Global Polyvinyl Butyral Market

Global Polyvinyl Butyral Market Size, Share, and COVID-19 Impact Analysis, By Type (Films & Sheets, Resins, Solutions, Other Types), By Application (Laminated Safety Glass, Paints & Coatings, Adhesives, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035

Report Overview

Table of Contents

Polyvinyl Butyral Market Summary

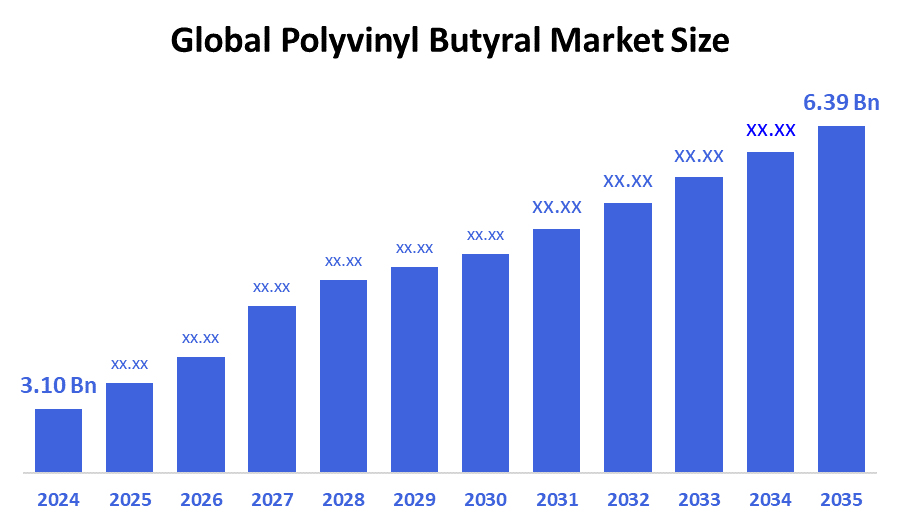

The Global Polyvinyl Butyral Market Size Was Estimated at USD 3.10 Billion in 2024 and is Projected to Reach USD 6.39 Billion by 2035, Growing at a CAGR of 6.8% from 2025 to 2035. The market for polyvinyl butyral (PVB) is expanding due to factors like the growing demand for architectural and automotive safety glass, increased construction activity, stricter safety regulations, improvements in recycling technologies, and a global focus on sustainable and energy-efficient building materials.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific held the largest revenue share of over 38.51% and dominated the market globally.

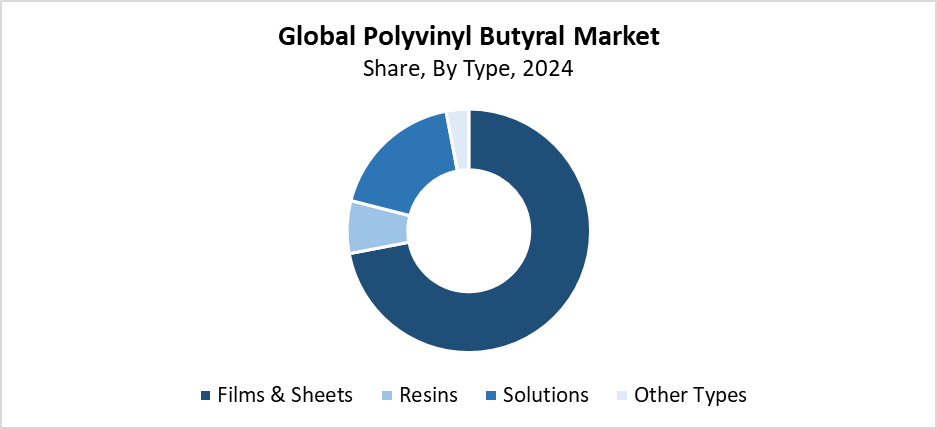

- In 2024, the films & sheets segment had the highest market share by type, accounting for 72.35%.

- In 2024, the laminated safety glass segment had the biggest market share by application, accounting for 70.51%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 3.10 billion

- 2035 Projected Market Size: USD 6.39 billion

- CAGR (2025-2035): 6.8%

- Asia Pacific: Largest market in 2024

The Polyvinyl Butyral (PVB) market produces and applies PVB resin, which functions as a versatile thermoplastic material that is widely used in laminated safety glass applications and especially in automotive and construction sectors. The unique properties of PVB make it ideal to connect glass sheets in windshields and architectural glazing because it delivers excellent bonding strength, together with clear optics and resistance to impacts and ultraviolet exposure. The market receives its main driving force from three key elements, which include rising automobile safety glass requirements and worldwide infrastructure growth, and the use of laminated glass for acoustic and thermal insulation in energy-efficient buildings. The expanding safety regulations, together with urban development, increase the demand for PVB-based products for multiple applications.

The PVB market experiences strong influence from technological advancements, which particularly focus on recycling processes and bio-based PVB resins, together with multi-layered glazing solutions. Producers use these advancements to develop advanced, eco-friendly materials that meet contemporary industrial needs. Governments worldwide promote market expansion through regulations that support energy-efficient and shatter-resistant materials as well as green building certifications and car safety standards. PVB adoption receives strong market support from smart city and infrastructure development incentives, particularly in the European and Asia-Pacific regions. The circular economy model benefits from the collaboration between industry participants and government agencies, which drives market expansion through improved PVB recycling of end-of-life windshields.

Type Insights

What Factors Enabled the Films & Sheets Segment to Dominate the Polyvinyl Butyral (PVB) Market with the Largest Revenue Share in 2024?

The films & sheets segment dominated the polyvinyl butyral (PVB) market with the largest revenue share of 72.35% in 2024. PVB films and sheets dominate the market because they find extensive application in laminated safety glass, which is widely used across construction and automotive sectors. The manufacturing of durable shatter-proof glass for solar panels, architectural windows, and car windshields depends on PVB films, which deliver excellent adhesion together with impact resistance and optical clarity. The expanding need for safe and energy-efficient glazing solutions worldwide, together with ongoing filmmaking technological advancements that enhance material quality and sustainability, supports the outstanding performance of this segment.

Throughout the forecast period, the solutions segment of the polyvinyl butyral (PVB) market will experience significant CAGR growth. The market expansion results from rising demand for customized PVB solutions that improve laminated glass optical clarity and provide UV protection and acoustic insulation. Solutions provide manufacturers with enhanced flexibility compared to traditional films and sheets to adapt to evolving market requirements across construction and automotive sectors, as well as renewable energy applications. The increased adoption results from new solution-based PVB formulations, which improve both processing capabilities and environmental sustainability measures. The worldwide PVB market solutions segment experiences rapid growth because of increasing demand for high-performance energy-efficient glazing materials.

Application Insights

How Did the Laminated Safety Glass Segment Lead the Polyvinyl Butyral (PVB) Market with a 70.51% Revenue Share in 2024?

The laminated safety glass segment held the largest revenue share of 70.51% and led the polyvinyl butyral (PVB) market during 2024. The extensive utilization of PVB as an interlayer in laminated glass serves as the main reason for this sector's market leadership because it creates enhanced safety through impact protection. The segment expands because the building sector needs impact-resistant and energy-efficient glass, and the automotive sector needs windshields. Safety standards worldwide, together with rising awareness about building and vehicle safety, have fueled the rising popularity of PVB-based laminated safety glass throughout the world. The material's leading status in this particular application area continues to grow because it delivers outstanding adhesion and durability, together with clear optical properties.

The paints & coatings segment of the polyvinyl butyral (PVB) market is anticipated to grow at the fastest CAGR throughout the forecast timeframe. The quick increase occurs because PVB functions as a resin and binder in high-performance coatings due to its excellent adhesion, flexibility, and durable properties. The paint and coatings industry uses PVB to make industrial, architectural, and automotive coatings more glossy, weather-resistant, and scratch-resistant. The market growth stems from increasing requirements for sustainable and environmentally friendly coatings, together with advancements in environmentally friendly PVB formulations. The worldwide growth of the automotive and construction sectors drives the usage of PVB-based paints and coatings, which accelerates market development.

Regional Insights

The North American polyvinyl butyral (PVB) market grows significantly because of strong demand from the construction and automotive sectors. The rising use of PVB in safety glass applications across the region stems from mandatory safety standards set for laminated glass in buildings and vehicles. The market experiences growth because of rising expenses for infrastructure development and renovation programs. The industry benefits from increased demand because of technical advancements, which deliver better optical clarity and durability in PVB formulations. The North American market for PVB products experiences increased popularity because of recycling initiatives and rising sustainability awareness. The market growth potential in North America stems from government safety regulations and energy efficiency standards, which drive the region to become a key global PVB market player.

Asia Pacific Polyvinyl Butyral Market Trends

The Asia Pacific polyvinyl butyral (PVB) market led the worldwide market with a 38.51% revenue share during 2024. The leadership in this market stems from the quick urban development and increased automobile manufacturing, as well as rising construction activities across China, India, Japan, and Southeast Asia. Laminated safety glass requires PVB applications extensively because the region needs enhanced building and vehicle safety regulations. The industry experiences growth because of state initiatives that encourage green building development, together with energy-saving technologies and infrastructure construction. The Asia Pacific region maintains its top position in the PVB market due to its affordable manufacturing processes and technological advancements, which position it as the central hub for global PVB market development.

Europe Polyvinyl Butyral Market Trends

The polyvinyl butyral (PVB) market in Europe shows continuous growth because of strict safety regulations combined with increasing use of laminated safety glass in construction and automotive sectors. The market growth for PVB stems from rising building security awareness and vehicle safety requirements, along with expanded understanding of energy-efficient glazing products. The region benefits from ongoing scientific progress, which leads to the development of advanced PVB resins that are environmentally friendly, together with state-of-the-art production capabilities. Public initiatives that support eco-friendly construction practices, along with waste recycling systems, play an important role in driving market expansion. PVB application in architecture gains more support from investments linked to smart city projects and sustainable building certification programs. The combination of these factors establishes Europe as a leading and growing market within the global PVB industry.

Key Polyvinyl Butyral Companies:

The following are the leading companies in the polyvinyl butyral market. These companies collectively hold the largest market share and dictate industry trends.

- Sekisui Chemical Co. Ltd.

- Anhui WanWei Bisheng New Material Co., Ltd.

- Hubergroup

- Kuraray Co. Ltd.

- Chang Chun Group

- Eastman Chemical Company

- Everlam

- Others

Recent Developments

- In January 2025, Maltha Glass Recycling, a prominent European company and Renewi affiliate, made a USD 3.14 million investment in polyvinyl butyral (PVB) recycling at its facility in Lommel, Belgium. With the introduction of new technology, more glass could be extracted and less waste would end up in landfills, due to the recycling of PVB resin from laminated glass used in car windshields.

- In November 2024, Eastman Chemical Company declared that it has made investments to improve and extend its extrusion capabilities for its product lines for Interlayers at its Ghent, Belgium, production plant. With the investment, Eastman was able to better address the increasing demand for Saflex polyvinyl butyral (PVB) products in the luxury automobile market both locally and internationally. Additionally, the facility was positioned for future expansion in the automotive and architecture industries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the polyvinyl butyral market based on the below-mentioned segments:

Global Polyvinyl Butyral Market, By Type

- Films & Sheets

- Resins

- Solutions

- Other types

Global Polyvinyl Butyral Market, By Application

- Laminated Safety Glass

- Paints & Coatings

- Adhesives

- Other applications

Global Polyvinyl Butyral Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 220 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |