Global Petrochemical Feedstock Market

Global Petrochemical Feedstock Market Size, Share, and COVID-19 Impact Analysis, By Type (Naphtha, Ethane, Propane, Butane, and Refinery Off-Gases), By Source (Fossil-Based, Bio-Based, Chemically Recycled (Pyrolysis Oil), and Gasification-Derived (Syngas)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Global Petrochemical Feedstock Market Insights Forecasts to 2035

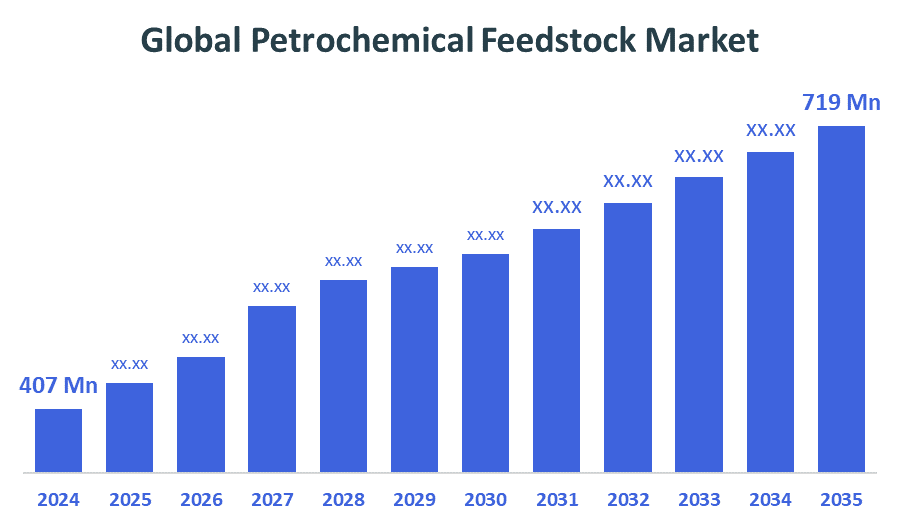

- The Global Petrochemical Feedstock Market Size Was Estimated at USD 407 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.31% from 2025 to 2035

- The Worldwide Petrochemical Feedstock Market Size is Expected to Reach USD 719 Million by 2035

- Middle East & Africa is Expected to Grow the fastest during the forecast period.

Petrochemical Feedstock Market

The petrochemical feedstock market involves raw materials like natural gas, naphtha, and ethane used to produce chemicals and plastics. These feedstocks are essential for manufacturing products such as fertilizers, synthetic fibers, and packaging materials. Government initiatives worldwide aim to promote sustainable petrochemical production by encouraging the use of cleaner feedstocks and investing in advanced technologies to reduce carbon emissions. Policies supporting energy efficiency, recycling, and alternative raw materials are driving innovation in the sector. The market is influenced by factors like crude oil prices, geopolitical stability, and growing demand from end-use industries including automotive, construction, and consumer goods. With increasing environmental regulations, companies are focusing on eco-friendly feedstock options to align with global sustainability goals. Overall, the petrochemical feedstock market is pivotal in the global chemical supply chain, adapting to evolving economic and environmental landscapes to ensure long-term growth and stability.

Attractive Opportunities in the Petrochemical Feedstock Market

- The integration of green hydrogen and renewable energy sources (like solar and wind) into petrochemical production processes presents a significant opportunity to reduce carbon emissions and improve sustainability. This shift supports global climate goals and helps companies comply with stricter environmental regulations. Investments in this area are growing rapidly, particularly in regions rich in renewables. Companies adopting these technologies can gain a competitive edge by positioning themselves as leaders in low-carbon petrochemical production.

- Breakthroughs in chemical recycling technologies (such as pyrolysis) allow the conversion of plastic waste into usable petrochemical feedstocks, reducing dependency on fossil resources. This supports the global push toward a circular economy, where materials are reused rather than discarded. Rising environmental concerns and policy support are accelerating adoption of such innovations. These developments open new revenue streams for companies while addressing sustainability challenges in the plastics and chemicals industries.

Global Petrochemical Feedstock Market Dynamics

DRIVER: Technological advancements improve feedstock processing efficiency

Growth in the petrochemical feedstock market is driven by rising demand for plastics, synthetic fibers, and chemicals across industries like automotive, construction, and packaging. Increasing urbanization and industrialization, especially in emerging economies, boost feedstock consumption. Technological advancements improve feedstock processing efficiency, reducing costs and environmental impact. Government support through favorable policies and investments in sustainable alternatives also fuels growth. Additionally, the shift toward petrochemical-derived products in renewable energy and electronics sectors creates new opportunities. Fluctuating crude oil prices and feedstock availability influence market dynamics, encouraging innovation and diversification to meet evolving global demand.

RESTRAINT: Fluctuating crude oil and natural gas prices create market instability

Fluctuating crude oil and natural gas prices create market instability, affecting feedstock availability and costs. Dependence on fossil fuels raises sustainability issues, driving demand for greener alternatives. Additionally, geopolitical tensions can disrupt supply chains, impacting feedstock distribution. High capital investment and operational costs for advanced processing technologies also limit market expansion. Growing awareness of plastic pollution and increased recycling efforts reduce reliance on virgin petrochemical feedstocks, posing challenges to traditional market growth.

OPPORTUNITY: Increasing investment in green hydrogen and renewable energy integration

Innovations in recycling technologies and chemical recycling offer potential to convert plastic waste into valuable feedstocks, promoting circular economy models. Expansion in emerging markets, driven by rapid industrialization and urbanization, opens new avenues for growth. Increasing investment in green hydrogen and renewable energy integration with petrochemical production can reduce carbon footprints and enhance sustainability. Moreover, development of advanced catalysts and process optimization improves efficiency and product yield, lowering costs. The shift toward lightweight, high-performance materials in automotive and packaging sectors further fuels demand. Collaborations between industry players and governments to promote eco-friendly practices and infrastructure development also create a favorable environment for market expansion and technological advancement.

CHALLENGES: Rising competition from alternative materials

Challenges in the petrochemical feedstock market include strict environmental regulations and pressure to reduce carbon emissions, which increase compliance costs. Volatile crude oil and natural gas prices cause supply and pricing uncertainties. Dependence on fossil fuels limits sustainability, while high capital investment for cleaner technologies poses financial barriers. Supply chain disruptions due to geopolitical tensions add risk. Additionally, rising competition from alternative materials and increasing consumer preference for eco-friendly products challenge traditional petrochemical feedstock demand and market growth.

Global Petrochemical Feedstock Market Ecosystem Analysis

The global petrochemical feedstock market is driven by raw materials like naphtha, ethane, and natural gas liquids used to produce chemicals and plastics. Asia-Pacific leads demand due to rapid industrialization, while North America benefits from abundant natural gas. Technological advances improve processing efficiency, with a growing shift toward sustainable bio-based feedstocks despite cost challenges. Government regulations are tightening to reduce environmental impact, prompting capacity adjustments. The market is projected to grow significantly by 2030, fueled by rising demand in automotive, packaging, and construction sectors.

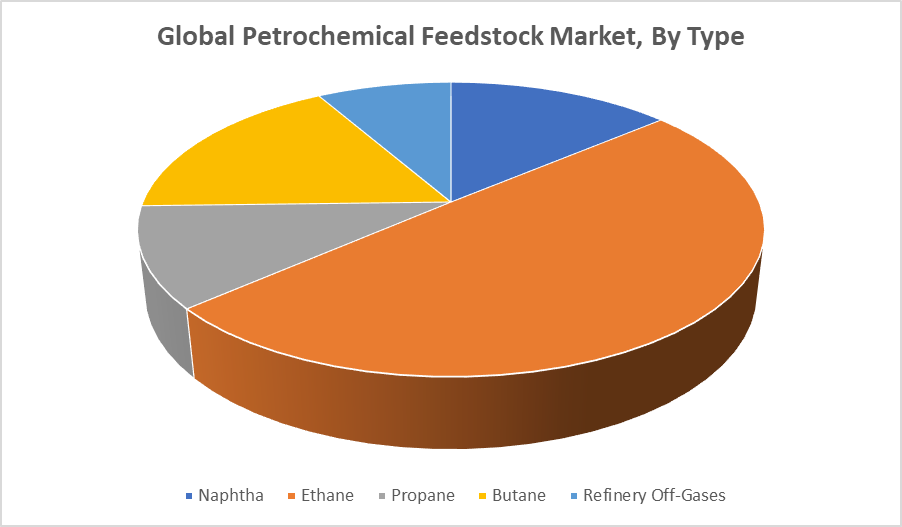

Based on the type, the ethane segment led the market with the leading revenue share over the forecast period

The ethane segment leads the petrochemical feedstock market, holding the largest revenue share over the forecast period. Its abundance, especially in North America, and cost-effectiveness make it a preferred feedstock for producing ethylene and other key chemicals. This dominance is supported by technological advancements in processing and growing demand from end-use industries like plastics and automotive manufacturing.

Based on the source, the bio-based segment held the market with the major revenue share over the forecast period

The bio-based segment held the largest revenue share in the petrochemical feedstock market over the forecast period. Growing environmental concerns and government support for sustainable alternatives are driving demand for bio-based feedstocks. Despite higher costs, their eco-friendly nature and lower carbon footprint make them increasingly preferred across industries focused on green production and circular economy initiatives.

Asia?Pacific is anticipated to hold the largest market share of the petrochemical feedstock market during the forecast period

Asia-Pacific is expected to dominate the petrochemical feedstock market throughout the forecast period due to rapid industrial growth and urbanization in countries like China, India, and Southeast Asia. The region’s expanding manufacturing base, especially in automotive, packaging, and construction sectors, drives high demand for petrochemical products. Additionally, availability of diverse feedstock sources and ongoing investments in infrastructure and technology support market growth. Favorable government policies promoting industrial development and exports further strengthen the region’s position. This combination of factors makes Asia-Pacific the largest and fastest-growing market for petrochemical feedstocks globally.

Middle East & Africa is expected to grow at the fastest CAGR in the petrochemical feedstock market during the forecast period

The Middle East & Africa region is expected to witness the fastest CAGR in the petrochemical feedstock market during the forecast period. This growth is driven by the region’s abundant natural gas and crude oil reserves, which provide a strong feedstock supply base. Investments in expanding petrochemical infrastructure and new production facilities, especially in countries like Saudi Arabia and the UAE, are fueling market expansion. Additionally, strategic government initiatives aimed at diversifying economies away from oil dependence support industry growth. Increasing demand from both domestic and export markets further accelerates the region’s rapid market development.

Recent Development

- In June 2022, SABIC announced a major investment dedicated to the development of bio-based petrochemical feedstocks. This strategic move aligns with SABIC’s broader commitment to sustainability and aims to address the growing global demand for eco-friendly and renewable raw materials in the petrochemical industry. By advancing bio-based feedstock technologies, SABIC is positioning itself at the forefront of the transition toward greener, more sustainable chemical production.

- In February 2024, LyondellBasell launched a series of sustainability-focused initiatives aimed at advancing the use of renewable feedstocks and implementing advanced recycling technologies. These projects reflect the company’s commitment to reducing its environmental footprint and promoting circular economy principles within the petrochemical sector. By integrating these innovations, LyondellBasell is actively working towards more sustainable production processes and a greener future.

Key Market Players

KEY PLAYERS IN THE PETROCHEMICAL FEEDSTOCK MARKET INCLUDE

- ExxonMobil Corporation

- SABIC (Saudi Basic Industries Corporation)

- Dow Chemical Company

- LyondellBasell Industries

- TotalEnergies SE

- Shell Chemicals

- BASF SE

- Chevron Phillips Chemical Company

- INEOS Group

- Mitsubishi Chemical Corporation

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the petrochemical feedstock market based on the below-mentioned segments:

Global Petrochemical Feedstock Market, By Type

- Naphtha

- Ethane

- Propane

- Butane

- Refinery Off-Gases

Global Petrochemical Feedstock Market, By Source

- Fossil-Based

- Bio-Based

- Chemically Recycled (Pyrolysis Oil)

- Gasification-Derived (Syngas)

Global Petrochemical Feedstock Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the revenue potential of the bio-based feedstock segment by 2035?

A: The bio-based segment is anticipated to hold the largest revenue share over the forecast period, driven by growing environmental concerns and demand for sustainable alternatives.

Q: Which startups are disrupting the Petrochemical Feedstock market?

A: While the market is currently dominated by established players, startups involved in chemical recycling technologies and green hydrogen integration are emerging as disruptors, although specific names are not highlighted in the report.

Q: Can you provide company profiles for the leading Petrochemical Feedstock manufacturers?

A: Yes. For example, SABIC has invested in bio-based feedstock development, while LyondellBasell has launched initiatives focused on renewable feedstocks and advanced recycling.

Q: Which regulations are affecting this market?

A: Regulations promoting energy efficiency, carbon reduction, and recycling are impacting market strategies, with increasing pressure on companies to adopt sustainable practices.

Q: What are the latest trends in the Petrochemical Feedstock market?

A: Major trends include the integration of green hydrogen and renewable energy, advancements in chemical recycling (e.g., pyrolysis), and increasing focus on bio-based feedstocks.

Q: What are the top investment opportunities in the Global Petrochemical Feedstock Market?

A: Attractive investment areas include bio-based and renewable feedstocks, chemical recycling technologies, and infrastructure for sustainable petrochemical production.

Q: What is the long-term outlook (2025–2035) for the Petrochemical Feedstock market?

A: The market is expected to maintain steady growth, driven by innovation, sustainability initiatives, and expanding demand from key industrial sectors globally.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 217 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Aug 2025 |

| Access | Download from this page |