Global Plant Protein Ingredients Market

Global Plant Protein Ingredients Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Source (Soy, Pea, Wheat, and Rice), By Form (Isolates, Concentrates, Hydrolysates, Textured, and Flour), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Report Overview

Table of Contents

Plant Protein Ingredients Market Size Summary, Size & Emerging Trends

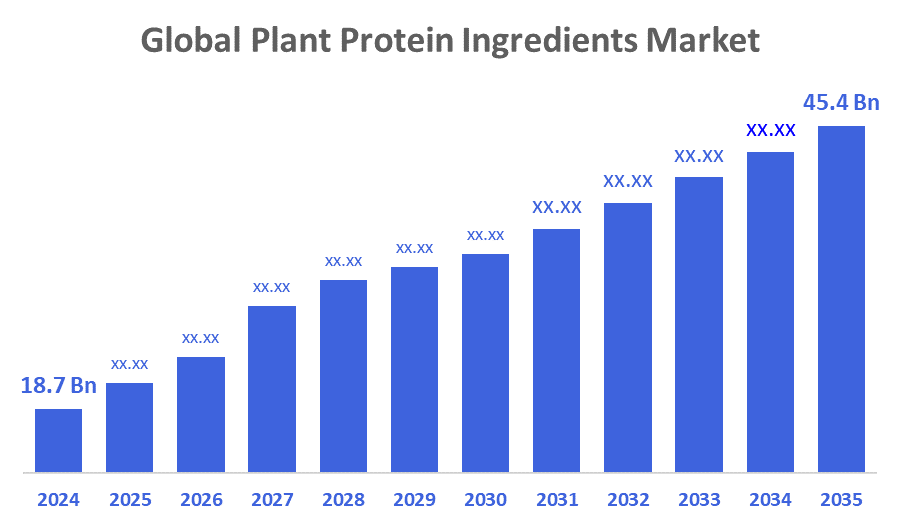

According to Decisions Advisors, The Global Plant Protein Ingredients Market Size is expected to Grow from USD 18.7 Billion in 2024 to USD 45.4 Billion by 2035, at a CAGR of 8.4% during the forecast period 2025-2035. Rising consumer demand for sustainable and health-conscious products, coupled with increased applications in food, beverages, and supplements, are primary factors driving market growth.

Key Market Insights

- Asia-Pacific is expected to be one of the fastest-growing regions in the plant protein ingredients market during the forecast period.

- Among sources, the pea protein segment is projected to dominate the market due to its allergen-free and sustainable nature.

- In terms of form, the isolates segments are expected to lead the market during the forecast period.

- In terms of application, the food & beverages segment accounted for the largest revenue share in the global plant protein ingredients market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 18.7 Billion

- 2035 Projected Market Size: USD 45.4 Billion

- CAGR (2025-2035): 8.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Plant Protein Ingredients Market

The plant protein ingredients market focuses on the extraction and utilization of protein-rich compounds derived from plant sources such as soy, peas, wheat, and rice. These proteins are used in a wide range of applications, including food and beverages, nutritional supplements, and meat alternatives. Plant proteins are gaining traction as consumers shift toward healthier, more sustainable, and ethically sourced ingredients. With increasing demand for vegan, allergen-free, and clean-label products, the market is undergoing rapid innovation in processing and product development. Plant proteins also align with global environmental and health goals, reinforcing their importance in future food systems.

Plant Protein Ingredients Market Trends

- Growing shift toward clean-label, non-GMO, and allergen-free plant protein ingredients.

- Advancements in protein extraction technologies are improving texture, solubility, and taste.

- Surge in demand for plant-based meat and dairy alternatives across global markets.

- Expanding use of novel legumes and grains as alternative protein sources.

Plant Protein Ingredients Market Dynamics

Driving Factors: Rising consumer demand for sustainable and plant-based nutrition

Key growth drivers include the growing adoption of plant-based diets, increasing health awareness, and a rise in food intolerances and allergies to animal-based proteins. Consumers are actively seeking natural, eco-friendly, and high-protein alternatives in their daily diets. Additionally, plant proteins offer a lower carbon footprint and require fewer natural resources for production, aligning with sustainability goals globally.

Restrain Factors: High production cost and taste/texture challenges

The market faces challenges, including high extraction and processing costs, flavour masking, and texture issues that may affect consumer acceptance. Additionally, the availability of alternative protein sources, such as animal and microbial proteins, may limit market penetration in certain segments. Regulatory complexities and inconsistent labelling requirements across regions further create entry barriers.

Opportunity: Expanding applications across health, wellness, and speciality nutrition

There is a strong opportunity in developing regions with rising disposable incomes and changing dietary habits. The integration of plant protein ingredients into infant nutrition, clinical nutrition, and sports supplements presents untapped growth potential. Continuous R&D efforts and innovations in product formulations are opening new avenues for application across diverse food categories.

Challenges: Supply chain variability and regulatory complexities

Major challenges include raw material supply volatility, climate-related agricultural risks, and global trade disruptions. Additionally, inconsistent regulations regarding plant-based labelling, allergen claims, and food safety standards may hinder global market harmonization and slow product approvals.

Global Plant Protein Ingredients Market Ecosystem Analysis

The global plant protein ingredients market ecosystem includes raw material suppliers, protein processors, formulation developers, and end-users in food, beverage, health, and nutrition sectors. Leading manufacturers prioritize expanding production, sustainable sourcing, and technological advancements. Governments and certification bodies enforce food safety and sustainability regulations. Collaborative partnerships across the value chain ensure product quality, cost efficiency, and continuous innovation, driving market growth and meeting evolving consumer demands for sustainable, high-quality plant protein products worldwide.

Global Plant Protein Ingredients Market, By Source

The pea protein segment is projected to lead the plant protein ingredients market with an estimated 35% market share by 2035. This growth is driven primarily by its hypoallergenic nature, making it suitable for consumers with allergies or dietary restrictions. Pea protein is rich in essential amino acids and offers a well-balanced nutritional profile, supporting muscle health and overall wellness. Additionally, its excellent solubility and emulsification properties make it highly versatile for food and beverage applications such as protein shakes, bakery items, dairy alternatives, and meat substitutes. These functional benefits enhance texture, flavor, and stability, contributing to its rapid adoption in clean-label and plant-based product development.

Soy protein remains a dominant and mature segment, expected to hold around 30% of the plant protein ingredients market share through 2035. Valued for its complete amino acid profile and high protein concentration, soy protein has a long-standing reputation for providing excellent nutritional benefits. Its functional properties such as gelation, water-binding, and emulsification enable diverse applications in meat alternatives, nutritional supplements, dairy substitutes, and bakery products. Despite emerging competitors, soy protein’s cost-effectiveness, availability, and extensive research supporting health claims keep it highly favored in both traditional and emerging markets. However, concerns over allergens and GMO status in some regions may influence its future growth compared to newer options.

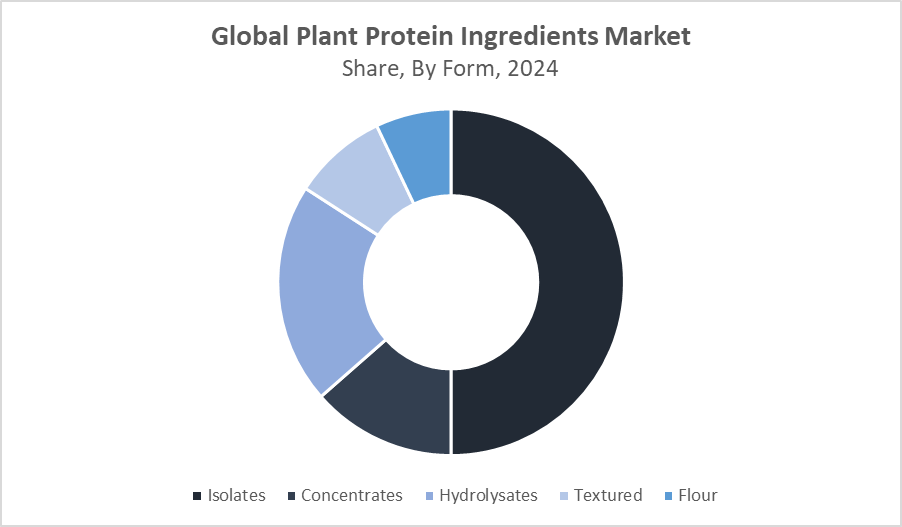

Global Plant Protein Ingredients Market, By Form

The isolates segments are expected to dominate the plant protein ingredients market, collectively holding around 65% of the total revenue share by 2035. These forms provide high protein purity, typically above 80% for concentrates and over 90% for isolates, offering excellent functional benefits such as solubility, emulsification, and gelation. Their versatility makes them ideal for use in dietary supplements, protein-enriched beverages, clinical nutrition products, and functional foods. Concentrates offer a cost-effective option with good nutritional value, while isolates cater to premium products requiring higher purity and better taste profiles.

The hydrolysates segment is gaining traction, projected to capture about 15% of the plant protein ingredients market share by 2035. Protein hydrolysates are partially broken-down proteins, which improve digestibility and bioavailability. This makes them particularly valuable in sensitive applications like infant formula, clinical nutrition, and sports nutrition, where rapid absorption and hypoallergenic properties are critical. The segment’s growth is fueled by increasing demand for specialised nutrition products addressing specific health needs and growing consumer awareness of protein quality and functionality.

North America remains the largest regional market for plant protein ingredients, expected to hold approximately 40% of the global market share by 2035.

This dominance is driven by widespread acceptance of plant-based lifestyles, high consumer awareness of health and sustainability, and strong R&D activities focused on innovative product development. The region is also home to major ingredient manufacturers and key end-use industries in food, beverage, and nutrition, further fueling market growth. Supportive regulatory frameworks and growing demand for clean-label and functional foods contribute to North America’s leading position.

The United States holds a significant share within the North American plant protein ingredients market, accounting for nearly 70% of the region’s revenue by 2035.

The U.S. market benefits from high consumer awareness of plant-based diets, extensive R&D investments, and a mature food and beverage industry focused on innovation. The booming demand for plant-based meat alternatives, protein supplements, and functional foods drives the adoption of diverse plant proteins. Additionally, strong regulatory support and the presence of leading ingredient manufacturers further reinforce the U.S. as a crucial hub for market growth.

Asia-Pacific is projected to be the fastest-growing regional market, anticipated to achieve a robust CAGR of around 12% and hold about 30% of the global market share by 2035.

This rapid growth is fueled by rising populations, urbanisation, and shifting dietary patterns toward protein-rich, plant-based foods. Increasing investments in food technology and processing infrastructure, especially in countries like China and India, are expanding production capacities and product availability. The surging demand across food, beverage, and nutrition sectors, combined with government initiatives supporting sustainable agriculture and health, positions the Asia-Pacific as a dynamic growth engine.

China is a key driver within the Asia-Pacific market, expected to hold around 45% of the region’s market share by 2035.

Rapid urbanisation, increasing disposable incomes, and a growing middle class are fueling dietary shifts toward healthier, plant-based options. Investments in food technology and protein processing facilities are accelerating to meet rising demand in the food, beverage, and nutrition sectors. Government initiatives promoting sustainable agriculture and nutrition awareness campaigns are also supporting market expansion, making China a focal point for plant protein ingredient growth in Asia-Pacific.

WORLDWIDE TOP KEY PLAYERS IN THE PLANT PROTEIN INGREDIENTS MARKET INCLUDE

- Archer Daniels Midland Company (ADM)

- Cargill

- Roquette Frères

- Ingredion Incorporated

- DuPont Nutrition & Biosciences

- Kerry Group

- Axiom Foods Inc.

- The Scoular Company

- Burcon NutraScience Corporation

- Puris

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the plant protein ingredients market based on the below-mentioned segments:

Global Plant Protein Ingredients Market, By Source

- Soy

- Pea

- Wheat

- Rice

Global Plant Protein Ingredients Market, By Form

- Isolates

- Concentrates

- Hydrolysates

- Textured

- Flour

Global Plant Protein Ingredients Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 172 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |