Global Pigeon Pea Flour and Protein Market

Global Pigeon Pea Flour and Protein Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (Flour, Protein Concentrate, and Protein Isolate), By Application (Bakery & Confectionery, Animal Feed, Functional Foods, and Nutritional Supplements), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Pigeon Pea Flour and Protein Market Summary, Size & Emerging Trends

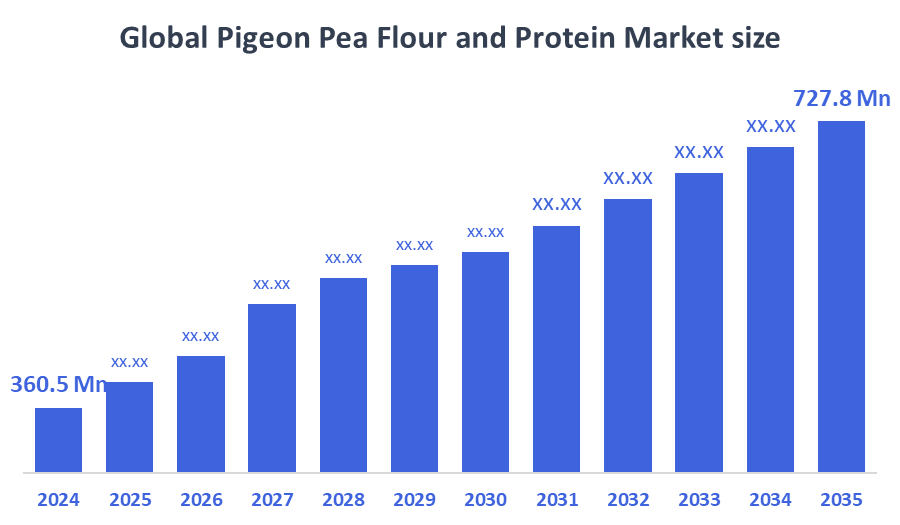

According to Decision Advisor, The Global Pigeon Pea Flour and Protein Market Size is Expected to Grow from USD 360.5 Million in 2024 to USD 727.8 Million by 2035, at a CAGR of 6.6% during the forecast period 2025-2035. Increasing consumer awareness regarding plant-based proteins and rising demand for gluten-free and allergen-free food ingredients are key driving factors for the pigeon pea flour and protein market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the pigeon pea flour and protein market during the forecast period.

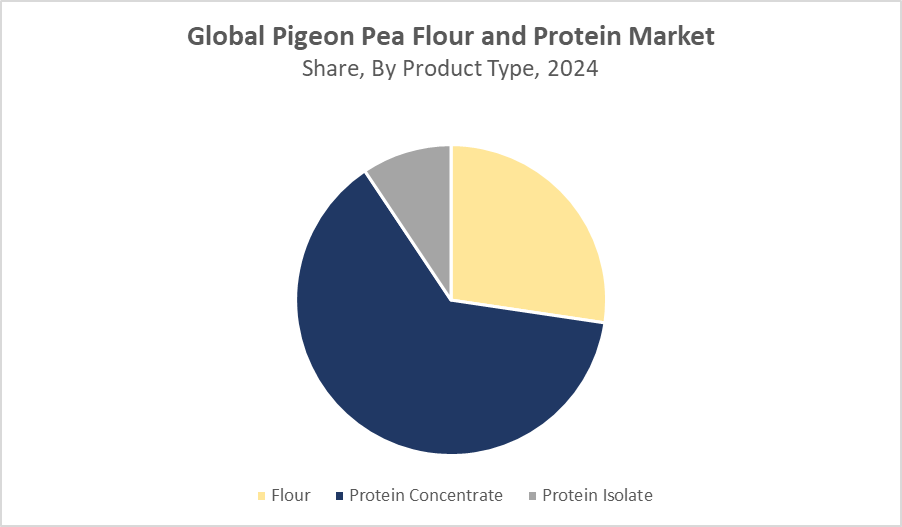

- In terms of product type, the protein concentrate segment dominated in terms of revenue during the forecast period.

- In terms of application, the bakery & confectionery segment accounted for the largest revenue share in the global pigeon pea flour and protein market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 360.5 Million

- 2035 Projected Market Size: USD 727.8 Million

- CAGR (2025-2035): 6.6%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Pigeon Pea Flour and Protein Market

The pigeon pea flour and protein market centers on the production and utilization of pigeon pea-derived ingredients that serve as nutrient-rich, plant-based alternatives in food and feed applications. These products are prized for their high protein content, digestibility, and functional properties such as emulsification and water retention. Increasing adoption in gluten-free bakery products, nutritional supplements, and animal feed formulations is fueling market growth. Government initiatives promoting sustainable agriculture and plant-based nutrition also support the market. Ongoing research into novel protein extraction methods enhances product quality and functionality. Rising consumer demand for healthy, allergen-free, and eco-friendly food ingredients positions pigeon pea flour and protein as key contributors to the plant protein industry’s expansion.

Pigeon Pea Flour and Protein Market Trends

- Growing preference for plant-based and gluten-free protein ingredients.

- Advancements in extraction technology improving protein purity and functional characteristics.

- Increased use of pigeon pea protein in sports nutrition and functional food segments.

Pigeon Pea Flour and Protein Market Dynamics

Driving Factors: Rising health awareness and demand for sustainable protein sources

Key growth factors for the pigeon pea flour and protein market include increasing consumer health consciousness, driving demand for protein-rich, allergen-free, and plant-based diets. The expanding vegan and vegetarian populations globally boost interest in sustainable and eco-friendly protein alternatives like pigeon pea. Additionally, the food industry’s shift towards clean-label and natural ingredients promotes pigeon pea protein adoption. Government initiatives supporting pulse cultivation and protein research further enhance supply and innovation, encouraging steady market expansion.

Restrain Factors: Limited consumer awareness and competition from other plant proteins

Restraining factors in the pigeon pea flour and protein market include low consumer awareness compared to established plant proteins such as soy and pea. Market growth is impacted by supply chain inefficiencies and price volatility. The strong presence of alternative proteins with better-developed supply chains and brand recognition restricts pigeon pea protein market penetration. Additionally, challenges related to consumer education and availability in some regions slow adoption, requiring increased marketing efforts and infrastructure improvements to build trust and reliability.

Opportunity: Expansion in emerging markets and development of novel food applications

The pigeon pea flour and protein market presents promising opportunities, especially in emerging economies with growing health-conscious populations. The development of new food products, including ready-to-eat snacks, plant-based meat alternatives, and fortified beverages, can drive demand. Collaborations between food manufacturers and protein producers are accelerating innovation and product diversification. Expanding into untapped markets and creating appealing formulations can unlock additional revenue streams, making pigeon pea protein an attractive ingredient for the evolving global food industry.

Challenges: Supply chain instability and regulatory hurdles

Challenges in the pigeon pea flour and protein market include maintaining consistent raw material quality amid climate change and agricultural variability. Regulatory complexities, including novel food approvals and labeling requirements across different countries, slow product launches and market entry. High processing costs and underdeveloped infrastructure in certain regions also hinder expansion and cost efficiency. Addressing these challenges requires better supply chain management, compliance strategies, and investment in advanced processing technologies to sustain growth and competitiveness.

Global Pigeon Pea Flour and Protein Market Ecosystem Analysis

The global pigeon pea flour and protein market ecosystem includes key stakeholders such as pulse farmers, ingredient processors, food manufacturers, and distributors. Major pigeon pea producing countries, particularly India, Myanmar, and Kenya, influence raw material availability and cost. Ingredient manufacturers focus on refining protein extraction and enhancing functional properties. Food companies leverage pigeon pea protein to meet consumer demand for plant-based and gluten-free products. Regulatory bodies enforce food safety and labeling standards to ensure consumer confidence and compliance. Growth relies on supply chain optimization, technological advancements, and increasing consumer education.

Global Pigeon Pea Flour and Protein Market, By Product Type

What key advantages helped the protein concentrate segment outperform others in the pigeon pea flour and protein market?

The protein concentrate segment dominated the pigeon pea flour and protein market due to its high nutritional value, growing demand from health-conscious consumers, and its wide application in functional foods, sports nutrition, and dietary supplements. Manufacturers favored protein concentrates for their superior protein content, easier digestibility, and ability to enhance the nutritional profile of food products without significantly altering taste or texture. Additionally, rising awareness about plant-based protein sources, especially in vegan and vegetarian diets, further boosted the segment's appeal.

How did the flour segment maintain its prominent standing in the pigeon pea flour and protein market?

The flour segment holds a significant share in the pigeon pea flour and protein market due to its versatility, cost-effectiveness, and widespread usage in traditional and modern food applications. Pigeon pea flour is commonly used in baked goods, snacks, and ethnic dishes, especially in regions where plant-based ingredients are a staple. Its rich nutritional profile, including fiber, protein, and essential minerals, makes it a popular choice for health-conscious consumers. Additionally, the growing demand for gluten-free and high-protein flour alternatives has further driven the segment's growth.

Global Pigeon Pea Flour and Protein Market, By Application

Why was the bakery & confectionery application preferred over other segments in the pigeon pea flour and protein market?

The bakery & confectionery segment accounted for the largest revenue share in the global pigeon pea flour and protein market due to the rising demand for healthier, plant-based ingredients in baked goods and sweet products. Pigeon pea flour is increasingly being used in bakery formulations to enhance protein content, improve texture, and meet gluten-free and allergen-free requirements. Its ability to blend well with other flours while offering nutritional benefits made it highly attractive to manufacturers. The growing consumer preference for high-protein snacks, clean-label products, and functional foods further propelled its adoption in this segment. Additionally, innovations in product development and increasing awareness of plant-based diets contributed to the segment’s strong performance during the forecast period.

What makes the animal feed segment a promising area in the pigeon pea flour and protein market?

The animal feed segment represents a growing application area in the pigeon pea flour and protein market due to the rising demand for sustainable, plant-based protein sources in livestock and poultry nutrition. Pigeon pea-based products offer a rich amino acid profile, high digestibility, and are cost-effective alternatives to traditional feed ingredients like soy. As the global animal nutrition industry moves towards cleaner, non-GMO, and locally sourced feed options, pigeon pea flour and protein have gained attention for their nutritional benefits and environmental advantages. Additionally, increased agricultural byproduct utilization and advancements in feed formulation technologies have further supported the segment’s expansion.

Asia Pacific is projected to dominate the global pigeon pea flour and protein market, accounting for approximately 50% of total market revenue during the forecast period.

This leadership stems from the region’s strong agricultural foundation especially in India and Myanmar, two of the world’s largest pigeon pea producers. Local dietary preferences for pulses and the growing use of pigeon pea derivatives in both food and animal feed industries further reinforce the region’s leading position. Industrial-scale adoption is increasing due to the ingredient’s nutritional value and versatility.

India is experiencing robust market growth with a projected CAGR of 9%.

This expansion is fueled by rising domestic consumption, expanding export opportunities, and favorable government policies that support pulse cultivation and protein innovation. Initiatives aimed at boosting food security and promoting plant-based protein alternatives are encouraging new investments and research, strengthening India’s role as both a producer and consumer in the global pigeon pea protein ecosystem.

North America is anticipated to witness the fastest growth rate, with the region holding an estimated 18% share during the forecast period.

This growth is driven primarily by increasing demand for plant-based and gluten-free protein sources in the U.S. and Canada. A shift toward clean-label products and a rise in health-focused food choices are creating a favorable environment for pigeon pea protein adoption.

In the United States, consumer preferences are evolving rapidly.

The growing popularity of vegetarian and vegan diets, along with a surge in gluten sensitivity awareness, is pushing demand for alternative protein sources. As a result, major food companies and ingredient manufacturers are introducing pigeon pea-based products, contributing to broader market penetration and consumer acceptance.

WORLDWIDE TOP KEY PLAYERS IN THE PIGEON PEA FLOUR AND PROTEIN MARKET INCLUDE

-

- Ardent Mills

- Ingredion Incorporated

- AGT Food and Ingredients

- Cargill, Incorporated

- Tata Chemicals

- ADM (Archer Daniels Midland Company)

- Bunge Limited

- SunOpta Inc.

- Roquette Frères

- Others

Product Launches in Pigeon Pea Flour and Protein Market

- In March 2024, Ingredion Incorporated, a global leader in ingredient solutions, launched a new range of high-protein pigeon pea concentrates specifically developed for use in gluten-free bakery products and nutritional supplements. This product line is designed to address the growing consumer demand for plant-based, allergen-friendly protein ingredients. By targeting the clean-label and functional food segments, Ingredion aims to expand its portfolio of sustainable protein options and support food manufacturers in developing innovative, health-focused products that cater to evolving dietary trends.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the pigeon pea flour and protein market based on the below-mentioned segments:

Global Pigeon Pea Flour and Protein Market, By Product Type

-

- Flour

- Protein Concentrate

- Protein Isolate

Global Pigeon Pea Flour and Protein Market, By Application

-

- Bakery & Confectionery

- Animal Feed

- Functional Foods

- Nutritional Supplements

Global Pigeon Pea Flour and Protein Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q. What is the projected market size of the global pigeon pea flour and protein market by 2035?

A: The market is expected to grow from USD 360.5 million in 2024 to USD 727.8 million by 2035, registering a CAGR of 6.6% during 2025-2035.

Q. Which region is expected to dominate the pigeon pea flour and protein market?

A: Asia Pacific is forecasted to hold the largest market share throughout the forecast period, driven by strong production in countries like India and Myanmar.

Q. Why does the protein concentrate segment lead the market?

A: Protein concentrate dominates due to its superior nutritional value, high protein content, ease of digestibility, and widespread application in functional foods, sports nutrition, and supplements.

Q. What makes the bakery & confectionery application segment the largest?

A: The bakery & confectionery segment leads due to the increasing demand for plant-based, gluten-free ingredients that improve protein content, texture, and meet allergen-free consumer preferences.

Q. What are the main drivers fueling the growth of the pigeon pea flour and protein market?

A: Rising health awareness, increasing demand for sustainable and plant-based protein sources, growing vegan and vegetarian populations, and supportive government policies are key drivers.

Q. What challenges does the market currently face?

A: Challenges include limited consumer awareness relative to established proteins (e.g., soy), supply chain inefficiencies, price volatility, regulatory hurdles, and high processing costs.

Q. Which region is expected to witness the fastest market growth?

A: North America is projected to experience the fastest growth, propelled by rising demand for plant-based and gluten-free proteins in the U.S. and Canada.

Q. How is the animal feed segment positioned within the market?

A: The animal feed segment is expanding due to increasing demand for sustainable, plant-based protein sources that provide a cost-effective alternative to traditional feed like soy.

Q. What opportunities exist for the pigeon pea flour and protein market?

A: Opportunities include growth in emerging markets, development of novel food products (e.g., plant-based meats, fortified beverages), and collaborations between protein producers and food manufacturers.

Q. Who are the leading players in the global pigeon pea flour and protein market?

A: Major companies include Ardent Mills, Ingredion Incorporated, AGT Food and Ingredients, Cargill, Tata Chemicals, ADM, Bunge Limited, SunOpta Inc., and Roquette Frères.

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 251 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Oct 2025 |

| Access | Download from this page |