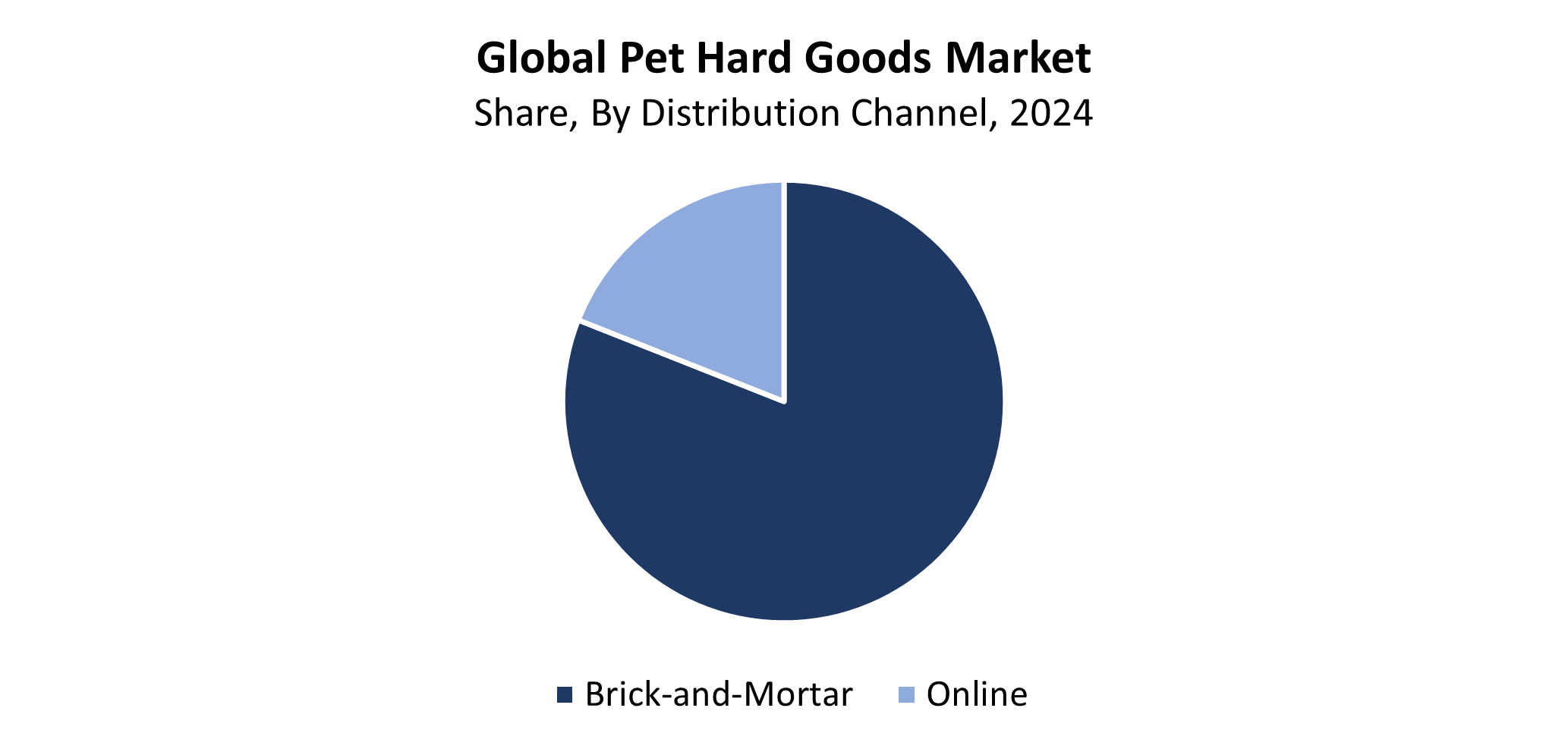

- In 2024, the brick-and-mortar segment had the biggest market share by distribution channel, accounting for 81.42%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 72.02 Billion

- 2035 Projected Market Size: USD 135.54 Billion

- CAGR (2025-2035): 5.92%

- North America: Largest market in 2024

The pet hard goods market serves as a specialized sector within pet care that sells non-perishable products, including toys and crates, together with carriers, beds and collars, and leashes, and grooming supplies. These products serve essential roles to maintain pet comfort while ensuring safety and training, and overall well-being. The increasing number of worldwide pets, together with pet humanization and rising pet care spending by customers, drives this market forward. The growing perception of dogs as family members has led owners to invest in superior products that enhance their pets' lifestyle and health. The pandemic's pet adoption growth, together with e-commerce expansion, has driven rising demand from both urban and semi-urban areas while opening up new market access and diverse product options.

Technological progress in the pet hard goods market drives the development of temperature-controlled beds along with automated feeding systems and smart collars that track GPS movement, as well as interactive pet toys that stimulate their physical and mental capabilities. The advanced technological products enhance how owners care for their pets while making their daily routines easier. Government agencies support market growth through animal welfare regulations and pet safety standards, and educational initiatives that promote responsible pet ownership. These advancements, together with supporting programs, have driven the worldwide pet hard goods market to expand at an accelerated rate.

Product Insights

The pet toys segment dominates the pet hard goods market with the largest revenue share of 27.53% in 2024. Fitness, along with mental stimulation and pet enrichment, remains a key drivers that fuel this market expansion. The increasing awareness among pet owners about animal health and mental well-being has caused a surge in demand for toys that include chew items as well as interactive gadgets and treat-dispensing puzzles. The rising trend of treating pets like family members has led to greater interest in purchasing customized and sophisticated toys. The expansion of pet stores and online shopping platforms enables consumers to access broader product selections. The pet toys segment maintains its leading market position because of these combined factors.

Throughout the projection period, the pet collars, leashes, and harnesses segment is anticipated to grow at a significant CAGR. The main reason behind this growth stems from the increasing number of pet owners who want stylish yet comfortable and secure walking products for their animals. The increasing interest in outdoor pet activities such as walking, hiking, and training has led to a rising demand for durable and long-lasting collars, leashes, and harnesses. Adoption of these products continues to grow because of smart collar technology that integrates GPS tracking with health monitoring functions, as well as ergonomic design elements and reflective materials. The market segment will experience substantial growth across both developed and emerging nations due to rising pet ownership in urban areas and changing lifestyles, and better pet safety knowledge.

Distribution Channel Insights

The brick-and-mortar segment led the pet hard goods market, with the largest revenue share of 81.42% in 2024. The lasting consumer trend toward store-based purchasing, followed by product quality and size assessments before purchases, results in this market dominance. Pet hard goods exist in a broad range of retail locations, which include supermarkets and specialty pet shops, along with big-box retailers. The selection process receives assistance from knowledgeable employees who guide customers. The majority of customers choose physical stores because these locations deliver immediate product delivery and straightforward return and exchange procedures. Loyalty programs and in-store promotions, together with bundled deals, lead to increased sales through this channel, which fortifies the company's leadership in the global pet hard goods market.

The online segment is expected to grow at a substantial CAGR throughout the forecast period. The rapid expansion of online sales stems from the expanding smartphone user base and internet access, combined with customer demand for convenient home-based purchasing solutions. The large selection of pet hard goods, combined with complete product details and user ratings, and affordable prices on online platforms, enables pet owners to make better purchasing choices. Online sales grow because e-commerce giants and specialized pet care platforms provide better delivery services to customers. The COVID-19 pandemic propelled online shopping, which led to permanent changes in how consumers behave. The pet hard goods industry finds strong growth potential in the online distribution channel due to these factors.

Regional Insights

The Asia Pacific pet hard goods market captured 15.87% of worldwide revenue in 2024. The increase in pet ownership, along with higher disposable income levels and urban development in China, India, Japan, and Australia, drives this market growth. Consumers dedicate increasing amounts of money toward pet-related hard goods, which include toys and collars and beds, and grooming supplies, because lifestyles are evolving and people now understand more about pet health. People humanize their pets as family members, which leads them to pursue luxurious and state-of-the-art pet products. The expansion of retail channels between physical stores and online platforms has made products more accessible, which drives market growth throughout the Asia Pacific region.

North America Pet Hard Goods Market Trends

During 2024, the North American pet hard goods market held the largest revenue share of 44.57% which positioned it as the leading region worldwide. The industry leadership stems from strong pet ownership numbers and rising pet humanization trends, together with substantial pet product spending in both the US and Canada. The region enjoys two major advantages from its booming e-commerce sector, which provides easy shopping access and a wide product selection alongside a developed network of specialty pet stores. High demand exists for premium innovative pet hard goods such as toys, collars, grooming supplies, and bedding because people have become more aware of pet health and wellness. The market shows rapid expansion in North America because of both legal regulations and programs that promote responsible pet ownership.

Europe Pet Hard Goods Market Trends

The European pet hard goods market shows continuous growth because of rising numbers of pet owners, along with increasing consumer attention toward pet health and welfare. The European pet industry experiences its highest sales in Germany and the UK, and France, because pet owners now invest in advanced and durable products, including toys and collars and grooming supplies, and bedding. The pet humanization trend drives the increasing popularity of customized and premium pet hard goods among consumers. The increased animal welfare awareness, along with stricter regulations about product safety, drives manufacturers to develop environmentally safe and secure products. The structured retail channels, along with e-commerce platforms, help make products more accessible across the region. The European pet hard goods market continues its growth because of supportive government initiatives, combined with rising consumer spending power and these elements.

Key Pet Hard Goods Companies:

The following are the leading companies in the pet hard goods market. These companies collectively hold the largest market share and dictate industry trends.

- Spectrum Brands Holdings, Inc.

- MidWest Homes for Pets

- The Hartz Mountain Corporation (Hartz)

- Coastal Pet Products, Inc.

- GNV Commodities Pvt Ltd (Ruffwear)

- KONG Company

- Lee's Aquarium & Pet Products

- Radio Systems Corporation (PetSafe)

- ZippyPaws

- New Age Pet

- Others

Recent Developments

- In July 2025, Coastal Pet added four new double-sided patterned collars, leashes, and overhead harness designs to its well-liked Sublime collection. With their wider-than-normal widths and enhanced durability, these additions are designed for larger dog breeds.

- In April 2025, in honor of Earth Day, Coastal Pet introduced a line of eco-friendly products. This project offers a range of long-lasting pet products manufactured from eco-friendly materials. The Turbo Scratcher Replacement Pads are composed of 95% recycled material, while the Eco Turbo Scratcher is produced completely of recycled polymers and wrapped with environmentally friendly materials. Furthermore, soy fibers derived from plants are used to make the New Earth line of collars, leashes, and harnesses.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the pet hard goods market based on the below-mentioned segments:

Global Pet Hard Goods Market, By Product

- Bedding & Furniture

- Pet Toys

- Collars, Leashes & Harnesses

- Feeding Supplies

- Grooming Products & Tools

- Cleaning & Waste Management

- Training & Behavior Aids

- Clothing & Apparel

- Aquarium & Terrarium Supplies

- Pet Safety, Containment & Travel

Global Pet Hard Goods Market, By Distribution Channel

- Store-driven/Brick-and-Mortar

- Online

Global Pet Hard Goods Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 235 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |