Global Polyethylene Terephthalate Catalyst Market

Global Polyethylene Terephthalate Catalyst Market Size, Share, and COVID-19 Impact Analysis, By Product (Antimony-Based, Aluminum-based, Titanium-based, Germanium-based, Other Catalysts), By Application (Packaging, Textile & Apparel, Automotive, Medical, Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Polyethylene Terephthalate Catalyst Market Summary

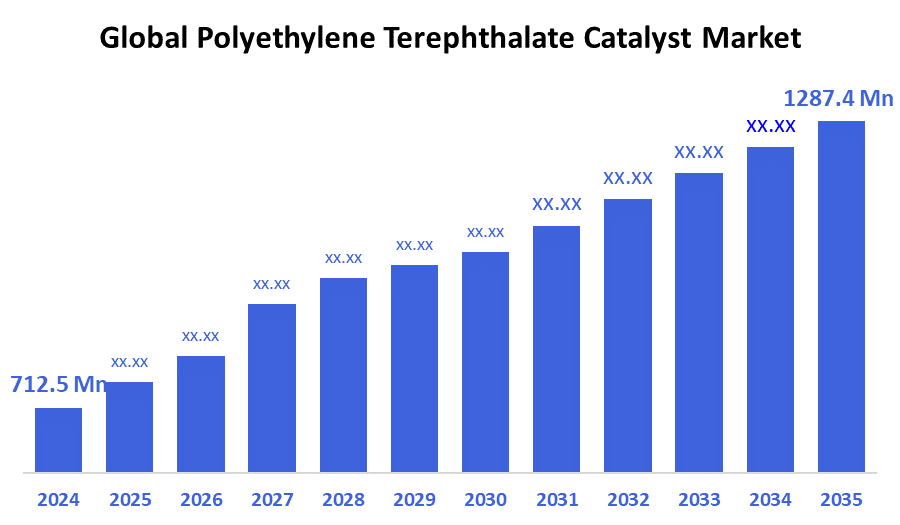

The Global Polyethylene Terephthalate Catalyst Market Size was estimated at USD 712.5 Million in 2024 and is projected to reach USD 1287.4 Million by 2035, growing at a CAGR of 5.53% from 2025 to 2035. The growing global demand for PET resin in a variety of applications, particularly food, beverage, and cosmetic packaging, as a result of urbanization and rising consumer affluence, is propelling the growth of the polyethylene terephthalate (PET) catalyst market.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the greatest revenue share of 51.5%, dominating the market for polyethylene terephthalate catalysts.

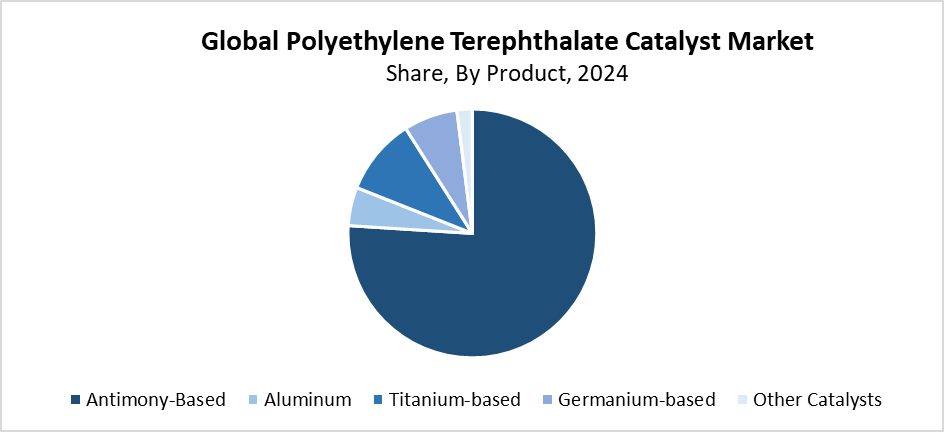

- In 2024, the antimony-based segment held the largest revenue share of 76.3% based on product, dominating the market.

- In 2024, the packaging segment held a 62.5% revenue share, dominating the polyethylene terephthalate catalyst market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 712.5 Million

- 2035 Projected Market Size: USD 1287.4 Million

- CAGR (2025-2035): 5.53%

- Asia Pacific: Largest market in 2024

The Polyethylene Terephthalate (PET) catalyst market exists as the worldwide industry that develops and applies catalysts to accelerate polymerization of PET, which is a durable, lightweight, recyclable thermoplastic polymer made from ethylene glycol and terephthalic acid. The catalysts play an essential role in enhancing the efficiency, reliability, and quality of PET production. The market experiences rapid growth because of the increasing requirements for PET in packaging uses, particularly within the food and beverage sector. The demand arises because of multiple factors, such as growing cities together with changing consumer preferences, and rising interest in convenient and environmentally friendly packaging products. The need for efficient catalyst systems grows stronger because PET serves as an attractive material combination of strength and recyclability.

The PET catalyst industry is experiencing a transformation because of major technological innovations that have emerged. The rising environmental and public health worries drive the transition toward sustainable catalysts that replace antimony compounds with organic and titanium-based alternatives. New developments minimize ecological damage and improve process productivity. The worldwide government sector supports this transformation through three main channels: enhanced environmental regulations and recycling standards, together with financial support for sustainable technology initiatives. The adoption of sustainable PET catalyst alternatives continues to grow because of circular economy initiatives which drive rapid market innovation and expansion.

Product Insights

The antimony-based category held the largest revenue share of 76.3% and dominated the polyethylene terephthalate (PET) catalyst market during 2024. The primary factors that drive its market dominance include its extensive industrial versatility combined with efficient catalytic performance and cost-effectiveness. The industry standard for PET synthesis has been antimony-based catalysts because of their capacity to speed up polymerization procedures without sacrificing product quality. Their reliable performance and integration with existing manufacturing systems maintain their leading market position despite increasing concerns about antimony residues affecting health and the environment. The need for safer, environmentally friendly substitutes, along with regulatory pressures, drives research towards titanium cobalt and organic material-based catalysts, which may alter market trends during the upcoming years.

The polyethylene terephthalate (PET) catalyst market's titanium-based segment is projected to grow at the fastest CAGR during the forecast time frame. The rapid growth mainly stems from rising health and environmental anxieties regarding traditional antimony-based catalysts, which push industries to seek safer, sustainable alternatives. Titanium-based catalysts provide multiple advantages that include lower toxicity levels and decreased heavy metal contamination in final products, and improved PET material recycling capabilities. The recent improvements in catalyst formulation have made titanium-based systems both cost-effective and efficient, which positions them as suitable alternatives for large-scale PET manufacturing. International markets accelerate the adoption of titanium-based catalysts through both supportive government regulations and increasing industrial emphasis on sustainable manufacturing operations.

Application Insights

The packaging segment held the largest revenue share of 62.5% in 2024 and dominated the Polyethylene Terephthalate (PET) catalyst market. The widespread application of PET in food and beverage packaging containers, including bottles and films, as well as containers, makes it dominate the market because of its excellent barrier properties and lightweight, durable nature. The demand for sustainable, safe, and convenient packaging solutions, especially in rapidly urbanizing areas, has driven the significant growth of PET usage. The increasing demand for carbonated beverages and bottled water, together with ready-to-eat foods, has solidified PET as the preferred choice for the packaging industry. The continuous demand for efficient, high-quality PET catalysts remains substantial since they enable mass production and help the segment sustain its leading market position.

Throughout the forecast period, the textile & apparel segment of the polyethylene terephthalate (PET) catalyst market is anticipated to grow at the fastest CAGR. The growth stems from the increasing use of PET-based fibers, particularly polyester for apparel, home textiles, and industrial fabrics, due to their strength, affordability, and long-lasting characteristics. The textile industry adopts PET because consumers want lightweight textiles that resist wrinkles and dry quickly. The growing attention sustainability has led to increased rPET fiber usage in clothes, but achieving high-quality fiber production requires proper catalyst system operations. The shift of fashion companies toward sustainable materials will drive the rising need for advanced PET catalysts in textile production.

Regional Insights

In 2024, the Asia Pacific polyethylene terephthalate (PET) catalyst market led globally, with the largest revenue share of 51.5%. The superior ranking of this region stems from three factors: its strong manufacturing sector, rapid industrial development, along rising PET usage in multiple sectors, including consumer products, packaging, and textile applications. The countries of China, India, Japan, and South Korea stand as key producers because of their extensive PET manufacturing capabilities and their growing need for packaged products and artificial fibers. The demand for PET material keeps growing because of expanding cities and increased consumer spending, and the growing retail sector and online shopping activities. The worldwide PET catalyst market leader position of Asia Pacific remains firm because governmental policies in this region actively support industrial growth.

Europe Polyethylene Terephthalate (PET) Catalyst Market Trends

The European market for polyethylene terephthalate (PET) catalysts accounted for 19.4% of worldwide sales in 2024. The region's market performance is propelled by high PET demand across textiles, automotive sectors, and the packaging industry, as well as growing sustainability and recycling initiatives. The European region leads the way in implementing rigorous environmental regulations, together with circular economy initiatives, which encourage the use of innovative, environmentally friendly catalyst technologies. The advancement of alternative catalysts, including titanium-based and organic systems, receives support from growing R&D budgets and advancements in environmentally friendly chemical processes. Through this innovative and regulatory-friendly environment, Europe maintains its status as a key force within the global PET catalyst market.

North America Polyethylene Terephthalate (PET) Catalyst Market Trends

The North American market for Polyethylene Terephthalate (PET) catalyst represented 16.5% of worldwide sales during 2024. The consistent market share of PET derives from its stable packaging industry demand, where it serves food containers, bottled beverages, and personal hygiene products. The market achieves success through renowned PET manufacturers and advanced manufacturing plants, and its focus on quality and efficiency standards. People show increasing interest in eco-friendly catalyst substitutes for traditional antimony-based systems because of growing sustainability and recycling awareness. Advanced PET catalyst technology adoption in North America receives additional momentum through regulatory frameworks that support both plastic waste reduction and circular economy development.

Key Polyethylene Terephthalate Catalyst Companies:

The following are the leading companies in the polyethylene terephthalate (PET) catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- TOYOBO

- NAN YA PLASTICS CORPORATION

- Evonik Industries AG

- Teijin

- Indorama Ventures

- Iwatani Corporation

- SAKAI CHEMICAL INDUSTRY CO., LTD.

- Catalytic Technologies Ltd

- Wellman Introduces

- Amerex Hubei Decon Polyester Co., Ltd.

- Others

Recent Developments

- In June 2025, Toyobo Co., Ltd. and DMC Biotechnologies, a U.S.-based company, signed a combined research and development agreement to produce and market sustainable chemical compounds, specifically as raw materials for general-purpose plastics, through sophisticated biomanufacturing techniques that use precision fermentation and synthetic biology. With less dependence on fossil fuels and greenhouse gas emissions, this project seeks to increase manufacturing efficiency.

- In May 2024, Toyobo Co., Ltd. declared that the Association of Plastic Recyclers (APR) recognized its recently created PET shrink label film, ReCrysta, under the APR Design for Recyclability. Based on third-party testing, this certification attests that ReCrysta satisfies or surpasses the most stringent requirements under APR's Critical Guidance Recognition pathway. Unlike typical PET shrink films, which use distinct monomers and need to be sorted separately during recycling, ReCrysta is made with more than 50% recycled PET resin and is created using the same monomers present in PET bottles. Because of their chemical compatibility, ReCrysta shrink labels and PET bottles can be recycled together, increasing the effectiveness and caliber of recovered PET resin flakes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the polyethylene terephthalate catalyst market based on the below-mentioned segments:

Global Polyethylene Terephthalate Catalyst Market, By Product

- Antimony-Based

- Aluminum

- Titanium-based

- Germanium-based

- Other Catalysts

Global Polyethylene Terephthalate Catalyst Market, By Application

- Packaging

- Textile & Apparel

- Automotive

- Medical

- Other Applications

Global Polyethylene Terephthalate Catalyst Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 245 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |