Global Preclinical CRO Market

Global Preclinical CRO Market Size, Share, and COVID-19 Impact Analysis, By Service (Bioanalysis and DMPK studies, Toxicology Testing, Compound Management, Chemistry, Safety Pharmacology, Others), By Model Type (Patient Derived Organoid (PDO) Model, Patient derived xenograft model), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025-2035.

Report Overview

Table of Contents

Preclinical CRO Market Summary

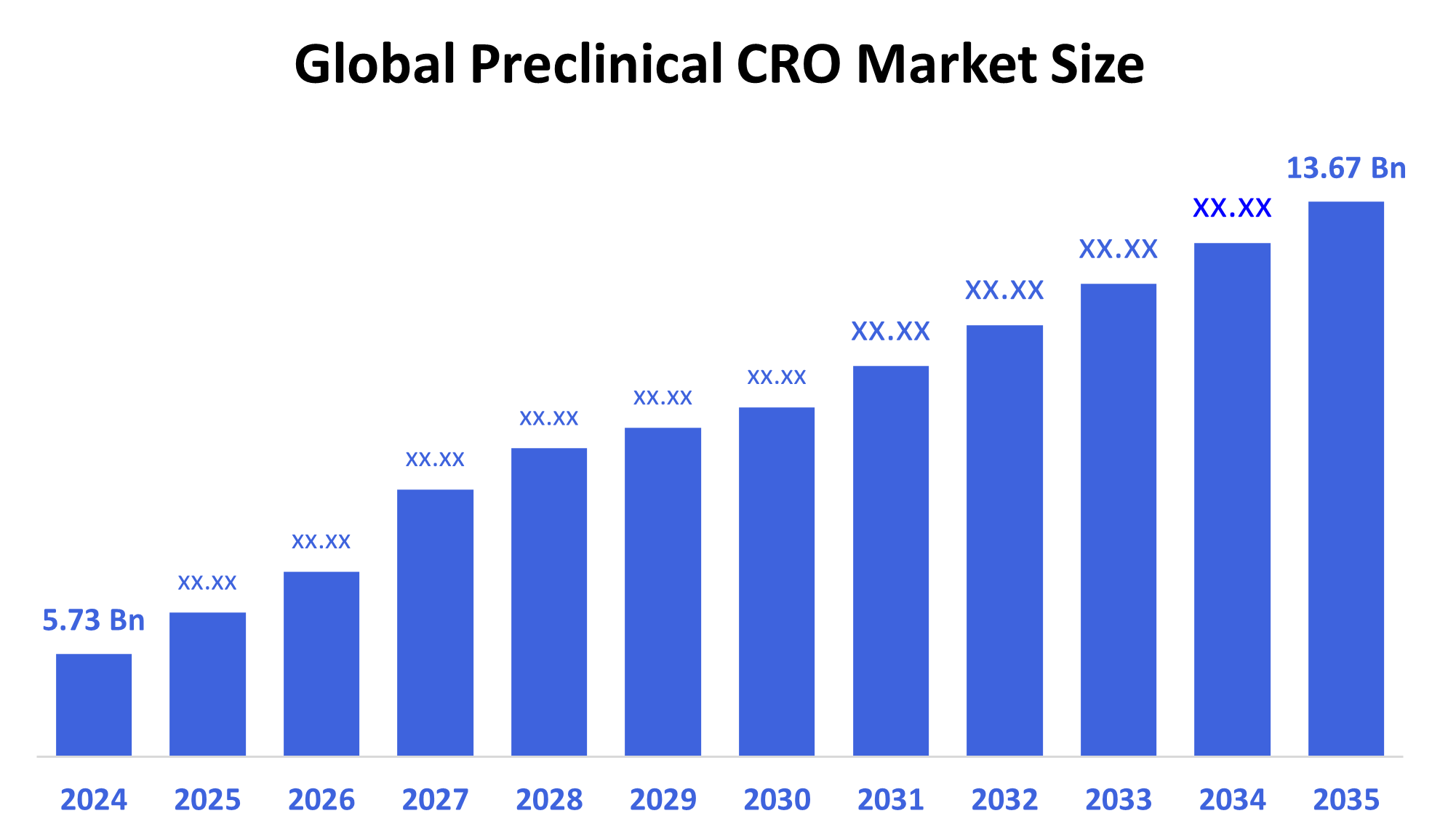

The Global Preclinical CRO Market Size Was Estimated at USD 5.73 Billion in 2024 and is Projected to Reach USD 13.67 Billion by 2035, Growing at a CAGR of 8.23% from 2025 to 2035. The preclinical CRO market growth is fueled by several factors, including the rise of chronic diseases, demand for faster and more affordable drug development, increased outsourcing, ongoing technical breakthroughs such as artificial intelligence and high-throughput screening, rising R&D expenditures, and a more complex regulatory environment.

Key Regional and Segment-Wise Insights

- In 2024, the preclinical CRO market in North America accounted for 47.27% of the global market share.

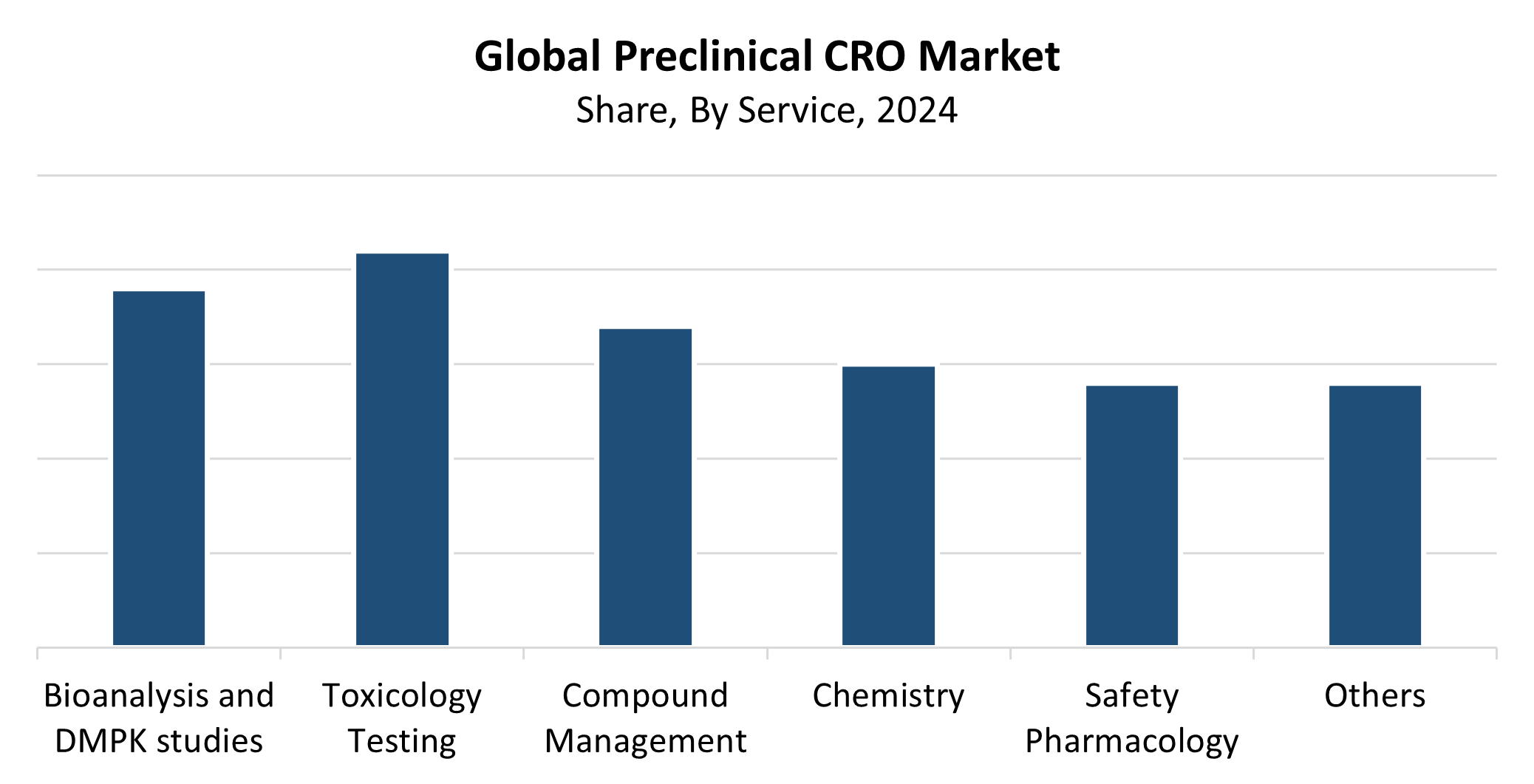

- With the highest revenue share of 21.93% in 2024, the toxicology testing segment dominated the market by service.

- Based on model type, the patient-derived organoid (PDOs) models segment dominated the market in 2024.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.73 Billion

- 2035 Projected Market Size: USD 13.67 Billion

- CAGR (2025-2035): 8.23%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Preclinical Contract Research Organizations (CROs) market operates as specialized businesses that provide outsourced research services to pharmaceutical and biotechnology and medical device companies during drug discovery and preclinical testing phases. The services required for regulatory clinical trial submissions include pharmacokinetics, together with toxicology and bioanalysis, and efficacy studies. The main drivers behind market growth stem from escalating life sciences R&D expenses combined with increasing demand for novel treatments, as well as the financial benefits of outsourcing work to specialized CROs. Small to medium-sized biopharma businesses increasingly rely on preclinical CRO services because they lack sufficient internal resources to expedite their drug development processes.

Preclinical research has become more precise and efficient because of technological advancements in areas including in vivo imaging, as well as AI-based drug research and high-throughput screening. The new developments boost predictions about clinical success, along with decreasing both financial costs and development duration. The market growth stems from positive government programs that provide funding for initial drug research phases, along with easier regulatory processes primarily seen in the U.S. and European territories. The evolving preclinical CRO market receives both regulatory encouragement for animal test replacements and partnerships between government and private organizations.

Service Insights

The toxicology testing segment dominated the worldwide preclinical CRO market with the largest revenue share of 21.93% in 2024. Toxicology studies hold a vital position in determining drug candidate safety profiles before clinical trials, which explains their market dominance. Regulatory agencies require detailed toxicological information to evaluate drug candidate safety because these services play an essential role in medication approval processes. The increasing number of new pharmacological compounds in development, together with pharmaceutical and biotech companies outsourcing their work, has driven up market demand. The preclinical CRO market segment grows because toxicology models continue to improve while safety standards and regulatory compliance receive more attention.

The Bioanalysis and DMPK Studies segment of the preclinical CRO market is anticipated to grow at the fastest CAGR throughout the forecast period. The expanding drug development and regulatory requirements for pharmacokinetic profiling, along with bioanalytical testing, have become the main drivers of market growth. As medicinal compounds have grown more complex, their ADME (absorption, distribution, metabolism, and excretion) properties require detailed examination. The effectiveness and precision of these investigations continue to advance through recent developments in LC-MS/MS technology and other analytical instruments. The segment growth results from biotechnology firms together with pharmaceutical companies selecting expert knowledge services for their outsourcing needs. These services serve as the foundation for optimizing drug dosage while ensuring safety and achieving successful development outcomes.

Model type Insights

Patient-derived organoid (PDOS) models segment held the largest revenue share and led the preclinical CRO market in 2024. The leading position of PDOs stems from their expanding application as advanced laboratory systems that recreate tumor biology together with patient-specific responses. These models outperform traditional cell lines and animal models because they predict outcomes more accurately, thus serving as essential tools for personalized medicine and oncology drug development. The pharmaceutical and biotech industry continues to adopt PDOs at an increasing rate to improve translational research outcomes and achieve better clinical trial results. The increased necessity for reliable preclinical testing systems, combined with rising precision medicine interest, has substantially elevated the demand for PDO models within the CRO industry.

The preclinical CRO market's Patient Derived Xenograft (PDX) Models segment is anticipated to grow at a significant CAGR throughout the forecast period. The rising demand for personalized and predictive oncology research models stands as the primary factor driving this growth. Researchers use PDX models to study treatment reactions and tumor behavior in biologically authentic environments through human tumor tissue implantation into immunocompromised mice. Targeted therapy evaluation becomes optimal through these models since they preserve the patient's tumor genetic makeup along with histological features. Pharmaceutical and biotechnology organizations utilize PDX models because cancer research funding has increased and precision medicine has gained importance, while clinical trial failure rates have declined.

Regional Insights

The global preclinical CRO market is dominated by the North America region with the largest revenue share of 47.27% during 2024. The dominant position of this region stems from its extensive biotechnology pharmaceutical industry and substantial research and development expenditures, and major contract research organizations operating in the area. The United States benefits from a superior research infrastructure, together with beneficial regulations and a growing early drug development focus. The market growth happened because more companies now choose specialized CROs for their preclinical studies to cut costs and accelerate their market entry. Good technological progress and a high volume of new drugs in development and government initiatives to accelerate drug discovery have strengthened North America's leading position in the preclinical CRO market.

Europe Preclinical CRO Market Trends

The preclinical CRO market in Europe is anticipated to grow at a significant CAGR throughout the forecast period because pharmaceutical R&D investments continue to increase and drug development procedures increasingly shift to outsourcing. European nations, particularly Germany and the UK, and France, are experiencing rising interest in preclinical services due to their strong scientific research infrastructure and well-trained workforce. Regulatory frameworks, including those from the European Medicines Agency (EMA), promote early-stage drug research. The industry grows because technology advances with organoids and AI-based medication screening alongside patient-specific treatment demands. The European life sciences ecosystem experiences growth of CROs through regional funding programs combined with public-private partnerships, which support innovation.

Asia Pacific Preclinical CRO Market Trends

During the forecast period, the Asia Pacific preclinical CRO market will experience the fastest CAGR because of increased pharmaceutical research and development activities, together with cost-effective service delivery and enhanced healthcare facilities. Nations including China, India, South Korea, and Japan have established themselves as prominent preclinical research centers because of their expert workforce, rising CRO entities, and regulatory improvements. The region's low operational costs compared to Western markets make it a preferred destination for multinational biotech and pharmaceutical companies to conduct preclinical research outsourcing. The market growth accelerates because government initiatives support innovation, together with research funding and infrastructure development. The rapid expansion of the Asia Pacific's preclinical CRO market receives additional momentum from developing regional biotech entities, along with the swift adoption of advanced technological solutions.

Key Preclinical CRO Companies:

The following are the leading companies in the preclinical CRO market. These companies collectively hold the largest market share and dictate industry trends.

- Eurofins Scientific

- LABCORP

- PPD (Thermo Fisher Scientific, Inc.)

- PRA Health Sciences, Inc. (ICON plc)

- SGA SA

- Intertek Group Plc (IGP)

- Medpace, Inc.

- Charles River Laboratories International, Inc.

- Wuxi AppTec

- Crown Bioscience

- Others

Recent Developments

- In March 2023, JSR Life Sciences Company and Crown Bioscience announced the opening of a new location in Singapore, which will help the business grow its capacity for both domestic and international biotech and pharmaceutical firms. Businesses involved in preclinical and translational oncology drug discovery and development will benefit from the facility.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the preclinical CRO market based on the below-mentioned segments:

Global Preclinical CRO Market, By Service

- Bioanalysis and DMPK studies

- Toxicology Testing

- Compound Management

- Chemistry

- Safety Pharmacology

- Others

Global Preclinical CRO Market, By Model Type

- Patient Derived Organoid (PDO) Model

- Patient derived xenograft model

Global Preclinical CRO Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Check Licence

Choose the plan that fits you best: Single User, Multi-User, or Enterprise solutions tailored for your needs.

We Have You Covered

- 24/7 Analyst Support

- Clients Across the Globe

- Tailored Insights

- Technology Tracking

- Competitive Intelligence

- Custom Research

- Syndicated Market Studies

- Market Overview

- Market Segmentation

- Growth Drivers

- Market Opportunities

- Regulatory Insights

- Innovation & Sustainability

Report Details

| Scope | Global |

| Pages | 230 |

| Delivery | PDF & Excel via Email |

| Language | English |

| Release | Sep 2025 |

| Access | Download from this page |